What is Avantis (AVNT)?

What Is Avantis?

(Source: avantisfi)

Avantis is a next-generation on-chain leveraged trading platform that seamlessly integrates cryptocurrency, forex, and commodities. It enables users to manage multiple assets from a unified interface, delivering an efficient, fair, and innovative trading experience.

Team Background

Powered by the Avantis Foundation and developed in collaboration with various service providers, the Avantis team consists of 12 seasoned professionals with deep roots in the crypto industry. Their expertise spans engineering, investment banking, consulting, venture capital/private equity, incentive mechanism design, product design, and both front-end and back-end development. With a combined experience of over 20 years in cryptocurrency, the team strikes a balance between cutting-edge innovation and sustainable growth in product development and market strategy.

Avantis Vision

Avantis positions itself as an on-chain cross-asset leveraged exchange, where users can go long or short on crypto, and also trade forex and commodities like gold—all on a single platform. This enables true multi-asset strategy execution and is especially appealing for traders seeking global macro positioning. Key features include:

- Synthetic Leverage: Utilizing USDC as the core liquidity pool asset, Avantis enables trading leverage up to 500x while maximizing capital efficiency.

- LP Risk Tranching: Liquidity providers can select distinct risk tranches and time parameters according to risk tolerance, allowing for specialized market-making roles.

- Composable Protocol: Built on a leverage engine, the platform lets developers build modular protocols, extending application scenarios.

Core Innovations

- Loss Rebate

In specific trading scenarios, traders who incur losses may receive rebates from the platform, which serves to rebalance open positions and reduce directional bias. - Positive Slippage

When trades contribute to rebalancing open interests, traders can benefit from better-than-market entry prices—a unique incentive mechanism rarely seen in traditional DeFi perpetual protocols. - Real-World Asset Integration

Beyond crypto exposure, Avantis lets users trade forex and gold on the same platform, bridging blockchain trading and global financial markets. - Zero-Fee Leverage

In certain modes, trading fees are only deducted from profits, making the model highly attractive for short-term and high-frequency trading strategies. - Revolutionary LP Risk Management

Unlike traditional perpetual protocols where LPs passively absorb risk, Avantis LPs actively choose their risk profile via tranching and time-locks—a concept reminiscent of Uniswap V3’s flexibly defined price range, now applied to leveraged trading.

Trading Engine

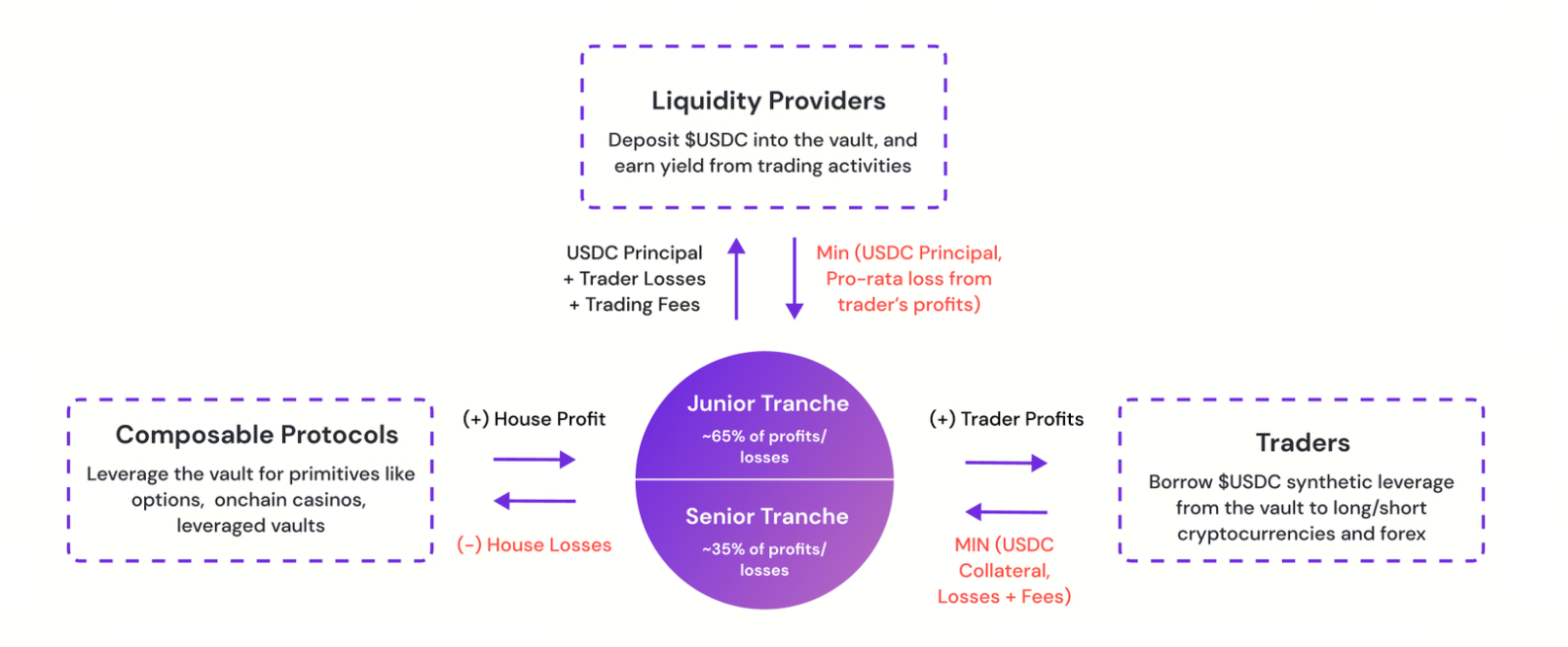

The USDC Vault is Avantis’s core liquidity pool, directly countering every trade:

- Trader profits are paid out from the Vault.

- Trader losses accrue to the Vault and are distributed to LPs.

As compensation, Vault holders receive all organic returns, including trading fees and distributed losses, making LPs the driving force of the ecosystem.

The Vault features a risk tranching system:

- Senior Tranche (Low Risk): Assumes about 35% of losses and profits, ideal for LPs seeking stable returns.

- Junior Tranche (High Risk): Assumes about 65% of losses and profits, tailored for volatility-tolerant LPs.

(Source: docs.avantisfi)

This architecture empowers LPs to adjust their risk-reward profile to suit their preferences, supporting flexible participation.

Revenue Model and Fee Structure

Avantis generates revenue from two primary sources:

- Trading Fees: Including open, close, and margin fees, dynamically adjusted in response to market conditions.

- Vault Deposit/Withdrawal Fees: LPs may incur fees based on protocol health and lock-up duration when depositing or withdrawing assets.

All protocol revenue is split as follows:

- 60% to LPs, incentivizing sustained market-making participation and risk.

- 40% to the protocol treasury, supporting native liquidity, trading competitions, and promotional rewards.

Tokenomics

AVNT is the cornerstone token of the Avantis ecosystem, functioning as both a utility and governance token. It secures protocol operations, aligns incentives, and facilitates decentralized governance. The total supply is capped at 1 billion tokens and serves various functions:

- Governance: Holders participate in protocol governance and parameter adjustment.

- Incentives: Used for community airdrops, user rewards, and protocol marketing.

- Security: Staking and collateralization reinforce protocol safety.

- Protocol Growth: Fuels developer initiatives and ecosystem expansion.

Token Allocation

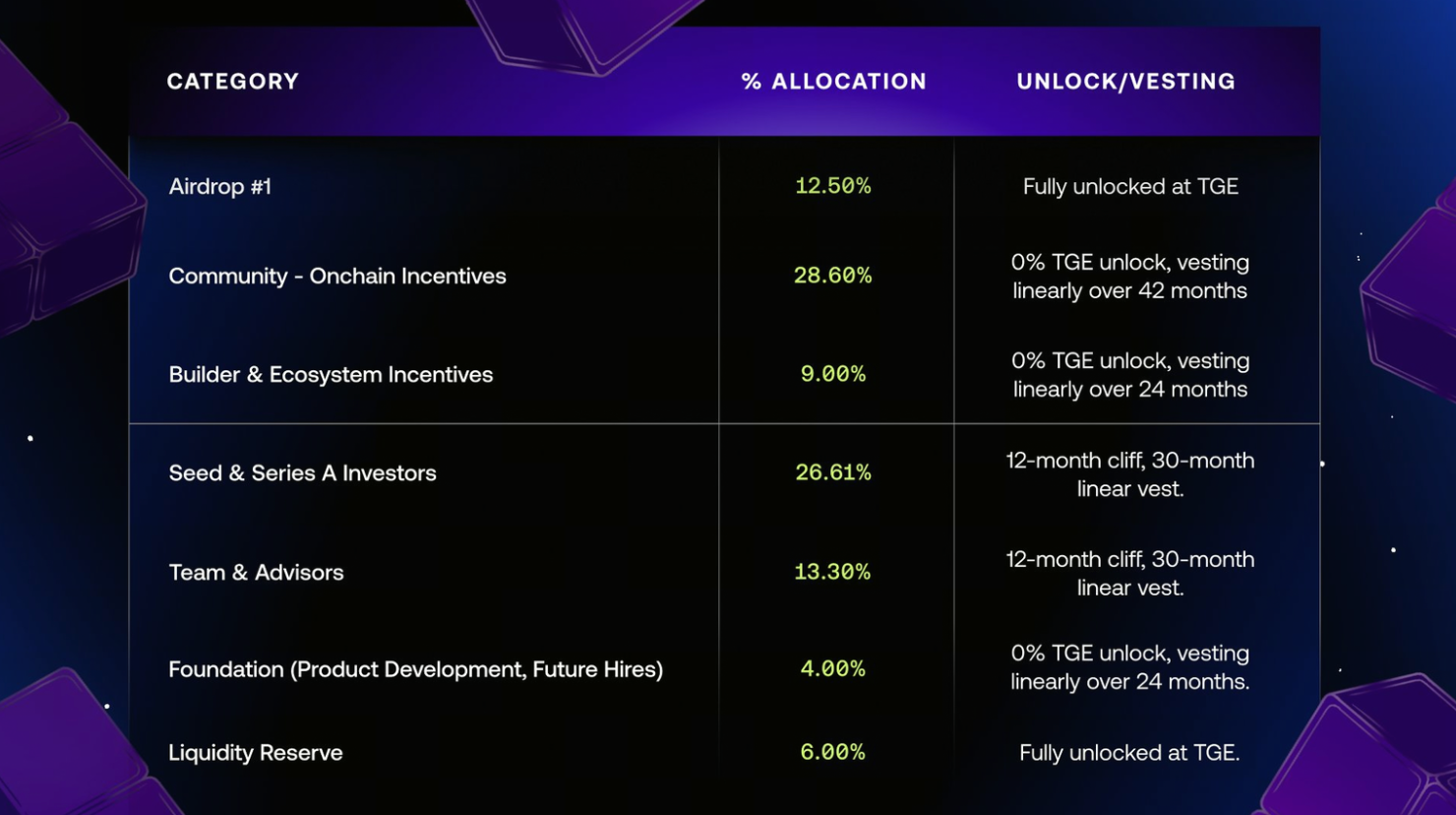

AVNT allocation prioritizes ecosystem expansion, community engagement, and long-term commitments:

- Initial Airdrop (12.5%): Fully unlocked at TGE, rewarding early supporters.

- Community Incentives (28.6%): Linear vesting over 42 months for on-chain participation and promotions.

- Builder & Ecosystem Rewards (9%): Linear vesting over 24 months, supporting development and partnerships.

- Seed & Series A Investors (26.61%): 12-month cliff, then linear vesting across 30 months.

- Team & Advisors (13.3%): 12-month cliff, then linear vesting across 30 months.

- Foundation (4%): For product development and future hiring, linear vesting over 24 months.

- Liquidity Reserve (6%): Fully unlocked at TGE, ensuring market stability.

(Source: docs.avantisfi)

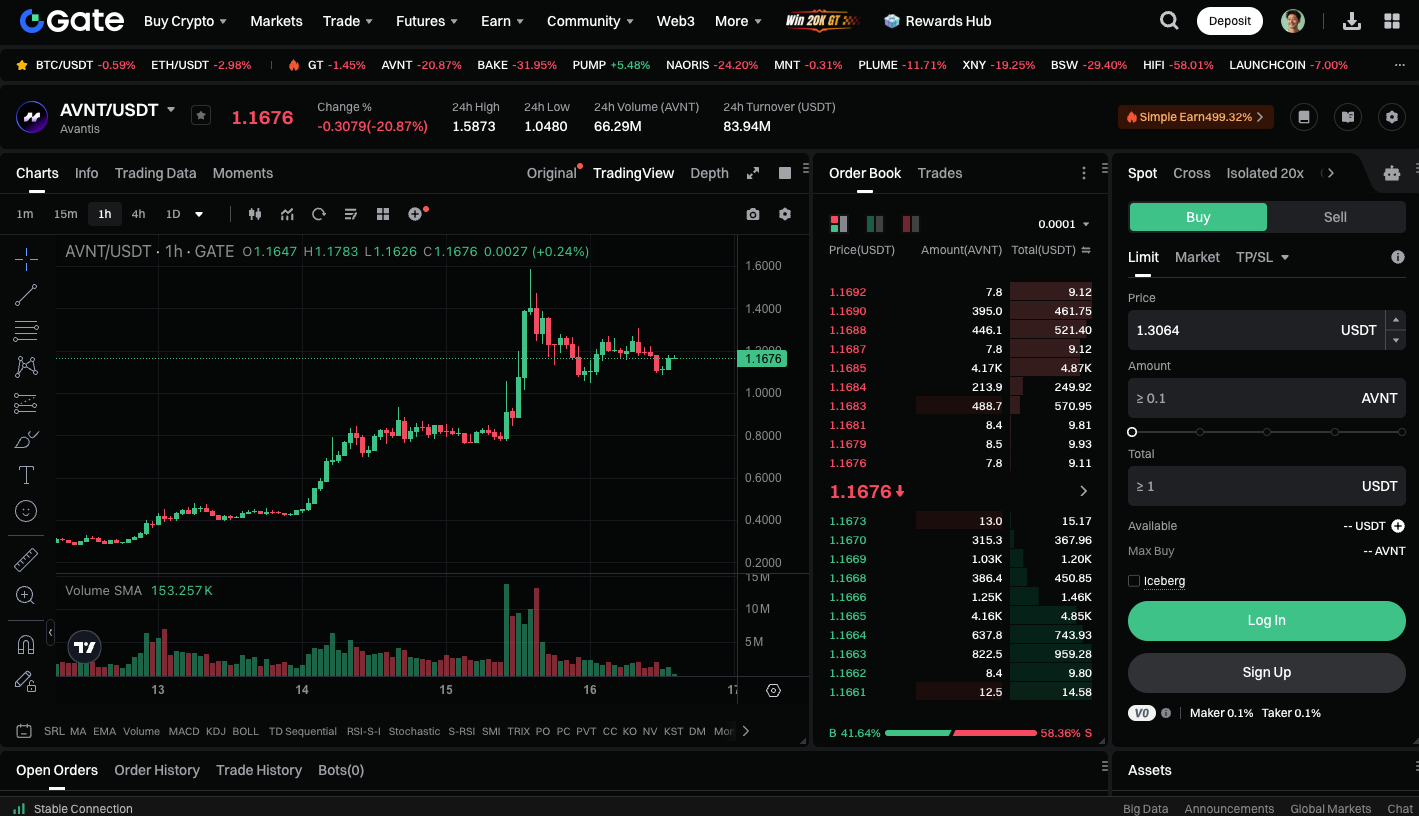

Start spot trading AVNT now: https://www.gate.com/trade/AVNT_USDT

Summary

Avantis is reshaping the landscape of on-chain leveraged trading, empowering global market participants to express their views on cryptocurrencies, forex, and commodities within a decentralized architecture. With its advanced risk management model and robust multi-asset support, Avantis operates not only as an exchange but as a foundational layer for decentralized global leveraged finance. As DeFi continues to evolve, Avantis stands to become an essential pillar of on-chain trading, with AVNT linking the community, liquidity, and protocol growth together.

Related Articles

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

Pi Coin Transaction Guide: How to Transfer to Gate.com

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution