Crypto24pro

No content yet

Crypto24pro

- Reward

- like

- Comment

- Repost

- Share

The crypto market is going through a period of uncertainty where indecision reigns. For several weeks, investors have been operating in an atmosphere of distrust fueled by a Fear & Greed index stuck in an extreme fear zone. Prices are stagnant, volumes are eroding, and no clear signal manages to revive confidence. This emotional inertia, coupled with a lack of technical direction, reflects a latent tension that weighs heavily on market dynamics. Doubt is settling permanently within the ecosystem.

In Brief

The crypto market remains stuck in indecision against a background of widespread investor

In Brief

The crypto market remains stuck in indecision against a background of widespread investor

BTC-5,74%

- Reward

- 1

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

#RIVERUp50xinOneMonth RIVER Emerges as One of 2026’s Most Explosive Altcoin Stories

RIVER has captured the crypto spotlight in January 2026, delivering one of the most intense rallies seen in the market this year. From a rapid surge to an all‑time high near $87.7, the token has since consolidated around the $50–$55 range, with the current price hovering at approximately $52. This parabolic movement has positioned RIVER as one of the top-performing altcoins, posting gains of nearly 1,800–2,000% in a single month and about 500% year-to-date.

The recent price action demonstrates the token’s abili

RIVER has captured the crypto spotlight in January 2026, delivering one of the most intense rallies seen in the market this year. From a rapid surge to an all‑time high near $87.7, the token has since consolidated around the $50–$55 range, with the current price hovering at approximately $52. This parabolic movement has positioned RIVER as one of the top-performing altcoins, posting gains of nearly 1,800–2,000% in a single month and about 500% year-to-date.

The recent price action demonstrates the token’s abili

- Reward

- 2

- 2

- Repost

- Share

EagleEye :

:

This post is truly impressive! I really appreciate the effort and creativity behind it.View More

- Reward

- like

- Comment

- Repost

- Share

Bitcoin ended the past week down about 7%, reinforcing a short-term bearish trend that has weighed on sentiment across the crypto market. After failing to hold recent support levels, BTC has struggled to attract strong buying interest, with price action showing lower highs and weak rebounds. The broader tone remains cautious, as traders reduce risk and wait for clearer direction.

▪️Why Some See a “Bargain”

Despite the gloomy backdrop, current prices are starting to look attractive to longer-term bulls. Momentum indicators suggest selling pressure is easing compared with earlier in the month, e

▪️Why Some See a “Bargain”

Despite the gloomy backdrop, current prices are starting to look attractive to longer-term bulls. Momentum indicators suggest selling pressure is easing compared with earlier in the month, e

BTC-5,74%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

Zcash’s bearish stretch began to ease after the token lost roughly 42% over the past two weeks. Recent data pointed to growing bullish interest, driven by whale accumulation, derivatives positioning, and improving price structure.

Whales accumulated during the dip

According to Nansen, the top 100 ZEC wallet addresses have increased their holdings by 8.85%, adding 42,623 tokens. Other whale cohorts have followed the same trend, with their holdings rising by over 5.06%.

Source: Nansen

This accumulation suggests that major crypto players are following a ‘buy-the-dip’ strategy.

At the same time, i

Whales accumulated during the dip

According to Nansen, the top 100 ZEC wallet addresses have increased their holdings by 8.85%, adding 42,623 tokens. Other whale cohorts have followed the same trend, with their holdings rising by over 5.06%.

Source: Nansen

This accumulation suggests that major crypto players are following a ‘buy-the-dip’ strategy.

At the same time, i

ZEC-8,41%

- Reward

- 1

- Comment

- Repost

- Share

#CryptoMarketWatch 🚀 | Navigating the Dynamic World of Cryptocurrency

In the fast-paced universe of digital finance, keeping up with market movements is not just a strategy it’s a necessity. CryptoMarketWatch is your ultimate guide to understanding, analyzing, and capitalizing on the latest trends in the cryptocurrency ecosystem. Whether you are a seasoned trader, a blockchain enthusiast, or a newcomer exploring crypto for the first time, staying informed is the key to success.

Current Market Overview

As the crypto landscape continues to evolve, we are witnessing unprecedented growth in both

In the fast-paced universe of digital finance, keeping up with market movements is not just a strategy it’s a necessity. CryptoMarketWatch is your ultimate guide to understanding, analyzing, and capitalizing on the latest trends in the cryptocurrency ecosystem. Whether you are a seasoned trader, a blockchain enthusiast, or a newcomer exploring crypto for the first time, staying informed is the key to success.

Current Market Overview

As the crypto landscape continues to evolve, we are witnessing unprecedented growth in both

- Reward

- 3

- Comment

- Repost

- Share

#ETHTrendWatch

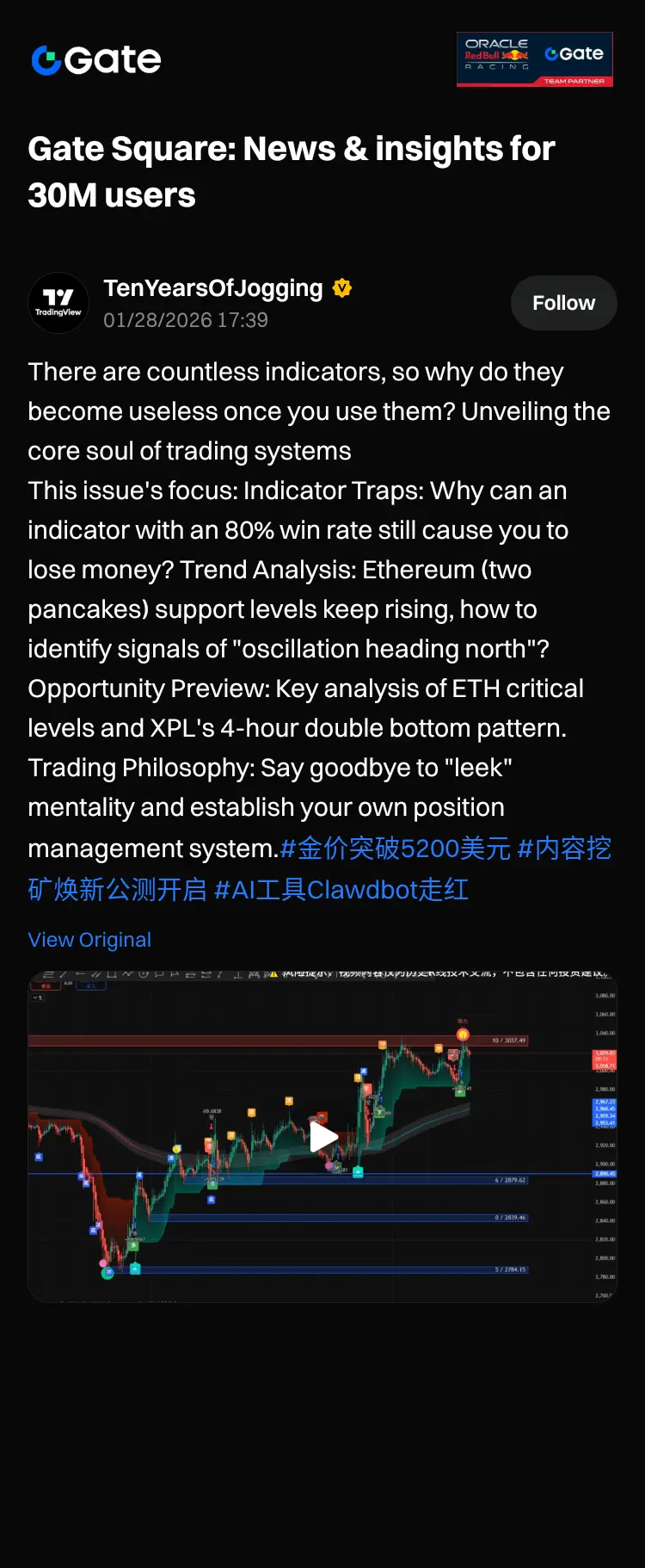

Ethereum Market Structure: Compression Phase, Risk Control, and Opportunity Mapping

Ethereum (ETH) is currently trading in a compressed price environment where volatility exists, but directional conviction remains limited. Price has been rotating within a clearly defined band, reflecting a market that is active — yet deliberately cautious. This behavior suggests positioning rather than trend expansion.

Over recent weeks, ETH has respected a broader range roughly spanning the low $3,000 area up toward the mid-$3,000s. Buyers have shown willingness to step in on pullbacks, while

Ethereum Market Structure: Compression Phase, Risk Control, and Opportunity Mapping

Ethereum (ETH) is currently trading in a compressed price environment where volatility exists, but directional conviction remains limited. Price has been rotating within a clearly defined band, reflecting a market that is active — yet deliberately cautious. This behavior suggests positioning rather than trend expansion.

Over recent weeks, ETH has respected a broader range roughly spanning the low $3,000 area up toward the mid-$3,000s. Buyers have shown willingness to step in on pullbacks, while

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

💥 $BTC hovering near $89,400 — and while retail is still dreaming of $100K, institutions are already playing a different game.

🏦 Corporate Adoption Accelerates

“Digital Asset Treasury” (DAT) companies now hold $125B+ in crypto, up from $117B last year. Smart money isn’t waiting for headlines — it’s positioning early.

📊 Ledger IPO Signal

Hardware wallet giant Ledger is preparing a $4B New York IPO. This is a big sign that crypto infrastructure is re-entering public markets, bringing credibility, capital, and long-term confidence.

📈 The takeaway:

Price is quiet, but foundations are getting s

🏦 Corporate Adoption Accelerates

“Digital Asset Treasury” (DAT) companies now hold $125B+ in crypto, up from $117B last year. Smart money isn’t waiting for headlines — it’s positioning early.

📊 Ledger IPO Signal

Hardware wallet giant Ledger is preparing a $4B New York IPO. This is a big sign that crypto infrastructure is re-entering public markets, bringing credibility, capital, and long-term confidence.

📈 The takeaway:

Price is quiet, but foundations are getting s

- Reward

- 1

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

$ETH (Ethereum) – ~$2,960 USD ⚫ (benchmark large-cap crypto)

Quick Market Snapshot

ALCH (Alchemist AI)

• Live ~$0.12 USD — modest gains in short term 📈 �

• Daily range roughly $0.1176–$0.1234 USD �

• Some price trackers show weekly pullback vs last 7d (down ~19.7%) �

👉 Your ~$0.21 figure might be outdated or from a different exchange/liquidity pool — major aggregator quotes closer to ~$0.12 today. �

CoinGecko

CoinGecko

CoinGecko

CoinGecko

$DOGS

• Trading in the very low fractional range (~$0.00004 USD) with minor short-term volatility. �

• Price action shows some fluctuation and technical ra

Quick Market Snapshot

ALCH (Alchemist AI)

• Live ~$0.12 USD — modest gains in short term 📈 �

• Daily range roughly $0.1176–$0.1234 USD �

• Some price trackers show weekly pullback vs last 7d (down ~19.7%) �

👉 Your ~$0.21 figure might be outdated or from a different exchange/liquidity pool — major aggregator quotes closer to ~$0.12 today. �

CoinGecko

CoinGecko

CoinGecko

CoinGecko

$DOGS

• Trading in the very low fractional range (~$0.00004 USD) with minor short-term volatility. �

• Price action shows some fluctuation and technical ra

- Reward

- like

- Comment

- Repost

- Share

A long-term Solana staker has begun a gradual exit after unstaking more than 98,000 SOL following nearly two years of holding.

The wallet originally withdrew the tokens from Binance near cycle highs before committing them to staking.

However, the current exit unfolds at significantly lower prices, locking in a realized loss exceeding $6.6 million. The holder uses a DCA approach rather than a single sell-off, which spreads supply across time.

As a result, the market avoids abrupt liquidation-driven reactions. Still, this steady distribution introduces persistent overhead pressure.

Meanwhile, bu

The wallet originally withdrew the tokens from Binance near cycle highs before committing them to staking.

However, the current exit unfolds at significantly lower prices, locking in a realized loss exceeding $6.6 million. The holder uses a DCA approach rather than a single sell-off, which spreads supply across time.

As a result, the market avoids abrupt liquidation-driven reactions. Still, this steady distribution introduces persistent overhead pressure.

Meanwhile, bu

- Reward

- like

- Comment

- Repost

- Share

ETF flows remained firmly red for Bitcoin and Ethereum over the past 24 hours, reinforcing signs of cautious sentiment among institutional investors.

Bitcoin ETFs recorded a net outflow of 9,762 BTC, valued at approximately $874.65 million in a single day. This sell-side pressure extends the weekly net outflow to 16,144 BTC, or roughly $1.45 billion, highlighting sustained distribution rather than a one-off reaction.

Ethereum ETFs mirrored Bitcoin’s weakness. Products tied to ETH saw a 1-day net outflow of 114,641 ETH, worth about $341.17 million. On a 7-day basis, Ethereum ETFs are now down 9

Bitcoin ETFs recorded a net outflow of 9,762 BTC, valued at approximately $874.65 million in a single day. This sell-side pressure extends the weekly net outflow to 16,144 BTC, or roughly $1.45 billion, highlighting sustained distribution rather than a one-off reaction.

Ethereum ETFs mirrored Bitcoin’s weakness. Products tied to ETH saw a 1-day net outflow of 114,641 ETH, worth about $341.17 million. On a 7-day basis, Ethereum ETFs are now down 9

- Reward

- 1

- 1

- Repost

- Share

Yusfirah :

:

2026 GOGOGO 👊- Reward

- like

- Comment

- Repost

- Share