Gate Research: ETH spot ETFs top $28B inflows | Gate lists Ondo zone

Summary

- This week, BTC rose by 2.9% and ETH by 1.10%, while tokens in the RWA sector gained over 20% on average.

- Gate launched the Ondo Zone, opening trading for tokenized stock assets.

- Pump.fun introduced the “Project Ascend” initiative, adjusting its creator fee mechanism and application process.

- Galaxy Digital partnered with Superstate to tokenize GLXY stock on Solana.

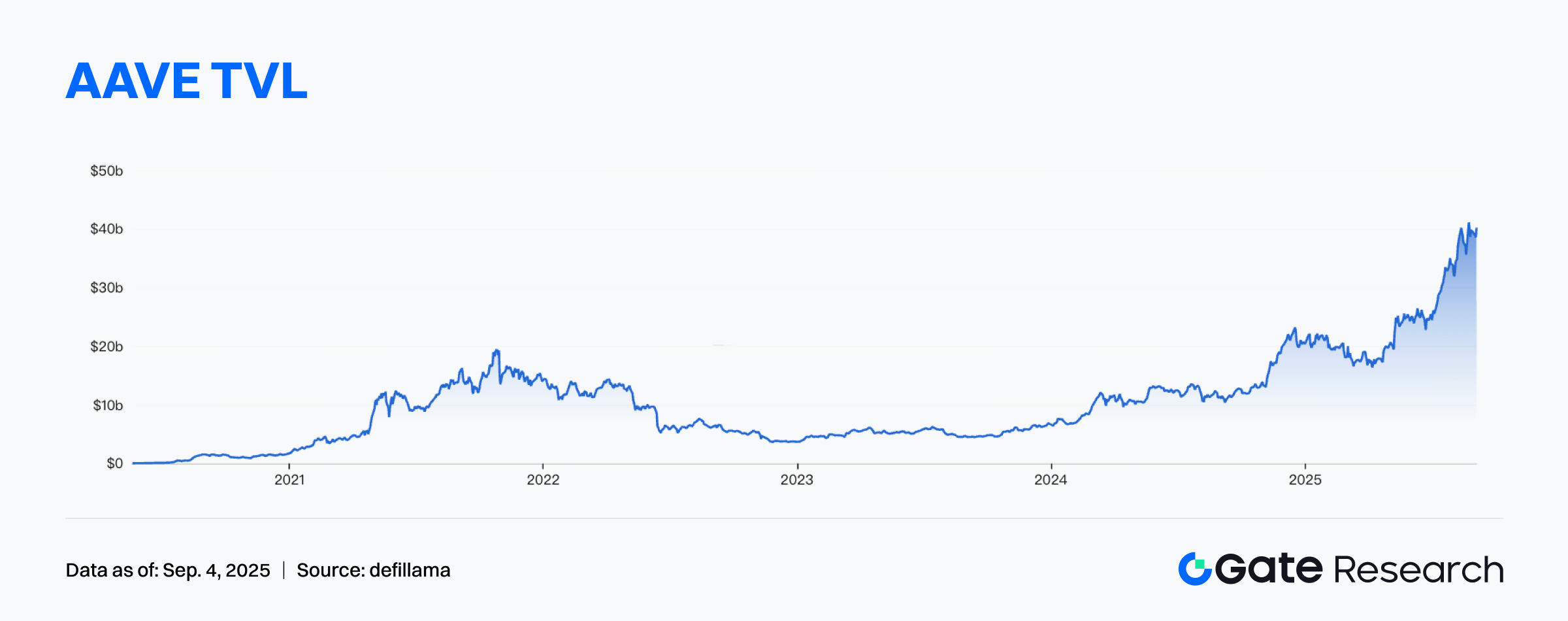

- AAVE’s TVL surged over 110% in the past 7 days, hitting a new high.

- Net inflows into Ethereum spot ETFs reached 3.6084 million ETH, equivalent to about $28.36 billion.

Market Overview

Market Commentary

- BTC – This week BTC rose by 2.9%. BTC as a whole remains in a short-term consolidation structure, with the current price interwoven above the hourly moving average, maintaining relatively stable short-term performance. The MACD indicator shows a bearish crossover, with continuously shrinking histogram bars and weakening momentum. If BTC cannot regain stability above 112,000 in the short term, it is necessary to pay attention to the support test in the 111,000 or even 110,000 range. Conversely, if it breaks through 112,500 with volume, it may open up further upward space.

- ETH – This week ETH rose by 1.10%. After a recent dip, ETH rebounded with fluctuations and is currently in a consolidation phase after the rebound, with the price facing resistance near 4,470 in the short term. The MACD indicator shows an initial bearish crossover at a high level, with signs of weakening short-term momentum. If it cannot effectively break through the resistance above 4,500, it is necessary to guard against the possibility of retesting the 4,400 to 4,350 range.

- Altcoins – This week, mainstream altcoins overall showed a slight upward trend, with IP and RWA sector tokens averaging more than 20% growth. In the past 7 days, among the top 100 cryptocurrencies by market capitalization, IP rose by 17.28% and ONDO rose by 1.1%, attracting wide attention from the market.

- Stablecoins – The total market capitalization of stablecoins is currently $296.9 billion, with USDC and USDE attracting strong market attention.

- Gas Fees – This week the Ethereum network’s gas fee has declined. As of September 4, the average daily gas fee was 0.281 Gwei.

Trending Tokens

This week, most mainstream altcoin sectors saw small increases. According to CoinGecko data, this week the IP, Stablecoin Protocol, and RWA sectors all showed significant upward trends, with gains over the past 7 days reaching 34.5%, 22.3%, and 11.2% respectively. Below are representative popular tokens in each sector and analysis of the reasons for their increases.

P Story Network (+5.14%, Circulating Market Cap $2.073B)

According to Gate market data, the IP token is currently quoted at $8.281, up 5.14% within 24 hours. Story Network is a protocol ecosystem focused on decentralized intellectual property (IP) management and creator incentives. Recently, it attracted market attention due to two major developments. First, the ecosystem application Aria Protocol announced the completion of $15M in financing, with investors including Polychain and Story Foundation. The project aims to split streaming income rights of music works into tradable assets and has already supported songs by artists such as BLACKPINK, BTS, and Dua Lipa. Second, the Poseidon application within the ecosystem has now launched on the Worldcoin Mini App Store, allowing users to earn points by uploading voice data, driving the implementation of AI data training applications. This round of increases was mainly driven by the above news. Investors gave positive feedback on Story’s ability to deliver in the AI and music IP sectors, and the overall warming sentiment in the IP sector drove concentrated capital inflows.

ENA Ethena (+5.07%, Circulating Market Cap $4.812B)

According to Gate market data, the ENA token is currently quoted at $0.7201, up 5.07% within 24 hours. Ethena is a stablecoin protocol focused on on-chain USD assets and interest-yielding structures. Its core product USDe features a “synthetic stablecoin” model that does not rely on banks, instead providing stable value anchoring through on-chain staking and hedging strategies. ENA, as the governance and incentive token of the platform, participates in revenue distribution and governance mechanisms of the ecosystem. This round of increases was mainly driven by multiple favorable data points. The team disclosed that USDe’s circulation on centralized exchanges has exceeded $1B, while its total market cap reached $12B, making it the fastest-growing digital dollar asset in history. The Ethena ecosystem’s cumulative interest income has also exceeded $500M, showing that its revenue model is gradually maturing. The market’s expectation of its growth speed and recognition of its on-chain USD status strengthened, driving the ENA token higher.

SYRUP Maple (+7.64%, Circulating Market Cap $559M)

According to Gate market data, the SYRUP token is currently quoted at $0.49751, up 7.64% within 24 hours. Maple is an on-chain credit market platform targeting institutional lending needs. Recently, it launched syrupUSDC, a derivative stable asset on the Arbitrum network, which can be used as collateral to borrow other mainstream stablecoins (such as USDC, USDT, GHO) and has been integrated into multiple lending protocols including 0xfluid, MorphoLabs, and Euler. This SYRUP increase may be related to syrupUSDC’s official launch on the Arbitrum network. The asset has now been integrated into multiple lending protocols and included in the Arbitrum DRIP incentive program, allowing users to borrow stablecoins using syrupUSDC as collateral and receive additional rewards. The launch of this feature enhanced the usage scenarios of syrupUSDC and may increase overall platform capital activity, becoming one of the short-term factors attracting market attention.

Focus of the Week

Pump.fun Launches “Project Ascend” Plan, Adjusts Creator Fee Mechanism and Application Process

Pump.fun announced the launch of the “Project Ascend” update plan, aiming to enhance the sustainability of platform tokens and optimize creator-related mechanisms. Updates include the introduction of a new creator fee structure, “Dynamic Fee V1,” designed for the PumpSwap platform. It charges creator fees based on tiers according to token market cap — the higher the token market cap, the lower the creator fee ratio. This design may help limit short-term speculation and guide projects to focus on long-term development. At the same time, the platform also improved the processing efficiency of CTO creator fee applications, stating that approval speed will increase by about 10 times. This move may help solve past delays encountered by creators in the application process and improve overall participation efficiency. Overall, the “Project Ascend” plan concentrated adjustments on revenue mechanisms and process management, and its subsequent effects remain to be observed from platform data and user feedback.

Galaxy Digital and Superstate Partner to Tokenize GLXY Stock on Solana

Galaxy Digital and asset tokenization platform Superstate announced a partnership to bring their listed GLXY stock onto the Solana blockchain for tokenized issuance. According to the announcement, investors who have completed KYC verification can convert their GLXY stock holdings into tokens via Superstate’s Opening Bell platform and transfer and circulate them on specific DeFi platforms. Superstate stated that this attempt is the first case of directly tokenizing and trading a listed company’s stock on a public blockchain. Although related operations are still subject to compliance review and investor identity restrictions, this case shows an exploratory path for combining traditional securities markets with blockchain technology, especially in potential applications within open financial infrastructure.

Gate Launches Ondo Zone, Opens Stock Asset Token Trading

Crypto asset trading platform Gate announced the official launch of the Ondo Zone and opened the first batch of 26 popular trading pairs, including AAPLON, METAON, TSLAON, and NVDAON, allowing users to trade with USDT. The zone is jointly launched by Gate and Ondo, based on a compliant physical asset tokenization model. All listed tokens are anchored to corresponding publicly traded stocks, fully collateralized, and support free on-chain transfer and cross-chain circulation, enabling integration and interoperability across ecosystems. To accompany the launch of the zone, Gate will hold a CandyDrop event from September 4 to September 17, where users participating in Ondo Zone trading will have the chance to share 384,615 ONDO tokens, with up to 220 tokens per person. The zone supports fractional share trading, on-chain transfers, and 24/7 trading, providing higher accessibility and flexibility compared to traditional markets.

Key Market Data Highlights

AAVE TVL Surged Over 110% in the Past 7 Days, Reaching a New High

According to the latest data, Aave’s total value locked (TVL) set a new record this month, exceeding $40B, up 100% since the beginning of the year, firmly maintaining its leading position in the Ethereum DeFi lending market, with its TVL share close to one-quarter of total DeFi TVL.

Meanwhile, the protocol’s fees and revenues are also climbing, reflecting simultaneous growth in lending demand and capital utilization. Two main driving factors: first, Aave relaunched and upgraded its institutional lending platform Horizon, allowing institutional investors to provide compliant collateral through tokenized U.S. Treasuries and other assets, opening new capital inflows. Second, Aave v4 is nearing the end of development and about to enter multi-path security audits. The market expects the new version to bring more efficient capital routing, flexible interest rate mechanisms, and stronger risk control tools, continuously strengthening confidence in Aave’s long-term development.

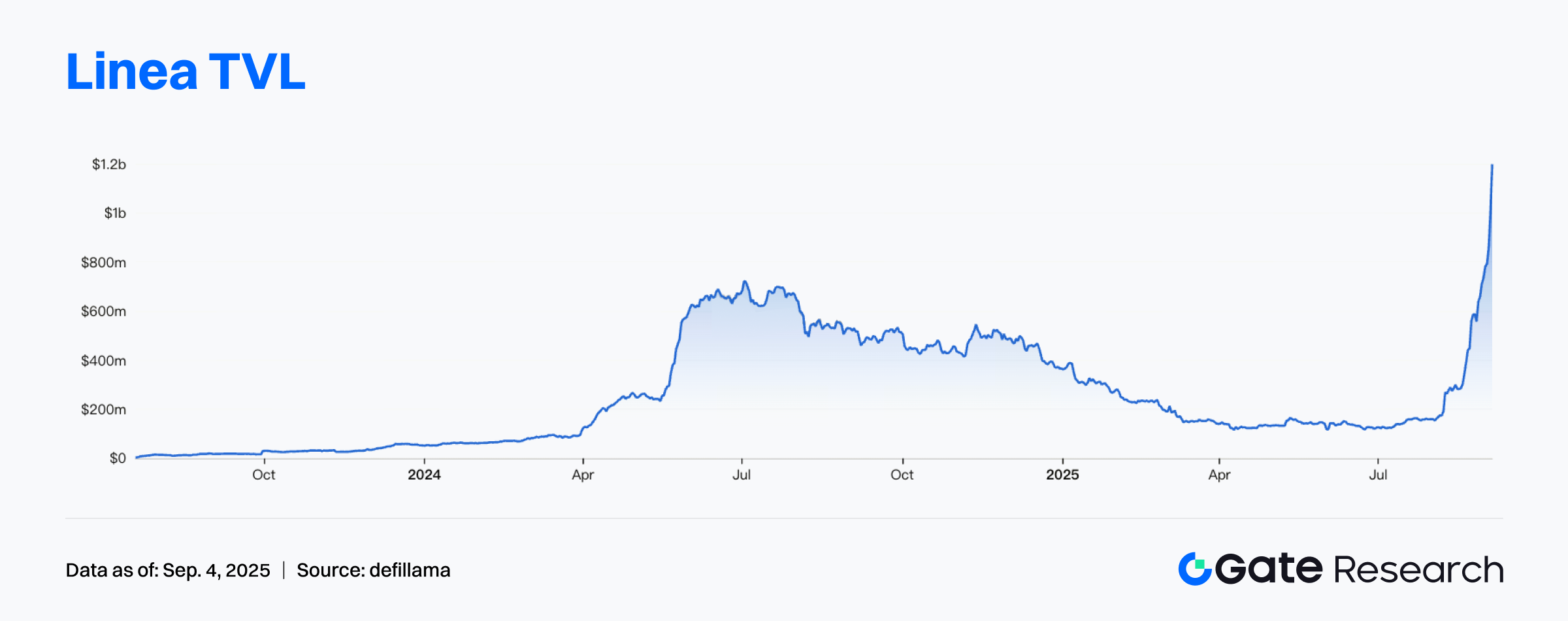

Linea Network TVL Reached $1.893B, Weekly Growth Over 80%

DeFiLlama data shows that Linea’s TVL surged to about $1.893B within a week, up 81.44%, reaching a historical high. This highlights the strong attractiveness of this Ethereum Layer-2 network in the DeFi ecosystem and the capital inflow enthusiasm.

The key factor driving this growth is the official launch of the Ignition liquidity incentive program, which will distribute 1 billion LINEA tokens and designate major DeFi protocols such as Aave, Etherex, and Euler as partners. Rewards distribution uses zero-knowledge proof mechanisms to ensure transparency and fairness, further enhancing participants’ trust.

Ethereum ETF Continues to Absorb Funds, On-Chain Holdings Exceed 6.54M ETH

According to Dune data, as of August 31, net inflows into Ethereum spot ETFs have reached 3.6084M ETH, equivalent to about $28.36B. Currently, ETF products hold a total of 6.54M ETH, accounting for 5.28% of Ethereum’s circulating supply. In just the past week, net inflows reached 167,300 ETH, showing that institutional funds are still continuously adding positions. If annualized based on the past month’s inflow pace, ETF products could absorb 8.4% of ETH’s circulating supply in the future. This means Ethereum is gradually becoming an important “institutional reserve asset” similar to Bitcoin ETFs, and its fund absorption capacity may also become an important medium- to long-term price support factor.

Funding Weekly Recap

According to RootData, between August 29 and September 4, 2025, a total of 15 crypto and related projects announced completion of financing or acquisitions, covering multiple tracks such as ETH infrastructure and decentralized AI verification. Overall financing activity remains high, showing capital’s continued focus on ETH infrastructure, AI applications, and asset tokenization. Below are brief introductions of the top 3 projects by financing scale this week:

Tron Inc

Announced on September 2 the completion of $110M financing to launch a TRX treasury strategy. Tron Inc. (TRON.US) is a listed company that was renamed from SRM Entertainment, Inc. in July 2025, headquartered in Florida, USA. The company mainly operates in two business areas: (1) designing and manufacturing customized products such as toys and souvenirs for theme parks and other entertainment venues; (2) as a pioneering blockchain-integrated financial strategy company, holding a large amount of TRON (TRX) cryptocurrency and committed to using decentralized financial tools to create long-term value.

Etherealize

Announced on September 3 the completion of $40M financing to build ETH DeFi infrastructure. Etherealize is an institutional marketing and product arm of the Ethereum ecosystem. Etherealize accelerates institutional adoption through a dual mission: on one hand, educating institutions to understand that Ethereum is both a store-of-value asset and a technology platform; on the other hand, by building products that bring assets and users into the Ethereum ecosystem, thereby connecting institutions with Ethereum.

SonicStrategy

Announced on September 2 the completion of $40M financing to build ETH DeFi infrastructure. SonicStrategy positions itself as the cornerstone of the refreshed Sonic token ecosystem, providing value to the ecosystem by combining token accumulation with active participation in staking and other DeFi projects.

Next Week to Watch

Token Unlocks

According to Tokenomist data, in the next 7 days (Sept 5–Sept 11, 2025), the market will see several important large token unlocks. The top 3 are as follows:

- ENA will unlock tokens worth about $123M in the next 7 days, accounting for 2.6% of circulating supply.

- IMX will unlock tokens worth about $12.68M in the next 7 days, accounting for 1.3% of circulating supply.

- ELX will unlock tokens worth about $7.11M in the next 7 days, accounting for 1.8% of circulating supply.

References:

- Gate, https://www.gate.com/trade/BTC_USDT

- Gate, https://www.gate.com/trade/ETH_USDT

- Coinmarketcap, https://coinmarketcap.com/

- jin10, https://rili.jin10.com/

- Coinmarketcap, https://coinmarketcap.com/view/stablecoin/

- etherscan, https://etherscan.io/gastracker

- Coingecko, https://www.coingecko.com/en/categories

- X, https://x.com/pumpdotfun/status/1962916227090731353

- X, https://x.com/TheBlock__/status/1963195292095791359

- Gate, https://www.gate.com/announcements/article/46930

- Defillama, https://defillama.com/chain/linea

- Defillama, https://defillama.com/protocol/aave

- Dune, https://dune.com/hildobby/eth-etfs

- Rootdata, https://www.rootdata.com/Fundraising

- Tokenomist, https://tokenomist.ai/

Gate Research is a comprehensive blockchain and cryptocurrency research platform that provides deep content for readers, including technical analysis, market insights, industry research, trend forecasting, and macroeconomic policy analysis.

Disclaimer

Investing in cryptocurrency markets involves high risk. Users are advised to conduct their own research and fully understand the nature of the assets and products before making any investment decisions. Gate is not responsible for any losses or damages arising from such decisions.

Related Articles

Exploring 8 Major DEX Aggregators: Engines Driving Efficiency and Liquidity in the Crypto Market

What Is Copy Trading And How To Use It?

What Is Technical Analysis?

How to Do Your Own Research (DYOR)?

12 Best Sites to Hunt Crypto Airdrops in 2025