Solana's official Perp protocol is revealed, launching a DEX counterattack

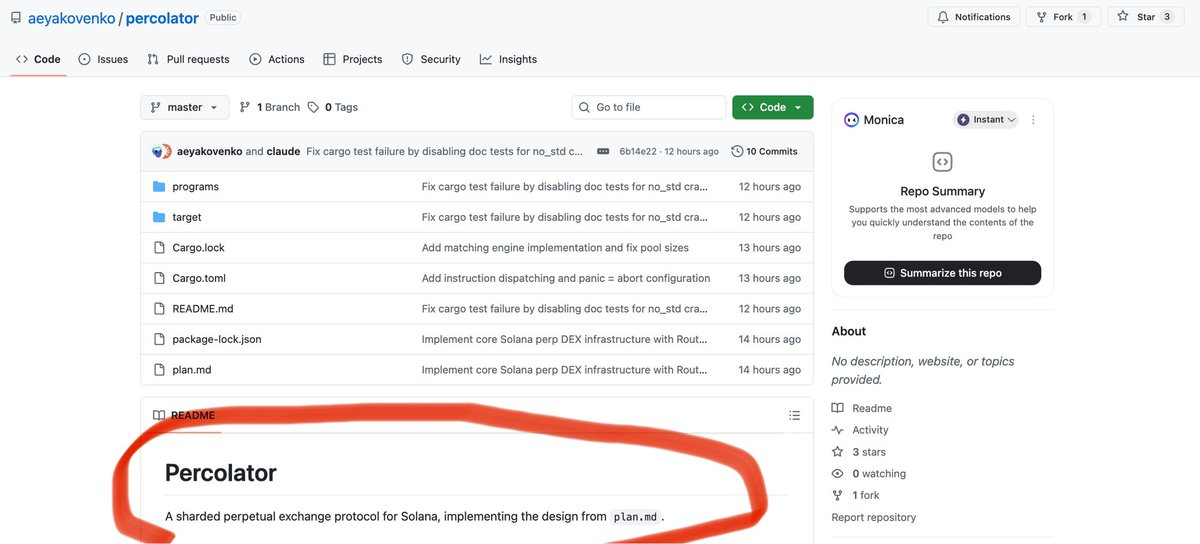

Previously, I wrote that Perp Dex was bound to experience explosive growth within the @solana ecosystem. Sure enough, a GitHub repository unexpectedly revealed by @aeyakovenko has become the center of attention: a sharded perpetual contract protocol framework called Percolator.

1) Its architectural innovation primarily involves splitting the order book into multiple shards for parallel processing, featuring global scheduling and margin management by the Router along with independent matching engines for each Slab. The framework also incorporates high-frequency trading optimizations and risk controls, such as a reserve-commit two-phase execution mechanism to prevent MEV attacks.

Interestingly, in the comments, Toly and others mentioned the possible introduction of a prop AMM competition mechanism, allowing LPs to customize their own matching engines and risk parameters.

2) Unexpectedly, many thought Solana would enter the Perp Dex race by supporting emerging projects in its own ecosystem, such as @DriftProtocol, @pacifica_fi, and @bulktrade. Instead, this initiative has been elevated to a strategic level directly led by Solana Labs. This demonstrates just how eager Solana is to sustain the Perp Dex boom.

3) The logic here is clear: Perp Dex is a sector that can simultaneously accommodate high-frequency, high-leverage, and large-volume trading. Over the past year, Solana has refined its performance with innovations like the Alpenglow consensus and the Firedancer client, proving it can handle peak volumes during events like Meme Season. Now is the ideal time to leverage this infrastructure to ignite the Perp Dex sector.

Moreover, there is still significant room for optimization at the validator layer, with @doublezero pushing further improvements in network bandwidth. @jito_sol has already shown that professional optimization at the validator level is viable. From a technical standpoint, it is entirely feasible for the Solana ecosystem to produce a Perp Dex on par with @HyperliquidX.

4) At this point, Toly, @calilyliu, and other core executives must be frustrated. With Solana’s robust infrastructure, how can projects like @Aster_DEX and @Lighter_xyz—whose capabilities remain unproven—be allowed to steal the spotlight?

The key is that many Perp Dex platforms, currently driven by exchange-backed interests, suffer from issues such as artificial volume from airdrop incentives, unsustainable trade mining, and a lack of genuine high-frequency trading demand. These problems give Solana a compelling reason to step in and seize the initiative.

5) With its foundational work in US stock tokenization and its long-term positioning in the ICM internet capital market, Solana has the opportunity to provide Perp DEX infrastructure that can truly accommodate traditional financial asset trading—not just crypto-native assets.

Imagine this: after US stock tokenization, users could open leveraged long or short positions on Tesla or NVIDIA directly on Solana, settle in $SOL or stablecoins, and have trading fees flow back into the ecosystem. This “on-chain Nasdaq” narrative is far more compelling than simply speculating on perpetual contracts for BTC, SOL, or ETH.

That concludes the analysis.

Next, let’s watch how the Perp Dex counteroffensive unfolds on Solana!

Statement:

- This article is reproduced from [tmel0211], with copyright belonging to the original author [tmel0211]. If you have any objections to this reproduction, please contact the Gate Learn team, who will handle it promptly according to relevant procedures.

- Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute investment advice.

- Other language versions of this article are translated by the Gate Learn team. Do not copy, distribute, or plagiarize translated articles without mentioning Gate.

Related Articles

How To Claim The Jupiter Airdrop: A Step-By-Step Guide

Solana Staking Simplified: A Complete Guide to SOL Staking

Introduction to Raydium

Complete Guide to Buying Meme Coins on the Solana Blockchain

Solana, Sui, Aptos: Potential Ethereum Killers - A Review of their Performance in 2024