# MajorStockIndexesPlunge

12.52K

U.S. stocks closed lower as risk appetite weakened, with crypto stocks also under pressure. Strategy (MSTR) fell over 7% in one day. How are you managing risk or finding opportunities in this pullback?

MrFlower_XingChen

#MajorStockIndexesPlunge Global Markets Face a Fault-Line Moment in Early 2026

Global financial markets are undergoing a significant stress test as sell-offs originating on Wall Street have rippled rapidly across Asia and Europe. January 21, 2026, marked one of the most emotionally charged sessions in recent memory, with global indices turning deep red. This is not a routine correction; it is a trial of confidence, liquidity, and cross-market coordination.

At the core of the shock lies a synchronized risk-off wave driven by two destabilizing forces. First, renewed tariff threats from Donald Tr

Global financial markets are undergoing a significant stress test as sell-offs originating on Wall Street have rippled rapidly across Asia and Europe. January 21, 2026, marked one of the most emotionally charged sessions in recent memory, with global indices turning deep red. This is not a routine correction; it is a trial of confidence, liquidity, and cross-market coordination.

At the core of the shock lies a synchronized risk-off wave driven by two destabilizing forces. First, renewed tariff threats from Donald Tr

- Reward

- 4

- 13

- Repost

- Share

HanssiMazak :

:

2026 GOGOGO 👊View More

#MajorStockIndexesPlunge

Early 2026 is rapidly evolving into a defining moment for global markets. What initially appeared as a routine equity pullback has escalated into a synchronized cross-asset repricing event, dragging stocks, bonds, and digital assets into the same volatility vortex. This is no longer a correction driven by earnings or valuation compression — it is a systemic response to macro uncertainty stacking all at once.

What makes this phase especially fragile is the absence of a clear stabilizer. Liquidity conditions are tightening, geopolitical signals are becoming more erratic

Early 2026 is rapidly evolving into a defining moment for global markets. What initially appeared as a routine equity pullback has escalated into a synchronized cross-asset repricing event, dragging stocks, bonds, and digital assets into the same volatility vortex. This is no longer a correction driven by earnings or valuation compression — it is a systemic response to macro uncertainty stacking all at once.

What makes this phase especially fragile is the absence of a clear stabilizer. Liquidity conditions are tightening, geopolitical signals are becoming more erratic

- Reward

- like

- 1

- Repost

- Share

TraderBro :

:

happy birthday to you and your family 🎈🎈 you have a great time with the boys in the#MajorStockIndexesPlunge

January 20–21, 2026 Stock Market Plunge: Causes, Reactions, and Recovery

Between January 20 and 21, 2026, U.S. and global financial markets experienced a dramatic bout of volatility, triggered by geopolitical tensions and investor uncertainty. This period marked one of the most notable single-day drops for the major U.S. stock indexes in recent months. Here’s a full, detailed breakdown of what happened, why it happened, and what it means for investors and markets going forward.

1. The Day of the Plunge: January 20, 2026

On January 20, 2026, the U.S. stock market suffe

January 20–21, 2026 Stock Market Plunge: Causes, Reactions, and Recovery

Between January 20 and 21, 2026, U.S. and global financial markets experienced a dramatic bout of volatility, triggered by geopolitical tensions and investor uncertainty. This period marked one of the most notable single-day drops for the major U.S. stock indexes in recent months. Here’s a full, detailed breakdown of what happened, why it happened, and what it means for investors and markets going forward.

1. The Day of the Plunge: January 20, 2026

On January 20, 2026, the U.S. stock market suffe

- Reward

- 8

- 11

- Repost

- Share

MrFlower_XingChen :

:

2026 GOGOGO 👊View More

#MajorStockIndexesPlunge

Global markets are experiencing a full-blown "fault line" rupture today! The earthquake that began on Wall Street yesterday continues today, turning Asian and European terminals red. The picture reflected on screens as of January 21, 2026, is both a major test and a strategic crossroads for investors.

Markets are facing one of the most complex "risk-off" waves in recent years. There are two massive triggers behind this collapse: Donald Trump's threats of tariffs on Greenland and the historic volatility in the Japanese bond market.

Wall Street: The S&P 500 fell 2.

Global markets are experiencing a full-blown "fault line" rupture today! The earthquake that began on Wall Street yesterday continues today, turning Asian and European terminals red. The picture reflected on screens as of January 21, 2026, is both a major test and a strategic crossroads for investors.

Markets are facing one of the most complex "risk-off" waves in recent years. There are two massive triggers behind this collapse: Donald Trump's threats of tariffs on Greenland and the historic volatility in the Japanese bond market.

Wall Street: The S&P 500 fell 2.

- Reward

- 86

- 103

- Repost

- Share

repanzal :

:

2026 GOGOGO 👊View More

#MajorStockIndexesPlunge

Major U.S. Stock Indexes Plunge Sharply Yusfirah’s Thoughts on Broader Market Volatility, Investor Sentiment, and Crypto Correlations

As I see it, the recent pullback in U.S. stock indexes represents more than just a one-day drop — it’s a reflection of weakening risk appetite across multiple asset classes, and the effects are being felt in crypto-linked equities and digital assets as well. For example, Strategy (MSTR) fell over 7% in one day, showing how closely crypto-adjacent stocks are tethered to broader equity sentiment. From my perspective, this environment offe

Major U.S. Stock Indexes Plunge Sharply Yusfirah’s Thoughts on Broader Market Volatility, Investor Sentiment, and Crypto Correlations

As I see it, the recent pullback in U.S. stock indexes represents more than just a one-day drop — it’s a reflection of weakening risk appetite across multiple asset classes, and the effects are being felt in crypto-linked equities and digital assets as well. For example, Strategy (MSTR) fell over 7% in one day, showing how closely crypto-adjacent stocks are tethered to broader equity sentiment. From my perspective, this environment offe

- Reward

- 6

- 7

- Repost

- Share

ybaser :

:

HODL Tight 💪View More

📉 🌍 💥 📊 ⚠️ 💣 🌪️ 🧨 💱 🏦 🔻

Major Stock Indexes Plunge — a rapid decline as a test for global markets.

As of January 22, 2026.

Global financial markets are entering a phase of heightened tension. Recent events have turned a normal correction into a full-scale stress test for investor confidence, liquidity, and macroeconomic resilience. What started with a sharp sell-off in the US quickly spread to Europe and Asia, forming a classic “risk-off” scenario.

1. Overall Market Picture.

Major stock indices demonstrated one of the sharpest single-day declines in recent months. The greatest pressu

View OriginalMajor Stock Indexes Plunge — a rapid decline as a test for global markets.

As of January 22, 2026.

Global financial markets are entering a phase of heightened tension. Recent events have turned a normal correction into a full-scale stress test for investor confidence, liquidity, and macroeconomic resilience. What started with a sharp sell-off in the US quickly spread to Europe and Asia, forming a classic “risk-off” scenario.

1. Overall Market Picture.

Major stock indices demonstrated one of the sharpest single-day declines in recent months. The greatest pressu

- Reward

- 16

- 37

- Repost

- Share

MrFlower_XingChen :

:

2026 GOGOGO 👊View More

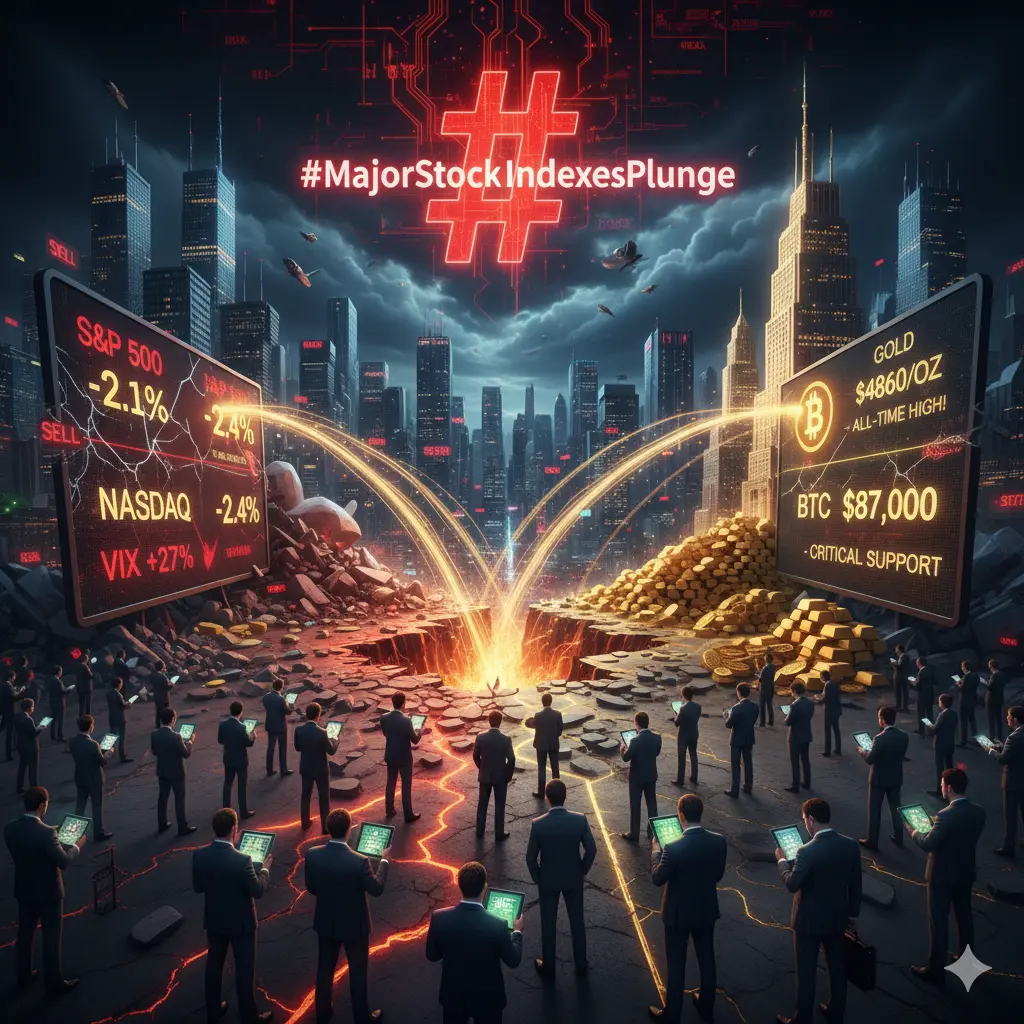

#MajorStockIndexesPlunge

The Global "Fault Line" Rupture: Market Chaos or a Generational Entry Point?

The global financial terminals are bleeding red today, January 21, 2026, as we witness what feels like a structural "earthquake" across all asset classes. What started as a tremor on Wall Street has evolved into a full-scale rupture, leaving investors at a critical strategic crossroads. The question on everyone's mind: Is this the start of a systemic collapse, or the ultimate "bear trap" before the next leg up?

The Perfect Storm: Geopolitics Meets Macro Fragility

This isn't just a random corr

The Global "Fault Line" Rupture: Market Chaos or a Generational Entry Point?

The global financial terminals are bleeding red today, January 21, 2026, as we witness what feels like a structural "earthquake" across all asset classes. What started as a tremor on Wall Street has evolved into a full-scale rupture, leaving investors at a critical strategic crossroads. The question on everyone's mind: Is this the start of a systemic collapse, or the ultimate "bear trap" before the next leg up?

The Perfect Storm: Geopolitics Meets Macro Fragility

This isn't just a random corr

- Reward

- 59

- 80

- Repost

- Share

Olmon :

:

Interesting article, we're watchingView More

#MajorStockIndexesPlunge

Global stock markets are facing a significant sell-off, with major stock indexes plunging as investors react to a mix of macroeconomic concerns, geopolitical tensions, and rising interest-rate expectations. This sudden drop reflects heightened risk aversion and cautious sentiment among both institutional and retail investors.

What Is Happening?

Major stock indexes, including benchmarks like the S&P 500, Dow Jones, and Nasdaq, have experienced sharp declines in recent sessions. The plunge is driven by:

Rising interest rates globally, which increase borrowing costs for

Global stock markets are facing a significant sell-off, with major stock indexes plunging as investors react to a mix of macroeconomic concerns, geopolitical tensions, and rising interest-rate expectations. This sudden drop reflects heightened risk aversion and cautious sentiment among both institutional and retail investors.

What Is Happening?

Major stock indexes, including benchmarks like the S&P 500, Dow Jones, and Nasdaq, have experienced sharp declines in recent sessions. The plunge is driven by:

Rising interest rates globally, which increase borrowing costs for

- Reward

- 6

- 9

- Repost

- Share

Yusfirah :

:

Buy To Earn 💎View More

Major Stock Indexes Plunge: Navigating Risk and Opportunity in Crypto and Equities

U.S. stock markets closed lower today as investor risk appetite weakened, triggering broad-based selling across equities and spilling over into crypto-linked stocks. The sharp decline highlighted the sensitivity of both traditional markets and crypto-related equities to macroeconomic concerns, market sentiment shifts, and profit-taking pressures. High-profile names, such as MicroStrategy (MSTR), experienced steep losses, falling over 7% in a single session, emphasizing how volatility in growth and tech sectors c

U.S. stock markets closed lower today as investor risk appetite weakened, triggering broad-based selling across equities and spilling over into crypto-linked stocks. The sharp decline highlighted the sensitivity of both traditional markets and crypto-related equities to macroeconomic concerns, market sentiment shifts, and profit-taking pressures. High-profile names, such as MicroStrategy (MSTR), experienced steep losses, falling over 7% in a single session, emphasizing how volatility in growth and tech sectors c

- Reward

- 10

- 12

- Repost

- Share

ybaser :

:

Watching Closely 🔍️View More

#MajorStockIndexesPlunge Global Markets Enter a Fault-Line Moment in Early 2026

Global financial markets are experiencing a full-scale “fault line” rupture as the sell-off that began on Wall Street has spread rapidly across Asia and Europe. Screens across global trading desks turned deep red on January 21, 2026, marking one of the most emotionally charged sessions investors have faced in recent years. This is no routine correction — it is a stress test of confidence, liquidity, and global coordination.

At the core of this shock lies a powerful risk-off wave, triggered by two destabilizing forc

Global financial markets are experiencing a full-scale “fault line” rupture as the sell-off that began on Wall Street has spread rapidly across Asia and Europe. Screens across global trading desks turned deep red on January 21, 2026, marking one of the most emotionally charged sessions investors have faced in recent years. This is no routine correction — it is a stress test of confidence, liquidity, and global coordination.

At the core of this shock lies a powerful risk-off wave, triggered by two destabilizing forc

- Reward

- 10

- 16

- Repost

- Share

GateUser-25e04af1 :

:

vsgshshhshsgsvsvwuhavsbsusvsvshjsjsjsjhdbdhdudhbdbdbrjjrhdvdbjdudjdbdbdbbdbdhdhdView More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

65.17K Popularity

44.85K Popularity

27.05K Popularity

71.61K Popularity

348.49K Popularity

15.15K Popularity

12.52K Popularity

21.43K Popularity

109.5K Popularity

26.29K Popularity

226.33K Popularity

22.66K Popularity

7.02K Popularity

17.81K Popularity

174.75K Popularity

News

View MoreMarket Report: Top 5 cryptocurrencies by decline on January 23, 2026, with Pump.fun experiencing the largest drop.

6 m

Aster announces that SPACE spot and futures trading will go live tonight

7 m

If Ethereum falls below $2850, the total long liquidation strength on mainstream CEXs will reach 771 million.

10 m

AI Payment Protocol PAN Network completes $1 million KOL funding round

11 m

YZi Labs announces strategic investment in BitGo

12 m

Pin

Gate ELSA Futures Trading Challenge is Now Live!

Share a 200,000 USDT Prize Pool

💰 Get 20 USDT for your first futures trade

🏆 Trade to share 160,000 USDT!

join now: https://www.gate.com/campaigns/3911

Announcement link: https://www.gate.com/announcements/article/49432

#ELSA #FuturesTrading #GateStrike Gold by Sharing Your TradFi Orders and Pictures!

Post on Gate Square and split $10,000 in rewards!

The TradFi Gold Lucky Bag is now live—1g of real gold every 10 minutes. Trade nonstop, win nonstop!

👉 https://www.gate.com/announcements/article/49357

🎁 50 lucky winners × $200 Position Vouchers ($10 × 20 leverage)

How to Join:

1️⃣ Post your order on Square with #GateTradFi1gGoldGiveaway, including:

A trade or draw screenshot

A brief experience sharing

2️⃣ Or create a related image (AI creation allowed) with a short promo line, such as:

Get gold on Gate App — 1g every 10 minutes!

⏰ Jan 2Gate Square New & Returning Creator Rewards are ongoing!

Your ideas may be more valuable than you think!

Make your first post or come back post to share a $20,000 monthly prize pool!

Post with #MyFirstPostOnSquare to receive a $50 Position Voucher each

Monthly Top Posters and Top Engagers will each earn an extra $50 reward

Your crypto insights could inspire many—start creating today!

👉 https://www.gate.com/postGate Square “Creator Certification Incentive Program” — Recruiting Outstanding Creators!

Join now, share quality content, and compete for over $10,000 in monthly rewards.

How to Apply:

1️⃣ Open the App → Tap [Square] at the bottom → Click your [avatar] in the top right.

2️⃣ Tap [Get Certified], submit your application, and wait for approval.

Apply Now: https://www.gate.com/questionnaire/7159

Token rewards, exclusive Gate merch, and traffic exposure await you!

Details: https://www.gate.com/announcements/article/47889