What’s the best way to farm Aster S2 and maximize your share of the $700 million airdrop?

Pumping the price is the best publicity.

In just one week, the Aster platform welcomed over 710,000 new users. Over the last 24 hours, perpetual contract trading volume hit $21.112 billion—more than double that of legacy DeFi derivatives platform Hyperliquid. Platform TVL is now $1.744 billion, and 24-hour revenue reached $7.12 million, making Aster the third highest-earning protocol globally, trailing only stablecoin leaders Tether and Circle.

Aside from, "Can you still buy ASTER?" the question, "Can you still farm Aster?" is frequently asked as well.

The second season Aster airdrop has 11 days remaining, with the pool accounting for 4% of total supply—approximately 320 million ASTER tokens. At the time of writing, assuming an $ASTER price of $2.3, the S2 airdrop is worth over $700 million. Against this backdrop, BlockBeats has summarized the core current Aster airdrop strategies.

1. Aster × Backpack Hedged Arbitrage Strategy

This is currently the primary points farming strategy. The key process involves placing opposing orders for the same asset simultaneously on two trading platforms (such as Backpack and Aster) to execute "points farming plus fee spread capture."

One critical detail: use "market orders" on Aster, as market takers earn double points there.

The step-by-step process: place a limit order to short $ASTER on Backpack and earn maker points, then quickly open a market order on Aster for immediate execution. Speed is essential—if one side doesn't fill quickly enough, you risk an unhedged exposure.

Also, manage your position holding time and trading frequency carefully. Longer holds yield higher points, but there is a cap at twice your weekly trading volume.

To avoid Sybil attacks, try varying your parameters—such as position size, leverage, and direction—rather than farming with the same settings repeatedly. High-frequency, parameter-fixed hedging may trigger risk controls and Sybil detection. Beginners should start with smaller trades and gradually increase volume and leverage as they gain experience.

2. Funding Rate Arbitrage

This strategy builds on the dual-platform hedged approach to further capitalize on funding rate differentials.

The core idea leverages perpetual contract funding rates: when the funding rate is positive, short perpetuals to earn the funding rate; when negative, go long. Typically, funding rates differ between platforms. Tools like the one below help visualize rate discrepancies, optimal trade direction, and APR across platforms.

Source: hibot

Continue using the Backpack (limit order) plus Aster (market order) for spot hedging and point earning. Net profit calculation: points value + funding rate income – trading fees – slippage.

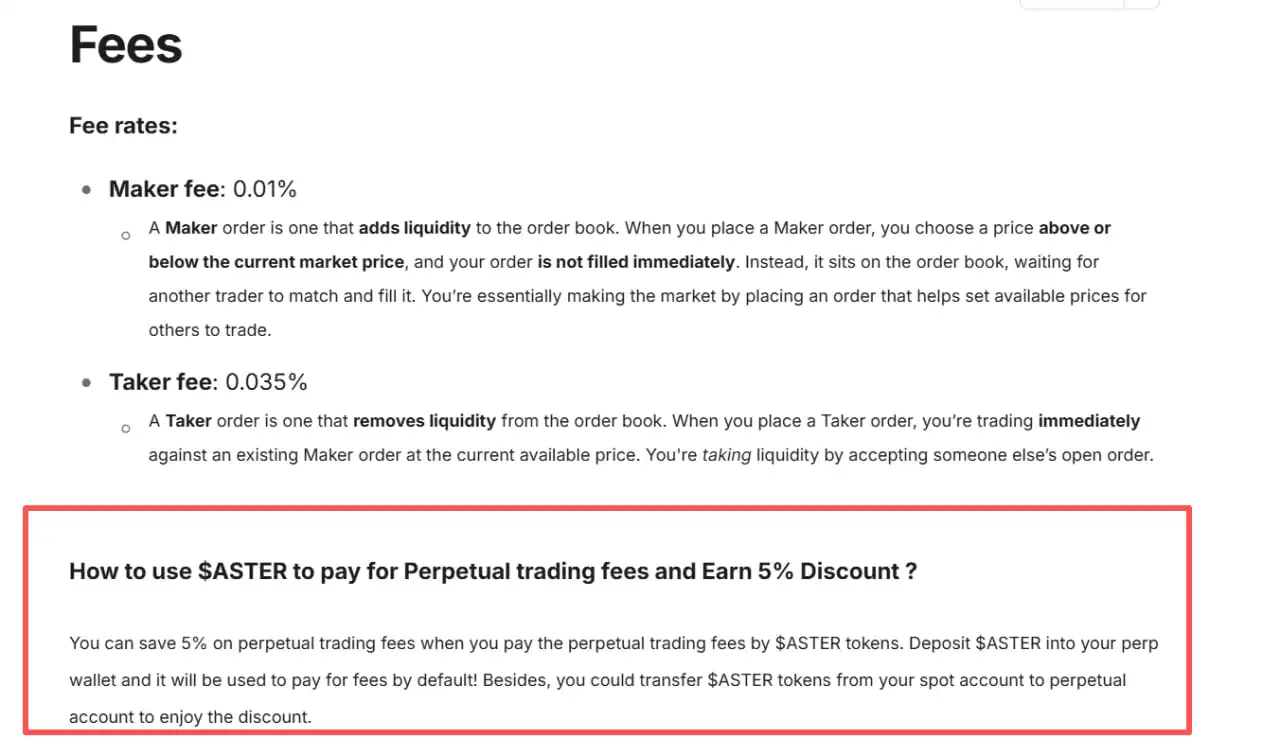

Always factor in the platform’s fee structure. Fees typically come in two flavors: Taker (market order) fees—higher, for immediate execution; Maker (limit order) fees—lower, for resting orders.

This method requires real-time monitoring and suits experienced traders or those deploying funding rate bots. Be vigilant for latency and reconciliation issues across multiple accounts and platforms. Funding rate arbitrage usually spans longer timeframes than points farming—don't neglect position management.

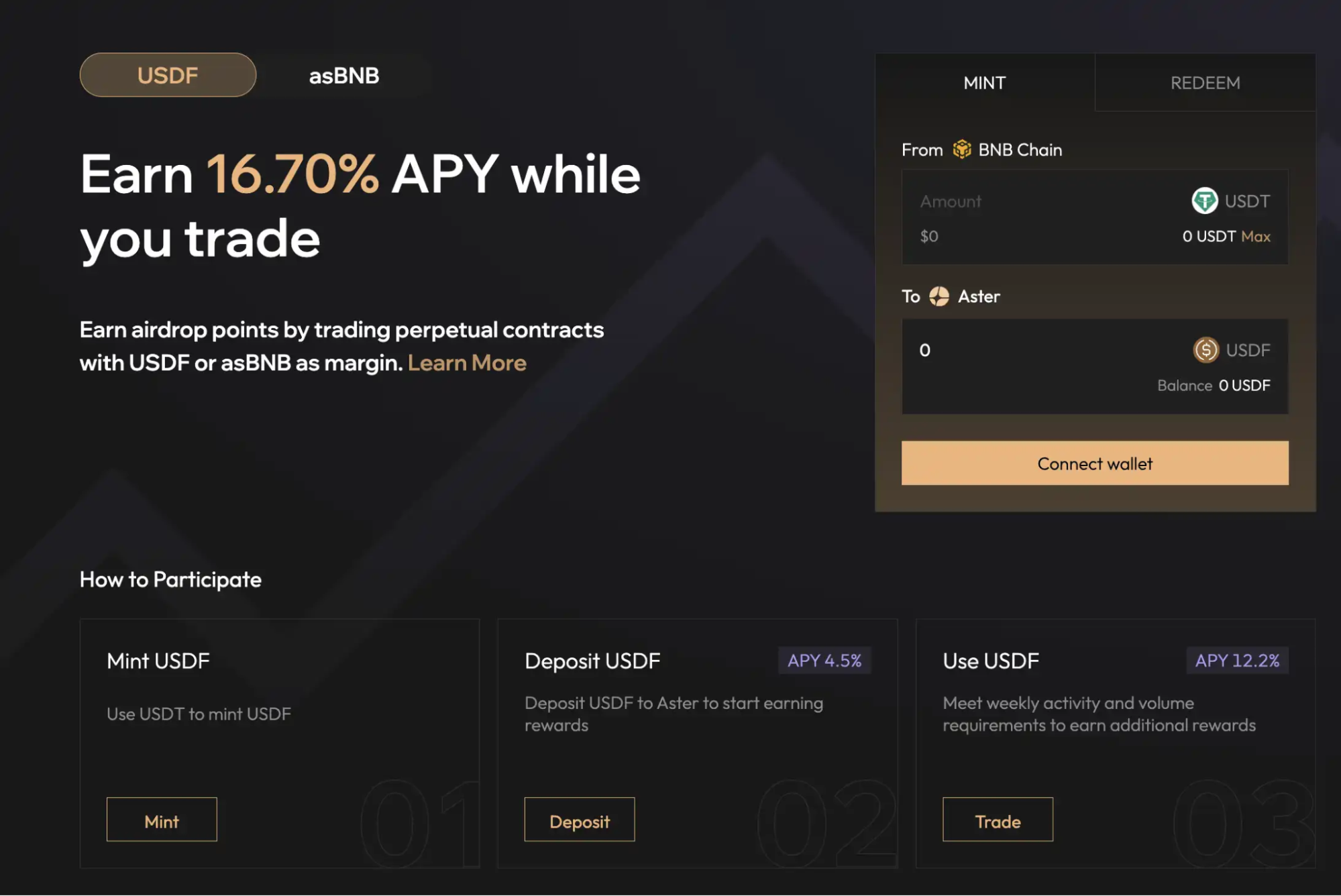

3. Convert Deposits to USDF

Beyond hedging and funding rate strategies, Aster also offers a relatively "low-risk, passive income" option through the USDF and asBNB "Trade & Earn" program. This builds on Aster’s previous expertise in asset staking liquidity, integrating trading with asset management so users can stay active while earning stable APY.

Currently, USDF offers an approximate 16.7% APY. There are two ways to participate: (1) Deposit rewards—holding more than 1 USDF in your account automatically accrues interest; (2) Trading rewards—requires users to be active for at least 2 days per week with a total volume exceeding 2,000 USDT. If you qualify, rewards are paid out the following week directly to your trading account with auto-compounding.

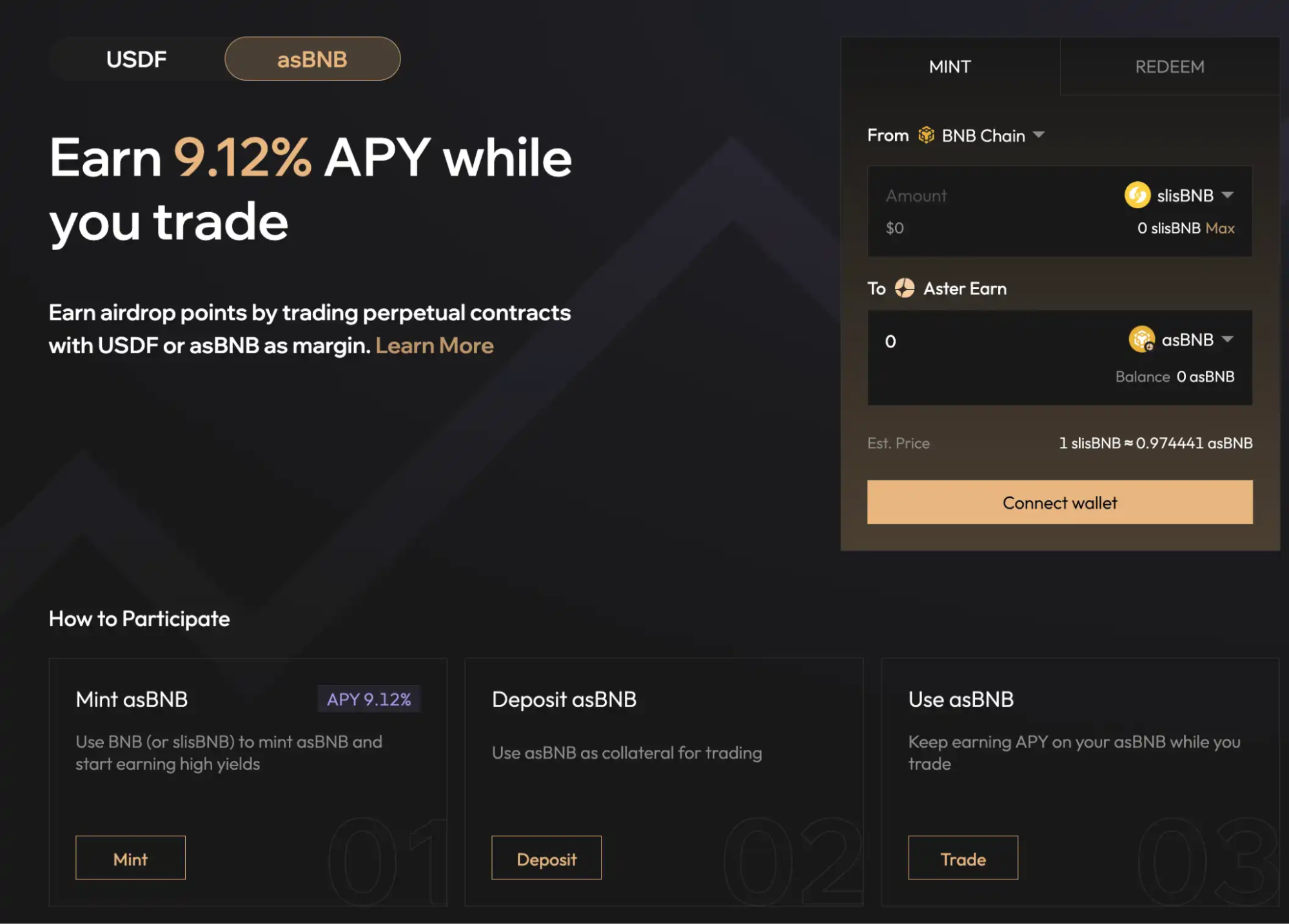

Aster also provides asBNB, which works similarly to USDF. Users may swap BNB or slisBNB for asBNB to use as margin while earning roughly 9.1% APY.

Additionally, Aster’s incentive design includes a "double points" mechanism. If you use USDF or asBNB as margin, you’ll receive double trading points, and your weekly trading volume cap for points also doubles. For airdrop hunters or commission seekers, these assets are almost essential, bundling interest income with boosted points for every trade.

Beyond that, holding $ASTER gives a 5% trading fee discount, so every wallet should keep some $ASTER.

4. Team Multiplier

Solo users can only earn so many points through their own trading. If you form a "team" and grow your network through referrals, you can leverage others' trading points and climb the leaderboard for a greater share of the rewards. Over time, a team’s total contribution may far surpass what one account can achieve; "invite plus teamwork" will be the critical differentiator in later stages.

The core logic combines "referral" and "team contribution" incentives to collectively boost your points.

Specifically, referral rewards have two tiers: referring a first-degree user gives you 10% of their Rh points; referring a second-degree user (i.e., your referral’s referral) earns you 5%. Note: This split only applies to their trading points (excluding referral and team points), preventing infinite recursive sharing.

Aster also introduced "Team Points." Each team’s points settle on T+1 and are compared across teams. Before awarding points, the system applies fairness adjustments—such as limiting dominance by whales and smoothing extreme volatility. Thus, team rewards depend both on the number of referrals and overall team activity and contribution rate.

Ultimately, all points are converted weekly into your share of the platform’s airdrop pool, directly determining your $ASTER allocation. In summary: referral relations provide a steady 10%/5% split; team points determine your leaderboard position and eligibility for extra rewards.

Aster’s second season airdrop has 11 days left, with the pool at 4% of supply (roughly 320 million ASTER) and S2’s value above $700 million at the time of writing.

Given explosive user growth and the complex points system, the Aster team has clarified: professional market makers are excluded from the Rh points system and cannot qualify for $ASTER airdrops. In the current stage, only pure spot holding and trading are excluded from the Rh points system, but this doesn't mean spot trading is worthless—based on official statements, Q3 airdrop rules are likely to include spot trades once again.

For now, retail users have plenty of opportunity. However, beware: the market is overheated, FOMO sentiment runs high, bots abound, and the timing of the second season airdrop is still uncertain. Competition is fierce, so users must manage their risk.

Disclaimer:

- This article is reposted from [BlockBeats]. Copyright remains with the original author [aleel加六]. If you object to the republication, please contact the Gate Learn team and we will handle it promptly per established procedures.

- Disclaimer: The views and opinions expressed are those of the author alone and do not constitute investment advice.

- Other language versions are translated by the Gate Learn team. Do not copy, distribute, or plagiarize translated articles without referencing Gate.

Related Articles

12 Best Sites to Hunt Crypto Airdrops in 2025

Top 20 Crypto Airdrops in 2025

Gate Research: BTC Breaks $100K Milestone, November Crypto Trading Volume Exceeds $10 Trillion For First Time

A Must-Try Project Backed by Binance Labs with Extra Staking Rewards (Step-by-Step Guide Included)

A Detailed Guide on Monad and Potential Airdrop Opportunities