Hyperliquid Stablecoin Decision Nears: Why New Team Native Markets Secured USDH

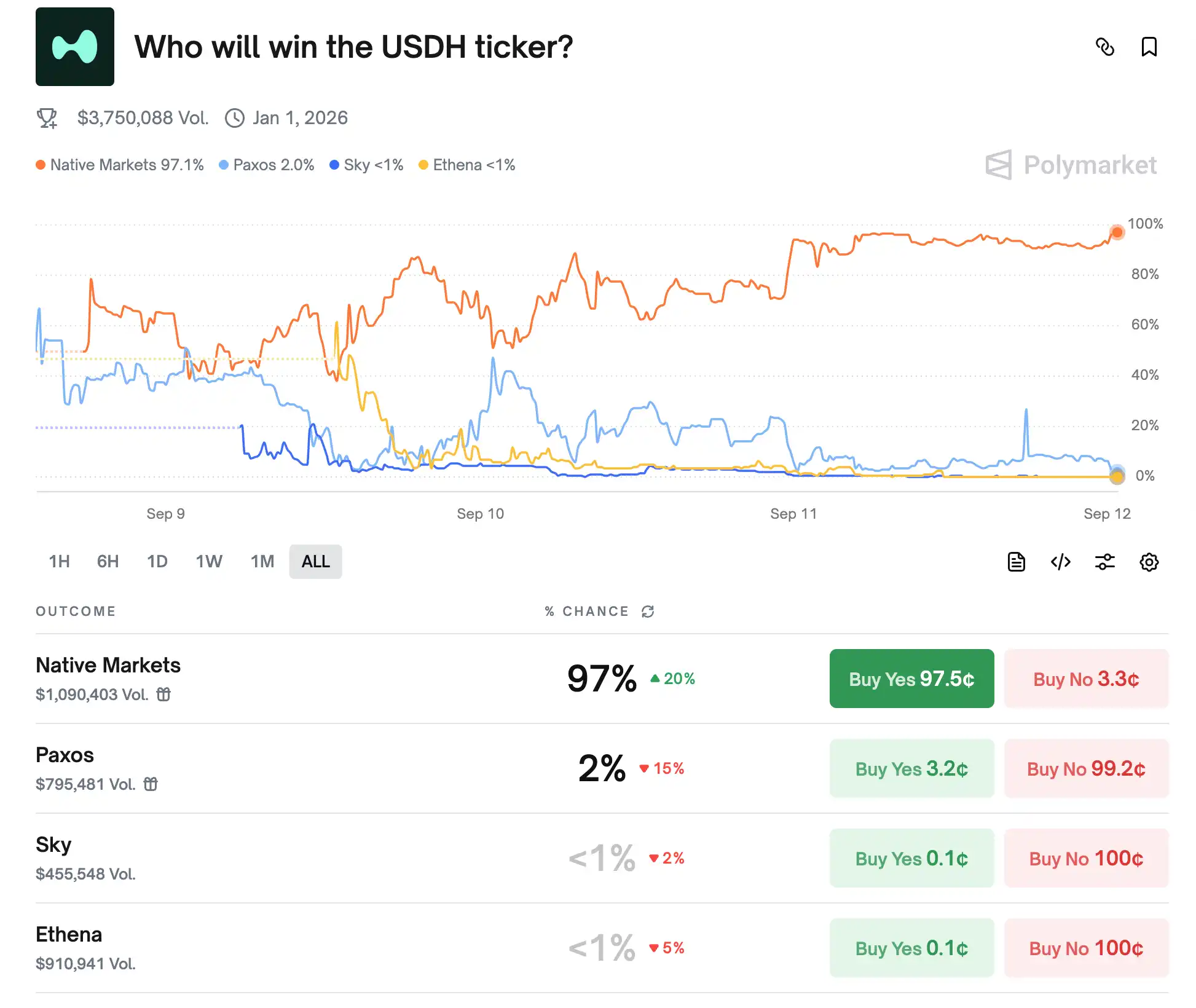

Hyperliquid, the decentralized derivatives trading platform, recently became the stage for a stablecoin competition. On September 5, the platform announced its upcoming auction for the native stablecoin USDH ticker, immediately igniting market excitement. Institutions such as Paxos, Ethena, Frax, Agora, and Native Markets quickly submitted bids, each vying for the right to issue USDH. As a leading player in the perpetual DEX sector, Hyperliquid is seen as a strategic must-enter opportunity by major firms—even when immediate profits aren’t guaranteed. At present, Native Markets leads the pack by a staggering 97%, nearly ensuring victory.

Native Markets’ Approach

Native Markets proposes a dual-reserve model for USDH, with BlackRock handling off-chain reserves and Superstate managing on-chain assets. This approach is designed to ensure regulatory compliance and maintain issuer neutrality. The structure stands out for splitting reserve interest income: half flows into an Assistance Fund for HYPE token buybacks, and the other half fuels ecosystem initiatives, including expanding the HIP-3 marketplace and HyperEVM applications.

Users can mint or redeem USDH using Bridge, with further fiat on-ramp options planned. The protocol’s core system, CoreRouter, has completed its security audit and been open-sourced, inviting direct community involvement. Native Markets further pledges that USDH will conform to U.S. GENIUS regulatory standards and inherit Bridge’s global compliance and fiat integration capabilities. Notably, payments giant Stripe acquired Bridge last year, and Native plans to leverage Stripe’s network for deep stablecoin-fiat connectivity.

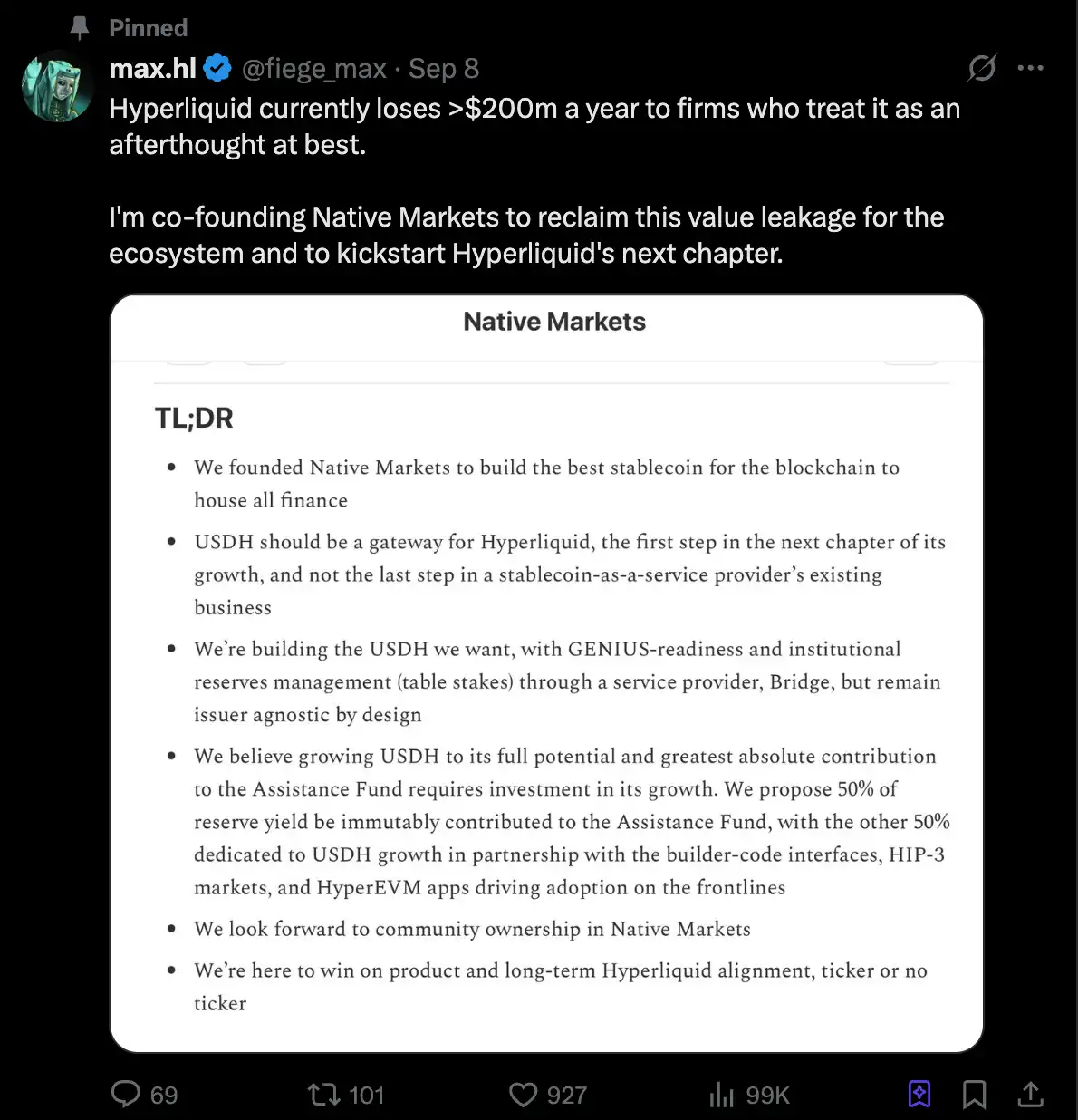

Despite being the less prominent bidder among the main bidders, Native Markets has gained momentum through its team’s extended work with Hyperliquid and by bringing on industry leaders from Paradigm, Uniswap, and more—establishing its leading position.

Founding Team

Over the past year, Max has focused on building out the Hyperliquid ecosystem as both investor and advisor, helping drive $2.5 billion in HyperEVM Total Value Locked and $15 billion in HyperCore trading volume. With previous product and strategy roles at Liquity and Barnbridge, he specializes in stablecoins and fixed-rate instruments. As a Hyperion community leader, he helped launch the Hyperliquid DAT-listed entity.

Mary-Catherine Lader was President and COO of Uniswap Labs from 2021 to 2025, and led BlackRock’s digital asset initiatives as early as 2015. As Managing Director at Goldman Sachs, she invested in fintech. She now brings her expertise to guide USDH and Hyperliquid’s post-GENIUS evolution.

Anish is a seasoned blockchain researcher and software engineer with more than ten years in the field. He was Ritual’s first team member, became Paradigm’s youngest researcher, and worked as a proprietary DeFi trader at Polychain. He’s also a longtime contributor to open-source MEV and DeFi tools.

Community Disputes

The community vote has sparked notable controversy. Dragonfly Managing Partner Haseeb Qureshi wrote Tuesday that he finds the USDH RFP process “a bit absurd,” stating that validators seem unwilling to seriously consider any team but Native Markets.

He noted that Native Markets submitted its bid almost instantly after the RFP was released, suggesting advance notice, while others were still preparing proposals. Stronger proposals from established names like Paxos, Ethena, and Agora were overshadowed, suggesting the process was specifically tailored for Native Markets.

Nansen CEO @ASvanevik quickly rebutted those claims, stating that, as one of Hyperliquid’s largest validator node operators, his team had worked closely with @hypurr_co to carefully review all proposals and communicate with bidders, ultimately supporting Native Markets as the best solution.

After recognizing the outcome, Ethena Labs withdrew its bid for USDH. While there are questions about Native Markets’ credibility, its rapid ascent demonstrates the Hyperliquid community’s defining traits: a level playing field where newcomers can win support and achieve fair success.

KOL CryptoSkanda (@thecryptoskanda) stated that Native Markets’ selection was inevitable, given Hyperliquid’s core needs for listing and pricing, which other teams couldn’t address.

Historically, dollar liquidity on Hyperliquid has depended largely on external stablecoins like USDC, with circulating supply reaching as high as $5.7 billion—7.8% of USDC’s total issuance. By opting for this strategy, Hyperliquid is effectively allocating potentially hundreds of millions in annual interest proceeds directly to its community.

Thus, control of USDH issuance is not just about market share, but also concerns control over substantial potential returns. In Hyperliquid’s case, the stablecoin issuer is willing to relinquish virtually all profit to secure ecosystem distribution rights—a unique approach. This may signal the beginning of the Stablecoin 2.0 Era.

Statement:

- This article is reprinted from [BlockBeats]; copyright belongs to the original author [kkk]. For any concerns regarding republication, please contact the Gate Learn team for prompt handling in line with relevant procedures.

- Disclaimer: The opinions expressed herein are solely those of the author and do not constitute investment advice.

- Other language versions were translated by the Gate Learn team and may not be copied, distributed, or plagiarized without explicit reference to Gate.

Related Articles

In-depth Explanation of Yala: Building a Modular DeFi Yield Aggregator with $YU Stablecoin as a Medium

What is Stablecoin?

Top 15 Stablecoins

A Complete Overview of Stablecoin Yield Strategies

Stripe’s $1.1 Billion Acquisition of Bridge.xyz: The Strategic Reasoning Behind the Industry’s Biggest Deal.