MicroStrategy is once again embroiled in legal trouble: Why are accounting standards causing such trouble?

1. Event Overview

In early July 2025, the law firm Pomerantz filed a class action lawsuit in the U.S. District Court for the Eastern District of Virginia on behalf of all individuals and entities that purchased or otherwise acquired securities of Strategy (formerly MicroStrategy, NASDAQ: MSTR) between April 30, 2024 and April 4, 2025. The lawsuit, filed under Sections 10(b) and 20(a) of the Securities Exchange Act of 1934 and SEC Rule 10b-5, seeks to hold Strategy and certain senior executives liable for alleged securities fraud regarding Bitcoin investment performance and accounting standards, and aims to recover related investment losses. As crypto assets increasingly become an integral part of modern corporate asset allocation, this lawsuit could serve as a crucial signal for regulators and market participants to reevaluate crypto asset accounting and disclosure standards.

2. Strategy’s Bitcoin Playbook

Strategy, widely recognized in the industry, was originally an enterprise-focused software company specializing in business intelligence (BI), cloud-based solutions, and data analytics, delivering data visualization, reporting, and decision-support tools to large corporate clients. Although the legacy software business was recognized, its revenue and profit growth had plateaued and showed little momentum.

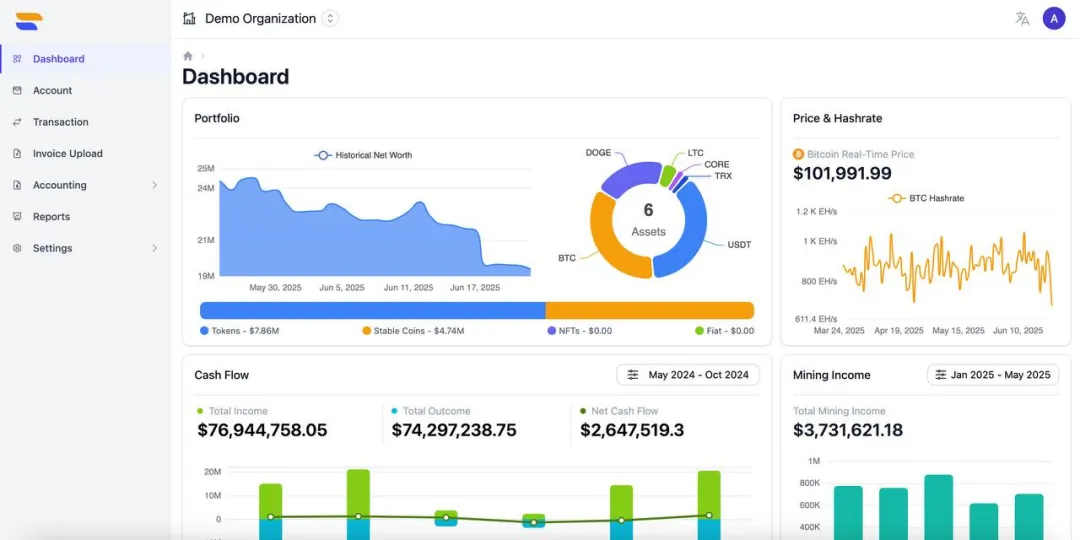

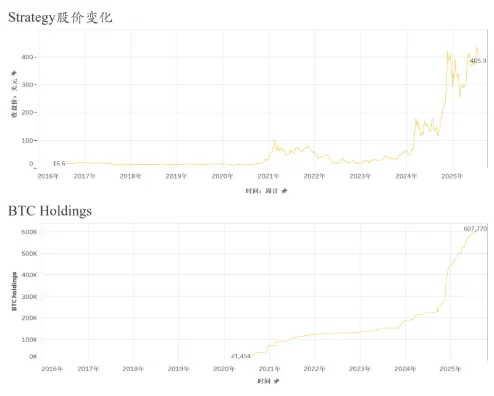

Starting in 2020, under founder Michael Saylor’s leadership, the company pivoted to a Bitcoin-focused asset allocation strategy, positioning Bitcoin as its primary reserve asset in lieu of cash. This shift marked a fundamental transformation, as Strategy began allocating significant capital into Bitcoin, scaling up its holdings through repeat rounds of financing. The firm utilized both its own funds and low-cost capital raised via convertible bonds, senior notes, and Bitcoin-backed loans to maximize investment scale. As a result, Strategy evolved from a traditional software provider into a Bitcoin-leveraged financial company.

At the core of its Bitcoin strategy is long-term holding: Strategy has made it clear it will not proactively liquidate its Bitcoin holdings, but will instead leverage Bitcoin’s long-term appreciation potential to boost both assets and market value. Throughout 2024, the company actively accumulated Bitcoin during periods of sharp price rebound. It accelerated purchases particularly after Bitcoin broke through $60,000. In Q1 2024 alone, it increased its position by more than 12,000 Bitcoins, and by early 2025, its total holdings exceeded 200,000 Bitcoins. This deepened its corporate identity based on a “Bitcoin standard.” Its stock price became highly correlated with Bitcoin price movements. Strategy was positioned as a high-profile alternative crypto asset vehicle in the capital markets.

3. Key Issues Alleged

The core allegations center on the claim that Strategy and its executives made several false and/or misleading statements or failed to adequately disclose key information, including: (1) overstating the expected profitability of its Bitcoin investment strategy and capital operations; (2) failing to adequately disclose the risks stemming from Bitcoin price volatility, especially following the adoption of Accounting Standards Update (ASU 2023-08), under which significant losses may be recognized due to fair value changes in crypto assets; and as a result, (3) public statements made by the company during all material periods were significantly misleading.

Analytically, these allegations focus on two core issues: first, false or misleading statements about the profitability of its Bitcoin investment strategy; second, failure to promptly disclose the major impact of new accounting standards while downplaying related risks.

The complaint asserts that Strategy made false and misleading claims about the profitability of its Bitcoin investment strategy in violation of federal securities laws. As a listed company, Strategy is required to accurately reflect the actual contribution of Bitcoin investments to its earnings in public filings and disclosures. The company is accused of overstating the positive financial impact of Bitcoin in communications, obscuring the fact that its profits depended on rising Bitcoin prices rather than recurring income from core operations. Further, the company may have used adjusted non-GAAP metrics or positive framing to embellish profit prospects, obscuring the real financial pressures from crypto market volatility. If these actions amounted to misstatements of material facts, they could constitute violations under Section 10(b) and SEC Rule 10b-5 of the Securities Exchange Act of 1934.

Separately, Strategy is alleged to have failed to timely and sufficiently disclose the effects of the ASU 2023-08 accounting changes on its financial data. In late 2023, the Financial Accounting Standards Board (FASB) introduced revised accounting rules for crypto assets, effective for fiscal years beginning after December 15, 2024—allowing companies to measure Bitcoin and other crypto assets at fair value and recognize changes directly in the income statement, with early adoption permitted.

Plaintiffs contend that, through both misstatements and insufficient disclosures, Strategy breached its legal duty as a public company to make proper disclosures in critical periods, misleading investors and resulting in substantial financial loss.

4. ASU 2023-08: Main Requirements and Practical Challenges

ASU 2023-08, issued by FASB in December 2023, marks a watershed in U.S. GAAP for crypto-asset accounting. The standard applies to qualifying interchangeable crypto assets and mandates fair value measurement at each reporting date, with changes recognized in current net income and detailed disclosures required in financial statements. It takes effect for fiscal years beginning after December 15, 2024, and can be adopted early. The standard introduces more granular disclosure requirements on asset type, quantity, fair value, liquidity restrictions, and period-over-period changes—enhancing transparency and comparability in financial statements. In brief, ASU 2023-08 raises the bar for accounting accuracy and demands stronger corporate compliance and risk management.

FinTax previously published an in-depth analysis of ASU 2023-08. For crypto firms, applying the standard may result in heightened financial transparency, simplified accounting processes, changes in tax and capital structures, and regulatory scrutiny over Non-GAAP measures. Before adopting ASU 2023-08, Strategy—whose core strategy centers on Bitcoin—had classified its Bitcoin as intangible assets and accounted for them under an impairment model. Under this approach, impairments were only recognized on price declines; increases were ignored unless assets were sold. It was not until April 7, 2025, that Strategy disclosed to the SEC an unrealized loss of $5.91 billion upon adopting ASU 2023-08. In the following May earnings release and calls, the company explained that these losses stemmed from fair value adjustments driven by the drop in Bitcoin prices. As the plaintiffs argue, this delayed disclosure undermined investor ability to accurately assess the company’s true financial condition and risk exposure during the class period, constituting an omission of material facts.

5. Conclusion

Overall, the class action against Strategy underscores the mounting twin pressures on public companies for disclosure and compliance amid the rapid evolution of crypto assets.

On one front, as companies increasingly integrate Bitcoin and other crypto assets into their balance sheets, profitability, asset volatility, and financing models become tightly linked to the crypto market. Any public statement that does not accurately reflect inherent risks may trigger legal exposure for omissions or misleading disclosures.

On the other, as companies implement the FASB accounting standard adopted at the end of 2023, they must record crypto assets at fair value and proactively assess the systemic impact on assets, profits, and disclosure obligations. Failure to clearly communicate the nature and scope of these changes may result in materially misleading investors.

This case, therefore, is not only about individual liability but also a case study in how listed companies must navigate disclosure duties—balancing strategic narrative with compliance—as the regulatory landscape for crypto-asset accounting continues to shift.

All information and content published by this source is provided solely for discussion or general reference. Nothing herein constitutes legal, tax, accounting, investment, or other professional advice, nor does it represent an endorsement or solicitation for any service or product. This source makes no express or implied warranties regarding the accuracy, integrity, or reliability of published materials. Updates to published content may occur without notice, and there is no obligation to update prior content. FinTax accepts no liability for any decision (action or inaction) or any legal consequence based on part or all of this content. No material may be used for any other purpose without prior written approval from FinTax. For reprints, authorization and full attribution to the author and “FinTax” as the source are required.

Disclaimer:

- This article is republished from FinTax, with copyright held by the original author FinTax. For any concerns regarding this republishing, please contact the Gate Learn team, which will address the matter promptly according to the established process.

- Disclaimer: The opinions and views expressed in this article are solely those of the author and do not constitute investment advice.

- Other language versions were translated by the Gate Learn team and may not be copied, distributed, or used without mention of Gate as the source.

Related Articles

Reflections on Ethereum Governance Following the 3074 Saga

Gate Research: 2024 Cryptocurrency Market Review and 2025 Trend Forecast

Gate Research: BTC Breaks $100K Milestone, November Crypto Trading Volume Exceeds $10 Trillion For First Time

NFTs and Memecoins in Last vs Current Bull Markets

Altseason 2025: Narrative Rotation and Capital Restructuring in an Atypical Bull Market