XRP Price Prediction: Market Cap Soars 51%, Can XRP Push Toward $250 Billion?

Preface

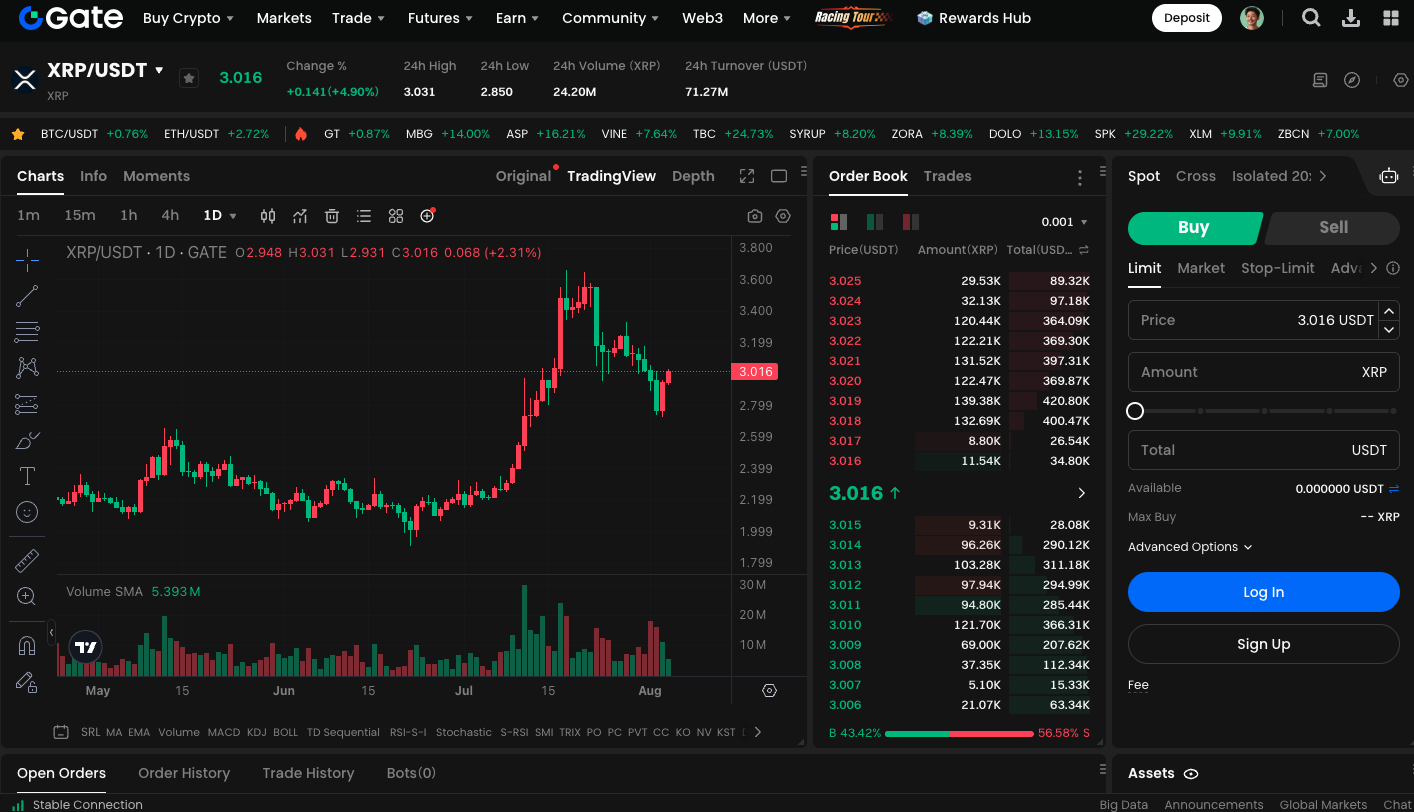

With Bitcoin prices trading sideways, XRP has recently surged at an impressive rate, once again sparking widespread discussion about a possible return of the altcoin season (altseason). As of this writing, XRP’s market capitalization stands at roughly $179 billion, rapidly approaching the unprecedented $200 billion mark.

Crypto Market Capital Rotation

The latest upswing in altcoins is not solely due to technical triggers; it’s also being driven by investors rebalancing their portfolios. As Bitcoin hit its peak and shifted into a consolidation phase, investors have increasingly turned to alternative assets with explosive potential, putting XRP squarely in the spotlight.

Critical Levels for XRP Bulls and Bears

Technical analysis shows XRP’s RSI is nearing overbought territory, echoing the pattern seen ahead of the late 2024 rally, when XRP’s market cap doubled within weeks, peaking near $195 billion. If strong buying momentum continues, XRP could soon test the next major psychological level. $250 billion. Reaching this milestone is not only numerically significant, it could also prompt mainstream institutional investors to reassess XRP’s value proposition.

Regulatory Developments and Institutional Strategy

Beyond price and market cap performance, the recent decision by the U.S. Securities and Exchange Commission (SEC) to pause approval of the Grayscale Digital Large Cap Fund has drawn renewed attention to the regulatory status of major cryptocurrencies. This fund includes BTC, ETH, XRP, SOL, and ADA, highlighting XRP’s status as a core asset recognized by institutional players.

Despite regulatory challenges, Grayscale’s legal team asserts that the SEC has missed its statutory review deadline and is demanding that the prior approval be recognized as valid. This case further highlights XRP’s strategic importance in both legal and financial arenas, reinforcing its long-term potential.

You can trade XRP spot at: https://www.gate.com/trade/XRP_USDT

Conclusion

XRP’s current price and market capitalization reflect strong recovery momentum. If market confidence remains high, reaching the $250 billion market cap is realistic. However, sustaining this bullish trend will require monitoring market sentiment and regulatory developments. Any ripple effects from Bitcoin’s price action should also be considered.

Related Articles

Pi Coin Transaction Guide: How to Transfer to Gate.io

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution

Understand Baby doge coin in one article