How We Made $5M Running the #1 Arbitrage Bot on HyperEVM

It’s March 2025. Crypto looks doomed. Tariffs are hitting hard. We wonder what the next best opportunities are.

With 40% of $HYPE still to be allocated to the community, we see it as a potential play. In February we had already tested some market-making strategies on UNIT assets but nothing serious. Just small moves.

HyperEVM just launched with some DEXs and my brother goes: “What if we try arbitraging between HyperEVM and Hyperliquid to farm a possible HL Season 3 even if it costs us money?”

We give it a try. Arb opportunities are there, but we don’t know if we can actually compete.

Why are there arbitrage opportunities on HyperEVM?

Blocks last for 2 seconds on HyperEVM. It means the price of $HYPE updates only every 2 seconds there. In 2 seconds, $HYPE can move. So $HYPE on HyperEVM often becomes “underpriced” or “overpriced” compared to Hyperliquid.

First steps and results

We build a first version, quite basic. Whenever there is a price difference between a HyperEVM AMM DEX pool and Hyperliquid spot, we send a tx on HyperEVM and hedge on Hyperliquid.

Example:

- If HYPE is moving up on Hyperliquid, it’s underpriced on HyperEVM.

- Trade: buy “cheap” HYPE on HyperEVM with USDT0 → sell HYPE for USDC → swap USDC back to USDT0 on Hyperliquid.

First few days, we make around $200k-300k daily volume on Hyperliquid and we don’t lose money. Even better, a few hundred dollars.

At the beginning, we execute arb trades when profit is above 0.15% after fees (Fees on the AMM DEX and on Hyperliquid)

2 weeks later, we start to see some potential as profit is going up. We identify 2 other competitors who are doing exactly like we do. They don’t seem really big though. We want to cook them.

In April, Hyperliquid introduces $HYPE staking for trading fee rebates. Perfect update: we have more size than competitors. We stake 100k HYPE to get a 30% rebate on trading fees and lower our profit threshold from 0.15% to 0.05%.

We want to put maximum pressure on them so they give up and let us eat the cake alone. Our goal is also to achieve >$500m in 2 weeks to improve our trading fee tier on HL.

Volume goes up, profit goes up and we reach >500m volume that puts competition in shambles. I remember this day when both competitors turned off their bots, my brother and I are travelling from Paris to Dubai and just frenetically watching the bot printing money. $120k profit in 24 hours.

Despite higher trading fees, competitors don’t give up and are forcing us to go for tight margin, around 0.04% margin, basically the gap between their fees and ours.

Volume is still going strong and daily profit is sitting in the 20k-50k USD range.

Scaling issues

As we scale, we start hitting limits. Gas per block on HyperEVM is capped at 2M. One arb eats ~130k gas, so we can only fit 7–8 arbs per block. That’s not much, especially as more pools and more DEXs launch on HyperEVM. Some of our txs get stuck, and we need to fix this quickly to avoid queued txs and unbalanced book.

We respond by introducing a few things:

- 100+ wallets, each sending arb transactions so no single wallet queues up

- Max 8 arbs per block

- Gas control: when HyperEVM gas spikes, we raise required ROI so we don’t send txs that will just get stuck in high gwei.

- Rate limiting: if we send more than x txs in the past 12 seconds, we increase profit requirements before sending new ones.

Improvements era

As we keep printing money and doing 5–10x more volume than the competition, we get OBSESSED with improvements. This isn’t our first rodeo. One day you’re printing while drinking beers, the next day some entity shows up and sends you straight to goblintown.

→ Becoming makers on Hyperliquid

In June, my brother wants to test an idea he’s been sitting on for weeks: start the arbitrage trade as a maker on Hyperliquid instead of a taker.

Two big benefits:

- Catch wick candles on HYPE → more arb opportunities

Save 0.0245% fee per trade → more profit

This is a challenging update because we take one trade on Hyperliquid and we are not sure we will be able to take the opposite trade on HyperEVM (someone might be faster than us).

Before that, we were starting our arb trades by sending one transaction on HyperEVM. The tx failed? We do nothing on HL. The tx succeeds? We execute trade on HL.

But as a maker, you take a risk as you agree to be filled on Hyperliquid without being sure to be filled on HyperEVM where the price opportunity is. This generates unbalancing risks in our book and then potential losses.

At first, every test ends up with +-10k HYPE unbalancing. We actually have a hard time to understand why these unbalancing setups are happening as we sometimes send 100 txs in 20 seconds and we don’t have any data analysis tool. Absolute mess.

In order to execute arb with trades as makers, we need to add new concepts that we translate into new parts of code and parameters:

- Profit range: when to create an order, when to keep it, and when to cancel + replace

- AMM pools we’re willing to trade as makers (e.g. HYPE/USDT0 0.05% on HyperSwap, HYPE/UBTC 0.3% on PRJX)

Size & order count per AMM pool

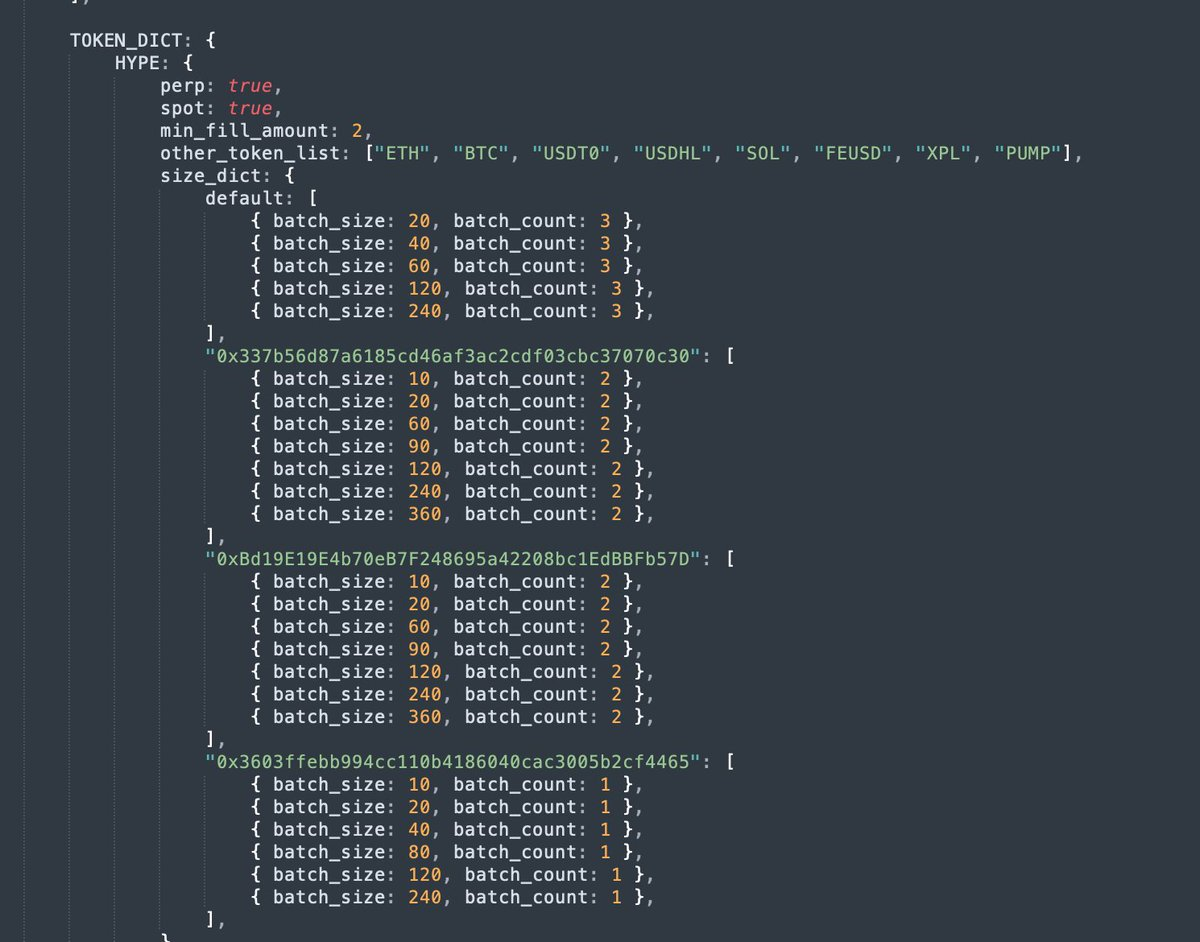

Parameters for taker trades look like this

After days of fine-tuning, we finally avoid most of the unbalancing. And in case of unbalancing, we TWAP asap to limit risk. Total game changer. Competitors are still only takers and we’re cooking them, hitting 20x their volume.

→ Skipping USDT/USDC trades on HL

The next challenge we see is USDT0 specific case.

USDC is top 1 stablecoin on Hyperliquid and USDT0 is top 1 stablecoin on HyperEVM.

The best pools on HyperEVM by volume and arb opportunities are HYPE-USDT0 pools.

But as we need USDT0 on HyperEVM and USDC on Hyperliquid, we still have to execute 2 trades on Hyperliquid to rebalance between the two assets.

Example when HYPE pumps:

- Maker order fills → sell HYPE for USDC (0% fee)

- Buy HYPE with USDT0 on HyperEVM

- Sell USDC for USDT0 on HL as taker (0.0245% fee)

That 3rd part sucks:

- We pay taker fees (less profit, less competitive)

USDT0/USDC market on HL is not mature → spread, mispricing

We decide to skip this trade whenever possible. To do that, we build new parameters and logic:

- USDC threshold: skip USDT0→USDC only if USDC balance >1.2M

- USDT0 threshold: skip USDC→USDT0 only if USDT0 balance >300k

True price feed: request Cowswap API every minute to get real USDT0/USDC price instead of trusting HL orderbook

→ Introducing perps on arb trades

Disclaimer before anything else: we have never used leverage or perps in our entire journey in crypto (except on Bitmex back in 2018 which was not very successful lmao) and have not much idea how it works.

But what we notice at some point is that volume on HYPE perps is much higher than on spot and fees are slightly better (0.0245% on spot vs. 0.019% on perp).

We feel like we should give a try to our strat with perps. No other competitors are using perps so we won’t be competing with them with the same orderbook liquidity.

What we understand is that while running tests with perps, we could also farm funding and get access to more arb opportunities when HYPE perp is trading at a premium or at a discount vs. spot. That’s something competitors are not doing.

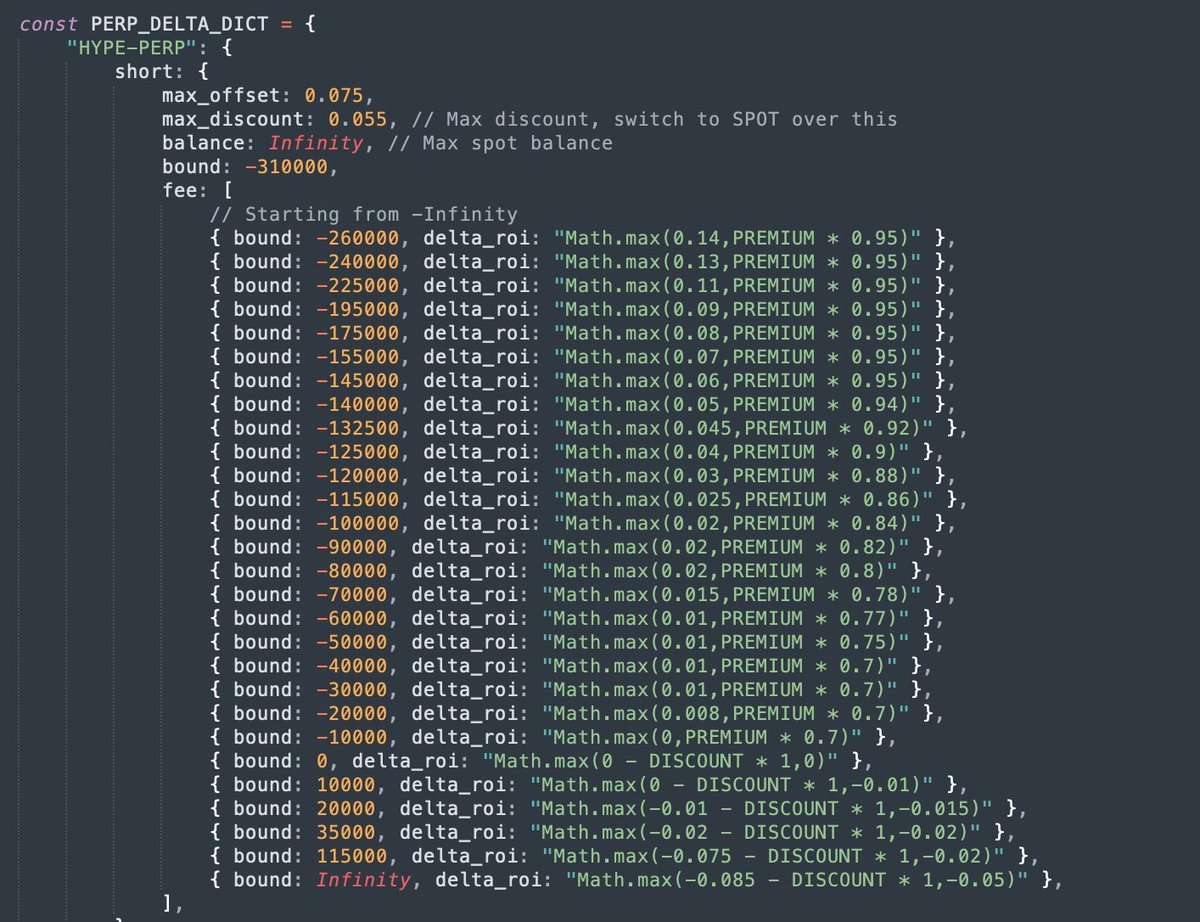

We design a new system with parameters:

- Bound: max HYPE size to short/long → avoid liquidation or draining USDC/HYPE balances

- Premium/Discount: current premium/discount on perp

- Max premium/ Max discount: if premium is too high, we stop creating long orders and go for spot instead

- Progressive ROI: the larger the short/long, the higher profit we require to avoid getting trapped too fast into a short/long position

- ROI formulas: depend on perp premium/discount + position size

This is how it looks like to configure short on HYPE as takers

Adding perps has probably been one of the most significant upgrades, it generated around $600k alone from funding and much more arb opportunities with premium/discount.

About our dynamics and synergies as two brothers while improving the bot

Very often, people ask us what do we do and how do we work together. I’m usually seen as the shitposter of the duo just yapping bullshit on CT (part that I don’t deny) and my brother is sometimes just seen as the geek coding stuff.

Things are much more nuanced than this. The dynamics that emerge are very similar to the ones during Blur farming era actually. With such bot, you never know what’s coming up. We face challenges and issues on a daily basis that we need to fix. We talk nonstop about improvements, every day. We don’t do anything until we reach agreement. He codes, but he also builds tools so I can manage parameters.

I have no fucking clue about coding a bot. My bro has. He has no fucking clue about how to configure the bot. I have.

Funny thing about my brother and me is that we have very different personalities when working on a bot. My brother likes to push updates and try things (too much in my opinion) while I’m very conservative ((too much in his opinion) and want to keep the same version as long as we are printing.

Typical exchange:

- Me (very toxic): “Bot looks weird… did you change something???”

- Him: “No.. well, maybe something minor.”

One strange thing about building a bot as two without proper corporate processes is that after 250 updates, you feel like you have created something you don’t fully understand or control anymore.

When you push new updates, it’s sometimes hard to grasp all the impacts it will have.

Conclusion

These last 8 months have been dedicated to building and improving this bot. Especially when these mfers of Wintermute joined the party in June with their shit ton of liquidity and army of wagies.

I remember our 5 days in July between Istanbul and Bodrum with my brother where we were supposed to chill and were just LOCKED IN improving the bot.

We managed to be top 1 for 8 months and felt like it was time for us to step back as our market share was progressively going down in October.

We end with:

- $5M profit

- $12.5B volume on HL

- $1.2M gas fees paid on HyperEVM (20% of total since HyperEVM launch)

- +2000 hours of grind

5% of Unit volume

Praying for a HL Season 3 & Unit Season 1

Thanks for reading and see you soon on a new on-chain adventure

CBB.

Disclaimer:

- This article is reprinted from [cbb0fe]. All copyrights belong to the original author [cbb0fe]. If there are objections to this reprint, please contact the Gate Learn team, and they will handle it promptly.

- Liability Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute any investment advice.

- Translations of the article into other languages are done by the Gate Learn team. Unless mentioned, copying, distributing, or plagiarizing the translated articles is prohibited.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?