Gate Research: Total Funding Up 7.3%, High-Value Seed Rounds Emerge as the New Focus|September 2025 Web3 Fundraising Overview

This report summarizes the Web3 industry financing in September 2025. During the month, a total of 100 funding rounds were completed, raising $2.2 billion, exhibiting a structural trend of “fewer deals, higher valuations.” This trend was primarily driven by traditional financial instruments such as PIPEs and IPOs, positioning CeFi as the leading capital-attracting sector. In terms of sector distribution, blockchain services and CeFi acted as dual drivers of capital flow. Regarding financing stages, the market showed high concentration in seed rounds—both in number and funding amount (e.g., Flying Tulip’s massive seed round)—while later-stage projects were highly selective.The report also highlights key financing projects, including Flying Tulip, Wildcat Labs, Aria, Share, and Titan.Summary

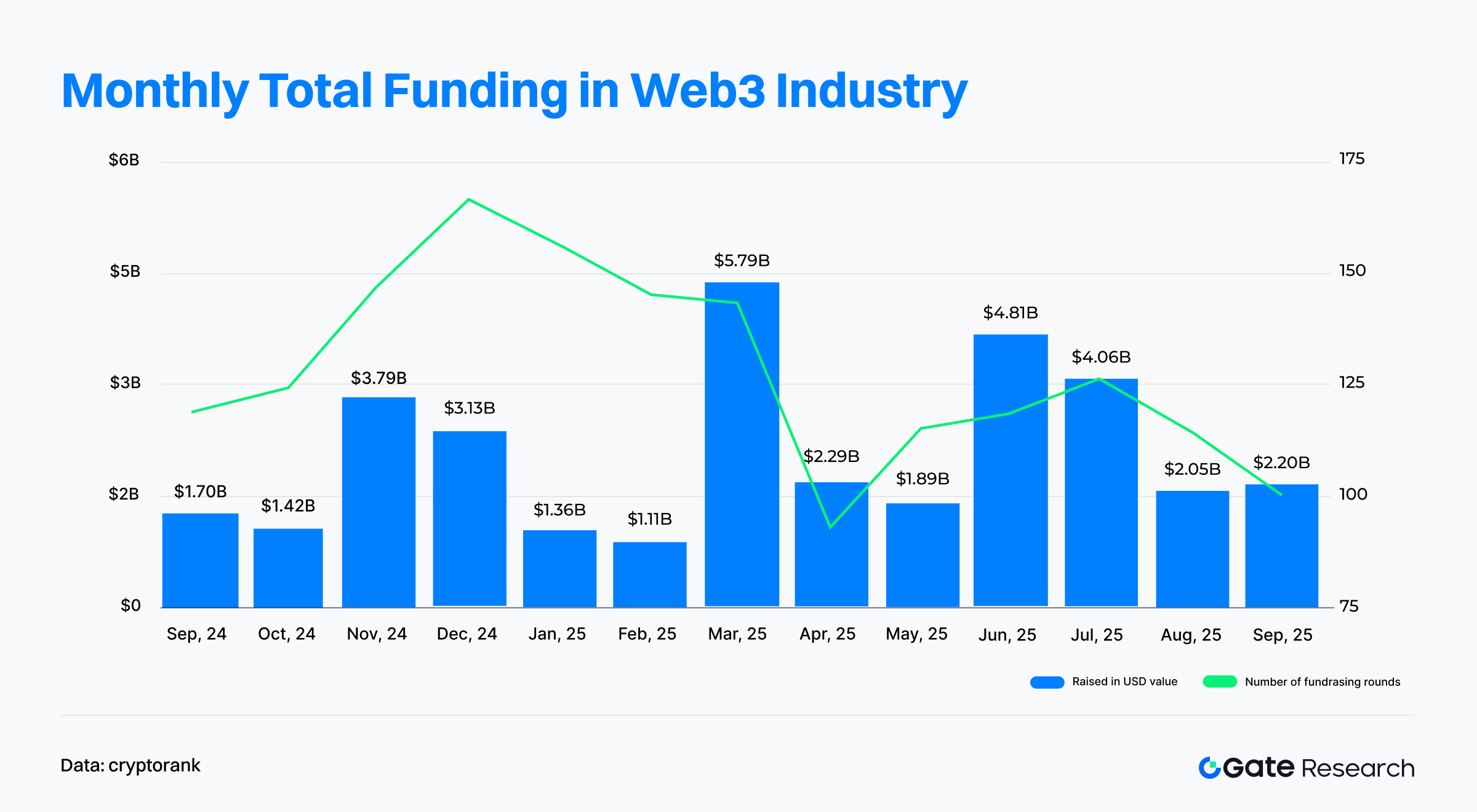

- According to data released by Cryptorank on October 9, 2025, the Web3 industry completed 100 fundraising deals in September 2025, with a total funding amount of $2.2 billion. While the number of deals decreased by 12.3% month-on-month, the total funding rose 7.3%, indicating that capital is increasingly flowing toward leading and mature projects.

- The Top 10 largest fundraising deals were primarily completed through PIPE, IPO, and Post-IPO Debt mechanisms — traditional capital market tools. This trend highlights Web3 projects’ accelerating integration with the traditional financial system, using compliant pathways to attract institutional capital. The CeFi sector led the month, accounting for 7 out of the top 10 deals and contributing the majority of total funding, signaling a strong capital shift back to centralized institutions with real yields and regulatory potential. Meanwhile, several publicly listed companies have begun channeling newly raised capital into on-chain treasury deployments, further bridging traditional and blockchain finance.

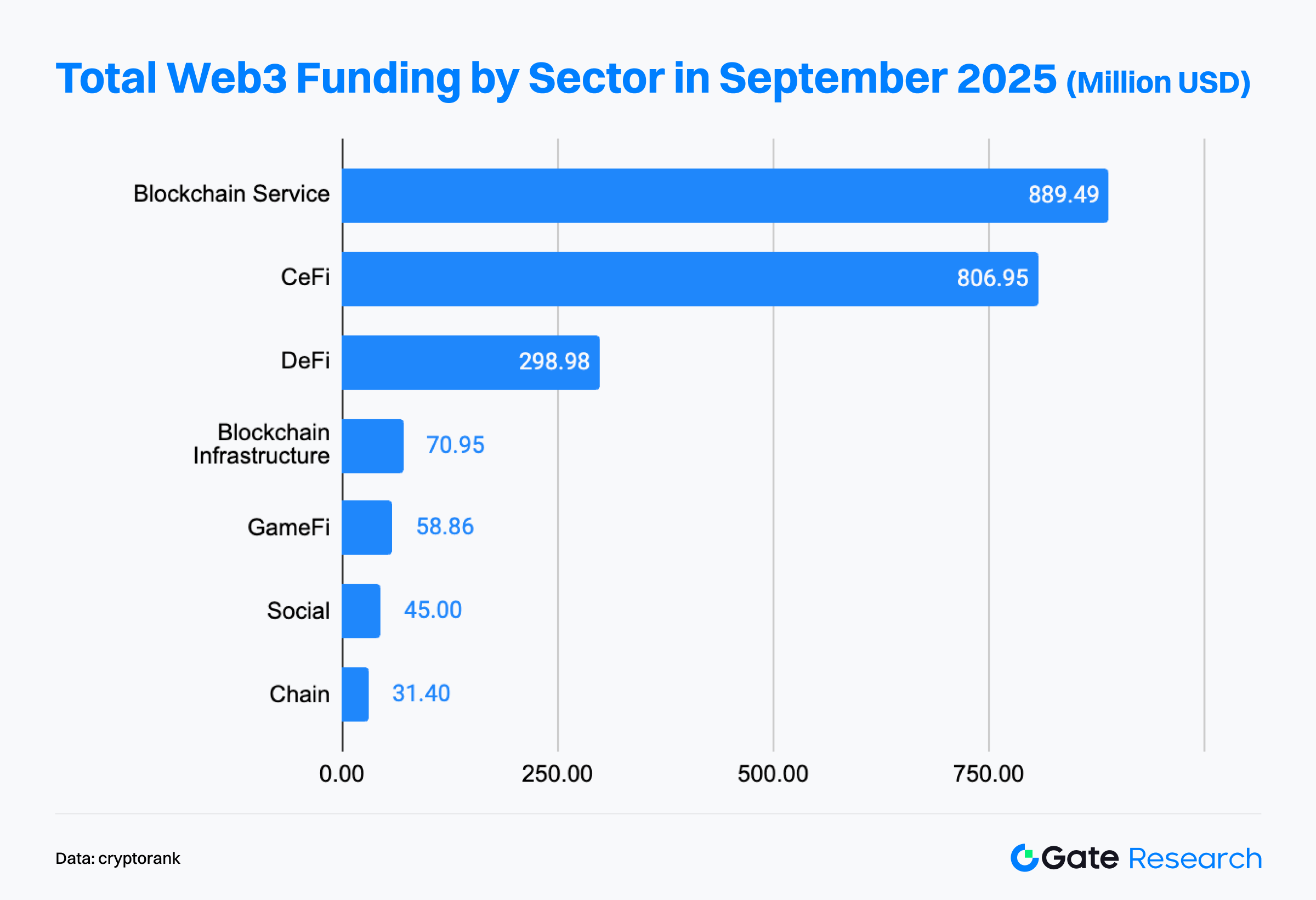

- From a sectoral perspective, Blockchain Services and CeFi formed a dual growth engine. Blockchain Services led with $889 million in total funding, surpassing CeFi, which followed closely with $806 million, demonstrating sustained capital absorption capacity.

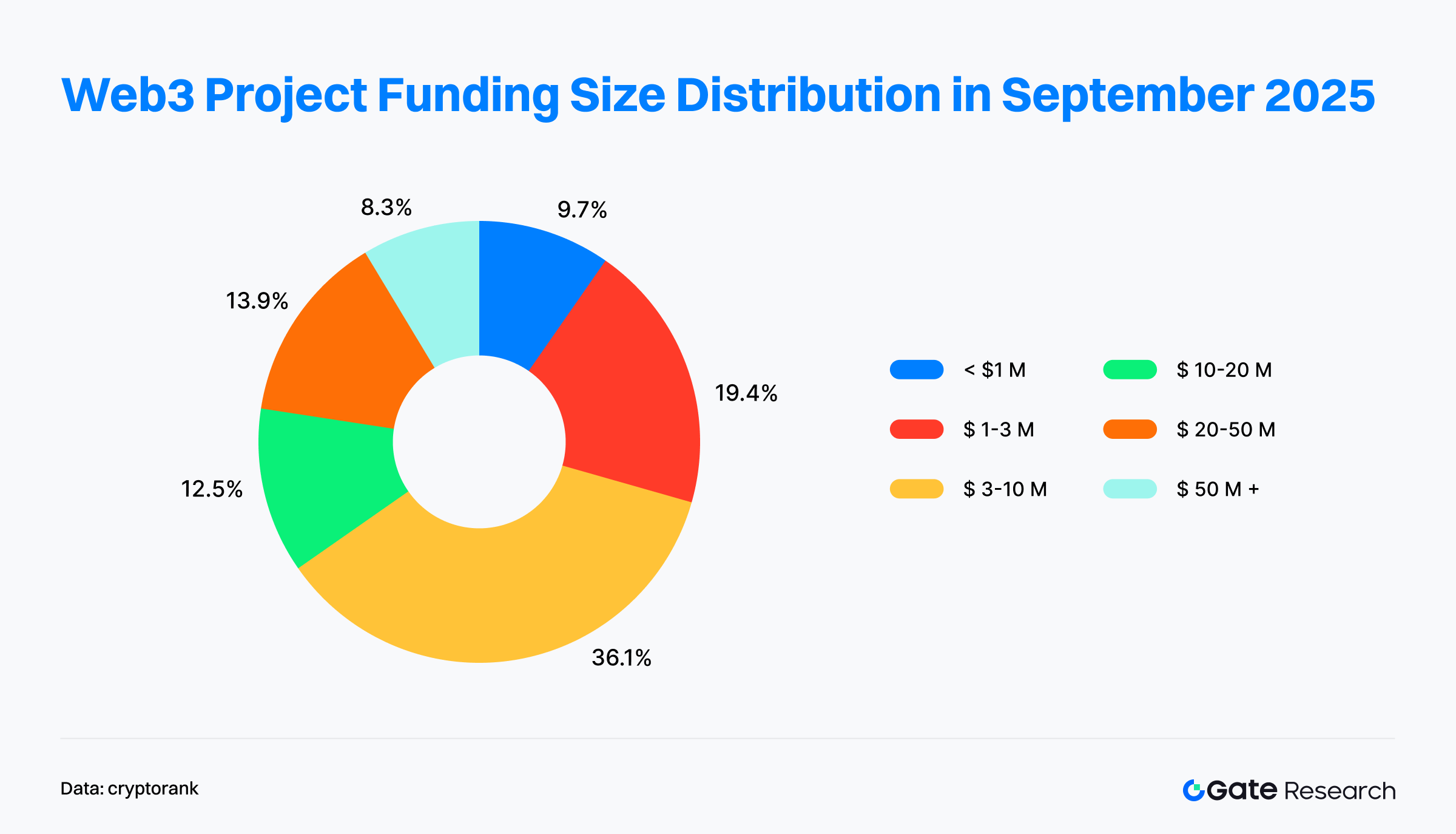

- In terms of funding structure, mid-sized rounds ($3–10M) remained dominant, accounting for roughly one-third of all deals. Small rounds (<$1M) dropped from 15% to 9.7%, while large-scale rounds (>$50M) increased to 8.3%, contributing a significant portion of total capital — evidence of an intensifying head-effect concentration.

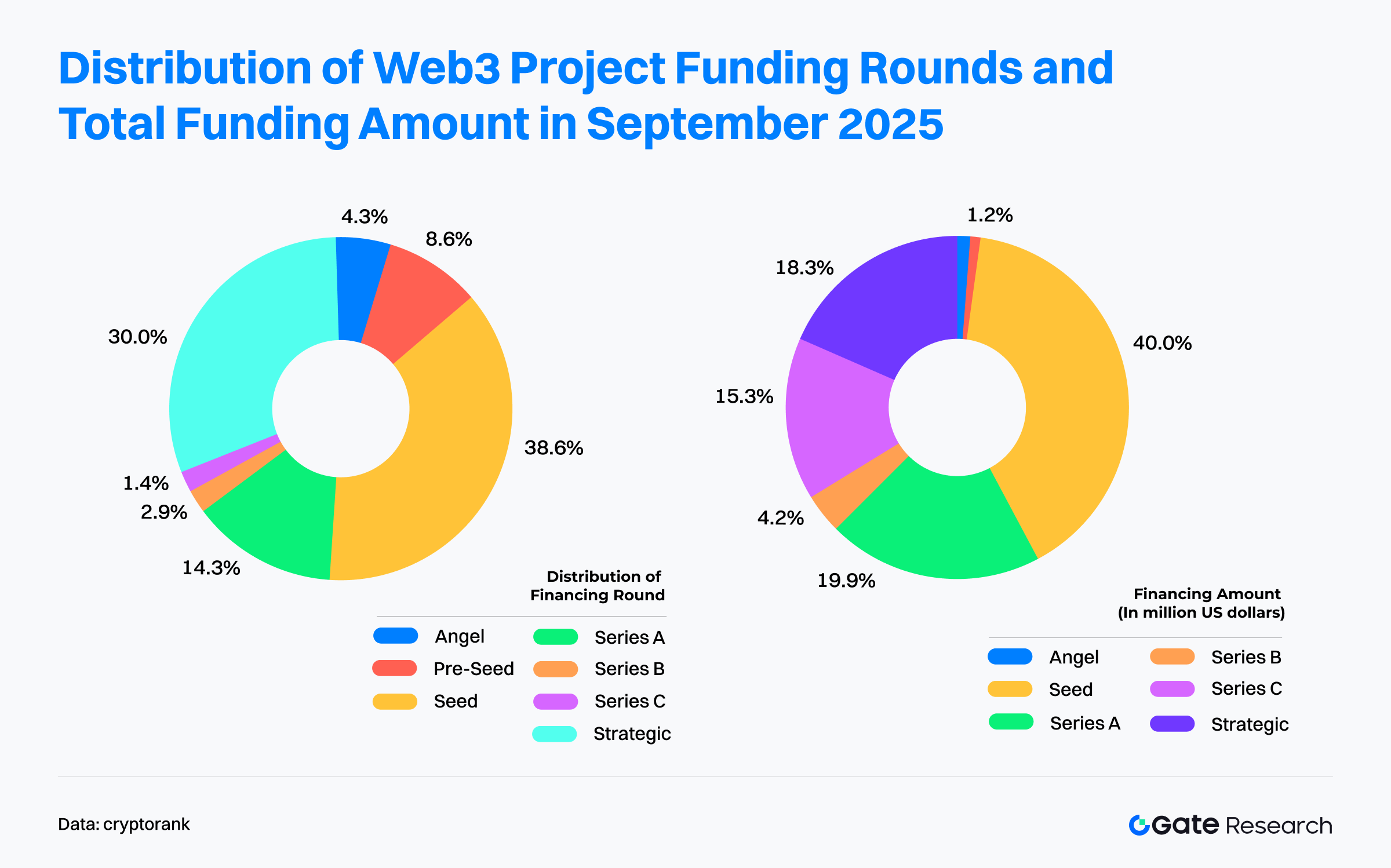

- The round distribution reveals a clear trend of “seed-stage dominance with selective mid-to-late rounds.” Seed rounds were the central focus in September, representing 38.6% of total deals and a substantial 40% of total funding, leading in both quantity and capital share.

- On the investor side, Coinbase Ventures remained the most active participant, maintaining broad exposure across multiple verticals including Blockchain Services, CeFi, DeFi, and Social sectors.

Financing Overview

According to data released by Cryptorank Dashboard on October 9, 2025, the Web3 industry recorded a total of 100 fundraising deals in September 2025, with an aggregate value of $2.2 billion【1】. It is worth noting that due to differences in statistical methodologies, this figure slightly diverges from the sum of individual disclosed deals (approximately $6.803 billion). Based on observation, this discrepancy likely arises from strategic crypto asset reserves, private placements, and IPO-related financings that were not included in Cryptorank’s dataset. To ensure consistency, this report adopts Cryptorank Dashboard’s original data as the standard for analysis.

Compared with August’s 114 deals totaling $2.05 billion, September saw a 12.28% month-on-month decline in deal count, yet a 7.3% increase in total capital raised. This “fewer deals, higher value” trend was primarily driven by several large-scale financings. For example, blockchain payment firm Fnality raised $136 million in its Series C, while average deal sizes at the seed stage rose significantly — notably, on-chain exchange Flying Tulip raised $200 million in its seed round, substantially lifting the overall funding scale.

Looking at the year-to-date trajectory, the fundraising peak occurred in March 2025, with $5.79 billion raised, largely driven by a few mega-deals. Activity then dipped in April–May, but rebounded in June and July, forming a mid-year resurgence with $4.81 billion and $4.06 billion, respectively. Interestingly, the number of deals peaked in December 2024, preceding the monetary peak — suggesting that smaller and mid-sized rounds dominated the earlier market phase.

As the second half of 2025 unfolded, the fundraising pace slowed, but both August and September maintained over $2 billion in monthly capital inflows — reflecting sustained investor confidence in Web3 innovation and its long-term foundations. Overall, despite fluctuations in deal volume, the Web3 sector has continued to attract billions in venture capital over the past year. This persistent activity signals a structural shift — from “high-frequency speculation” to “selective, quality-driven capital deployment.” Investors are increasingly focusing on projects with clear business models and long-term ecosystem value, marking the industry’s transition into a new phase of maturity and differentiation.

While some large-scale fundraisings via traditional capital channels were not captured in conventional monthly metrics, Cryptorank’s Fundraising Rounds data show that traditional financial instruments dominated the Top 10 deals【2】. Most of these top financings were completed through PIPE (Private Investment in Public Equity), IPO (Initial Public Offering), and Post-IPO Debt — mechanisms typical of the traditional capital markets. This structural trend indicates that mature Web3 projects are increasingly integrating with the traditional financial system, pursuing compliant pathways to attract institutional capital. The industry is thus entering a new phase of deep integration and refined capital allocation.

From a sectoral perspective, CeFi strongly led the Top 10 list, capturing seven positions and contributing the majority of total funding. This reflects a capital pivot toward centralized institutions with real yield models and regulatory potential. More importantly, since “on-chain treasury assetization” emerged as a new strategic narrative, several public companies and financial institutions have explicitly stated their intention to use raised funds to build chain-specific treasuries, creating a new model for large-scale capital deployment.

- Forward Industries ($1.65B) and Helius Medical Technologies ($500M) used PIPE funding to establish Solana (SOL) ecosystem treasuries.

- ETHZilla ($350M) focused on Ethereum-based asset allocations, signaling that mainstream public chain tokens are being incorporated into corporate balance sheets.

- Meanwhile, Figure ($787M, IPO) and StablecoinX ($530M, PIPE) concentrated on blockchain financial services and Ethena protocol infrastructure, further reinforcing the institutionalization and financialization of the CeFi sector.

Beyond CeFi, blockchain service and infrastructure projects such as Rapyd, AlloyX, and Fnality also secured large-scale investments, underscoring the continued momentum in payment and cross-border settlement verticals. Meanwhile, the DeFi sector produced notable highlights: Flying Tulip, an on-chain exchange, secured a record-breaking $200 million seed round, signaling renewed investor conviction in derivatives and structured-yield innovations on-chain.

In summary, the Top 10 financings of September 2025 reflect a profound transformation in Web3’s capital landscape:

- Traditional capital is taking the lead in large-scale deal structures.

- CeFi remains the primary entry point for institutional funds.

- Infrastructure and payments maintain steady growth.

- DeFi innovation is regaining traction.

Capital deployment logic has evolved from pure innovation chasing to a balance of compliance, sustainable yield, and strategic ecosystem alignment — marking the onset of Web3’s next capital cycle.

According to Cryptorank Dashboard data, the Web3 financing landscape in September 2025 exhibited a clear “dual-core” pattern, with Blockchain Services and CeFi (Centralized Finance) emerging as the dominant forces. Among them, the Blockchain Services sector led with $889 million in total funding, overtaking the long-standing CeFi frontrunner, signaling that capital is accelerating toward projects providing foundational support to the broader Web3 ecosystem, including technology platforms, data services, and solution-oriented projects. These “infrastructure enablers” are viewed as critical for scaling the industry and improving efficiency.

The CeFi sector followed closely with $806 million, demonstrating strong capital absorption capacity. Together, these two leading sectors accounted for over $1.6 billion in financing, reflecting the market’s strategic confidence in both financial infrastructure and service systems.

At the application layer, DeFi (Decentralized Finance) performed relatively steadily, ranking third with $298 million in funding. Although overall hype has cooled, investment focus has shifted from high-risk narratives to projects with tangible yields and robust mechanisms, such as on-chain derivatives, lending protocols, and yield aggregation platforms, demonstrating sustained confidence in sustainable financial innovation.

By contrast, Blockchain Infrastructure raised roughly $70.95 million, indicating continued steady progress in foundational innovation. GameFi ($58.86 million) and Social ($45 million) saw lower capital allocation, reflecting the higher selection threshold for application-layer projects in a capital-constrained environment. The Chain sector raised only $31.4 million, highlighting a significant cooling of new chain narratives.

Overall, September’s financing data clearly illustrates a deepening shift in Web3 capital allocation logic: capital is moving from high-risk application-layer projects toward stable service and financial sectors, forming a new pattern of “services first, finance rules.” Infrastructure and service platforms are increasingly replacing single-finance narratives as the core focus of the next wave of capital deployment.

Based on the 72 disclosed Web3 financing rounds in September 2025, mid-sized funding rounds ($3–10 million) remained the market mainstream, accounting for more than one-third of all deals, showing that capital still highly values early-stage projects with growth potential. Rounds in the $1–3 million range accounted for 19.4%, up from 12.5% last month, indicating that incubator and seed-stage projects remain resilient in a tighter capital environment, with investors favoring startups that have technical breakthroughs or clearly defined application scenarios. In contrast, micro-rounds under $1 million fell from 15% last month to 9.7%, reflecting increasing caution toward purely conceptual projects.

For mid-to-late stage funding, projects raising $10–50 million maintained a stable proportion, with capital mainly directed toward infrastructure and financial service projects with mature business models and ecosystem synergies. Notably, the share of large rounds $20–50 million and $50 million+ both increased. Although projects above $50 million accounted for only 8.3% of deals, they contributed a significant portion of total financing, highlighting the strong capital-absorbing effect of top-tier projects and the trend toward capital concentration.

In summary, September’s Web3 financing landscape exhibited a “polarized yet structurally robust” characteristic: one end attracted sustained funding toward early-stage innovative projects with breakthrough potential, while the other concentrated capital on mature enterprises with proven market validation and clear revenue paths. Market capital increasingly favors “quasi-unicorn” projects with long-term moats and scalable potential.

According to data on 67 disclosed Web3 financing rounds in September 2025, the market structure showed a clear pattern of “seed rounds dominating in both number and amount, while mid-to-late stage rounds are highly selective.”

High concentration in seed rounds: capital heavily backing early innovation: Seed rounds were the core stage of financing that month, with projects accounting for approximately 38.6% of total deals, while the financing amount reached 40%, leading in both deal count and capital. This high concentration was largely driven by a few exceptionally large rounds, such as the on-chain exchange Flying Tulip, which successfully raised $200 million in its seed round. This indicates that capital still favors early-stage projects with high potential but is increasingly selective, focusing on those with innovative mechanisms, real yield models, or new narrative potential, and willing to deploy large sums to secure early growth opportunities.

Strategic synergies and selective mid-to-late rounds: Strategic rounds maintained strong activity, accounting for about 30% of projects, reflecting deeper ecosystem synergies between mature projects and large institutions, with capital increasingly participating through strategic investments aimed at ecosystem development and vertical integration. Unlike previous months, where Series A/B rounds dominated in terms of funding volume, in September Series A and B combined accounted for 24.1% of total financing, showing a “steady continuation” pattern. Notably, Series C rounds, though representing only 1.4% of project count, contributed 15.3% of total financing (e.g., blockchain payments company Fnality), highlighting the large capital allocation per deal in later stages.

Cautious early-stage incubation: In contrast, angel and pre-seed rounds were relatively limited, accounting for about 12.9% of deals but less than 2.5% of total financing, reflecting a more cautious approach toward very early-stage incubation. The market is gradually moving into a refined investment cycle focused on business validation.

Overall, September’s financing structure reveals a new pattern of “early-stage concentration, selective later-stage, strategic synergy”: early innovation remains the primary focus of capital, but with higher concentration; mid-to-late stage financing is more rational, supporting leading projects with sustainable revenue and ecosystem synergies. This trend indicates that the Web3 market is transitioning from a “capital trial-and-error period” to a “value selection period,” entering a new phase oriented toward quality and sustainable growth.

According to Cryptorank data released on October 9, 2025, the most active institutional investors in September were Coinbase Ventures, Mirana Ventures, and Paradigm, leading in the number of projects invested and showing continued dominance in the early-stage sector.Coinbase Ventures was the most active institution in terms of project count, investing across multiple sectors including Blockchain Service, CeFi, DeFi, and Social, demonstrating a systematic and ecosystem-oriented investment strategy. Mirana Ventures and Paradigm focused more on blockchain infrastructure and DeFi protocols, continuing the dual-engine strategy centered on technological innovation and financial derivatives.

DeFi and Blockchain Service remained the dominant investment targets, indicating that market attention is shifting from single-layer financial innovation to sustainable development integrating both service and yield layers. In contrast, Social, GameFi, and NFT projects had lower financing shares, reflecting that application-layer projects face higher hurdles for business validation and user growth under tighter capital conditions.

Overall, September’s institutional investment landscape shows that capital allocation is shifting from “narrative-driven” to “structure-driven.” Top-tier institutions are increasing investments in infrastructure and service sectors, mid-tier institutions focus on ecosystem linkage and application innovation, and the overall market investment logic is moving toward maturity and differentiation.

Highlighted Project of the Month

Flying Tulip

Overview: Flying Tulip is an on-chain exchange offering spot trading, perpetual contracts, lending, options, and structured yield products. The platform combines automated market makers (AMM) with order books, supports volatility-adjusted lending, and enables cross-chain deposits for a unified DeFi trading experience.【3】

On September 30, Flying Tulip completed a $200 million private seed round, with a token FDV of $1 billion. The project now plans a public sale of its FT token, targeting $800 million at a $1 billion valuation.【4】

Investors / Angel Backers: Brevan Howard Digital, CoinFund, DWF Labs, FalconX, Hypersphere, Lemniscap, Nascent, Republic Digital, Selini, Sigil Fund, Susquehanna Crypto, Tioga Capital, Virtuals Protocol, and others.

Highlights:

- Flying Tulip’s most innovative feature allows private or public investors to burn FT tokens at any time and redeem their principal in original assets (e.g., ETH). This mechanism provides a downside protection floor while retaining upside potential—an unprecedented safeguard in the DeFi space.

- The platform integrates spot trading, perpetuals, options, lending, insurance, and a native stablecoin (ftUSD) within a single ecosystem. It uses volatility-sensitive curves and adaptive AMM mechanisms, with smart routing for limit orders to optimize execution. Perpetual contracts settle internally without reliance on external oracles, maintaining decentralization while reducing liquidation risk.

- Flying Tulip avoids unsustainable incentive-driven models. Initial funds are deployed into low-risk DeFi strategies to cover operating costs until the product line becomes self-sustaining. Revenue from trading fees, lending spreads, liquidations, and insurance will drive token buybacks, creating a natural deflationary cycle that encourages long-term holding and supports sustainable token economics.

Aria

Overview: Aria is an IP asset tokenization platform built on the Story blockchain, aimed at transforming music, art, film, and other intellectual property into tradable on-chain assets. Developed by Aria Protocol Labs Inc. and Aria Foundation, it addresses liquidity and valuation transparency issues in traditional IP markets.【5】

On September 3, Aria completed a $15 million seed and strategic round, with a post-money valuation of $50 million. The funding will be primarily used to expand into new IP categories such as art and film, accelerating the global deployment of its IP tokenization ecosystem.【6】

Investors: Polychain Capital, Neoclassic Capital, Story Protocol Foundation, and others.

Highlights:

- Aria not only tokenizes IP but also creates a full financial ecosystem, enabling fractionalization, liquidity, and financialization of IP. Rights are protected via smart contracts, ensuring clear ownership and automated revenue distribution. Built on Story blockchain, the platform incorporates embedded copyright management and automated payout mechanisms, enabling full lifecycle management and value circulation of music, film, and art IP while maintaining compliance and scalability.

- Aria launched its first music IP token, APL, representing royalty rights for top global artists such as Justin Bieber, BLACKPINK, and BTS. Using Stakestone’s LiquidityPad, Aria raised $10.95 million to acquire music rights. Token holders can stake APL to receive real-time royalty income, demonstrating operational capability and cash flow generation. Collaborations with Story Protocol and Contents Technologies will expand the platform into the Korean music market, which accounts for over half of global music distribution, providing a large IP source and commercial potential.

- Current income comes from IP issuance, trading, and management fees. To accelerate ecosystem growth, some fees are temporarily waived to attract creators and users. Eventually, Aria plans a multi-tiered revenue system including transaction fees, asset management fees, licensing fees, and ecosystem service fees, supporting sustainable growth.

Wildcat Labs

Overview: Wildcat Labs is an Ethereum lending protocol that allows borrowers to parametrize their loans, deploying under-collateralized credit limits according to their preferences. Lenders benefit from innovative interest rate and withdrawal mechanisms.【7】

On September 5, Wildcat Labs announced it had raised $3.5 million in a seed round led by Robot Ventures, aimed at expanding adoption of on-chain collateralized lending.【8】

Investors: Robot Ventures, Triton Capital, Polygon Ventures, Safe Foundation, Hyperithm, Hermeneutic Investments, Kronos Research, and others.

Highlights:

- Wildcat does not directly underwrite loans; instead, borrowers can set their own parameters (e.g., reserve ratios, withdrawal schedules, whitelists), creating a highly flexible “custom credit market”. Unlike over-collateralized models such as Aave or Compound, Wildcat supports low-collateral or even partially uncollateralized loans, significantly improving capital efficiency.

- All loan data and risk metrics are on-chain and transparent, ensuring lender trust. The V2 version deployed on Ethereum mainnet costs only 0.06969 ETH (~$180), demonstrating high technical efficiency. The protocol earns revenue by charging a 5% protocol fee on interest, forming a sustainable income model.

- The platform has provided customized credit lines for institutions such as Wintermute, Amber Group, and Keyrock, and offers emergency bridge financing post-security incidents. Additionally, the Plasma (XPL) token sale mechanism allows early investors to secure fixed returns and price arbitrage before token listing.

- The protocol currently manages $150 million in outstanding credit, with a total of $368 million lent since the V2 launch in February 2025, showing significant growth. Current TVL is approximately $13 million, reflecting strong market demand and ongoing expansion.

Share

Overview: Share is an on-chain social trading mobile app built on Solana, Base, and Ethereum. Users can display personal trades, follow any wallet, view real-time charts, and directly interact with on-chain wallets, creating a seamless “social + trading” experience.【9】

On September 25, Scott Gray, founder of Genie, announced the launch of Share and completed $5 million in funding.【10】

Investors / Angel Backers: Coinbase Ventures, Collab+Currency, Palm Tree Crypto, and others.

Highlights:

- Share integrates a social platform, blockchain explorer, and crypto wallet into a single app, becoming the first native iOS on-chain social trading application. It indexes all transactions on Solana, Base, and Ethereum, transforming complex on-chain data into an intuitive, interactive social feed.

- Each wallet address has its own personal profile on Share. Even if users don’t register, a viewable on-chain identity is automatically generated. Users can view charts, track other wallets, execute token trades, and share their transactions as social posts.

- The platform’s core vision is to “make every transaction shareable financial information.” By converting verifiable on-chain transactions into a content feed, Share reveals the beliefs and expectations behind capital flows, making trading a socially interactive and shareable expression. This approach enhances transparency, adds engagement to trading, and introduces new ways for Web3 users to express themselves socially and through content.

Perle

Overview: Titan is a next-generation decentralized exchange (DEX) aggregator built on Solana, designed to provide users with a more efficient and transparent trading experience by smartly aggregating liquidity, optimizing trade execution, and enhancing security mechanisms. It integrates multiple leading DEX aggregators into a single platform, comparing quotes in real time and automatically routing trades along the best available paths, ensuring users always transact at the optimal price.【11】

On September 19, Titan announced it had raised $7 million in a seed round led by Galaxy Ventures. The funding will accelerate Titan’s development as a comprehensive portal for the internet capital markets.【12】

Investors: Galaxy Ventures, Frictionless, Mirana, Ergonia, Auros, Susquehanna, and others.

Highlights:

- Titan’s core innovation lies in its Talos Gateway Routing algorithm. Unlike traditional DEX aggregators, Titan not only consolidates multiple liquidity sources but also promises zero-fee best execution for users. The algorithm outperforms existing aggregators over 80% of the time, using granular optimization to mitigate slippage caused by execution delays, particularly in volatile markets.

- Titan is the first meta-aggregator in the Solana ecosystem. Its Titan Prime API is the highest-performance on-chain trading API on Solana, designed to support platforms and traders across the ecosystem. The API connects all major routers and compares quotes, handling highly complex and resource-intensive computations.

- Titan also developed its proprietary aggregator router, Argos, which is a core component of Titan Prime API. Argos outperforms competitors in 70–75% of cases, providing strong technical assurance for users to obtain the best trade prices on Solana.

- Titan has officially completed its private testing phase and is now publicly accessible via titan.exchange. During private testing, the platform processed over $1.5 billion in spot trading volume.

Conclusion

In September 2025, Web3 industry financing reached $2.2 billion across 100 deals, exhibiting a structural trend of “fewer deals, higher valuations.” CeFi and blockchain service sectors acted as dual capital drivers, creating a new balance between financial institutions with real yield models and underlying technology platforms. The frequent use of traditional financial instruments such as PIPEs, IPOs, and post-IPO debt indicates accelerating integration of Web3 with traditional capital markets, with increasingly mature, compliant financing pathways.

In terms of financing structure, the market logic shows a trend of “early-stage concentration with high stakes, late-stage selectivity with stable allocation.” Seed rounds dominated in terms of number of projects (~38.6%) and financing amount (40%), showing that capital is willing to make large investments in a few highly disruptive early-stage projects like Flying Tulip.

Key innovative projects focused on addressing core industry pain points and driving sustainable growth:

- DeFi: Flying Tulip introduces the “Perpetual Put” risk protection mechanism and a yield-driven operational model, while Wildcat Labs enhances capital efficiency through its flexible custom credit markets, jointly promoting institutionalization and sustainability in DeFi.

- Application layer: Aria advances IP assetization and financialization, unlocking real-world copyright value, while Share integrates wallets, trading, and social features, significantly improving the on-chain trading experience.

- Infrastructure layer: Titan optimizes liquidity routing with a zero-fee, high-performance meta-aggregation algorithm, maximizing efficiency and supporting large-scale application deployment across the industry.

Overall, September’s financing landscape reflects a profound shift in Web3 capital logic—from chasing concepts to building structured value, from short-term speculation to long-term construction. Capital is refocusing on trust, yield, and compliance. With CeFi institutionalization, platformization of blockchain services, and refinement of DeFi, Web3 is entering a new capital cycle driven by traditional finance co-building and real yield generation.

Reference:

- Cryptorank , https://cryptorank.io/funding-analytics

- Cryptorank, https://cryptorank.io/funding-rounds

- Flying Tulip, https://flyingtulip.com/

- The Block, https://www.theblock.co/post/372787/andre-cronje-flying-tulip-funding-crypto-token-valuation?utm_source=twitter&utm_medium=social

- Aria, https://ariaprotocol.xyz/

- X, https://x.com/Aria_Protocol/status/1963271027406074217

- Wildcat Labs, https://app.wildcat.finance/lender

- The Block, https://www.theblock.co/post/369453/wildcat-labs-3-5-million-usd-round-robot-ventures

- Share, https://about.share.xyz/

- Blockworks, https://blockworks.co/news/social-trading-app-fundraise

- Titan, https://titan.exchange/

- The Block, https://www.theblock.co/press-releases/371306/titan-raises-7m-seed-from-galaxy-ventures-and-launches-publicly-on-solana

Gate Research is a comprehensive blockchain and cryptocurrency research platform that provides deep content for readers, including technical analysis, market insights, industry research, trend forecasting, and macroeconomic policy analysis.

Disclaimer

Investing in cryptocurrency markets involves high risk. Users are advised to conduct their own research and fully understand the nature of the assets and products before making any investment decisions. Gate is not responsible for any losses or damages arising from such decisions.

Related Articles

Gate Research: 2024 Cryptocurrency Market Review and 2025 Trend Forecast

Gate Research: BTC Breaks $100K Milestone, November Crypto Trading Volume Exceeds $10 Trillion For First Time

Gate Research-A Study on the Correlation Between Memecoin and Bitcoin Prices

Detailed Analysis of the FIT21 "Financial Innovation and Technology for the 21st Century Act"

Gate Research: Web3 Industry Funding Report - November 2024