Plasma: Building a Zero-Fee Stablecoin Payment Layer-1 Blockchain

A New Efficient Solution for Stablecoin Payments

(Source: Plasma)

Plasma is a high-performance Layer 1 blockchain purpose-built for stablecoin payments and settlement. It supports Ethereum Virtual Machine (EVM) smart contracts and integrates Bitcoin sidechain security mechanisms. The platform delivers zero-fee payment channels and supports high-throughput transactions. Plasma aims to bring blockchain technology into everyday financial use cases. Its architecture suits daily payments, cross-border remittances, and stablecoin DeFi applications. Users benefit from a seamless and cost-effective transaction experience.

Core Technical Highlights

- PlasmaBFT Consensus Mechanism

Plasma’s proprietary PlasmaBFT, an enhanced version of HotStuff, streamlines the consensus process using parallelization. It achieves sub-second finality and processes over 2,000 transactions per second. - EVM Compatibility and Multi-Model Support

The platform uses the Reth client to support Solidity smart contracts and integrates with Ethereum toolchains like MetaMask and Hardhat. It also supports the Bitcoin UTXO model, so BTC users can pay gas and benefit from cross-chain operability. - Native Bitcoin Bridge

Plasma includes a secure Bitcoin Bridge that anchors on-chain state to the Bitcoin mainnet, providing robust security and transparency. This approach delivers Bitcoin’s decentralized security and the flexibility of Ethereum smart contracts. - Custom Gas Model

Plasma offers zero-fee stablecoin payment channels. Users can transfer USDT without gas fees. Paid channels are also available for those needing faster transactions, meeting diverse user needs. - Privacy and Regulatory Compliance

The platform is developing a privacy payment module to conceal transaction details. Selective disclosure will allow compliance with regulatory requirements, balancing privacy and compliance.

Key Use Cases

- Zero-Fee Payments: Users transfer USDT on Plasma with no fees, which is ideal for merchant settlements and routine payments.

- Cross-Border Remittances: The low cost and high efficiency make this solution suitable for cross-border transactions in regions with volatile currencies or economic sanctions.

- Compliant Digital Finance: Banks and payment providers can integrate stablecoin settlement into their operations.

- Merchant and Micro-Payments: The platform supports subscription models and micropayments. Yellow Card, Africa’s largest stablecoin infrastructure provider, is among its adopters.

- Stablecoin DeFi: Plasma is partnering with Curve, Maker, and Aave to expand a robust, diverse DeFi ecosystem.

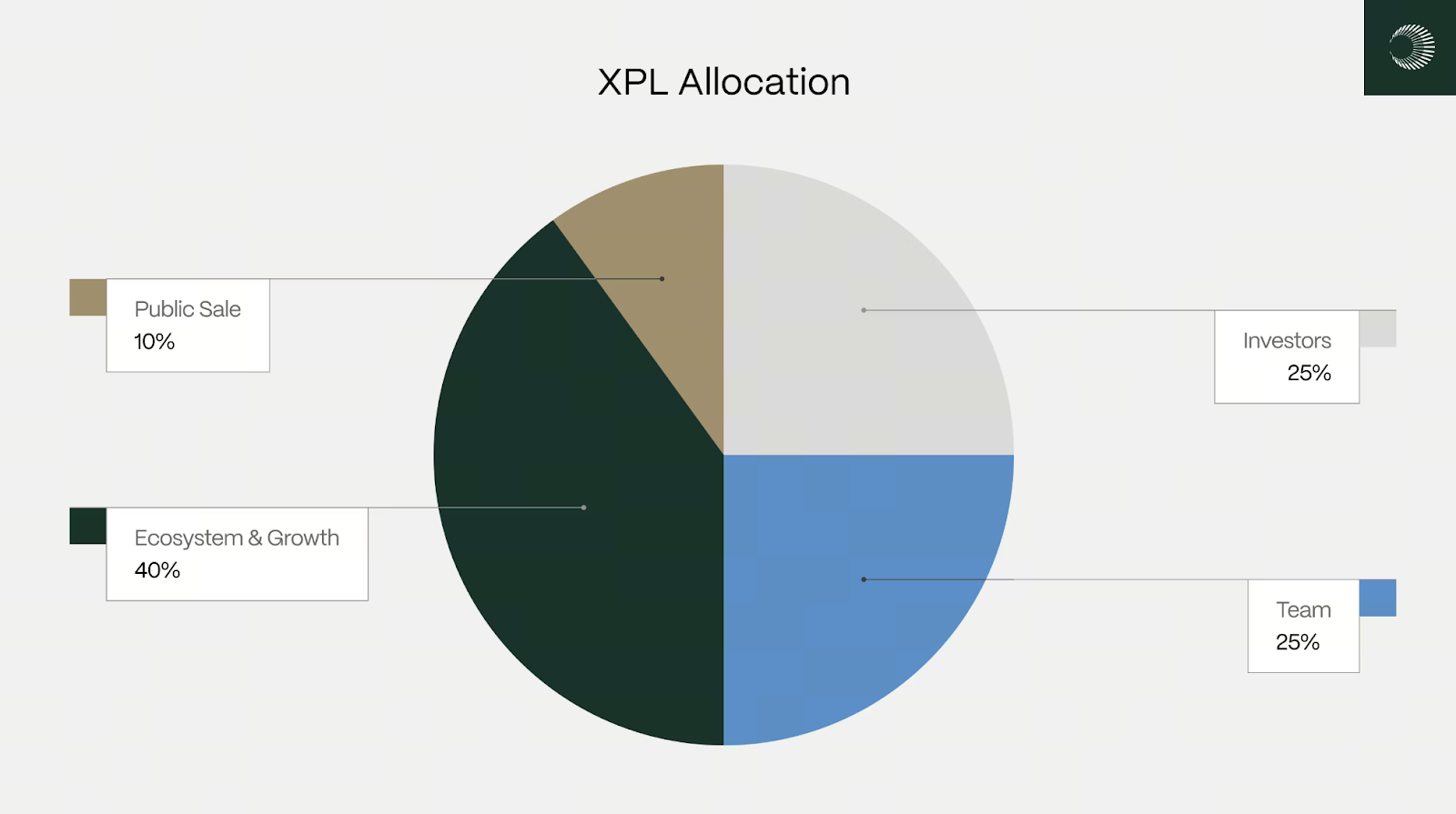

XPL Token Design and Utility

Plasma’s native token XPL has an initial supply of 10 billion, allocated as follows:

- Public Sale (10%): 1 billion XPL for early adopters. Non-U.S. users can unlock tokens immediately. U.S. users are subject to a 12-month lock-up period.

- Ecosystem and Growth (40%): Used for DeFi incentives, liquidity, and ecosystem expansion. The platform releases 8% at mainnet launch, with the remaining 32% unlocked linearly over three years.

- Team (25%): Incentivizes core developers. One-third is locked for one year, and the rest is released gradually over two years.

- Investors (25%): Includes Founder’s Fund, Framework, Bitfinex, and others. The lock-up schedule matches the team’s for long-term alignment.

(Source: docs.plasma)

XPL serves both as a gas token and a governance token. Holders can stake tokens and participate in network security and protocol upgrade decisions.

Plasma’s Unique Advantages

By combining zero-fee stablecoin payments with Bitcoin-anchored security, Plasma offers a distinct solution in the stablecoin payment market. Its focus, strong investor backing, and ecosystem partnerships—such as with Ethena and Yellow Card—are driving rapid network expansion.

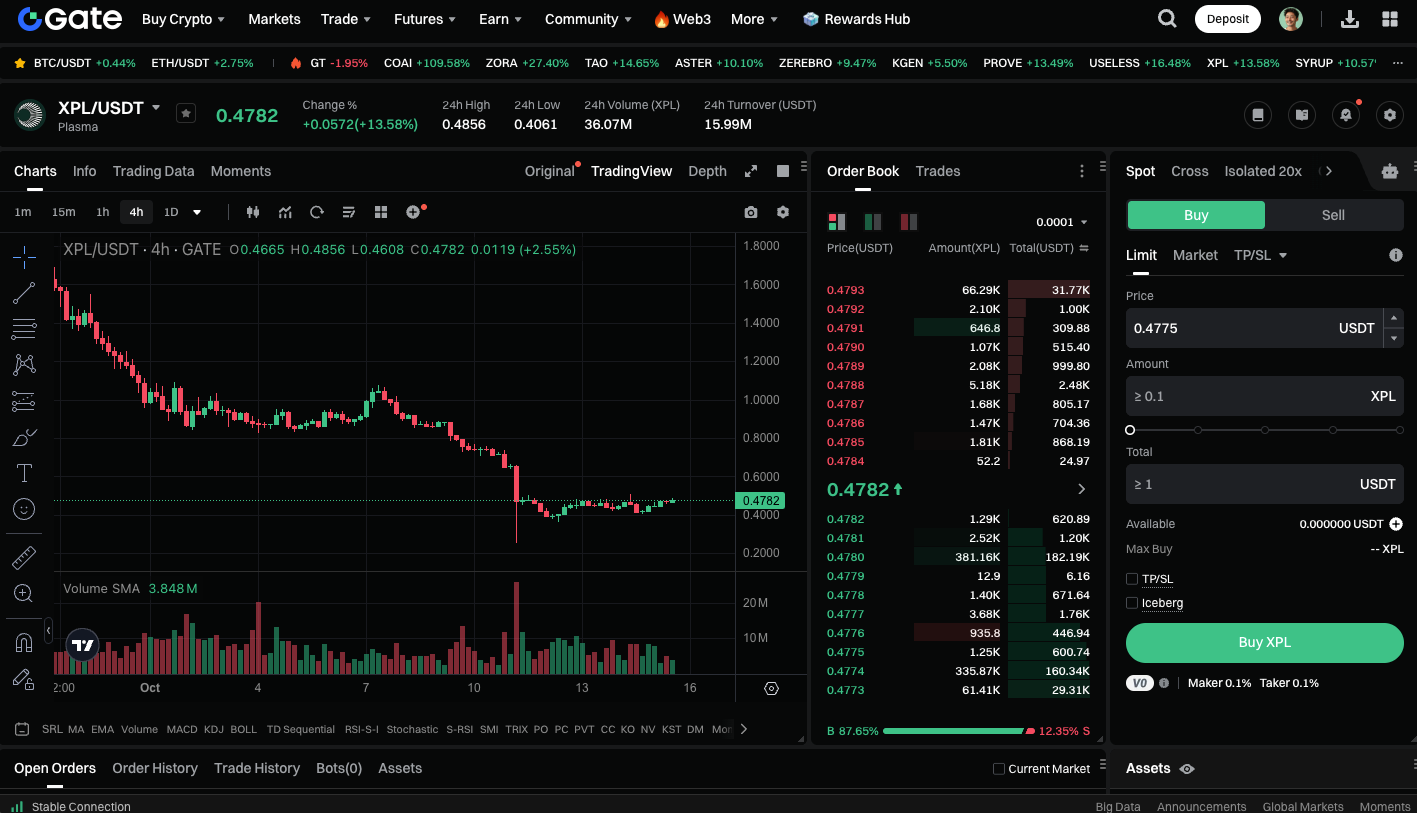

Start trading XPL spot now: https://www.gate.com/trade/XPL_USDT

Conclusion

The rising global demand for stablecoins positions Plasma to become a core infrastructure for dedicated stablecoin settlement networks. Real-world adoption and strong network effects will be crucial. These factors will determine if Plasma becomes a mainstream Layer 1 blockchain.

Related Articles

Pi Coin Transaction Guide: How to Transfer to Gate.io

What is N2: An AI-Driven Layer 2 Solution

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

Understand Baby doge coin in one article