EagleEye

Actions speak louder than words prove it by your actions

EagleEye

- Reward

- 5

- 8

- Repost

- Share

HighAmbition :

:

Happy New Year! 🤑View More

#当前行情抄底还是观望?

Will the market continue to decline? (Current Evidence)

Short-term price behavior shows bearish pressure:

Bitcoin recently dropped below key levels around $63,000–$67,000, marking the lowest range in over a year and signaling continued selling pressure. This happened as BTC lost half its value from its October 2025 peak, and leveraged positions were liquidated extensively, eroding confidence and buyer activity.

Broader sell-off dynamics indicate risk of further downside:

Trading volume remains elevated on declines, which often suggests real selling pressure rather than shallow

Will the market continue to decline? (Current Evidence)

Short-term price behavior shows bearish pressure:

Bitcoin recently dropped below key levels around $63,000–$67,000, marking the lowest range in over a year and signaling continued selling pressure. This happened as BTC lost half its value from its October 2025 peak, and leveraged positions were liquidated extensively, eroding confidence and buyer activity.

Broader sell-off dynamics indicate risk of further downside:

Trading volume remains elevated on declines, which often suggests real selling pressure rather than shallow

BTC16.05%

- Reward

- 6

- 8

- Repost

- Share

HighAmbition :

:

New year Wealth ExplosionView More

#当前行情抄底还是观望?

#BTC Bottom-fishing or Wait-and-See? My Take

Market view:

I don’t think we’ve seen the final bottom yet.

When BTC, U.S. stocks, gold, and silver all fall together, it usually signals liquidity stress, not just a crypto-specific issue.

Forced deleveraging > fundamentals in the short term.

Bottom-fishing signals I’m watching: Panic selling + funding rates deeply negative

Strong volume spike with long lower wicks on BTC daily

Macro confirmation: USD cooling down or bond yields stabilizing

Until at least 2 of these appear, I prefer scaling in slowly instead of going all-in.

Why

#BTC Bottom-fishing or Wait-and-See? My Take

Market view:

I don’t think we’ve seen the final bottom yet.

When BTC, U.S. stocks, gold, and silver all fall together, it usually signals liquidity stress, not just a crypto-specific issue.

Forced deleveraging > fundamentals in the short term.

Bottom-fishing signals I’m watching: Panic selling + funding rates deeply negative

Strong volume spike with long lower wicks on BTC daily

Macro confirmation: USD cooling down or bond yields stabilizing

Until at least 2 of these appear, I prefer scaling in slowly instead of going all-in.

Why

BTC16.05%

- Reward

- 8

- 8

- Repost

- Share

HighAmbition :

:

2026 GOGOGO 👊View More

#BuyTheDipOrWaitNow?

Market volatility has returned with renewed intensity, forcing investors and traders to confront a question as old as markets themselves: should one buy the dip, or is caution the wiser course? The answer is rarely straightforward, because short-term price movements are shaped not just by fundamentals, but also by liquidity dynamics, macroeconomic forces, regulatory developments, and behavioral factors. Understanding these layers is essential for making decisions that balance risk, opportunity, and timing.

Technical Dynamics and Market Structure

From a technical standpoin

Market volatility has returned with renewed intensity, forcing investors and traders to confront a question as old as markets themselves: should one buy the dip, or is caution the wiser course? The answer is rarely straightforward, because short-term price movements are shaped not just by fundamentals, but also by liquidity dynamics, macroeconomic forces, regulatory developments, and behavioral factors. Understanding these layers is essential for making decisions that balance risk, opportunity, and timing.

Technical Dynamics and Market Structure

From a technical standpoin

- Reward

- 9

- 12

- Repost

- Share

HighAmbition :

:

New year Wealth ExplosionView More

#GateJanTransparencyReport

Progress, Platform Expansion, and Market Implications

Gate has released its January 2026 Transparency Report, offering a comprehensive look at platform operations, trading activity, and strategic developments. The report underscores Gate’s ongoing efforts to expand capabilities across both crypto and TradFi markets, highlighting a multi-scenario approach to trading that integrates advanced analytics, diversified instruments, and robust infrastructure. By emphasizing transparency, operational efficiency, and cross-market integration, Gate is signaling its intent to p

Progress, Platform Expansion, and Market Implications

Gate has released its January 2026 Transparency Report, offering a comprehensive look at platform operations, trading activity, and strategic developments. The report underscores Gate’s ongoing efforts to expand capabilities across both crypto and TradFi markets, highlighting a multi-scenario approach to trading that integrates advanced analytics, diversified instruments, and robust infrastructure. By emphasizing transparency, operational efficiency, and cross-market integration, Gate is signaling its intent to p

- Reward

- 11

- 8

- Repost

- Share

HighAmbition :

:

New year Wealth ExplosionView More

#USIranNuclearTalksTurmoil

Geopolitical Uncertainty and Global Implications

The latest round of U.S.-Iran nuclear talks has descended into turmoil, highlighting both the fragility of diplomatic engagement and the broader geopolitical stakes for regional stability and global markets. While negotiations have historically oscillated between periods of cautious progress and abrupt breakdowns, the current impasse underscores the complexity of balancing nuclear non-proliferation goals with economic and political considerations on both sides. The turmoil carries implications that extend well beyond

Geopolitical Uncertainty and Global Implications

The latest round of U.S.-Iran nuclear talks has descended into turmoil, highlighting both the fragility of diplomatic engagement and the broader geopolitical stakes for regional stability and global markets. While negotiations have historically oscillated between periods of cautious progress and abrupt breakdowns, the current impasse underscores the complexity of balancing nuclear non-proliferation goals with economic and political considerations on both sides. The turmoil carries implications that extend well beyond

- Reward

- 8

- 7

- Repost

- Share

Falcon_Official :

:

Watching Closely 🔍️View More

#BitcoinHitsBearMarketLow

Implications for Price, Market Structure, and Investor Sentiment

Bitcoin has recently approached levels consistent with a bear market low, signaling a pivotal moment for the cryptocurrency ecosystem. While such lows are often interpreted as capitulation points or potential entry opportunities, understanding the full implications requires a deeper examination of market structure, investor behavior, and macroeconomic context. The significance of this development extends beyond price alone—it reflects shifts in liquidity, sentiment, and structural dynamics within both r

Implications for Price, Market Structure, and Investor Sentiment

Bitcoin has recently approached levels consistent with a bear market low, signaling a pivotal moment for the cryptocurrency ecosystem. While such lows are often interpreted as capitulation points or potential entry opportunities, understanding the full implications requires a deeper examination of market structure, investor behavior, and macroeconomic context. The significance of this development extends beyond price alone—it reflects shifts in liquidity, sentiment, and structural dynamics within both r

BTC16.05%

- Reward

- 8

- 9

- Repost

- Share

HighAmbition :

:

New year Wealth ExplosionView More

#EthereumL2Outlook

Ethereum’s Layer-2 (L2) ecosystem has reached a critical juncture, as adoption, technology, and market dynamics converge to define the network’s near- and medium-term outlook. While Ethereum’s base layer continues to emphasize security and decentralization, L2 solutions are increasingly taking the lead in addressing throughput, transaction costs, and user experience. Understanding the trajectory of these networks is essential for investors, developers, and institutional participants seeking exposure to Ethereum-based infrastructure.

The primary role of Layer-2 solutions is

Ethereum’s Layer-2 (L2) ecosystem has reached a critical juncture, as adoption, technology, and market dynamics converge to define the network’s near- and medium-term outlook. While Ethereum’s base layer continues to emphasize security and decentralization, L2 solutions are increasingly taking the lead in addressing throughput, transaction costs, and user experience. Understanding the trajectory of these networks is essential for investors, developers, and institutional participants seeking exposure to Ethereum-based infrastructure.

The primary role of Layer-2 solutions is

ETH15.13%

- Reward

- 12

- 9

- Repost

- Share

HighAmbition :

:

New year Wealth ExplosionView More

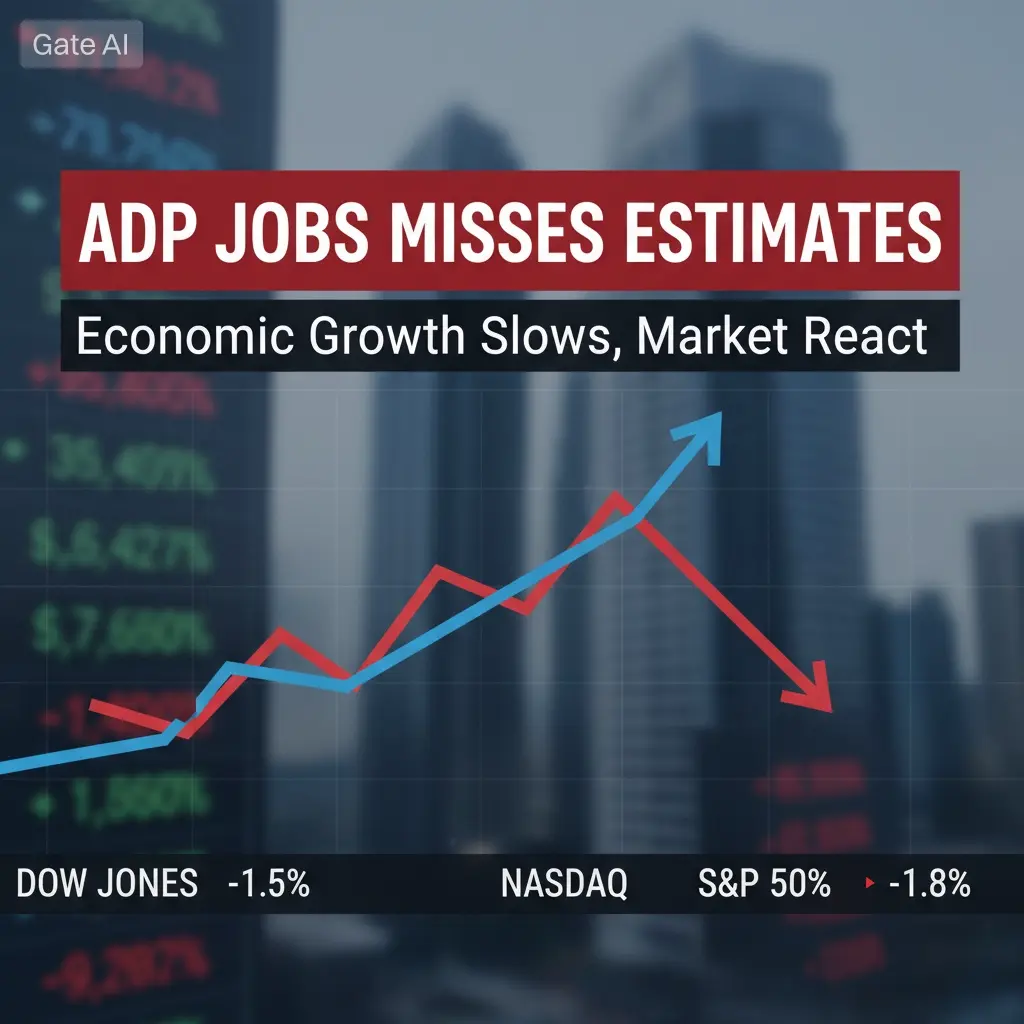

#ADPJobsMissEstimates

Labor Market Signals and Economic Implications

ADP’s latest employment report showed job growth falling short of market expectations, a development that has captured the attention of economists, investors, and policymakers. While headline numbers alone tell part of the story, the broader implications lie in what these figures reveal about the underlying strength of the U.S. labor market, wage dynamics, and the trajectory of economic recovery.

A jobs miss of this magnitude can be interpreted in multiple ways. On one hand, it suggests that hiring momentum is softening, pot

Labor Market Signals and Economic Implications

ADP’s latest employment report showed job growth falling short of market expectations, a development that has captured the attention of economists, investors, and policymakers. While headline numbers alone tell part of the story, the broader implications lie in what these figures reveal about the underlying strength of the U.S. labor market, wage dynamics, and the trajectory of economic recovery.

A jobs miss of this magnitude can be interpreted in multiple ways. On one hand, it suggests that hiring momentum is softening, pot

- Reward

- 8

- 8

- Repost

- Share

HighAmbition :

:

New year Wealth ExplosionView More

#FidelityLaunchesFIDD

A Strategic Move in Digital Asset Investment

Fidelity’s launch of the Fidelity Digital Dollars (FIDD) marks a significant milestone in institutional adoption and mainstream integration of digital assets. The initiative reflects a broader trend of traditional financial institutions entering the digital asset space with products designed to bridge conventional finance and the emerging decentralized ecosystem. By offering a regulated, institutional-grade digital dollar product, Fidelity is signaling confidence in the long-term utility of tokenized currencies while addressin

A Strategic Move in Digital Asset Investment

Fidelity’s launch of the Fidelity Digital Dollars (FIDD) marks a significant milestone in institutional adoption and mainstream integration of digital assets. The initiative reflects a broader trend of traditional financial institutions entering the digital asset space with products designed to bridge conventional finance and the emerging decentralized ecosystem. By offering a regulated, institutional-grade digital dollar product, Fidelity is signaling confidence in the long-term utility of tokenized currencies while addressin

DEFI9.36%

- Reward

- 7

- 5

- Repost

- Share

HighAmbition :

:

2026 GOGOGO 👊View More

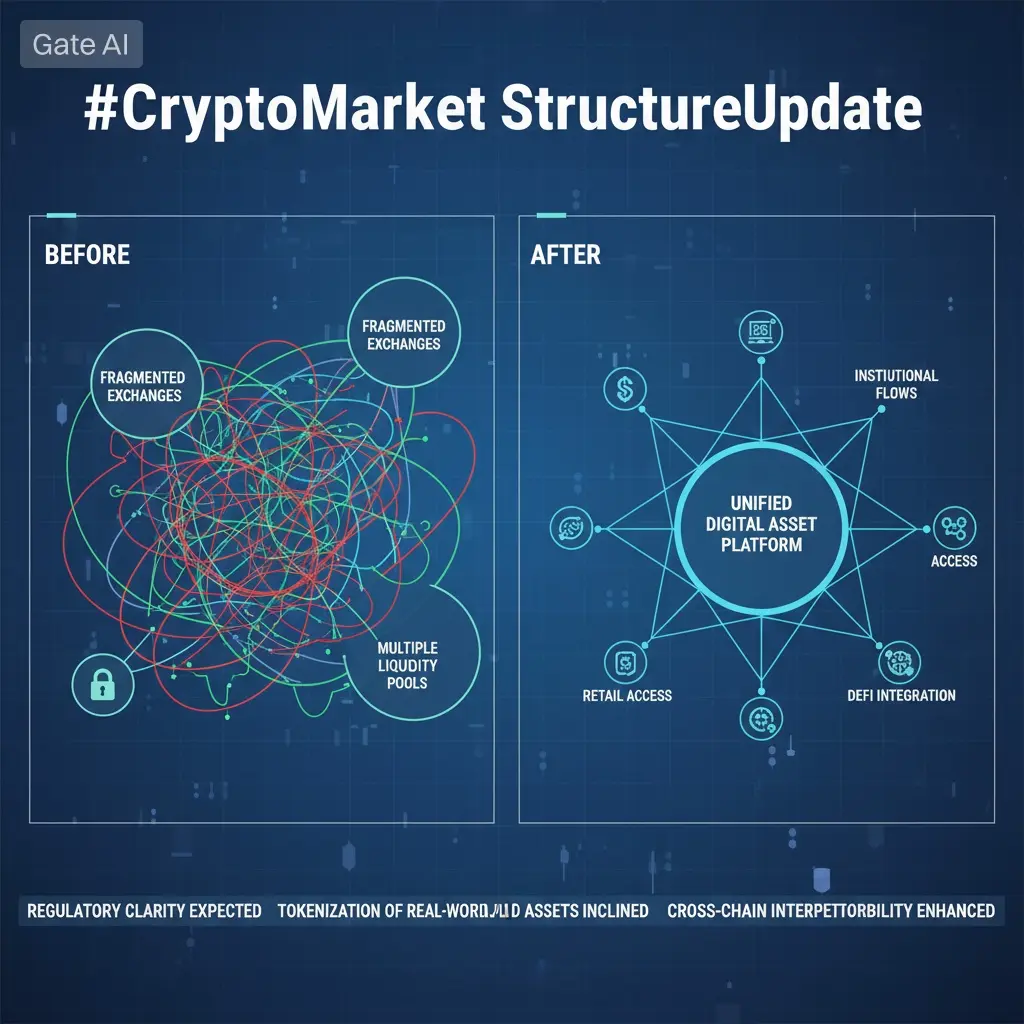

#CryptoMarketStructureUpdate

Evolving Dynamics in Digital Asset Markets

The crypto market continues to evolve rapidly, and recent developments in market structure highlight both maturation and ongoing challenges. Exchanges, institutional participants, and decentralized protocols are increasingly shaping how liquidity is sourced, priced, and distributed across global markets. Far from the fragmented, retail-driven ecosystem of earlier years, today’s market is characterized by competing priorities: efficiency versus decentralization, transparency versus speed, and risk management versus innovat

Evolving Dynamics in Digital Asset Markets

The crypto market continues to evolve rapidly, and recent developments in market structure highlight both maturation and ongoing challenges. Exchanges, institutional participants, and decentralized protocols are increasingly shaping how liquidity is sourced, priced, and distributed across global markets. Far from the fragmented, retail-driven ecosystem of earlier years, today’s market is characterized by competing priorities: efficiency versus decentralization, transparency versus speed, and risk management versus innovat

DEFI9.36%

- Reward

- 8

- 9

- Repost

- Share

HighAmbition :

:

New year Wealth ExplosionView More

#PartialGovernmentShutdownEnds

Implications for the Economy and Governance

The end of the partial U.S. government shutdown marks a critical turning point for both federal operations and the broader economy. After days or even weeks of halted services, furloughed employees returning to work signals the resumption of essential government functions, from regulatory oversight to public services. While the shutdown itself may have been brief relative to historical examples, its effects ripple across multiple layers of economic activity, investor confidence, and public trust in governmental stabili

Implications for the Economy and Governance

The end of the partial U.S. government shutdown marks a critical turning point for both federal operations and the broader economy. After days or even weeks of halted services, furloughed employees returning to work signals the resumption of essential government functions, from regulatory oversight to public services. While the shutdown itself may have been brief relative to historical examples, its effects ripple across multiple layers of economic activity, investor confidence, and public trust in governmental stabili

- Reward

- 5

- 4

- Repost

- Share

HighAmbition :

:

2026 GOGOGO 👊View More

#WarshNominationBullorBear?

Bull or Bear for Markets? A Deep-Dive Analysis

The nomination of former Federal Reserve Governor Kevin Warsh to a key financial or regulatory role has sparked intense discussion among investors, economists, and policymakers. Warsh’s career is characterized by a nuanced understanding of monetary policy, financial markets, and systemic risk, placing him in a unique position to influence the trajectory of both traditional and digital financial markets. The central question market participants are asking is straightforward yet complex: will Warsh’s approach signal a co

Bull or Bear for Markets? A Deep-Dive Analysis

The nomination of former Federal Reserve Governor Kevin Warsh to a key financial or regulatory role has sparked intense discussion among investors, economists, and policymakers. Warsh’s career is characterized by a nuanced understanding of monetary policy, financial markets, and systemic risk, placing him in a unique position to influence the trajectory of both traditional and digital financial markets. The central question market participants are asking is straightforward yet complex: will Warsh’s approach signal a co

- Reward

- 5

- 4

- Repost

- Share

HighAmbition :

:

2026 GOGOGO 👊View More

#WhenWillBTCRebound?

When Will BTC Rebound? A Deep-Dive Analysis of Market Dynamics, On-Chain Signals, and Macro Context

Bitcoin (BTC) has spent recent weeks trading under sustained pressure, oscillating around key support levels while repeatedly failing to breach major resistance zones. Price behavior has been characterized by weak bounces, short-lived rallies, and periods of sideways consolidation, leaving traders and investors questioning whether the current lows represent the floor, or if further downside is possible before a meaningful rebound. Understanding when BTC might enter a confir

When Will BTC Rebound? A Deep-Dive Analysis of Market Dynamics, On-Chain Signals, and Macro Context

Bitcoin (BTC) has spent recent weeks trading under sustained pressure, oscillating around key support levels while repeatedly failing to breach major resistance zones. Price behavior has been characterized by weak bounces, short-lived rallies, and periods of sideways consolidation, leaving traders and investors questioning whether the current lows represent the floor, or if further downside is possible before a meaningful rebound. Understanding when BTC might enter a confir

- Reward

- 5

- 4

- Repost

- Share

HighAmbition :

:

2026 GOGOGO 👊View More

#WhiteHouseCryptoSummit

White House 2026 Crypto Summit: Federal Policy and Regulatory Priorities for Digital Assets

The 2026 White House Crypto Summit brought together banks, crypto firms, and policymakers in a rare convergence aimed at shaping the future of U.S. digital asset regulation. The discussions focused heavily on stablecoin frameworks and the implementation of the Clarity Act, signaling that the federal government is prioritizing concrete policy around digital assets. While the summit demonstrated high-level engagement across sectors, it also made clear that consensus remains elusiv

White House 2026 Crypto Summit: Federal Policy and Regulatory Priorities for Digital Assets

The 2026 White House Crypto Summit brought together banks, crypto firms, and policymakers in a rare convergence aimed at shaping the future of U.S. digital asset regulation. The discussions focused heavily on stablecoin frameworks and the implementation of the Clarity Act, signaling that the federal government is prioritizing concrete policy around digital assets. While the summit demonstrated high-level engagement across sectors, it also made clear that consensus remains elusiv

- Reward

- 5

- 5

- Repost

- Share

HighAmbition :

:

2026 GOGOGO 👊View More

#BitMineAcquires20,000ETH

BitMineAcquires20,000ETH A Strategic Signal for Ethereum and the Institutional Landscape

BitMine’s recent acquisition of 20,000 ETH represents one of the largest single-entity purchases in recent history and signals more than a mere trading decision. At face value, it is a massive allocation of capital, but the implications extend far beyond the immediate market. In an environment where attention and narrative previously drove the majority of price action, this type of move signals a shift toward endurance, credibility, and the recognition of Ethereum as infrastruct

BitMineAcquires20,000ETH A Strategic Signal for Ethereum and the Institutional Landscape

BitMine’s recent acquisition of 20,000 ETH represents one of the largest single-entity purchases in recent history and signals more than a mere trading decision. At face value, it is a massive allocation of capital, but the implications extend far beyond the immediate market. In an environment where attention and narrative previously drove the majority of price action, this type of move signals a shift toward endurance, credibility, and the recognition of Ethereum as infrastruct

ETH15.13%

- Reward

- 4

- 5

- Repost

- Share

HighAmbition :

:

new year Wealth ExplosionView More

#Web3FebruaryFocus

Web3 has entered a phase that appears quieter on the surface yet is far more consequential underneath. The period when attention and narrative alone could sustain entire ecosystems is ending, and what is being tested now is not creativity but endurance. Protocols must survive contact with law, with ordinary human behavior, and with the unforgiving arithmetic of revenue and risk. February therefore feels less like another month in a speculative cycle and more like an examination of whether the ideas of the last decade can function as real infrastructure. Decentralization is

Web3 has entered a phase that appears quieter on the surface yet is far more consequential underneath. The period when attention and narrative alone could sustain entire ecosystems is ending, and what is being tested now is not creativity but endurance. Protocols must survive contact with law, with ordinary human behavior, and with the unforgiving arithmetic of revenue and risk. February therefore feels less like another month in a speculative cycle and more like an examination of whether the ideas of the last decade can function as real infrastructure. Decentralization is

- Reward

- 5

- 3

- Repost

- Share

HighAmbition :

:

New year Wealth ExplosionView More

#CryptoMarketWatch

The classic puzzle of the farmer, the wolf, the goat, and the cabbage has endured for centuries because it distills a rich logical structure into a deceptively simple narrative. A farmer must transport a goat, a cabbage, and a wolf across a river using a boat that can carry only the farmer and at most one passenger. The challenge arises not from the act of crossing itself but from the constraints governing which items may be left together unsupervised: the goat cannot be left alone with the cabbage, and the wolf cannot be left alone with the goat. The puzzle is compelling b

The classic puzzle of the farmer, the wolf, the goat, and the cabbage has endured for centuries because it distills a rich logical structure into a deceptively simple narrative. A farmer must transport a goat, a cabbage, and a wolf across a river using a boat that can carry only the farmer and at most one passenger. The challenge arises not from the act of crossing itself but from the constraints governing which items may be left together unsupervised: the goat cannot be left alone with the cabbage, and the wolf cannot be left alone with the goat. The puzzle is compelling b

- Reward

- 3

- 2

- Repost

- Share

HighAmbition :

:

2026 GOGOGO 👊View More

#GateJanTransparencyReport

Gate’s January 2026 Transparency Report highlights a clear evolution: the platform is no longer just a crypto exchange; it is becoming a comprehensive multi-asset financial ecosystem. In January, Gate Perp DEX surpassed $5.5 billion in monthly trading volume, signaling that on-chain perpetuals are moving from niche instruments to high-frequency trading tools. On the traditional finance side, Gate TradFi crossed $20 billion in cumulative trading volume, enabling users to trade metals, FX, indices, commodities, and equities alongside crypto in a single, unified system

Gate’s January 2026 Transparency Report highlights a clear evolution: the platform is no longer just a crypto exchange; it is becoming a comprehensive multi-asset financial ecosystem. In January, Gate Perp DEX surpassed $5.5 billion in monthly trading volume, signaling that on-chain perpetuals are moving from niche instruments to high-frequency trading tools. On the traditional finance side, Gate TradFi crossed $20 billion in cumulative trading volume, enabling users to trade metals, FX, indices, commodities, and equities alongside crypto in a single, unified system

BTC16.05%

- Reward

- 7

- 13

- Repost

- Share

ShainingMoon :

:

2026 GOGOGO 👊View More

#USIranNuclearTalksTurmoil

The collapse of the latest US-Iran nuclear talks has sent ripples through global diplomacy, energy markets, and regional security, but understanding the situation requires context beyond the headlines. These negotiations have been ongoing for years, focusing on Iran’s nuclear program, sanctions relief, and international security guarantees. Each round of talks involves multiple layers: technical agreements on uranium enrichment limits, verification protocols, sanctions frameworks, and political signaling to domestic constituencies on both sides.

Why the talks are in

The collapse of the latest US-Iran nuclear talks has sent ripples through global diplomacy, energy markets, and regional security, but understanding the situation requires context beyond the headlines. These negotiations have been ongoing for years, focusing on Iran’s nuclear program, sanctions relief, and international security guarantees. Each round of talks involves multiple layers: technical agreements on uranium enrichment limits, verification protocols, sanctions frameworks, and political signaling to domestic constituencies on both sides.

Why the talks are in

- Reward

- 6

- 8

- Repost

- Share

ShainingMoon :

:

Happy New Year! 🤑View More

Trending Topics

View More115.57K Popularity

22K Popularity

389.19K Popularity

8.76K Popularity

6.77K Popularity