US Regulators Move Forward With Stablecoin Oversight Framework

US Stablecoin Regulation Enters Substantive Advancement Phase

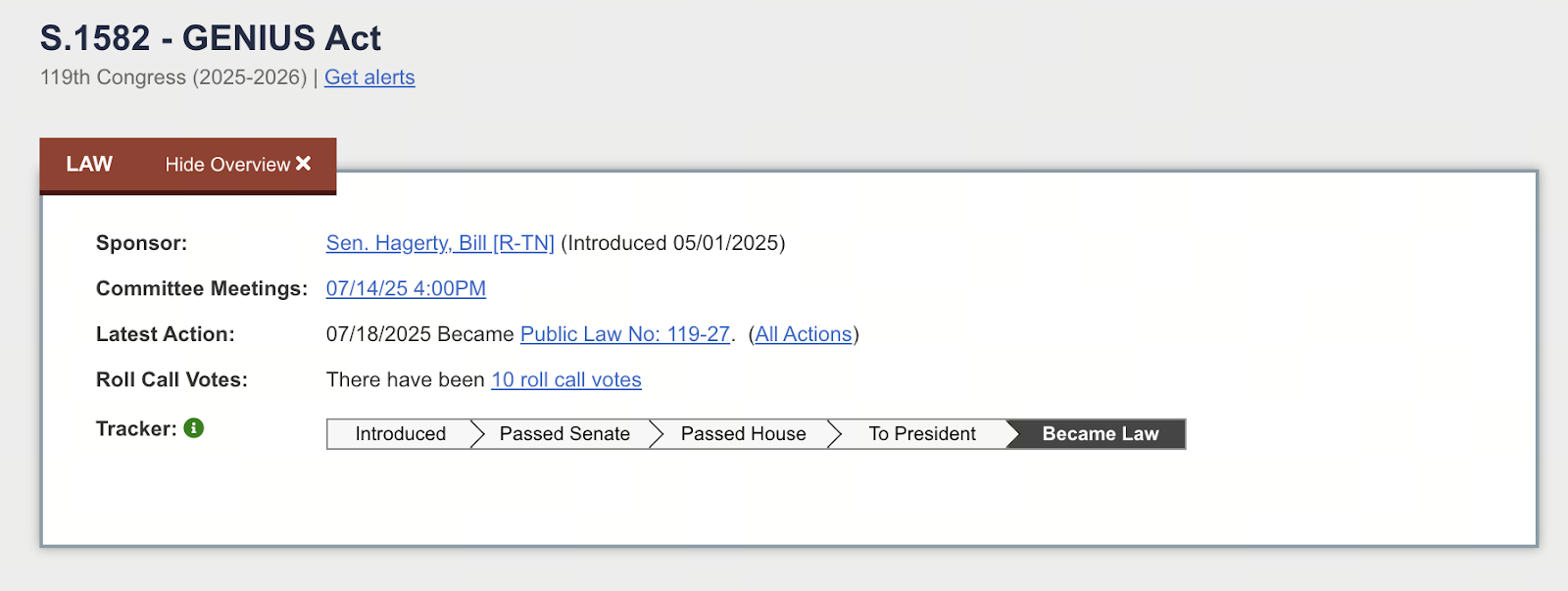

(Source: Congress)

Travis Hill, Acting Chairman of the Federal Deposit Insurance Corporation (FDIC), will soon testify before the House Financial Services Committee and has already provided an update on recent developments: The first set of draft rules for stablecoin regulation is expected to be formally introduced by the end of December. This milestone signifies the transition of the GENIUS Act (Guiding and Establishing National Innovation for U.S. Stablecoins) from the legislative stage to implementation, with multiple federal and state agencies collaborating on its rollout.

Establishing the Application Framework for Stablecoin Issuers

According to Hill’s prepared testimony, the FDIC has started developing a comprehensive review process for stablecoin issuers. This process includes:

- Procedures for applying for federal regulatory oversight

- Evaluation criteria and review framework

- Core compliance requirements for issuers

The draft will be released to the public this month for open feedback from stakeholders and the general public.

Capital, Liquidity, and Reserve Management Requirements

After the application framework is established, the FDIC will draft more detailed regulatory provisions, including:

- Minimum capital requirements for issuers

- Liquidity standards

- Rules on the composition and quality of stablecoin reserves

These provisions are expected to be introduced in a separate draft early next year, establishing clear supervisory guidelines for banks and other regulated entities issuing stablecoins.

Treasury and Federal Reserve Advance in Parallel

The responsibility for implementing the GENIUS Act does not rest solely with the FDIC. The US Treasury and other departments are also developing related regulations. In her prepared testimony, Federal Reserve Vice Chair Michelle Bowman noted that the Fed is working, as required by the Act, to establish:

- Capital standards for stablecoin issuers

- Liquidity management standards

- Asset diversification requirements

Together, these measures will form a comprehensive US stablecoin regulatory framework.

Regulatory Positioning of Tokenized Deposits

Hill further noted that, in response to the President’s Working Group (PWG) report on the digital asset market, the FDIC is developing additional guidance to clarify:

- The regulatory status of tokenized deposits

- Their role within the current banking system

- Legal distinctions between tokenized deposits and stablecoins

This effort aims to provide banks with clearer guidelines for engaging with tokenized financial products.

If you’d like to learn more about Web3, register here: https://www.gate.com/

Summary

With the FDIC, Federal Reserve, and other agencies clarifying their positions, the US is now gradually establishing a concrete regulatory framework under the GENIUS Act. From the application process for issuers and requirements for liquidity and reserves, to the regulatory treatment of tokenized deposits, these actions show the US is moving toward a more systematic stablecoin framework. If enacted, these rules will provide long-awaited transparency to the stablecoin market, fostering a more predictable environment for financial institutions and the Web3 industry.

Related Articles

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

Pi Coin Transaction Guide: How to Transfer to Gate.com

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution