Gate Ventures Research Insights: The Bittensor Revolution – The Rise of AI’s Bitcoin and the New Economic Landscape

Investment Overview

Bittensor is a universal incentive platform inspired by the Bitcoin network, leveraging a subnet architecture and game theory. Bitcoin motivates miners through token issuance for SHA256 computations to maintain network availability. Bittensor, in turn, incentivizes subnet miners—via new token issuance—to provide resources such as AI inference, data storage, GPU power, and bandwidth.

- Team: All three core members hold computer science backgrounds—Ala specializes in academic research and AI algorithms, Jacob focuses on machine learning and blockchain architecture, and Garrett brings engineering implementation and product development expertise. Together, they represent a robust technical founding team.

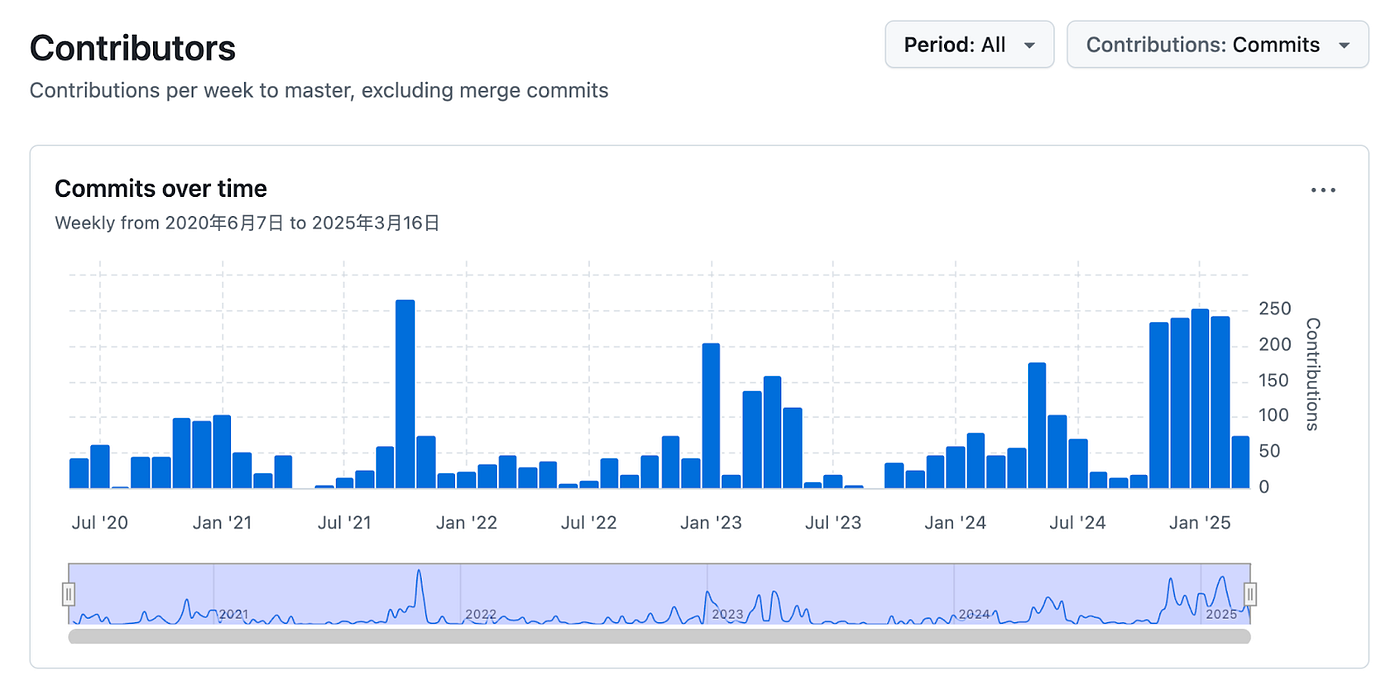

- Development Progress: The project has maintained steady development, with activity picking up in the past quarter.

- Product: Bittensor introduces innovative tokenomics: subnet teams are rewarded only by improving project quality and thus increasing subnet token prices. Game-theoretic mechanisms drive subnets to compete by offering optimal resources—whether quantitative model performance, GPU pricing, storage efficiency, or protein folding speed.

- Ecosystem: With 80 subnet projects and accelerating growth, the ecosystem shows marked expansion, though many projects overlap or repeat similar business models.

- Narrative: Bittensor is closely connected to themes in AI, DePin, and public blockchains.

Risks:

- Limited infrastructure, weak marketing, and insufficient community support lead to high opacity.

- Significant project duplication and lack of independent external teams, with single Labs developing multiple subnets—reducing focus and competitive edge.

- The TAO mechanism is complex, requiring high expertise and posing a substantial learning curve for retail users.

Bittensor’s unique architecture fuels rapid ecosystem growth, with no direct rivals to date—most AI competitors are individual subnets. We remain optimistic about its potential. Unlike Allora and Sentiment, which focus on large-scale models, or Sahara AI, which solely offers data, Bittensor’s subnets (miners) function like sovereign nations operating within a global system, each free to pursue distinct business directions within Bittensor’s framework. Subnet currency value serves as the benchmark for success. This open, subnet-token-based incentive structure presents an opportunity for a standout ecosystem. Increasing venture investment, including from YZi Labs, signals growing institutional support for Bittensor.

1. General Overview

1.1 Project Introduction

Bittensor is a universal incentive platform inspired by Bitcoin’s PoW network, built on subnet architecture and game theory. Bitcoin rewards miners for SHA256 computations via token issuance, preserving network utility. Bittensor rewards subnet miners with tokens for providing resources including AI inference, data storage, GPU compute, and bandwidth. Through game theory and token incentives, it fosters a competitive, distributed crowdsourcing environment.

1.2 Basic Information

Note: Data sourced from CoinMarketcap & Coinglass; statistics as of March 17, 2025 (UTC)

2. Project Details

2.1 Team Overview

Jacob Robert Steeves: Founder

Jacob Robert Steeves, founder, earned a Bachelor of Applied Science from Simon Fraser University, majoring in mathematics and computer science. As a student, he placed eighth in the 2014 ACM-ICPC Northwest North America Regional. Jacob’s career spans machine learning research (Knowm), algorithm development (Google), and decentralized technology (Bittensor), with deep expertise in machine learning, distributed computing, cryptography, and conventional tech enterprises.

Ala Shaabana: Co-Founder

Ala Shaabana, co-founder, holds a Computer Science degree from University of Windsor and a Ph.D. from McMaster University. His career includes software development (firmCHANNEL, VMware, Instacart) and academic research, covering computer science, machine learning, and distributed computing in enterprise and scholarly settings.

Garrett Oetken: CTO

Garrett Oetken, CTO, graduated from University of Idaho in Computer Science. He has professional experience in software development (Safeguard Equipment), AI research, and tech startups (Quantum Star Technologies, Opentensor Foundation), focusing on AI, computer vision, natural language processing, and distributed computing.

Opentensor, founded in March 2023 with about 40 employees (average tenure: 1.3 years), is Bittensor’s development team. All core leaders have computer science backgrounds. Ala emphasizes research and AI algorithms, Jacob excels in machine learning and blockchain, and Garrett specializes in engineering implementation and product development—a strong technical founding team.

2.2 Funding

Bittensor has not disclosed any primary market fundraising. Public records show millions in OTC token deals from Polychain, DCG, and DAO5.

2.3 Codebase

Contributors, source: Github

Opentensor’s main Github repo, Tensor, saw notably accelerated development and code updates in Q1 2025.

2.4 Product

2.4.1 Origin

Bittensor was conceived through analysis of the Bitcoin network, which motivates global miners with token rewards to run network-sustaining algorithms. However, Bitcoin mining provides basic, monolithic computational output. Inspired by this, Bittensor incentivizes miners to supply broader digital resources (especially in the AI era), from computation to intelligent services. While Bitcoin miners run SHA256, Bittensor miners can supply different algorithms and resources—AI inference, storage, compute, bandwidth—mapping these to a decentralized market with unified incentives.

2.4.2 Product Description

Bittensor is open-source; participants can create digital goods including compute, storage, AI training/inference, protein folding, financial prediction, and more. The network consists of multiple subnets, each an independent miner and validator community. Subnet creators manage incentives; TAO stakers back preferred validators.

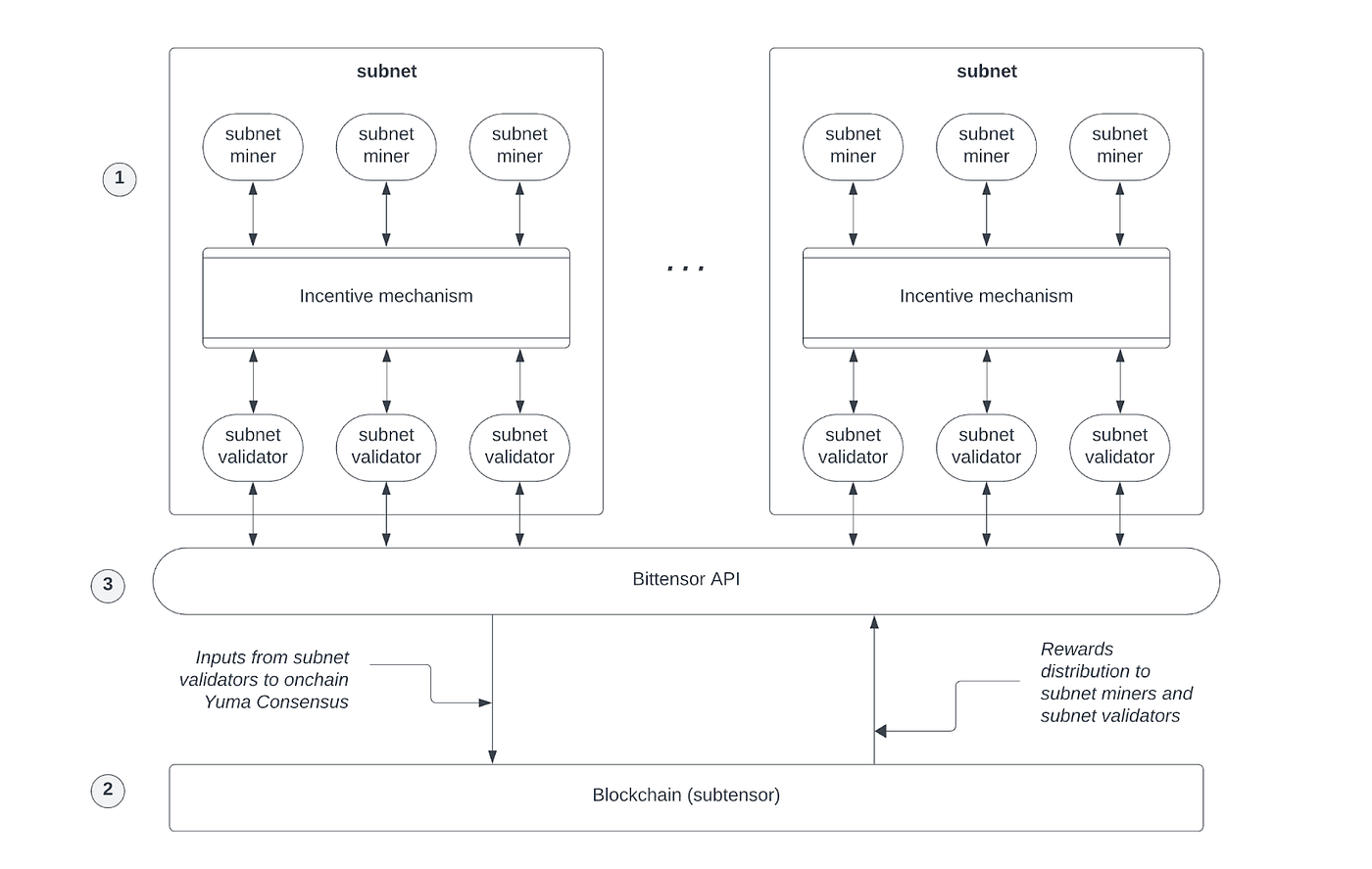

TAO Architecture, source: Bittensor

TAO consists of several core components:

- Subnets: Each subnet is a competitive, incentive-driven market producing a specific AI digital good, consisting of miners (producers) and validators (evaluators) enforcing subnet standards.

- Mainnet: The Bittensor mainnet records balances and transactions for miners, validators, and subnet creators; the TAO token is used for subnet incentives.

- API: The Bittensor API handles subnet miner-validator interactions and mainnet access as needed.

Subnets have two roles: miners and validators.

Miners:

- Miners provide not just PoW computation but resources for AI training/inference or other digital goods (e.g., bandwidth).

- Subnets focus on specialized tasks (NLP, CV, multimodal, etc.); miners join those best suited to their hardware/algorithms for resource contribution and rewards.

Validators:

- Validators maintain Bittensor’s security, handling block packaging and transaction validation (similar to Polkadot/Substrate) for network integrity.

- Subnet-level validators enforce internal consensus and prevent malicious actions.

Subnet Liquidity

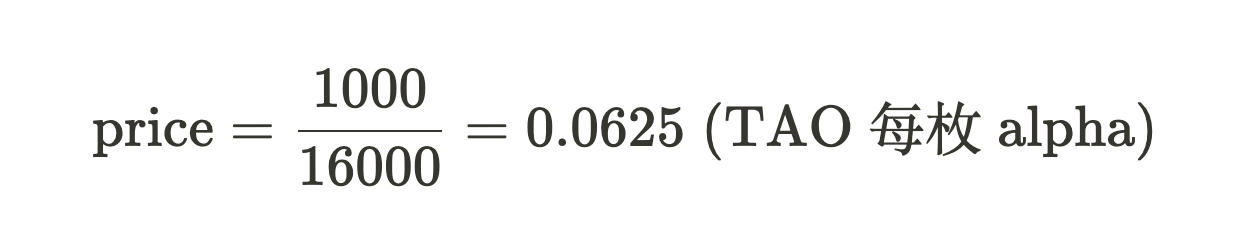

Each subnet uses an independent AMM pool with two reserves: TAO tokens and the subnet’s token (Alpha Token). Subnet tokens are acquired by staking TAO into the subnet pool. Example: an AMM pool has 1,000 TAO and 16,000 Alpha tokens; by formula:

One Alpha token equals 0.0625 TAO. As demand for Alpha rises, users buy Alpha with TAO, decreasing Alpha supply and increasing TAO, causing Alpha’s price to rise. Fresh TAO and subnet tokens are injected per block, impacting token prices.

Token issuance and incentives are governed by Bittensor’s dynamic TAO mechanism, which follows below.

2.4.3 Technical Details

Bittensor’s legacy Yuma Consensus algorithm resolved consensus and incentive allocation for AI model contribution while deterring collusion. It determined both validator votes and TAO rewards to subnets. Key challenges included:

- Validators couldn’t adequately evaluate many subnets, leading to inaccurate results, indifference, or bribery;

- Subnets could bribe validators to boost votes;

- High-quality subnets might be unfairly overlooked.

Bittensor’s dynamic TAO (DTAO) introduces market-led token rewards: every subnet issues its own token (Alpha) and leverages the AMM pool for price discovery. A subnet’s value is market-driven; the higher its token price, the greater its TAO and Alpha reward allocations.

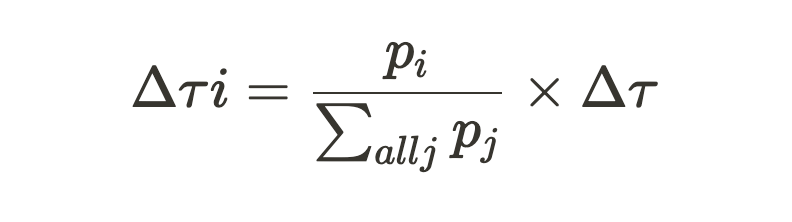

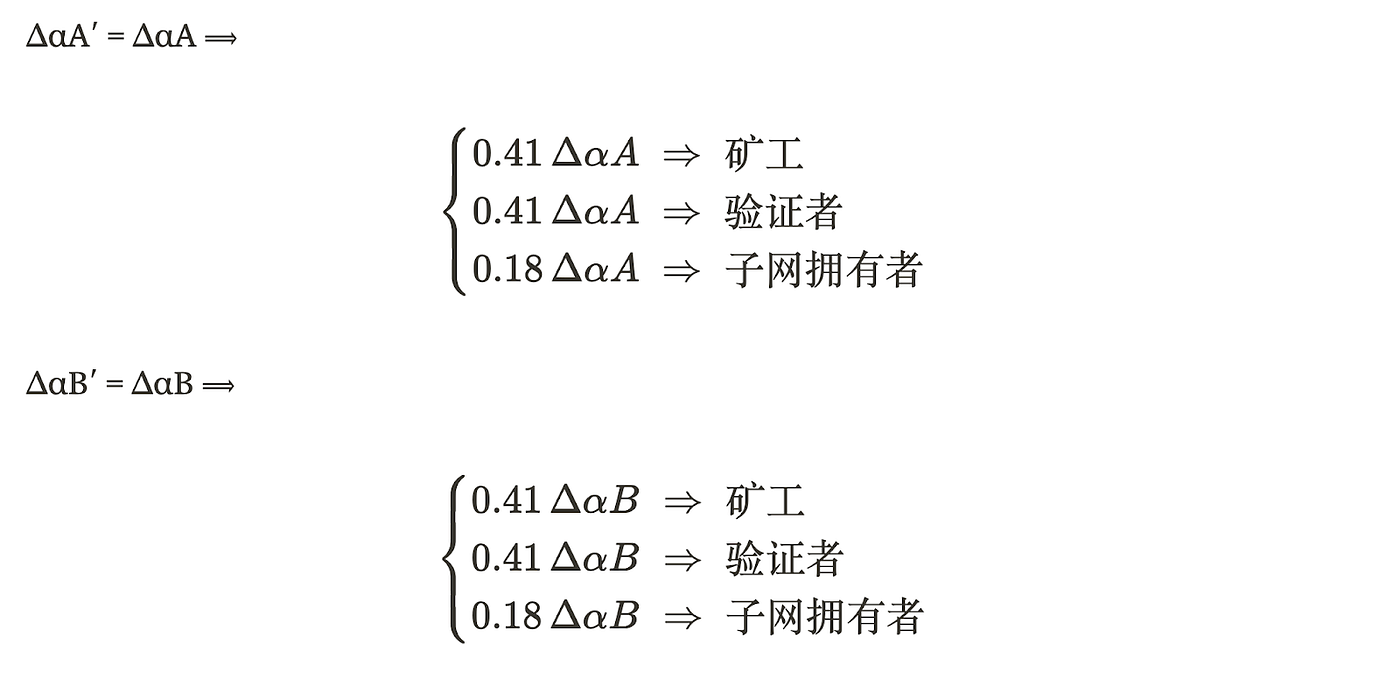

Example: Subnets A and B each issue one TAO per block. Their tokens (alphaA, alphaB) are valued at P_a, P_b. Default allocation is 1:1 TAO-to-token, with both capped at 21 million. Each subnet’s TAO allocation Δτ is proportional to its token price versus total subnet prices:

If P_a = P_b = 1 TAO, each subnet gets 0.5Δτ per block. If the market prefers alphaA, extra TAO flows to A’s pool.

AMM pool price stability requires matching Alpha token injections. Steps:

- Calculate Δαi—the Alpha needed to maintain price pi;

- If this exceeds the subnet’s cap, only the capped amount is injected.

DTAO distributes matching Alpha tokens to participants (miners, validators, subnet owners) instead of the former TAO rewards:

- Miners: 41%

- Validators: 41%

- Subnet Owners: 18%

Pool injections maintain price; direct distribution incentivizes ecosystem actors. Alpha tokens accrue and are released after each Tempo interval (360 blocks), reducing fragmentation. Miners earn tokens only via this mechanism; validators secure the network.

A common issue: each TAO injection is paired with Alpha issuance into the AMM pool, stabilizing pool prices but increasing sell pressure. This mirrors Bitcoin’s miner rewards. Proportional TAO and Alpha pool injections deepen liquidity, lower slippage, and bolster market confidence. Alpha distributions reward high-quality miners and subnet developers. With a 21 million supply cap, subnet tokens cannot be infinitely minted—the model converges on the cap, much like Bitcoin issuance.

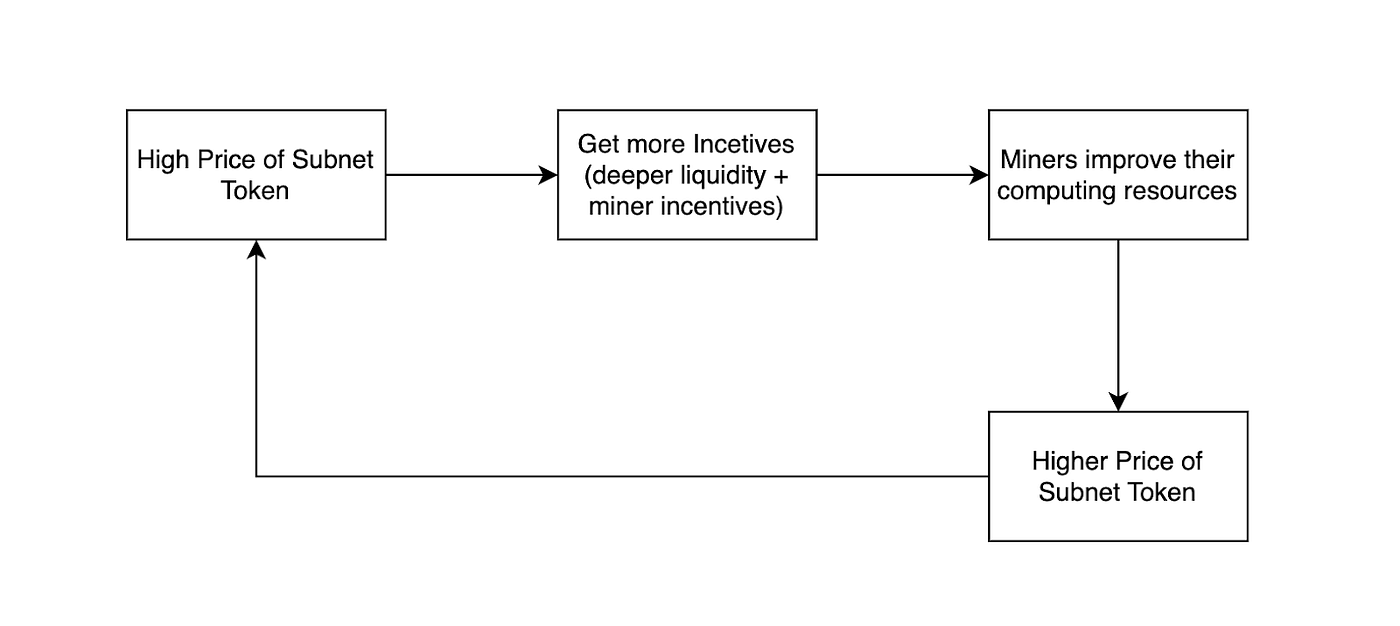

Positive Cycle Mechanism

Dynamic TAO creates a positive feedback loop: subnet developers are incentivized to build for fair, transparent token rewards. The system deters vote manipulation; only projects with sound fundamentals can sustain high token values, while market forces punish weak or manipulated subnets.

3. Development

3.1 Past

3.2 Present

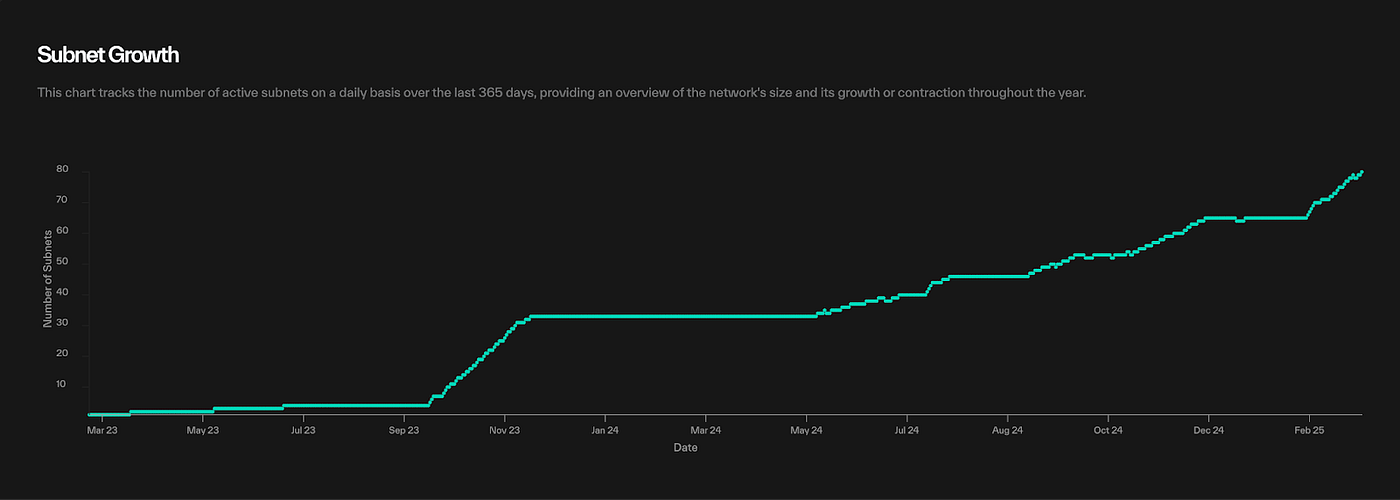

Subnet Growth, source: taostats

Bittensor subnets went live in October 2023 and have developed for 18 months. The network now comprises 80 subnets (including Root), with rapid ecosystem growth. As of March 23, total market cap stands at $1.65 billion; 24-hour subnet token trading volume is $47.66 million.

3.2.2 Ecosystem Growth

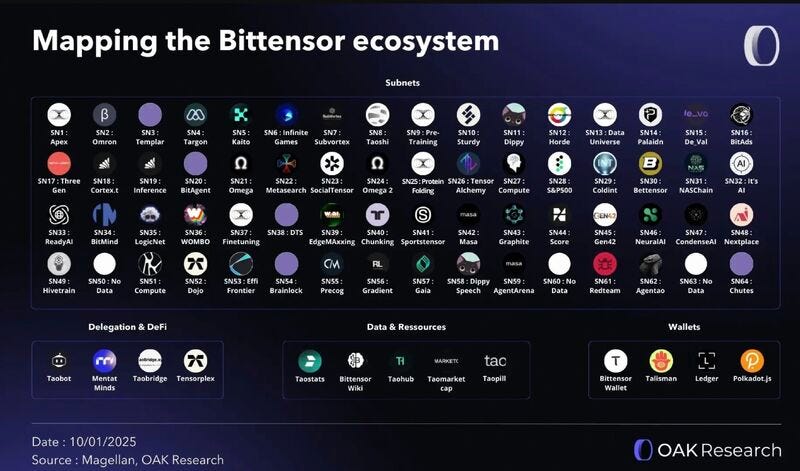

Bittensor ecosystem, source: OKA Research

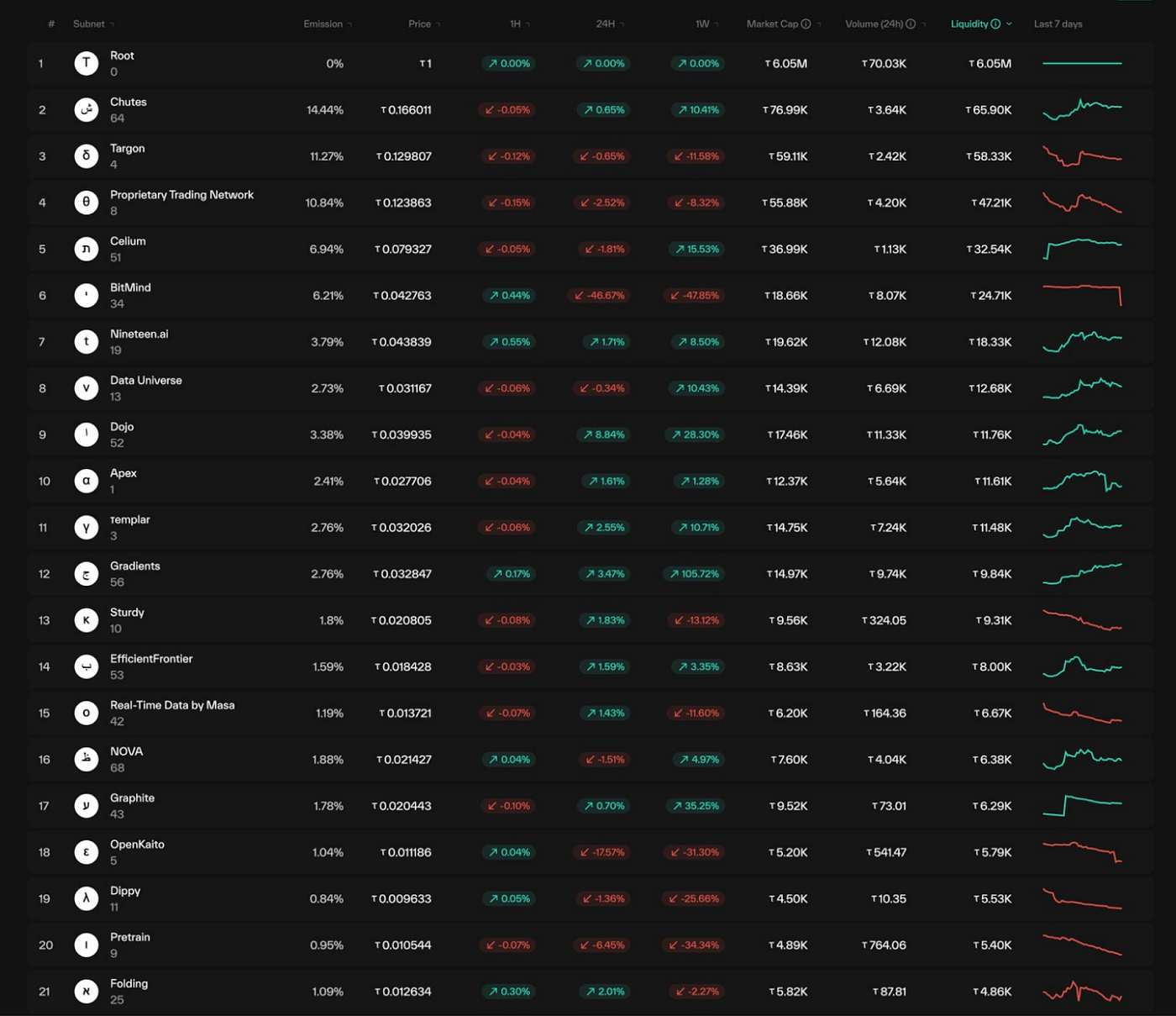

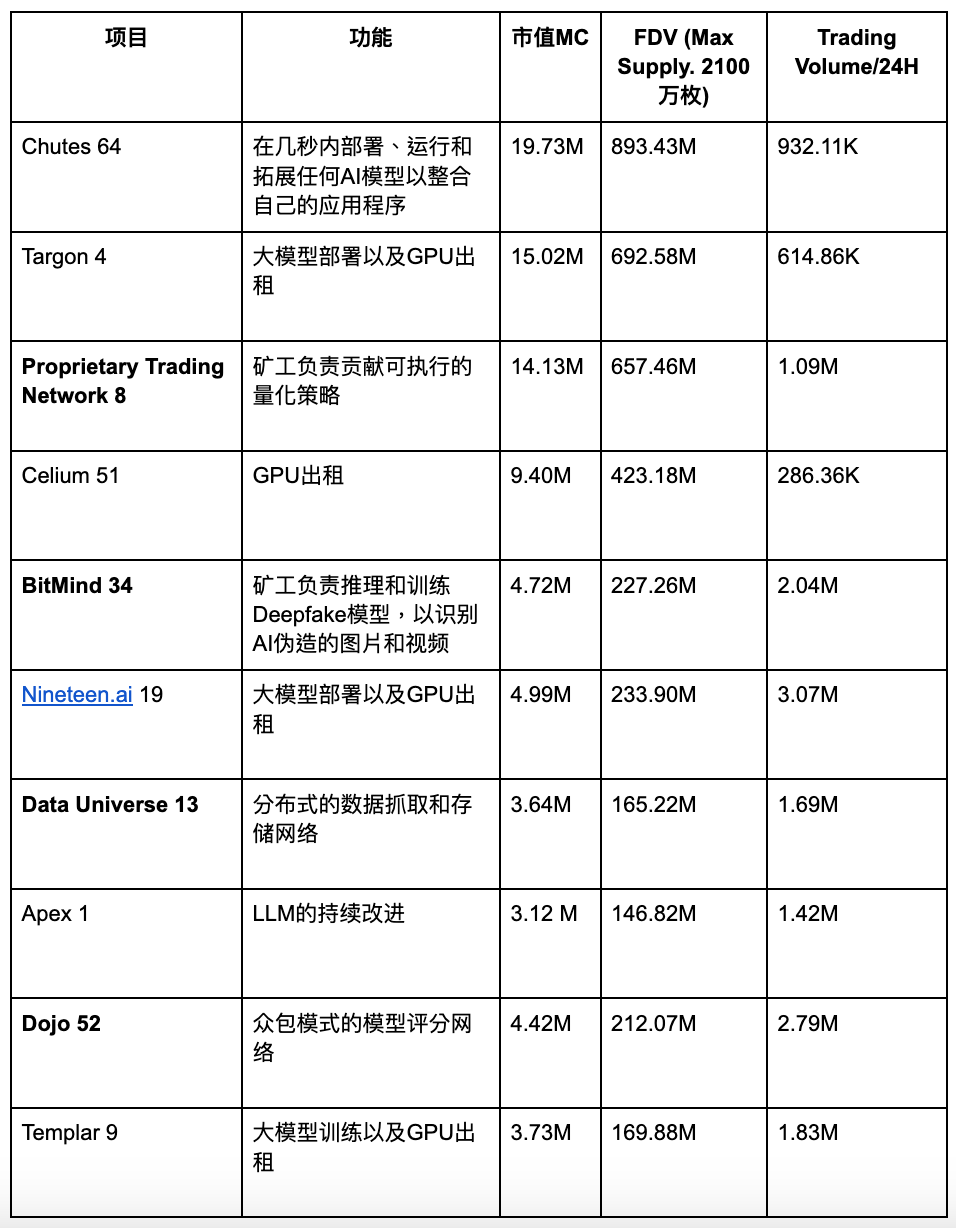

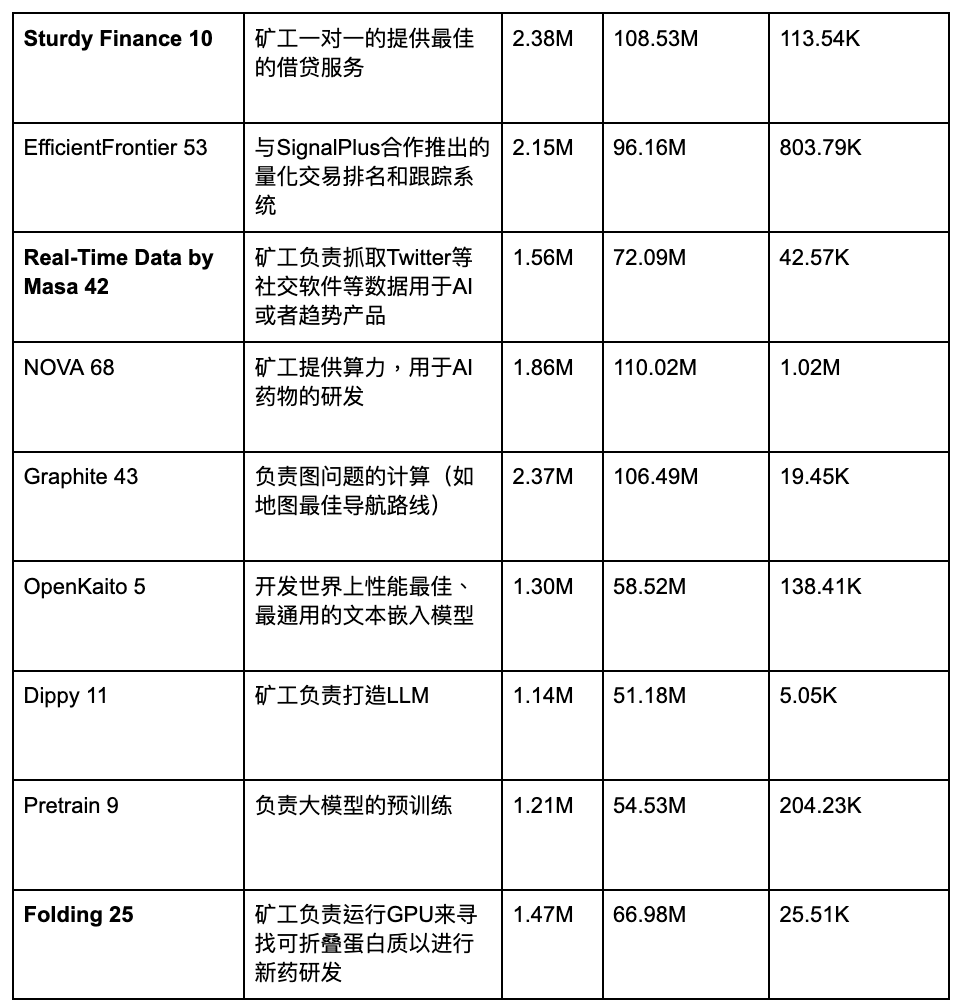

Top 20 by Liquidity, source: Taostates

We ranked the top 20 projects by AMM pool liquidity, excluding the Root network (the former, validator-driven distribution system now deprecated). These rankings reflect enduring value and market recognition.

The ecosystem shows significant duplication: 11 of the top 20 projects use decentralized GPUs for large-model pretraining, training, fine-tuning, and inference. Subnets also support decentralized GPU computation for protein folding, graph theory, etc. Many subnets are built by the same studios, such as Microcosmos (#1, #9, #13, #25, #37) and Rayon Labs (#64, #19, Gradients), reflecting a shortage of fully independent development teams.

Community feedback highlights several key issues:

- Since dynamic TAO mainnet launch and Root subnet retirement (loss of central oversight), the decentralized incentive network now incentivizes subnets by market cap, which has resulted in meme tokens capturing rewards—potentially undermining network objectives.

- Inference-focused LLM subnets often struggle with inefficiency and redundancy due to excess mining and uneven incentive and model quality standards, driving miners toward model homogeneity to avoid misclassification.

Issue one deserves attention; mechanisms or a DAO could mitigate detrimental outcomes. The second issue reflects poor subnet management—unvaluable subnets will lose price and incentives. Market self-regulation applies. In the long-term, Bittensor’s general incentive network model retains merit; we will outline use cases in the ecosystem section.

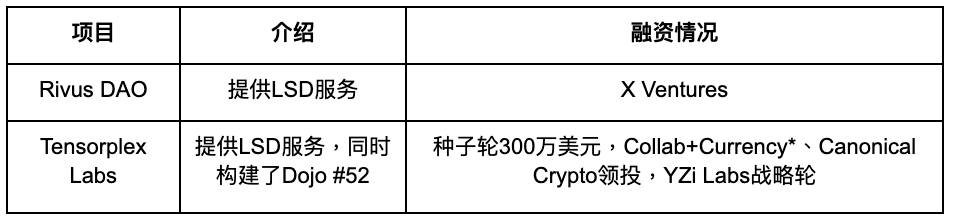

Venture capital support is growing in the Bittensor ecosystem, with more projects securing funding:

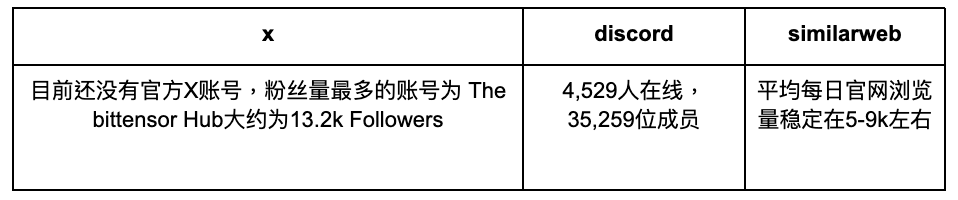

3.2.2 Social Media

Bittensor’s community interaction is limited: Discord is the only official channel, and marketing efforts remain minimal.

3.3 Future

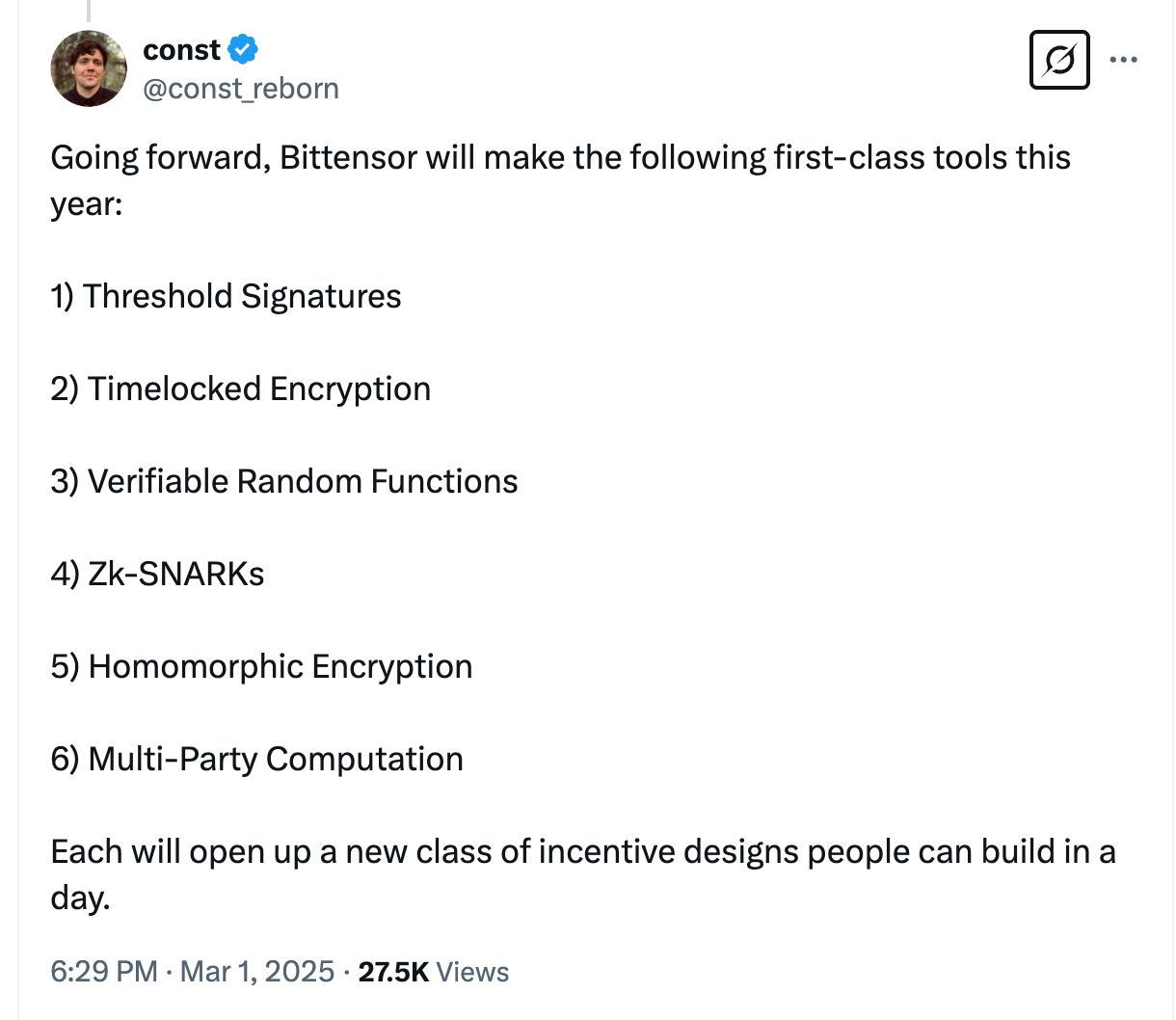

Team Member X, source: const

The official blog ceased updates last year, and no 2025 roadmap is published. The team prioritizes developers over community engagement. The founder outlined upcoming goals (via X): threshold signatures, time-lock encryption, verifiable functions, ZK-SNARKs, homomorphic encryption, and multi-party computation—cryptographic tools to help developers redesign the incentive system.

4. Tokenomics

4.1 Token Allocation

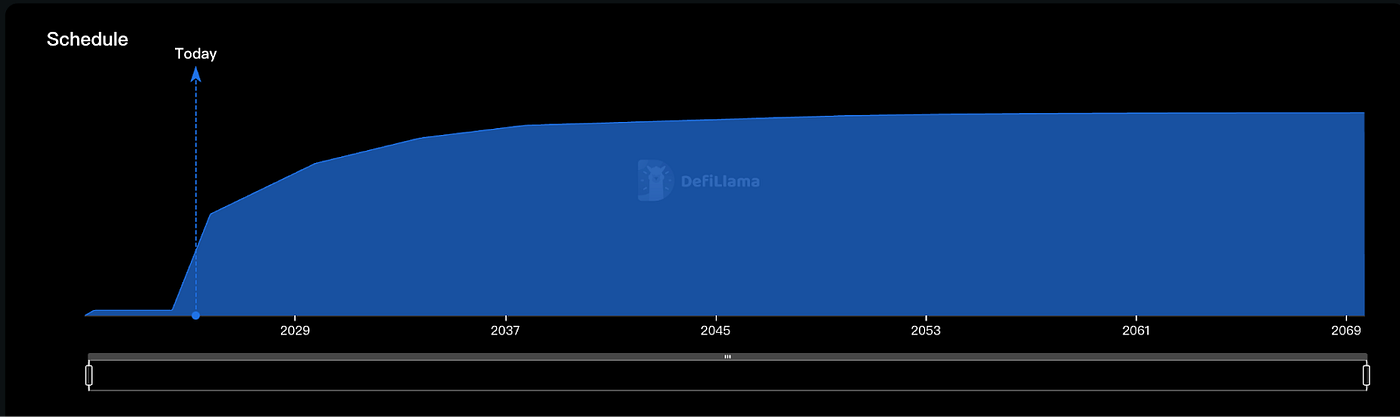

Vesting Schedule, source: Defillama

Finney Network went live March 20, 2023, with first miners mining at launch. Bittensor, like Bitcoin, reserved no allocations for team or VC investors in the primary market. Total supply is 21 million tokens, with 36.95% (about 8.5 million) mined and 68.05% remaining. One TAO is mined every 12 seconds, or roughly 7,200 per day (equivalent to $1.8 million daily at $250/TAO; daily spot volume is $96.62 million).

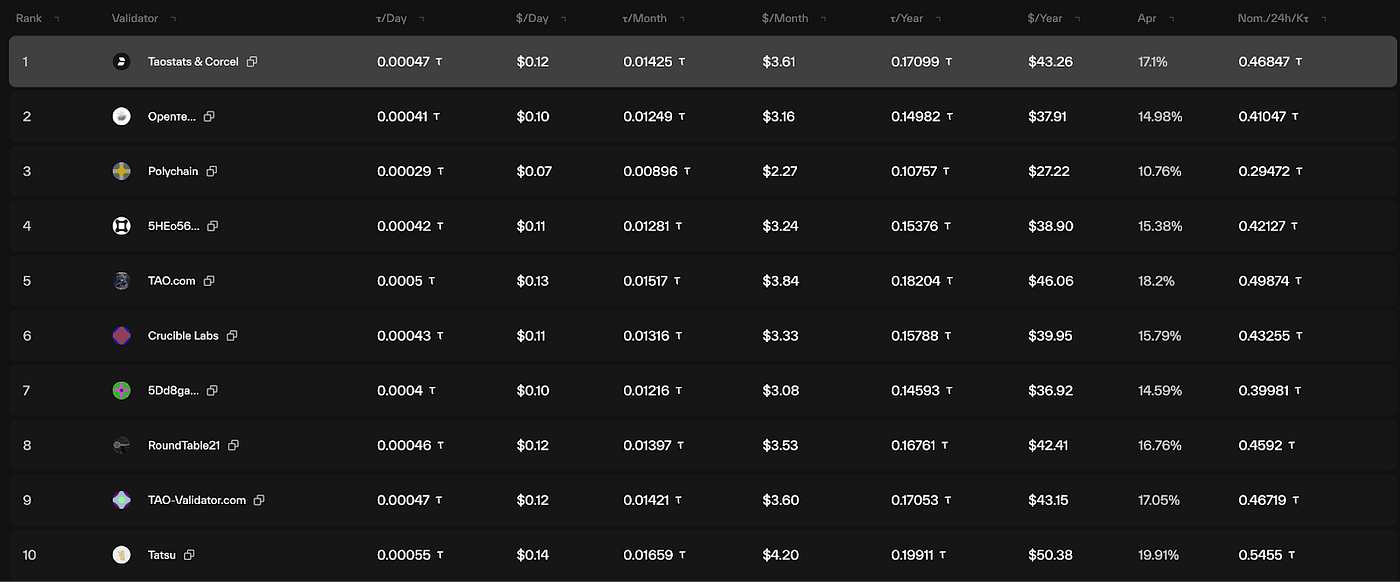

Staking Validators, source: Taostates

Currently, 6,143,675 TAO tokens are staked (72.3% of circulating supply), with staking APY at 15-17%. Comparatively, Solana yields 7.5%, NEAR 9.2%, and Ethereum 2.9%.

TAO’s tokenomics mirror BTC: network value is denominated by TAO; all economic incentives go to validators and subnet rewards. Full emission will take centuries, maintaining a slow, stable release rate.

4.2 Token Utility

- Governance and voting

- Registration fees (miners, validators, subnets)

- Recycling: TAO features a unique recycling mechanism—the network recycles reward TAO back into the pool. Recycling comes from new miner/validator registrations and closed subnets.

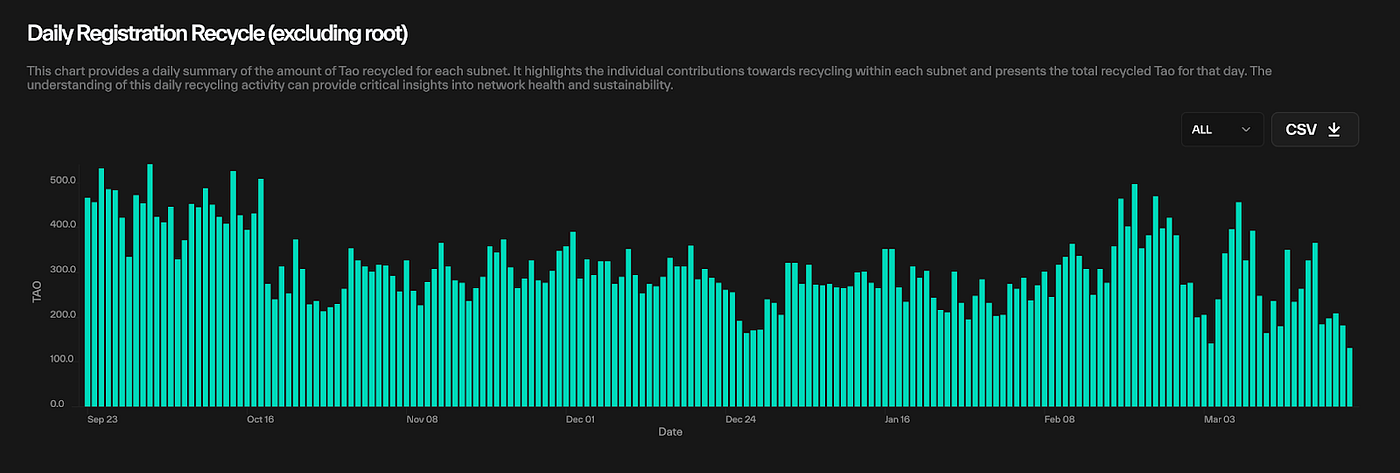

Registration Recycle, source: Taostates

The chart shows daily recycling, reflecting ecosystem engagement, with 150–300 TAO recycled per day.

4.3 Holder Addresses

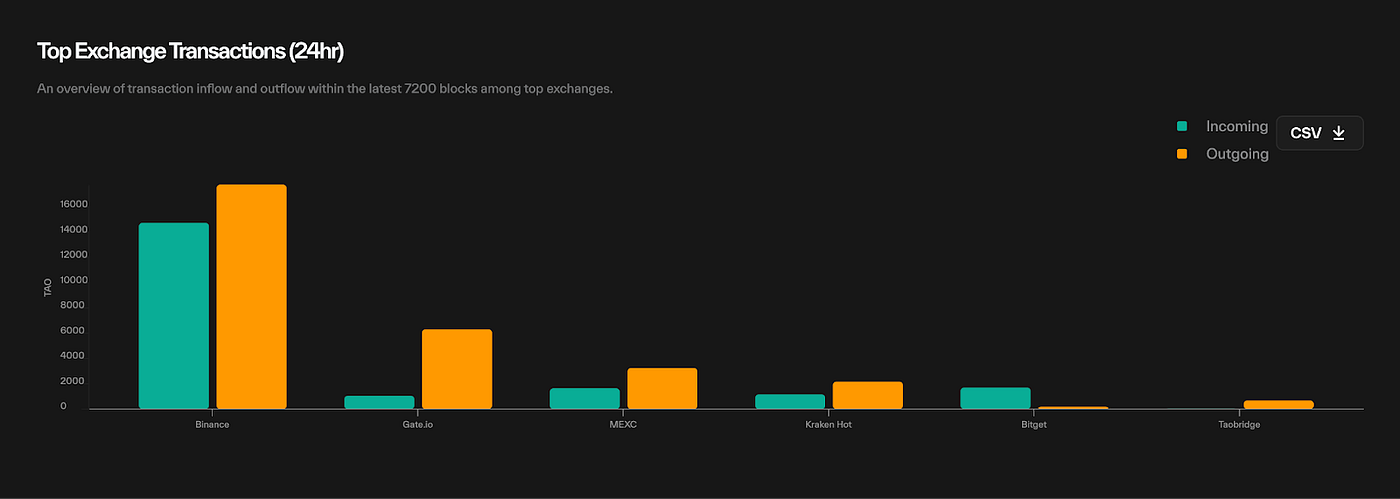

Exchange Transactions, source: Taostates

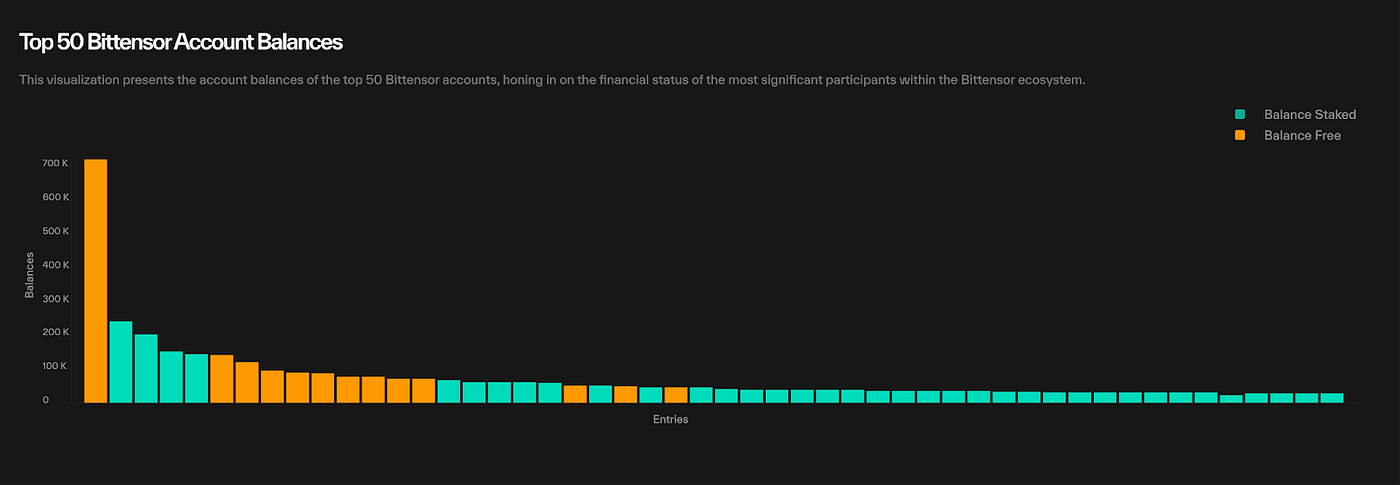

Top50 Balance, source: Taostates

The top 50 addresses control roughly 30% of circulating supply. Binance dominates trading volume, surpassing all other exchanges combined. MEXC is the largest holder by individual addresses.

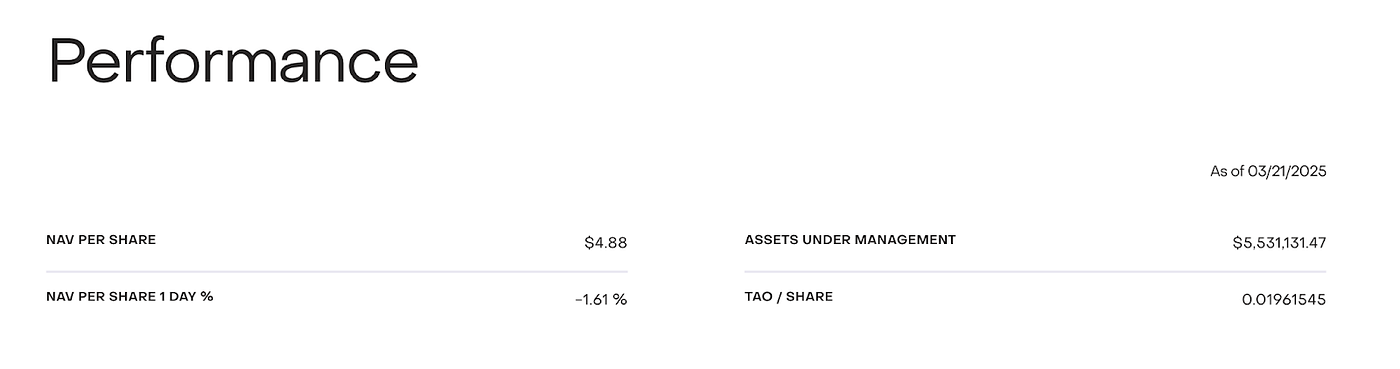

TAO Trust, source: Grayscale

On the ETF front, Grayscale holds $5.5 million worth of TAO.

5. Market & Competition

Bittensor follows a BTC-style release model, with no pre-mined tokens. The project uses game theory for competitive, decentralized solutions across GPU markets, research, distributed storage/indexing, AI training, and inference. Allora, Sentient (model inference), and Sahara AI (crowd-sourced data) are competitors, but Sentient and Sahara AI are effectively subnet-level competitors, while Allora is the most similar structurally.

5.1 Market & Value Chain Overview

Bittensor’s business model parallels Web2 crowdsourcing (e.g., Scale AI, which uses low-cost labor for data labeling, serving companies training large domain models; current valuation exceeds $14 billion). Crowdsourcing yields lower costs and higher flexibility versus centralization, which is more stable and regulated. Decentralization is less efficient, but idle resources in subnets retain latent value. Many companies outsource short-cycle, high-demand tasks to boost efficiency and control costs.

5.2 Track Project: Allora

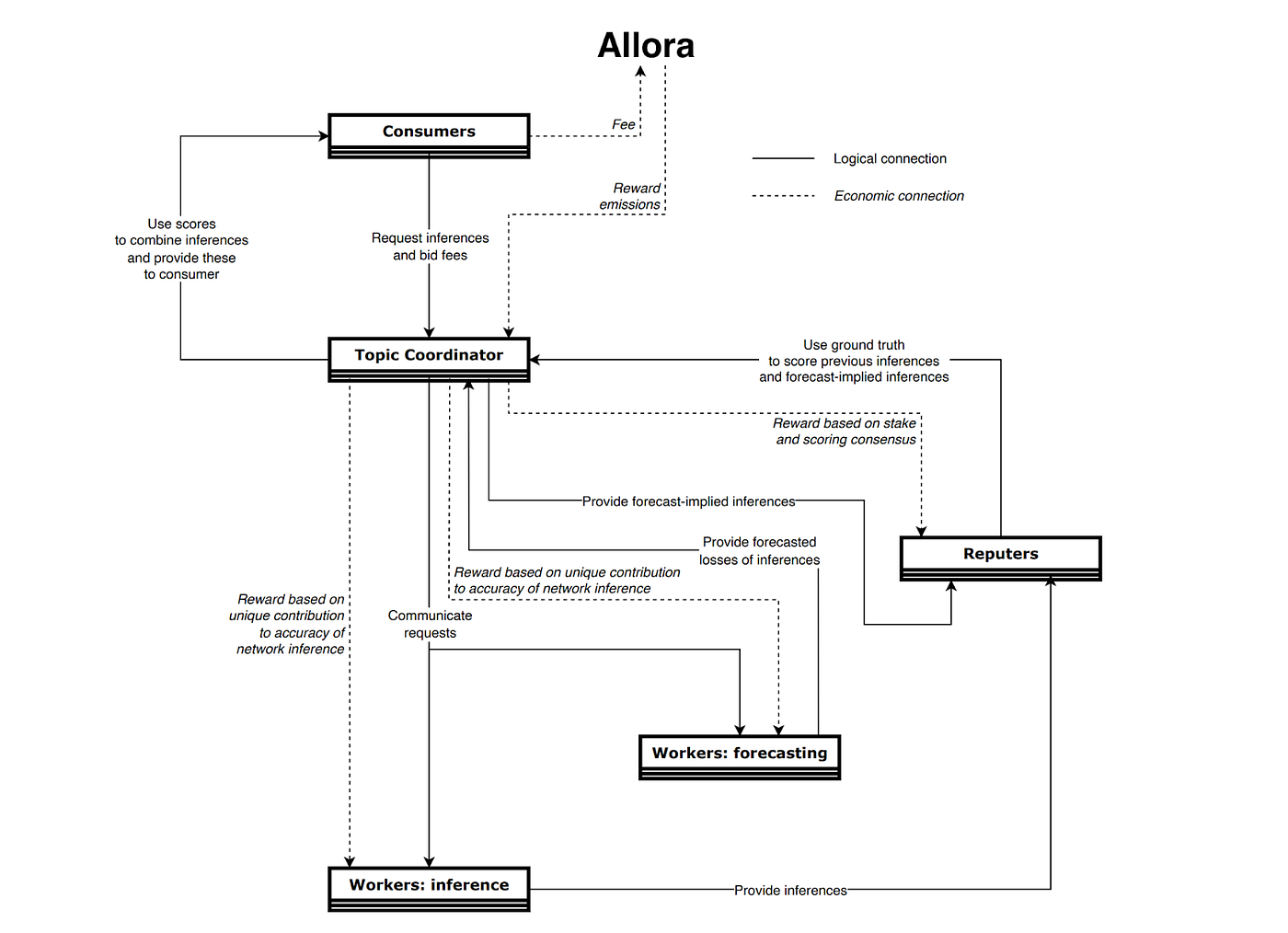

Allora is a community-driven, self-improving AI network. Participants contribute; validators use context-aware inference to assess contributions. Roles: workers (resource providers—analogous to miners in Bittensor), reputers (quality assessors—similar to Bittensor’s Root validators), validators (Cosmos-based infrastructure), consumers (resource users).

Allora Structure, source: Allora

Architecture: Inference Workers generate responses; Forecasting Workers predict error; Reputers combine results for the Top Coordinator, who interacts with consumers.

Key: Forecasting Workers are global—accessing all Inference results. For price prediction, the system evaluates which worker excels under specific circumstances, highlighting Allora’s context-aware technology for scenario-based performance assessment.

5.3 Competitor Comparison

Allora and Bittensor both use game theory to surface top contributors. Differences:

Miner Evaluation

Bittensor uses token economics—reward allocations depend on subnet token price. The goal is to grow subnet token value to earn more issuance rewards.

Allora employs the Shapley approach: contribution is assessed by measuring how network performance degrades in the absence of each worker. Reputers score loss, informing future reward allocation via proportional sharing.

Ecosystem Openness

Bittensor offers greater ecosystem autonomy—subnet developers can offer any service and must source their own clients. In Allora, miners are limited to large models, often tailored to finance or predictions, and ecosystem integrations are centrally coordinated. Allora resembles a tightly organized model cluster; Bittensor is like islands linked by bridges, each with its own currency and core industry.

Community & Capital

Allora excels in community and funding, raising almost $33 million from leading VCs. Bittensor claims only Discord as an official channel. Allora offers Telegram, X, Discord, and Forums. Bittensor is more Bitcoin-like, preferring organic community development.

Tokenomics

Bittensor subnets can issue their own tokens; Allora miners use a single Allora token. Bittensor had a fair launch; Allora reserved major allocations for team and VCs. Both employ Bitcoin-style emission models with four-year halvings.

In summary, Bittensor’s architecture is uniquely open, supporting independent projects with self-issued tokens, unlike any current competitors.

6. Risk Factors

- Lack of infrastructure, marketing, and community engagement increases opacity.

- High redundancy in the ecosystem, insufficient independent teams—single Labs manage multiple subnets, limiting focus and competitiveness.

- Complex TAO mechanism, high retail learning curve, and demanding knowledge requirements on project teams.

References

- Bittensor (TAO): https://oakresearch.io/en/reports/protocols/bittensor-tao-presentation-protocol-combining-ai-blockchain

- Bittensor Docs: https://docs.bittensor.com/

- THUBA Report: https://foresightnews.pro/article/detail/67830

- Demystify Bittensor: https://www.trendx.tech/news/comprehensive-analysis-of-the-decentralized-ai-network-bittensor-1215435

- Reflexivity Research: https://x.com/reflexivityres/status/1843319486138474552

Disclaimer:

This content does not constitute an offer, solicitation, or advice. Always seek independent professional guidance before making investment decisions. Gate and/or Gate Ventures may restrict or prohibit services in some regions. Please refer to the applicable user agreement for details.

About Gate Ventures

Gate Ventures is the venture capital arm of Gate, focusing on investments in decentralized infrastructure, ecosystems, and applications that will reshape the world in the Web3 era. We partner with global industry leaders to empower innovative teams and startups, helping redefine social and financial interactions.

Website: https://ventures.gate.com/

Twitter: https://x.com/gate_ventures

Medium: https://medium.com/gate_ventures

Related Articles

Gate Ventures Weekly Crypto Recap (September 29, 2025)

Gate Ventures Weekly Crypto Recap (October 6, 2025)

Gate Ventures Weekly Crypto Recap (September 22, 2025)

Gate Ventures Weekly Crypto Recap (October 20, 2025)

How On-Chain TCGs Could Unlock the Next $2 Billion Market: Landscape Overview and Valuation Outlook