# BitcoinFallsBehindGold

23.18K

Bitcoin’s gold ratio is down about 55% from its peak and has fallen below the 200-week MA. Is this a good dip-buying opportunity? Share your latest Bitcoin strategy.

MrFlower_XingChen

#BitcoinFallsBehindGold #比特币相对黄金进入深度弱势 🔥

Global financial markets are quietly delivering a clear signal: the hierarchy of safe-haven assets is shifting once again. Recent price behavior across major asset classes points to a growing divergence between Bitcoin and Gold — one that reflects a decisive change in investor priorities. As geopolitical tension, monetary uncertainty, and macro instability intensify, capital is no longer chasing innovation. It is seeking protection.

Gold’s advance is neither emotional nor accidental. Its move toward the $4,900–$5,000 per ounce region reflects deliberat

Global financial markets are quietly delivering a clear signal: the hierarchy of safe-haven assets is shifting once again. Recent price behavior across major asset classes points to a growing divergence between Bitcoin and Gold — one that reflects a decisive change in investor priorities. As geopolitical tension, monetary uncertainty, and macro instability intensify, capital is no longer chasing innovation. It is seeking protection.

Gold’s advance is neither emotional nor accidental. Its move toward the $4,900–$5,000 per ounce region reflects deliberat

BTC1.9%

- Reward

- 16

- 112

- Repost

- Share

GateUser-72338806 :

:

Happy New Year! 🤑View More

#BitcoinFallsBehindGold

#BitcoinFallsBehindGold #比特币相对黄金进入深度弱势 🔥

As of 27 January 2026, financial markets are witnessing a notable shift in relative asset performance as Bitcoin falls behind gold, signaling a period of deep weakness for the leading cryptocurrency when compared to traditional safe-haven assets. While Bitcoin has long been promoted as “digital gold,” recent price action suggests that investors are reassessing that narrative amid rising global uncertainty. Gold’s steady climb contrasts sharply with Bitcoin’s struggle to maintain momentum, highlighting a divergence in investor b

#BitcoinFallsBehindGold #比特币相对黄金进入深度弱势 🔥

As of 27 January 2026, financial markets are witnessing a notable shift in relative asset performance as Bitcoin falls behind gold, signaling a period of deep weakness for the leading cryptocurrency when compared to traditional safe-haven assets. While Bitcoin has long been promoted as “digital gold,” recent price action suggests that investors are reassessing that narrative amid rising global uncertainty. Gold’s steady climb contrasts sharply with Bitcoin’s struggle to maintain momentum, highlighting a divergence in investor b

BTC1.9%

- Reward

- 4

- 3

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊View More

#BitcoinFallsBehindGold #比特币相对黄金进入深度弱势 🔥🚀

🚀Global financial markets are quietly delivering a clear signal: the hierarchy of safe-haven assets is shifting once again. Recent price behavior across major asset classes points to a growing divergence between Bitcoin and Gold — one that reflects a decisive change in investor priorities. As geopolitical tension, monetary uncertainty, and macro instability intensify, capital is no longer chasing innovation. It is seeking protection.

Gold’s advance is neither emotional nor accidental. Its move toward the $4,900–$5,000 per ounce region reflects delib

🚀Global financial markets are quietly delivering a clear signal: the hierarchy of safe-haven assets is shifting once again. Recent price behavior across major asset classes points to a growing divergence between Bitcoin and Gold — one that reflects a decisive change in investor priorities. As geopolitical tension, monetary uncertainty, and macro instability intensify, capital is no longer chasing innovation. It is seeking protection.

Gold’s advance is neither emotional nor accidental. Its move toward the $4,900–$5,000 per ounce region reflects delib

BTC1.9%

- Reward

- 7

- 8

- Repost

- Share

Crypto_Buzz_with_Alex :

:

“Really appreciate the clarity and effort you put into this post — it’s rare to see crypto content that’s both insightful and easy to follow. Your perspective adds real value to the community. Keep sharing gems like this! 🚀📊”View More

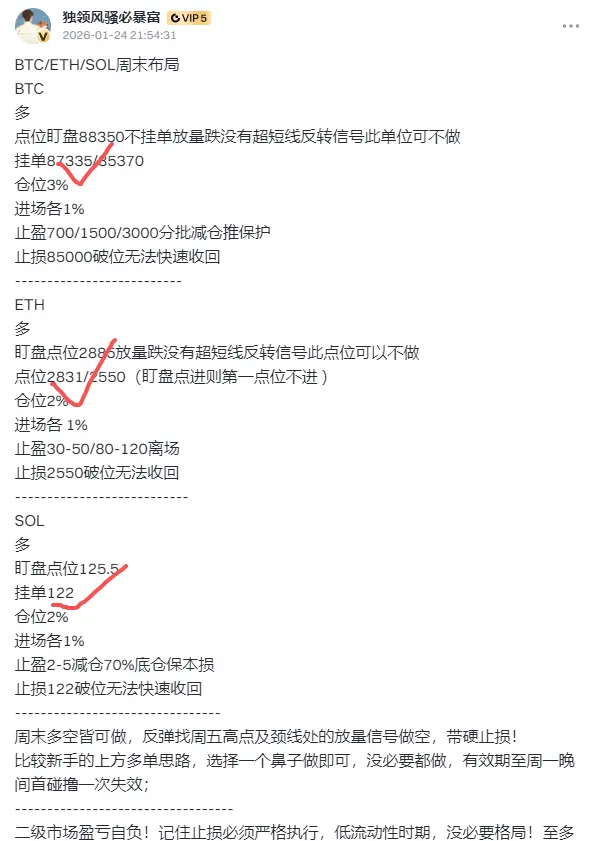

🔥 Effectiveness Over Noise. Survival Over Flexing.

Whether the market is “stable” or not is irrelevant.

What matters is effectiveness.

Don’t just talk about how 骚哥 helped you cut losses on a few trades —

look at how many times he helped you survive extreme market conditions.

That’s the real edge.

🧠 Missed the Weekend Low? So What.

Yes, you might’ve missed the perfect long entry over the weekend.

But markets don’t move once — they give multiple chances.

Buying on Monday after confirmation is not a mistake.

It’s discipline.

📌 Clear Strategy This Cycle • Bitcoin (BTC): Capital preservation com

Whether the market is “stable” or not is irrelevant.

What matters is effectiveness.

Don’t just talk about how 骚哥 helped you cut losses on a few trades —

look at how many times he helped you survive extreme market conditions.

That’s the real edge.

🧠 Missed the Weekend Low? So What.

Yes, you might’ve missed the perfect long entry over the weekend.

But markets don’t move once — they give multiple chances.

Buying on Monday after confirmation is not a mistake.

It’s discipline.

📌 Clear Strategy This Cycle • Bitcoin (BTC): Capital preservation com

- Reward

- 1

- Comment

- Repost

- Share

#比特币相对黄金进入深度弱势 🔥

Global financial markets are quietly delivering a clear message: the hierarchy of safe-haven assets is shifting, and traditional defenses are reclaiming their historical role. Recent price action across multiple asset classes confirms a growing divergence between Bitcoin and Gold, signaling a decisive change in investor behavior. As uncertainty deepens across geopolitical, monetary, and economic fronts, capital is flowing not toward speculative innovation, but toward stability and preservation.

Gold’s ascent is not accidental. It reflects a deliberate reallocation by institut

Global financial markets are quietly delivering a clear message: the hierarchy of safe-haven assets is shifting, and traditional defenses are reclaiming their historical role. Recent price action across multiple asset classes confirms a growing divergence between Bitcoin and Gold, signaling a decisive change in investor behavior. As uncertainty deepens across geopolitical, monetary, and economic fronts, capital is flowing not toward speculative innovation, but toward stability and preservation.

Gold’s ascent is not accidental. It reflects a deliberate reallocation by institut

BTC1.9%

- Reward

- like

- Comment

- Repost

- Share

$BTC

Rejected hard from range high and now breaking the range low.

Lower highs → momentum is rolling over.

This looks like distribution, not a healthy pullback.

If price fails to reclaim the range, downside continuation is the base case.

Risk stays to the downside until structure flips.

#BTC #GoldandSilverHitNewHighs #TrumpWithdrawsEUTariffThreats #GateWeb3UpgradestoGateDEX #BitcoinWeakensVsGold

Rejected hard from range high and now breaking the range low.

Lower highs → momentum is rolling over.

This looks like distribution, not a healthy pullback.

If price fails to reclaim the range, downside continuation is the base case.

Risk stays to the downside until structure flips.

#BTC #GoldandSilverHitNewHighs #TrumpWithdrawsEUTariffThreats #GateWeb3UpgradestoGateDEX #BitcoinWeakensVsGold

BTC1.9%

- Reward

- like

- Comment

- Repost

- Share

$RVN looks like it’s carving out a classic falling wedge on the macro chart a structure that usually signals exhaustion on the downside.

Weekly price action suggests the bottom may already be in. Momentum is quietly shifting, and if this setup plays out, a solid reversal could be next.

I’m eyeing a potential 50%–100% upside from these levels. Definitely one to keep on your radar. 👀📈

#GateWeb3UpgradestoGateDEX #BitcoinWeakensVsGold

Weekly price action suggests the bottom may already be in. Momentum is quietly shifting, and if this setup plays out, a solid reversal could be next.

I’m eyeing a potential 50%–100% upside from these levels. Definitely one to keep on your radar. 👀📈

#GateWeb3UpgradestoGateDEX #BitcoinWeakensVsGold

RVN2.77%

- Reward

- like

- Comment

- Repost

- Share

Market Evolution: Is Gold Strengthening Its Position?

The opening weeks of 2026 have introduced a new dynamic for global investors. While Bitcoin has seen a significant price correction after its peak in late 2025, currently consolidating between $85,000 and $95,000, Physical Gold (XAU) has maintained a steady upward trajectory, moving closer to the $5,000 milestone.

Understanding the Market Shift

Current market trends suggest that recent movements are driven by broader macroeconomic factors rather than just price volatility:

Global Sentiment Shift: Rising geopolitical uncertainties a

The opening weeks of 2026 have introduced a new dynamic for global investors. While Bitcoin has seen a significant price correction after its peak in late 2025, currently consolidating between $85,000 and $95,000, Physical Gold (XAU) has maintained a steady upward trajectory, moving closer to the $5,000 milestone.

Understanding the Market Shift

Current market trends suggest that recent movements are driven by broader macroeconomic factors rather than just price volatility:

Global Sentiment Shift: Rising geopolitical uncertainties a

BTC1.9%

- Reward

- 56

- 55

- Repost

- Share

CryptoSelf :

:

1000x VIbes 🤑View More

#BitcoinRelativeToGoldDeepWeakness

(#比特币相对黄金进入深度弱势)

The global financial market is witnessing a powerful shift in sentiment as Bitcoin shows deep relative weakness compared to gold. This trend is not just a short-term fluctuation—it reflects a deeper transformation in investor psychology, capital allocation strategies, and macroeconomic risk management. For the first time in a long while, gold is clearly outperforming Bitcoin as the preferred hedge asset during uncertainty.

Historically, Bitcoin has often been called “digital gold.” It was promoted as a decentralized store of value, a hedge ag

(#比特币相对黄金进入深度弱势)

The global financial market is witnessing a powerful shift in sentiment as Bitcoin shows deep relative weakness compared to gold. This trend is not just a short-term fluctuation—it reflects a deeper transformation in investor psychology, capital allocation strategies, and macroeconomic risk management. For the first time in a long while, gold is clearly outperforming Bitcoin as the preferred hedge asset during uncertainty.

Historically, Bitcoin has often been called “digital gold.” It was promoted as a decentralized store of value, a hedge ag

BTC1.9%

- Reward

- 32

- 29

- Repost

- Share

Crazyasianrich :

:

Happy New Year! 🤑View More

The global financial market is witnessing a powerful shift in sentiment as Bitcoin shows deep relative weakness compared to gold. This trend is not just a short-term fluctuation—it reflects a deeper transformation in investor psychology, capital allocation strategies, and macroeconomic risk management. For the first time in a long while, gold is clearly outperforming Bitcoin as the preferred hedge asset during uncertainty. Historically, Bitcoin has often been called “digital gold.” It was promoted as a decentralized store of value, a hedge against inflation, and an alternative to traditional f

BTC1.9%

- Reward

- like

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

6.64K Popularity

69.01K Popularity

26.41K Popularity

9.26K Popularity

8.97K Popularity

8.16K Popularity

7.33K Popularity

6.69K Popularity

73.57K Popularity

20.13K Popularity

81.61K Popularity

23.18K Popularity

49.24K Popularity

43.44K Popularity

196.33K Popularity

News

View MoreMirae Asset Global Investments 增持 8.7 万股 MSTR,价值 1410 万美元

2 m

Da Hongfei: Focus on asset onboarding and application development, empowering NEO and GAS

4 m

An address has invested nearly $100,000 to bet on the California 2026 election passing a billionaire one-time wealth tax.

5 m

With a nearly 40 million scale heavy position in NASDAQ and copper, the "Prestigious Block Trader" has earned $2 million in profit this month.

15 m

Data: If BTC drops below $84,899, the total long liquidation strength of mainstream CEXs will reach $1.78 billion.

22 m

Pin

𝙏𝙤𝙠𝙚𝙣𝙞𝙯𝙚𝙙 𝙍𝙒𝘼𝙨 𝙟𝙪𝙨𝙩 𝙘𝙧𝙤𝙨𝙨𝙚𝙙 $21𝘽 𝙞𝙣 𝙏𝙑𝙇.

-

Long-term forecasts vary — $2–4T by McKinsey, up to $16T per Boston Consulting Group, but directionally, the slope is clear.

© Cryptorank🚨😵💫💥 The $85K Floor: Can Bitcoin Hold Support Amid Sustained ETF Exits ⁉️

While early January 2026 saw a brief "clean slate" recovery, the latest figures suggest institutional caution is back in the driver's seat

📉 What’s happening ⁉️

⚡️Persistent Outflows: Following a massive $1.73 billion weekly exit in late January, the trend remains shaky. Even brief "green" days (like the $6.8M inflow on Jan 26) are pale compared to the billions lost in late 2025

⚡️Price Pressure: Outflows often act as a "sell signal" for the broader market, as they represent institutional de-risking

🔍 What does thThe U.S. crypto market has witnessed a significant internal rift as of late January 2026, with industry giants Ripple and Coinbase taking opposing stances on the newly amended CLARITY Act.

WHAT'S THE WAY FORWARD FOR BITCOIN?

PUMPING OR DUMPING SOON ? FIND OUT HERE:

As of January 27, 2026, Bitcoin ($BTC ) is trading around $87,700 - $88,600 (With a live price of $88,300 at the time of writing) showing signs of consolidation after recent volatility. The cryptocurrency has been under pressure from macroeconomic factors, geopolitical tensions (such as U.S.-Iran issues), and market rotations away from risk assets. This has led to a choppy trading environment, with BTC struggling to reclaim higher levels like $90,000 while defending key supports. Short-Term Price Movement (1-30 DGate Square New & Returning Creator Rewards are ongoing!

Your ideas may be more valuable than you think!

Make your first post or come back post to share a $20,000 monthly prize pool!

Post with #MyFirstPostOnSquare to receive a $50 Position Voucher each

Monthly Top Posters and Top Engagers will each earn an extra $50 reward

Your crypto insights could inspire many—start creating today!

👉 https://www.gate.com/post