Post content & earn content mining yield

placeholder

SignatureQueen

[New Streamer]Crypto winter nearing its end: The industry enters a spring recovery phase, presenting opportunities for low-price accumulation

- Reward

- like

- Comment

- Repost

- Share

🚨 EVERYONE\'S WRONG ABOUT CME GAPS: The 2022 bear market left TWO massive gaps unfilled for 12+ months. Mariano shows you the PROOF on the charts. Don\'t assume $79K-$83K will close just because you need it to 📊 #CMEGaps #BitcoinAnalysis #BTC #CryptoTrading #BearMarketStrategy

BTC-4,62%

- Reward

- like

- Comment

- Repost

- Share

Gate Indices section futures has now launched US2000, TW88, AUS200, VIX and HSCHKD. Trade to earn instant rewards, meet trading targets to share additional prizes, and enjoy exclusive welcome bonuses for new users. Both new and existing users are invited to participate and share a 200,000 USDT reward pool. https://www.gate.com/uk/campaigns/4015?ref=VVEXUW1ZAQ&ref_type=132

- Reward

- 2

- Comment

- Repost

- Share

XBRUSD

布伦特原油

Created By@High-FrequencyHedging

Listing Progress

0.00%

MC:

$0.1

Create My Token

Don’t you hate when price gets so close to TP,just to fully reverse and come back to BE just to see it go to TP again without you?$NQ

- Reward

- like

- Comment

- Repost

- Share

🇺🇸 PRESIDENT TRUMP JUST SAID HE HAD AN EXCELLENT CONVERSATION WITH PRESIDENT XI OF CHINA“MANY POSITIVE RESULTS EXPECTED WITH CHINA”BULLISH FOR MARKETS 🚀

- Reward

- like

- Comment

- Repost

- Share

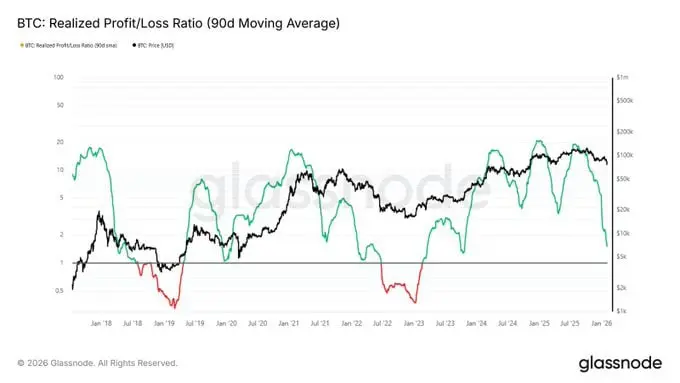

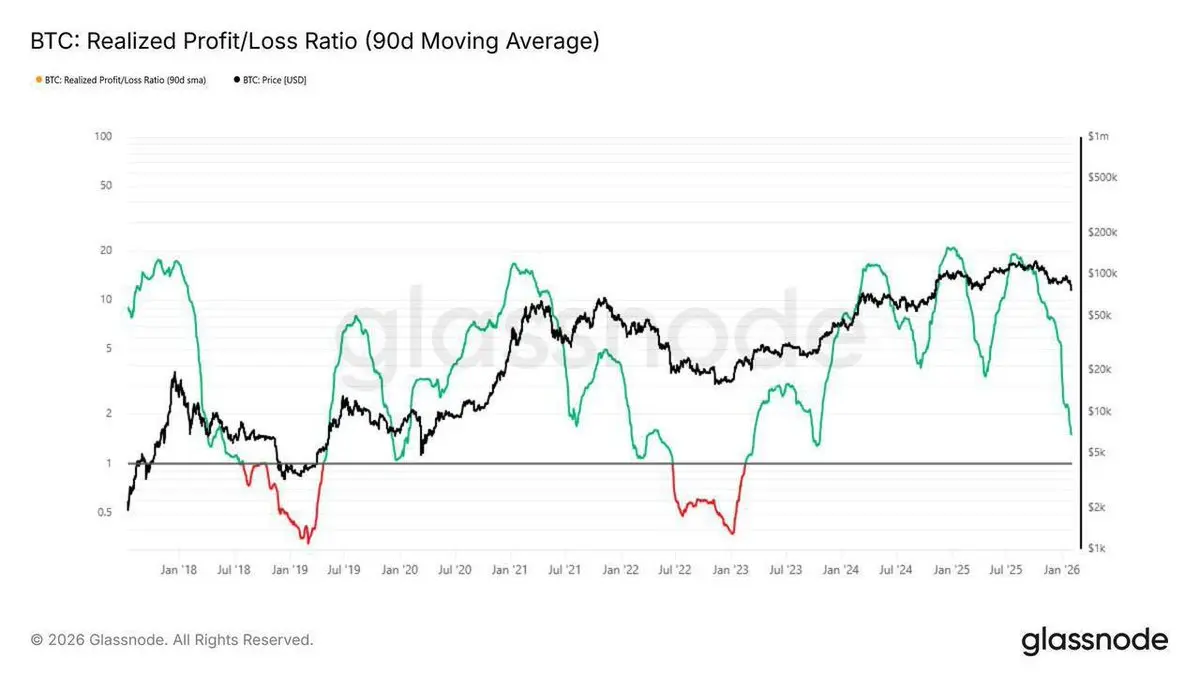

🥶 Mass capitulation of $BTC is imminent

Glassnode warns of the risks of mass capitulation of $BTC

The Realized Profit/Loss Ratio indicator has fallen to ~1.5 and is moving towards the critical mark of 1.

📉 Historically, breaking through this level triggers widespread capitulation: investors massively lock in losses instead of profits, the market loses liquidity, and this can trigger a serious $BTC crash.

Glassnode warns of the risks of mass capitulation of $BTC

The Realized Profit/Loss Ratio indicator has fallen to ~1.5 and is moving towards the critical mark of 1.

📉 Historically, breaking through this level triggers widespread capitulation: investors massively lock in losses instead of profits, the market loses liquidity, and this can trigger a serious $BTC crash.

BTC-4,62%

- Reward

- like

- Comment

- Repost

- Share

$testicle playing out as expected/higher

- Reward

- like

- Comment

- Repost

- Share

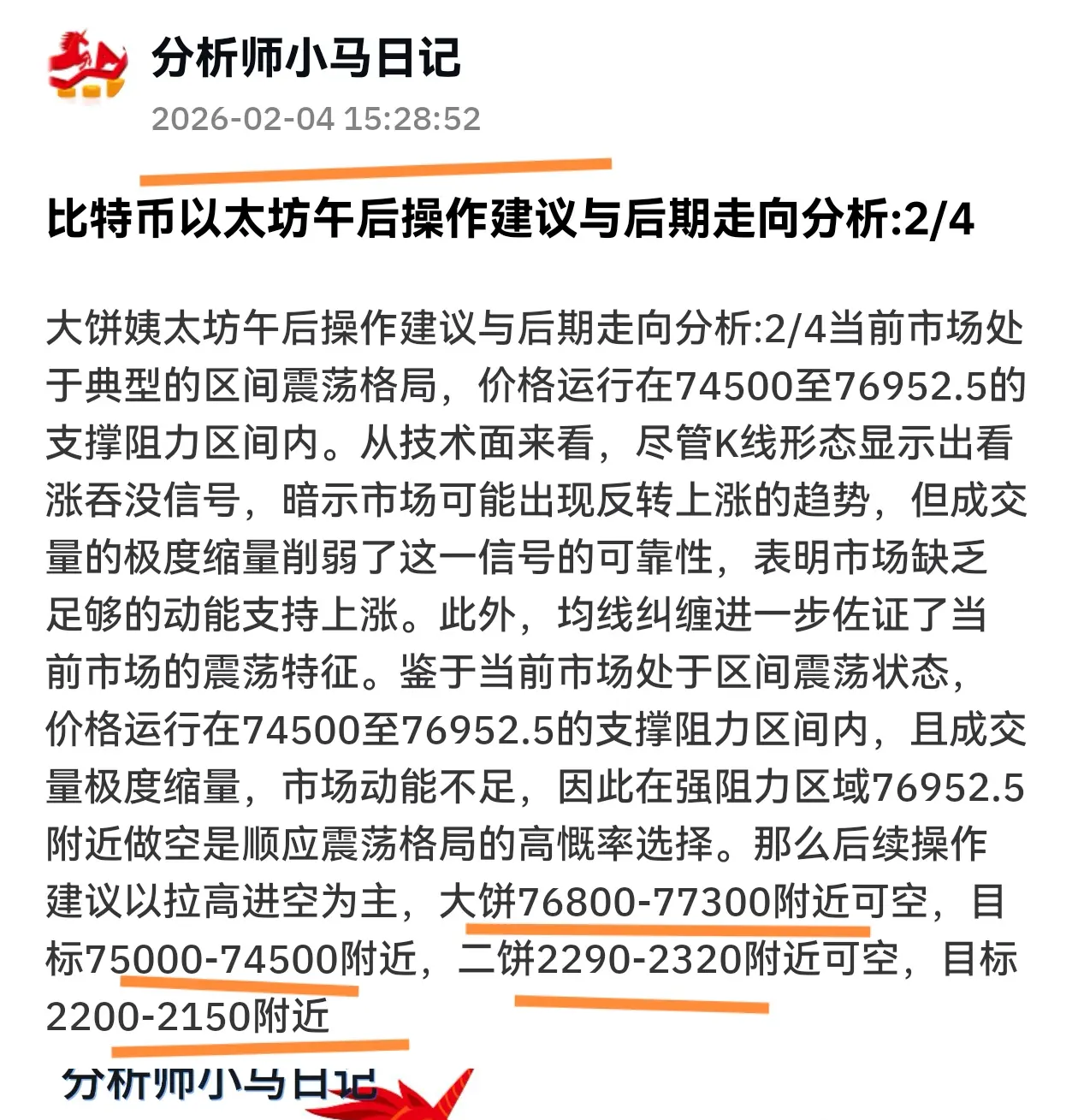

“Candlesticks are the market's breathing, and the ups and downs are its heartbeat. Don't think you've understood the entire script just because of a sharp fluctuation—Even Satoshi Nakamoto might not have predicted today's plot.” The strategy of shorting again proves valid. Our bearish entry points focus on around 76800 for Bitcoin and around 2290 for Ethereum. After Ethereum's midday oscillation and decline, we followed Dan's operation, entering Bitcoin near 76500 and Ethereum around 2290. In the evening, the market directly dropped to our target levels, around 74500, where we exited promptly.

View Original

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Bitcoin Latest Market Analysis + Support and Resistance Levels Sharing!!! #BTC $BTC

🩸 Fish Nightly Urgent News: 74,295 "Last Line of Defense" Declared Broken! Panic Selling Reignites, Wave C Deep Abyss Directly Targets 72,000!

Latest Situation In-Depth Review (Breakout Alert):

Collapse of Defense Line: Brothers, this is bad news! Just now, we were still hoping that 74,300 could hold as a double bottom, but just now, the main bearish force kicked through 74,295 (yesterday's V reversal point / intraday bottom). The current price of 74,141 means that the last trench of the bulls above 74k has b

🩸 Fish Nightly Urgent News: 74,295 "Last Line of Defense" Declared Broken! Panic Selling Reignites, Wave C Deep Abyss Directly Targets 72,000!

Latest Situation In-Depth Review (Breakout Alert):

Collapse of Defense Line: Brothers, this is bad news! Just now, we were still hoping that 74,300 could hold as a double bottom, but just now, the main bearish force kicked through 74,295 (yesterday's V reversal point / intraday bottom). The current price of 74,141 means that the last trench of the bulls above 74k has b

BTC-4,62%

- Reward

- 3

- 1

- Repost

- Share

superuser666 :

:

New Year Wealth Explosion 🤑Bitcoin Aunt Ethereum Afternoon Layout Short Position Dan Wins Again: On 2/4, the afternoon short position layout was once again validated. Our bearish outlook suggested key levels around 76,800 for Bitcoin and around 2,290 for Ethereum. Bitcoin Aunt Ethereum experienced a midday oscillation and decline. We followed Dan's strategy, entering around 76,500 for Bitcoin and near 2,290 for Ethereum. In the evening, the market directly dropped to our target levels, around 74,500, where we exited promptly. Bitcoin reached around 2,150, and we exited simultaneously. To prevent a rebound, we took profi

View Original

- Reward

- 1

- Comment

- Repost

- Share

XPTUSD

XPTUSD

Created By@High-FrequencyHedging

Listing Progress

0.00%

MC:

$2.65K

Create My Token

Bessent during a House Financial Services Committee hearing in Washington. Representative Waters told Bessent to “shut up.”Bessent asked if Representative Waters could maintain some level of dignity after she requested that he “shut up.”#crypto

- Reward

- like

- Comment

- Repost

- Share

Gm frens The real once understand this isn\'t the time to run away This is the time to plan , strategize so that when up times return you can also become a millionaire!

- Reward

- like

- Comment

- Repost

- Share

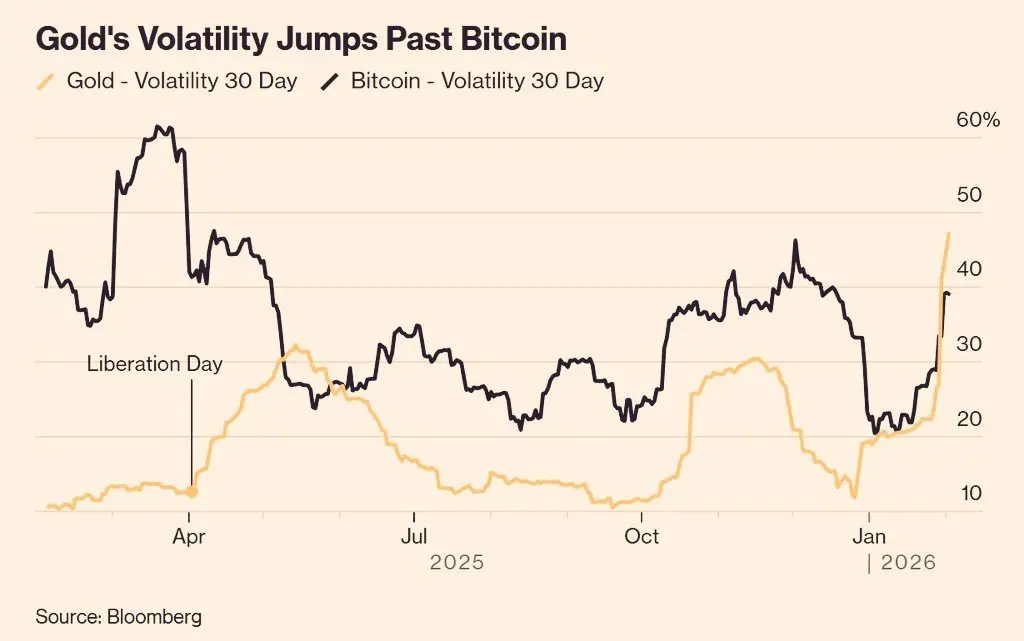

- Federal Reserve reforms trigger macroeconomic uncertainty with cryptocurrency price fluctuations:

Global markets continue to face macroeconomic uncertainty amid Federal Reserve reforms. After the U.S. central bank kept the target interest rate within the 3.50% to 3.75% range on January 28, President Donald Trump nominated Kevin Warch to succeed Jerome Powell as Federal Reserve Chair.

Market participants are reassessing Warch's previous hawkish stance as Fed Chair, leading to instability and sharp sell-offs in precious metals like gold and silver, as well as digital assets.

KAIKO Research sta

Global markets continue to face macroeconomic uncertainty amid Federal Reserve reforms. After the U.S. central bank kept the target interest rate within the 3.50% to 3.75% range on January 28, President Donald Trump nominated Kevin Warch to succeed Jerome Powell as Federal Reserve Chair.

Market participants are reassessing Warch's previous hawkish stance as Fed Chair, leading to instability and sharp sell-offs in precious metals like gold and silver, as well as digital assets.

KAIKO Research sta

XRP-3,9%

- Reward

- like

- 1

- Repost

- Share

Long-TermVegetarianism :

:

Experienced driver, guide me 📈Has the dip buying started in Bitcoin? Critical level at $73,000!

- Reward

- 1

- 1

- Repost

- Share

Atilss :

:

Hold tight 💪All girls love $MONEYgMONEY

- Reward

- like

- Comment

- Repost

- Share

Glassnode analysts flag a potential mass capitulation risk in $BTC. The Realized Profit/Loss Ratio is approaching a critical threshold, historically, a decisive break below this level has preceded broad-based capitulation events. If triggered, expect heightened volatility and accelerated downside as weak hands exit positions. #crypto

BTC-4,62%

- Reward

- like

- Comment

- Repost

- Share

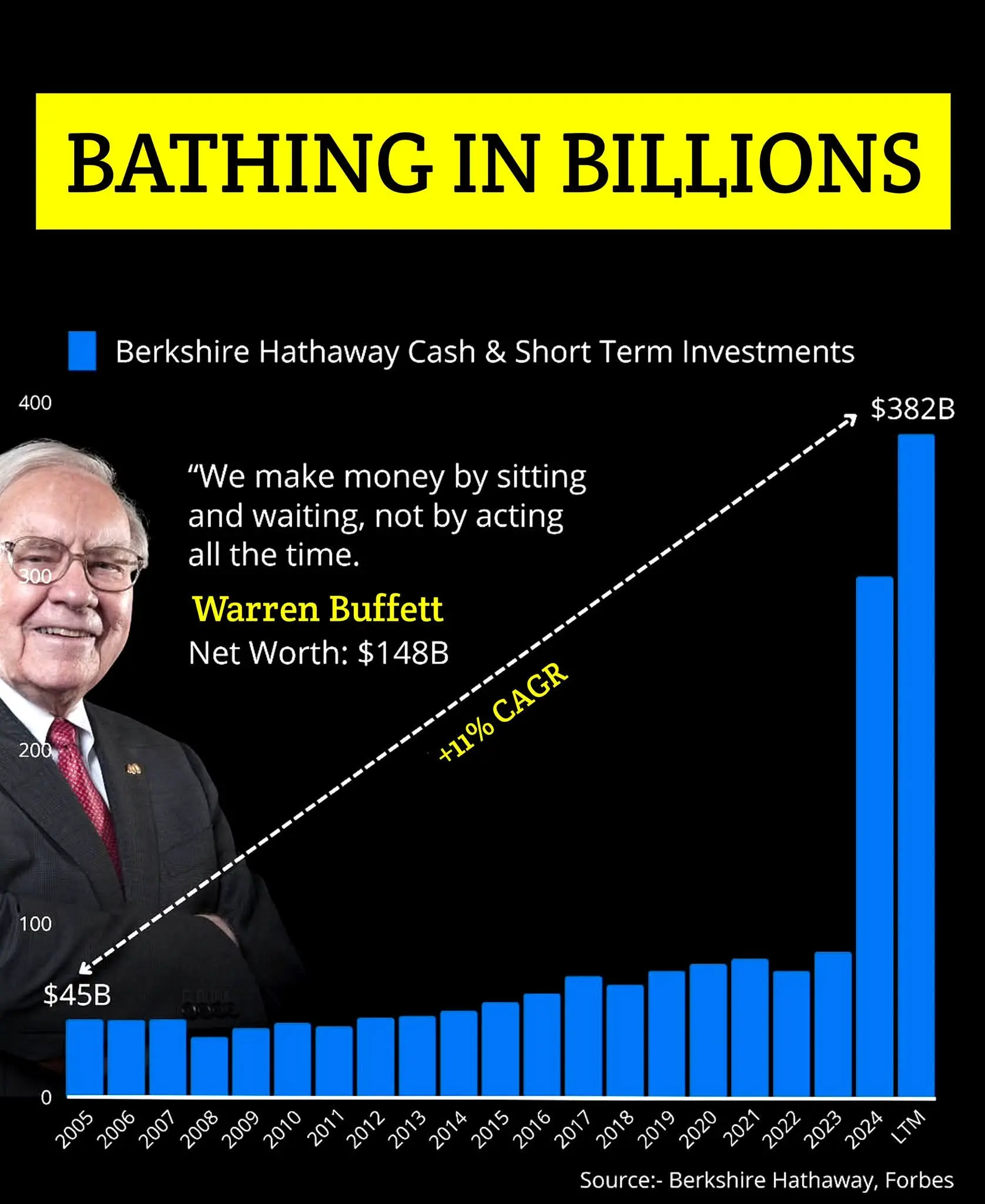

Bathing In Billions Massive market caps Explosive revenue growth * Cash-rich balance sheets * Winners of this cycle Insight: Real wealth isn’t flashy — it compounds quietly.

👇👇👇

NEED LATEST MARKET UPDATES on SQUARE & Gate io Square ❓❓❓

✅ FOLLOW ME NOW 🔥💰💵

🧲

💹 GateIo Square :

https://www.gate.com/profile/Lionish_Lion

#OvernightV-ShapedMoveinCrypto

👇👇👇

NEED LATEST MARKET UPDATES on SQUARE & Gate io Square ❓❓❓

✅ FOLLOW ME NOW 🔥💰💵

🧲

💹 GateIo Square :

https://www.gate.com/profile/Lionish_Lion

#OvernightV-ShapedMoveinCrypto

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More15.66K Popularity

10.39K Popularity

8.93K Popularity

3.44K Popularity

5.71K Popularity

Hot Gate Fun

View More- MC:$2.62KHolders:10.00%

- MC:$0.1Holders:10.00%

- MC:$0.1Holders:10.00%

- MC:$0.1Holders:00.00%

- MC:$2.65KHolders:10.00%

News

View MoreSuspected Multicoin Capital is massively converting ETH to HYPE

3 m

Trend Research Deposits Additional 10,000 ETH Worth $21.2M to CEX

4 m

Tether Mints $1B USDT on Tron Network, Total $1.75B Issued in 24 Hours

11 m

AMD's decline widens to 16%, marking the biggest drop in 8 years

25 m

A certain whale sold all 9,485 ETH purchased 5 months ago, resulting in a loss of $24.27 million.

27 m

Pin