U.S. Government Shutdown Ends: Between Political Compromise and Market Confidence

Government Shutdown Crisis Resolves

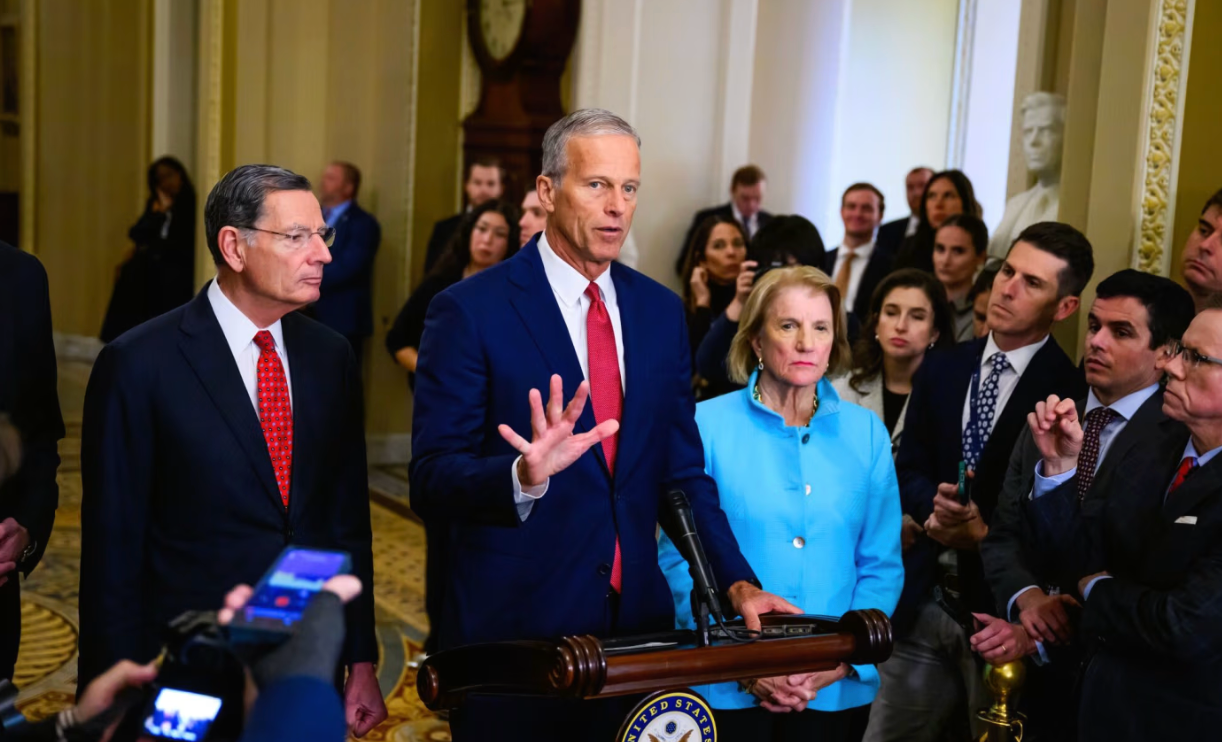

(Source: Pete Kiehart / Bloomberg News)

After 40 days under the threat of a shutdown, the U.S. federal government has finally received relief. In November 2025, following extensive bipartisan negotiations, the Senate reached a temporary funding agreement, ending the longest shutdown on record. The deal extends government funding until January 30, 2025, giving a brief window for further fiscal discussions. For Washington, this marks a compromise born of political necessity; for the markets, it provides much-needed stability.

Key Elements of the Temporary Agreement

The agreement focuses on immediate relief. Beyond extending funding, it introduces several symbolic amendments:

- Repeals executive orders from the Trump administration allowing dismissal of federal employees, restoring stability to the administrative system;

- Ensures the Supplemental Nutrition Assistance Program (SNAP) remains funded through fiscal year 2026, preventing disruptions in social support;

- Adds budget stabilization provisions to guard against future shutdowns, requiring both parties to complete fiscal talks within set deadlines;

- Separates Medicaid issues from this round of negotiations with a distinct vote on the Affordable Care Act (ACA).

This strategy reflects a classic phased political compromise: postponing divisive policies in exchange for short-term institutional stability.

Democratic Party Strategic Shift

For Democrats, the shutdown served as both a test of resilience and a strategic turning point. While the party initially insisted on maintaining healthcare reform, strong resistance from Trump supporters and conservatives led to a tactical concession—separating healthcare issues to restart government operations.

Some progressives criticized the move as excessive, but mainstream Democrats emphasized that political compromise is essential for governance. Amid high inflation and market turbulence, keeping federal agencies closed would be far more costly than prioritizing governance over specific policy issues. The party is shifting from issue-driven tactics to prioritizing governance over specific policy issues, signaling a more pragmatic, practical style of politics.

Delayed Governance and Eroded Trust

The 40-day shutdown was not just an administrative halt—it signaled a deeper breakdown in institutional trust. Budget freezes caused federal departments to suspend operations, which delayed economic data releases, hampered corporate decisions, and interrupted social assistance.

These delays in government operations affected market confidence more than the immediate fiscal costs. Data from the American Federation of Government Employees shows more than 800,000 federal workers faced payroll delays during the shutdown. Public transportation and food assistance systems stalled in several regions. Congress faces both political risk and a warning about the integrity of the governance structure.

Market Reaction

Once the agreement was reached, U.S. equity futures rallied. S&P 500 futures jumped over 1.2%, demonstrating investors’ strong appetite for short-term stability. Analysts noted that, while the solution doesn’t address the root budget issues, it signals that institutional mechanisms can still bridge political divides. Most observers expect this reprieve to buy time for year-end budget negotiations. It also provides a clearer context for Federal Reserve monetary policy decisions.

Conclusion

The end of the government shutdown highlights the U.S. political system’s resilience under pressure—but also exposes its vulnerabilities. The temporary nature of the agreement means the crisis is delayed, not resolved. In Washington, consensus usually follows exhaustion and stress, while market participants rebuild confidence amid uncertainty. As efficient governance grows increasingly scarce, political compromise itself has become an essential component of financial stability.

Related Articles

Pi Coin Transaction Guide: How to Transfer to Gate.io

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution

Understand Baby doge coin in one article