Cardano (ADA) Coin Price: Shows Strength as Long-Term Holders Accumulate and Retail Interest Rises

ADA Coin Price Poised to Reach New Highs

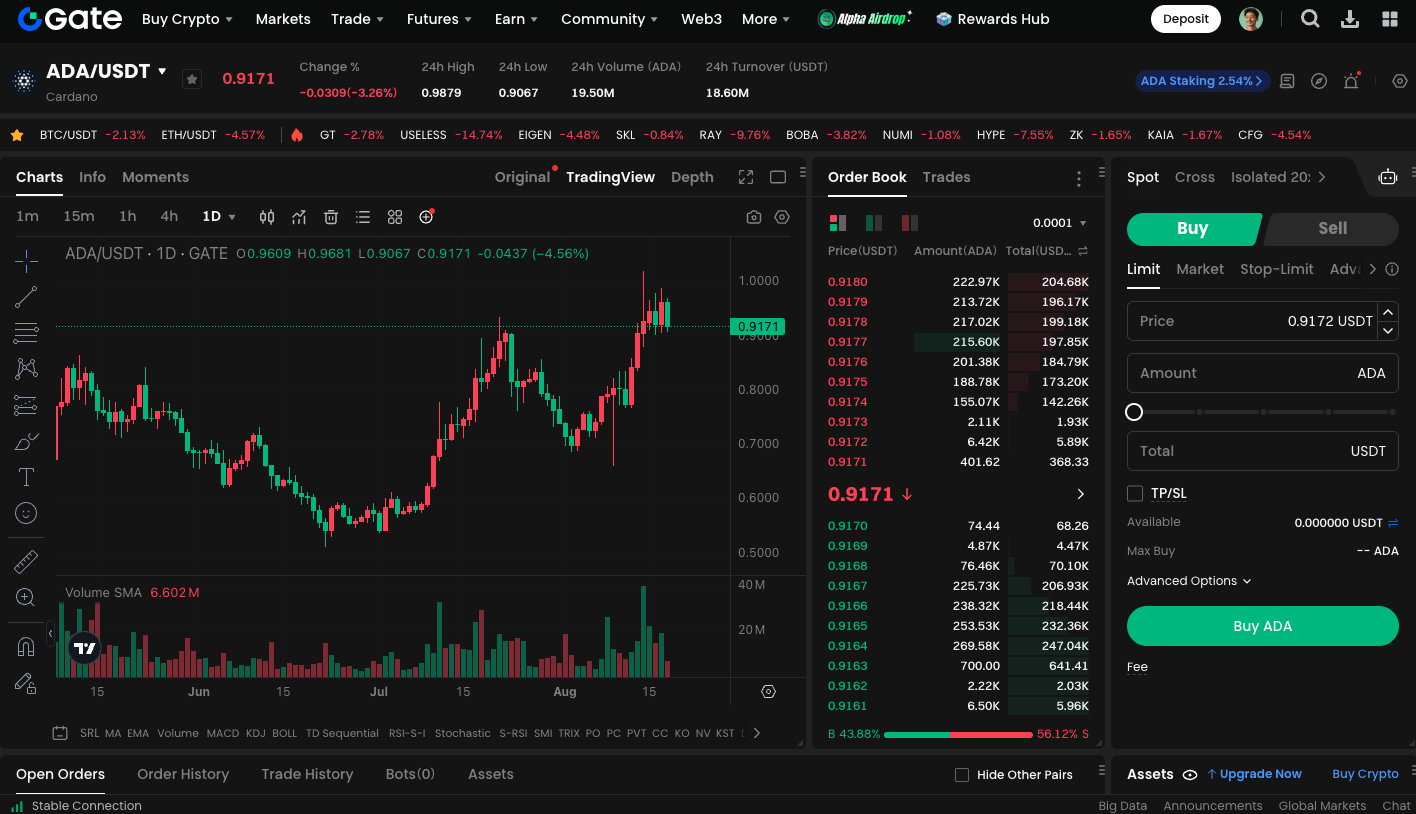

Cardano (ADA) has once again attracted market attention with its recent price performance. After several months of consolidation, the ADA coin price has broken through a key resistance level, signaling a return to a bullish trend. This surge strengthens technical indicators and points to renewed capital inflows into the altcoin market.

Technical Indicators Signal Continued Upside

On the technical charts, ADA’s breakout from a prolonged consolidation range demonstrates clear momentum for further gains. Analyst Clifton Fx notes that the next several weeks could bring substantial upside, with the price likely to test the $1.60 to $1.75 range in the near term and the potential to challenge relative highs not seen since 2022.

(Source: clifton_ideas)

Long-Term Holders Show Strong Conviction

The current rally is not driven by short-term traders alone. On-chain analysis reveals that roughly 15 billion ADA tokens have remained untouched for over a year, indicating a significantly higher level of conviction among long-term investors. This reduction in selling pressure provides a strong foundation for continued price appreciation.

Retail Interest on the Rise

In addition to institutions and long-term holders, retail participation has increased significantly. According to Google Trends, recent searches for Cardano and altcoin have hit their highest levels in five months, indicating that retail capital is returning to the altcoin space and could continue to drive ADA’s price higher.

ETF Narrative Emerges as a Key Driver

Another significant catalyst is the growing possibility of a crypto ETF. Market discussions about a potential Cardano ETF are intensifying, with some observers putting the approval probability at 75%. Should this materialize, ADA would likely attract increased capital inflows and greater media exposure, driving further upward momentum in ADA’s price.

Begin ADA spot trading now: https://www.gate.com/trade/ADA_USDT

Summary

Cardano’s technical breakout, the continued accumulation by long-term holders, and heightened engagement from retail and institutional investors all present favorable conditions for ADA coin price. If the bullish momentum persists, ADA could experience even larger gains in the coming months. Nevertheless, investors should evaluate risks carefully and avoid buying during periods of high volatility.

Related Articles

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

Pi Coin Transaction Guide: How to Transfer to Gate.com

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution