How important is timing for TGE?

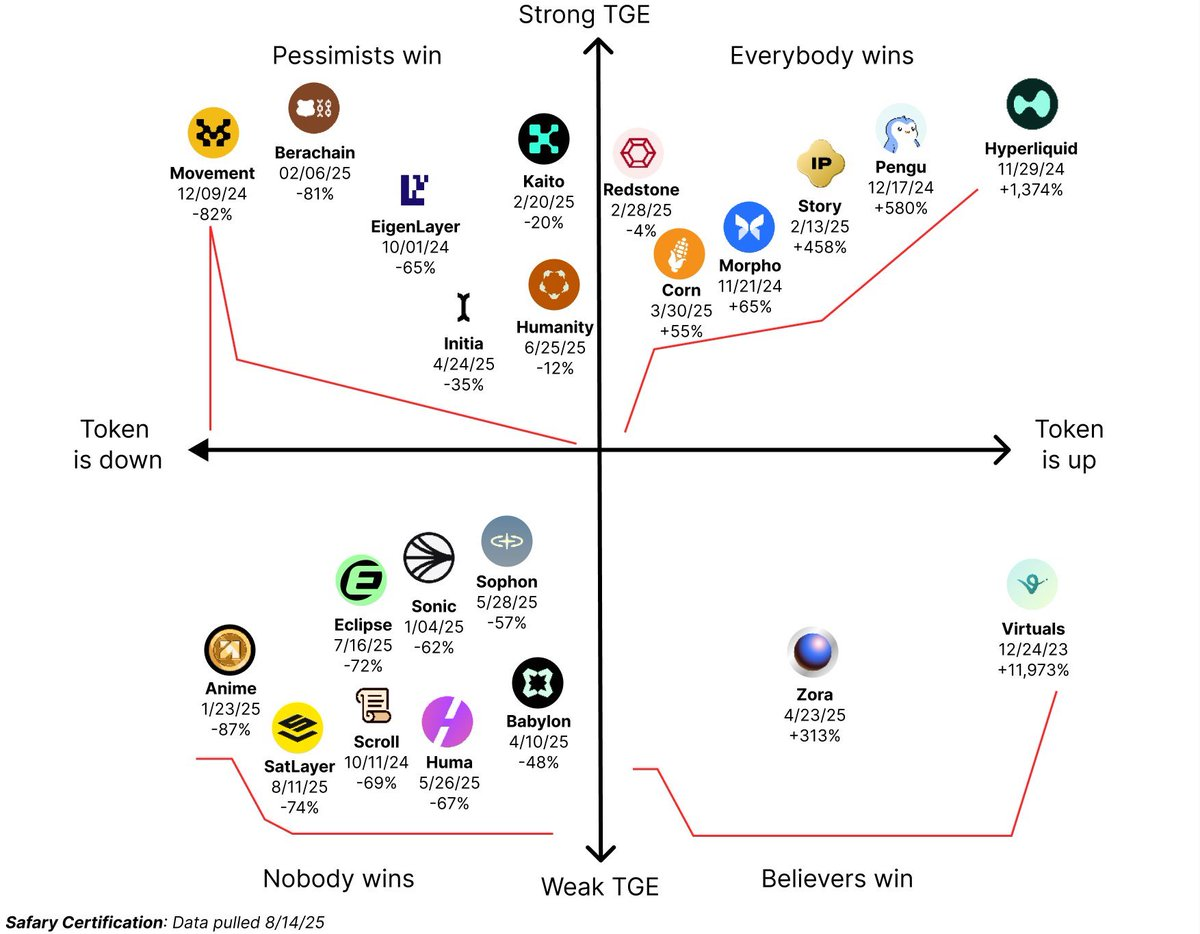

Analysis of a chart seen on Twitter led to several considerations worth sharing and discussing:

1) Timing a TGE during periods of strong market liquidity is critical—sometimes even more important than the project’s fundamentals.

For example, $Pengu, an NFT community meme token, launched on December 17 last year amid high liquidity and outperformed most other projects. By contrast, $BABY and $HUMA—both with technological narratives and backing from VCs—launched during the liquidity drought in April and May this year, resulting in poor performance.

2) Projects often crowd into the same launch window, but it’s vital to consider whether the market’s liquidity can absorb them all.

Take last November and December, when projects like Hyperliquid, Movement, Pengu, and Morpho clustered their launches. Despite mixed results, most managed to break through. In contrast, this April and May saw Babylon, Initia, Zora, Huma, and Sophon launch together, but inadequate liquidity led to disappointing outcomes.

3) Even in favorable TGE windows, some projects peak right at launch.

Certain projects exploit periods of abundant liquidity and heightened retail FOMO for their TGE, masking weak fundamentals. Examples include Movement and Berachain, which saw surging FOMO at launch but ultimately suffered relentless declines. This demonstrates that without solid fundamentals, the benefits of market liquidity can accelerate a project’s decline.

4) In unfavorable TGE windows, resilient projects with strong fundamentals may uncover golden opportunities for value discovery.

$ZORA is a prime example: it launched during the market’s quietest, driest liquidity phase and emerged as the sole winner among its cohort. Similarly, $Virtual launched in a downturn but led a Solana AI Agent trend thanks to its standout fundamentals, rewarding committed supporters in the end.

5) Regardless of the launch window’s strength, fundamentally strong projects ultimately stand out.

For instance, Hyperliquid built a massive community and drove a Perp DEX narrative wave, with $HYPE prices climbing stepwise. @flock_io also launched during last year’s liquidity peak. While $FLOCK’s circulating market capitalization fell to a striking $3 million, its solid fundamentals led to nearly every major exchange listing, allowing core believers to ultimately prevail.

In summary,

For most retail investors, recognizing the significance of TGE timing can guide differentiated strategies: In strong TGE periods, beware of chasing tops and consider rapid entry and exit; in weak TGE periods, focus on research, seek undervalued quality assets, and hold for the long term. Both approaches offer the potential to come out ahead, even though the journey may be tough.

Statement:

- This article is reposted from [tmel0211]. Copyright belongs to the original author [tmel0211]. If you have any objections to this repost, please contact the Gate Learn team; the team will follow established procedures to resolve requests promptly.

- Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute investment advice.

- Other language versions have been translated by the Gate Learn team. Copying, distributing, or plagiarizing translated articles is prohibited unless Gate is clearly cited.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?