DarkHorse_sBlack_Drago

- Reward

- 2

- 5

- Repost

- Share

Piqi :

:

Can't come down, going up nowView More

Post and Interact to Share $50,000 Red Packets on Gate Square https://www.gate.com/campaigns/4044?ref=UFRFAQ0M&ref_type=132

- Reward

- 6

- 5

- 1

- Share

User_any :

:

To The Moon 🌕View More

#我在Gate广场过新年 Chinese Meme has become a fixed track. Once the market correction ends, a new wave of explosion is expected!

In early 2026, the crypto market will rebound, and Chinese Meme coins will lead the surge. Projects like "I'm coming, damn it" have skyrocketed over 420%, and over 6,000 related tokens have emerged on the Gate platform within a month. From occasional memes to established narratives, Chinese Meme has experienced two waves, relying on platforms like Gate with comprehensive infrastructure such as spot trading, derivatives, ETFs, and more, forming a complete trading ecosystem.

In early 2026, the crypto market will rebound, and Chinese Meme coins will lead the surge. Projects like "I'm coming, damn it" have skyrocketed over 420%, and over 6,000 related tokens have emerged on the Gate platform within a month. From occasional memes to established narratives, Chinese Meme has experienced two waves, relying on platforms like Gate with comprehensive infrastructure such as spot trading, derivatives, ETFs, and more, forming a complete trading ecosystem.

我踏马来了-3,68%

- Reward

- 4

- 3

- Repost

- Share

GateUser-c094e03d :

:

Either not stupid or it's bad. Inspection complete😄View More

- Reward

- 1

- 2

- Repost

- Share

GateUser-6a17bbfa :

:

Market manipulation is as rapid as diarrhea, and declines are like constipation—slow and gradual.View More

#TrumpAnnouncesNewTariffs

Trump Announces New Tariffs and Signals a Potential Structural Shift in Global Trade, Inflation Dynamics, Capital Flows, Monetary Policy Expectations, and Long-Term Market Regimes

When tariffs re-enter the political and economic agenda at a serious level, this is not just about trade balances or campaign rhetoric. It becomes a structural macro event. Markets don’t move long term because of headlines — they move because of shifts in capital flows, liquidity conditions, and growth expectations. Tariffs sit directly at the intersection of all three.

At the surface level

Trump Announces New Tariffs and Signals a Potential Structural Shift in Global Trade, Inflation Dynamics, Capital Flows, Monetary Policy Expectations, and Long-Term Market Regimes

When tariffs re-enter the political and economic agenda at a serious level, this is not just about trade balances or campaign rhetoric. It becomes a structural macro event. Markets don’t move long term because of headlines — they move because of shifts in capital flows, liquidity conditions, and growth expectations. Tariffs sit directly at the intersection of all three.

At the surface level

BTC-0,61%

- Reward

- 1

- 2

- Repost

- Share

Sakura_3434 :

:

2026 GOGOGO 👊View More

- Reward

- 2

- 1

- Repost

- Share

SpringBreezeAndSummerRain :

:

Light mapping isn't enough; the ecosystem needs to be implemented.Participate in horse racing betting, complete tasks to earn horse racing tickets, and enjoy a million red envelope rain daily, sharing a prize pool of 100,000 USDT at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=UQNHVgw

View Original

- Reward

- 2

- 2

- Repost

- Share

Language :

:

Wishing you great wealth in the Year of the Horse 🐴View More

Am I seeing things? Why are so many live rooms broadcasting nonstop? I watch them when I go to sleep, and when I wake up, they're still live. After lunch, they're still broadcasting in the afternoon. Are they working themselves to death? Even on the big weekend, you're still streaming like this. If you got up early at 7 a.m., it wouldn't be a big deal, maybe there'd be some market movement. What are you doing?

View Original- Reward

- 2

- 1

- Repost

- Share

TheFutureIsPromising6 :

:

Earning money isn't easy😁- Reward

- 3

- 1

- Repost

- Share

hotkut2535 :

:

2026 GOGOGO 👊- Reward

- 3

- 1

- Repost

- Share

GateUser-75f82f6d :

:

Taking advantage of March 14th to quickly do more mapping, so people can settle their positions, right?Enze: The main upward wave started at the 4842 low point, with gold and silver bulls fully erupting

From the current market perspective, since the low point of 4842, the trend has maintained a strong bullish structure with higher highs and higher lows. The price has strongly broken through two key resistance levels at 5050 and 5080, and is currently trading around 5107. The Bollinger Bands are opening upward overall, with the price strongly operating near the upper band, indicating a clear bullish rhythm.

Trading Suggestions:

Gold: Around 5050-5080, with a stop loss below 5030, aiming for 5150

From the current market perspective, since the low point of 4842, the trend has maintained a strong bullish structure with higher highs and higher lows. The price has strongly broken through two key resistance levels at 5050 and 5080, and is currently trading around 5107. The Bollinger Bands are opening upward overall, with the price strongly operating near the upper band, indicating a clear bullish rhythm.

Trading Suggestions:

Gold: Around 5050-5080, with a stop loss below 5030, aiming for 5150

XAUT0,38%

- Reward

- 2

- 1

- Repost

- Share

Zegna :

:

误人子弟🏮 Only 2 days left! $50,000 Red Packet Rain Final Call!

Don't miss your fortune! 🐎

1️⃣ Post and win: 100% win for new users, up to 28U per post!

2️⃣ Lucky winner: Post with #CelebratingNewYearOnGateSquare and win 50 GT + Gift Box!

3️⃣ Grand Prizes: Win Inter Milan jerseys, Red Bull jackets, and VIP camping gear!

⏰ Ends: Feb 23, 16:00 UTC

Update app to v8.8.0+ to join!

Details: https://www.gate.com/announcements/article/49773

Don't miss your fortune! 🐎

1️⃣ Post and win: 100% win for new users, up to 28U per post!

2️⃣ Lucky winner: Post with #CelebratingNewYearOnGateSquare and win 50 GT + Gift Box!

3️⃣ Grand Prizes: Win Inter Milan jerseys, Red Bull jackets, and VIP camping gear!

⏰ Ends: Feb 23, 16:00 UTC

Update app to v8.8.0+ to join!

Details: https://www.gate.com/announcements/article/49773

- Reward

- 5

- 1

- Repost

- Share

Stuart_Crown :

:

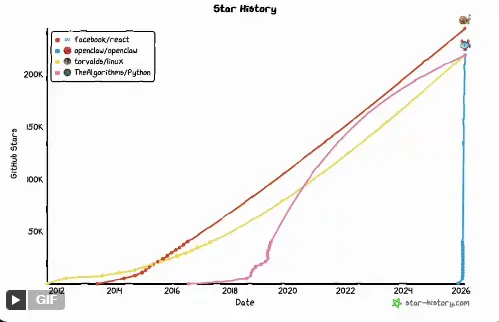

Diamond Hands 💎In three months, OpenClaw ranks second in stars on Github

React: 243270⭐️

OpenClaw: 218261⭐️

Linux: 218260⭐️

Can you imagine that React and Linux have been built and developed for years, and this OpenClaw came out of nowhere to top the charts in just three months!

View OriginalReact: 243270⭐️

OpenClaw: 218261⭐️

Linux: 218260⭐️

Can you imagine that React and Linux have been built and developed for years, and this OpenClaw came out of nowhere to top the charts in just three months!

- Reward

- 2

- 1

- Repost

- Share

GateUser-6dd822fb :

:

Go full throttle 🚀- Reward

- 3

- 1

- Repost

- Share

BrotherZhuang,PleaseTakeCareOf :

:

Can the big players have a little conscience? They only target me to exploit.- Reward

- 2

- 1

- Repost

- Share

OldFriendsInTheRiversAndLakes, :

:

HahaJoin the horse racing predictions, complete tasks to earn horse racing tickets, enjoy daily million Gift Coins giveaways, and share a 100,000 USDT prize pool—all at the Gate 2026 Spring Festival Celebration. https://www.gate.com/competition/year-of-horse-2026?ref_type=165&utm_cmp=7EQB9Jba&ref=VLFAULPWUQ

- Reward

- 3

- 1

- Repost

- Share

CryptosTalker :

:

To The Moon 🌕Who understands this! Pi Circle godfather Youlong's latest prediction: Pi coin will drop below $0.1. How should holders respond 🤷♂️?

PI-5,35%

- Reward

- 2

- 1

- Repost

- Share

GateUser-d08d427f :

:

What the hell is the point of you posting these every day?💰 $BTC Review/Updates:

↗️ The price of BTC is consolidating near the $68,000 level. To continue growing, the price may manipulate and collect liquidity below the $66,500 level. If the price forms a reversal during the accumulation of liquidity, an upward movement will begin with the goal of reaching the current high of $72,250.

↗️ The price of BTC is consolidating near the $68,000 level. To continue growing, the price may manipulate and collect liquidity below the $66,500 level. If the price forms a reversal during the accumulation of liquidity, an upward movement will begin with the goal of reaching the current high of $72,250.

BTC-0,61%

- Reward

- 4

- 1

- Repost

- Share

CryptosTalker :

:

To The Moon 🌕Load More

Trending Topics

View More352.28K Popularity

115.31K Popularity

426.61K Popularity

10.95K Popularity

127.74K Popularity

Pin