SHOLEH0X

No content yet

SHOLEH0X

TON’s DeFi Is Designed for Scale

Scaling DeFi is not just about handling more transactions per second. It is about maintaining quality as usage grows.

Many networks can process transactions quickly, but struggle when:

Liquidity becomes fragmented

Slippage increases

Execution becomes unreliable

Infrastructure breaks under demand

User experience deteriorates

TON approaches scaling differently.

It combines:

A high-performance blockchain with low fees and fast finality

Native distribution through Telegram

Invisible UX design

Aggregated liquidity routing

And professional liquidity infrastructure

Th

Scaling DeFi is not just about handling more transactions per second. It is about maintaining quality as usage grows.

Many networks can process transactions quickly, but struggle when:

Liquidity becomes fragmented

Slippage increases

Execution becomes unreliable

Infrastructure breaks under demand

User experience deteriorates

TON approaches scaling differently.

It combines:

A high-performance blockchain with low fees and fast finality

Native distribution through Telegram

Invisible UX design

Aggregated liquidity routing

And professional liquidity infrastructure

Th

TON-0,52%

- Reward

- like

- Comment

- Repost

- Share

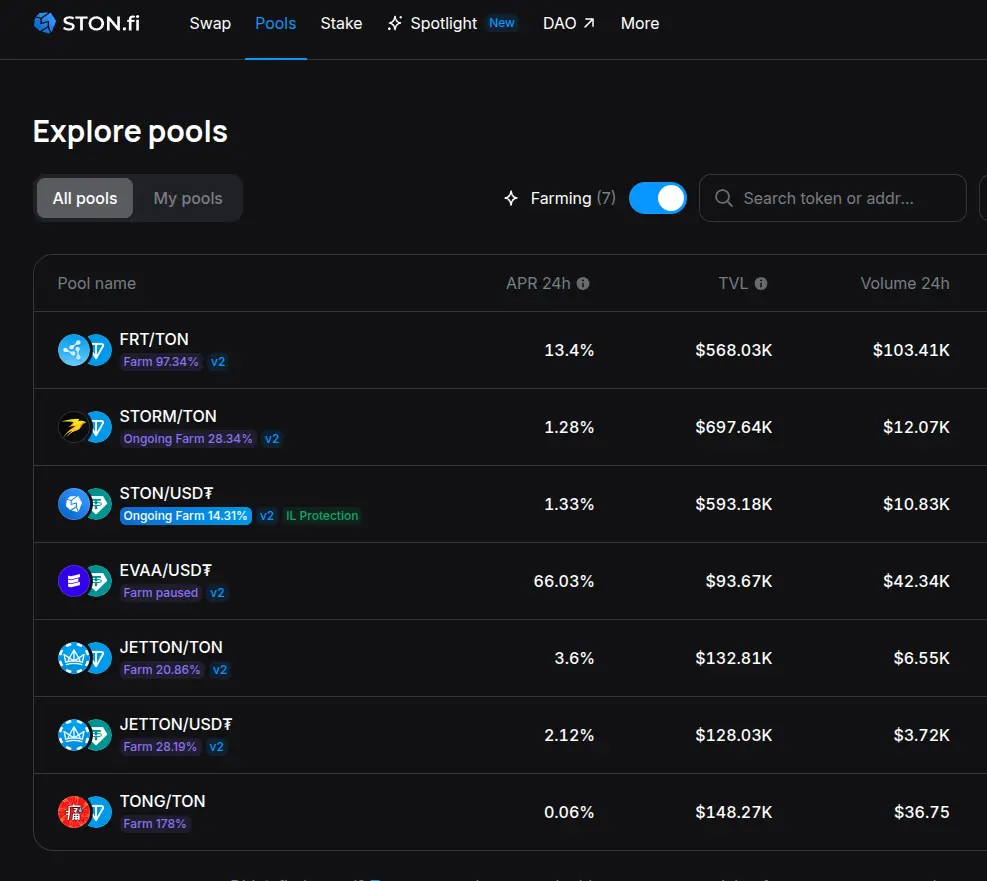

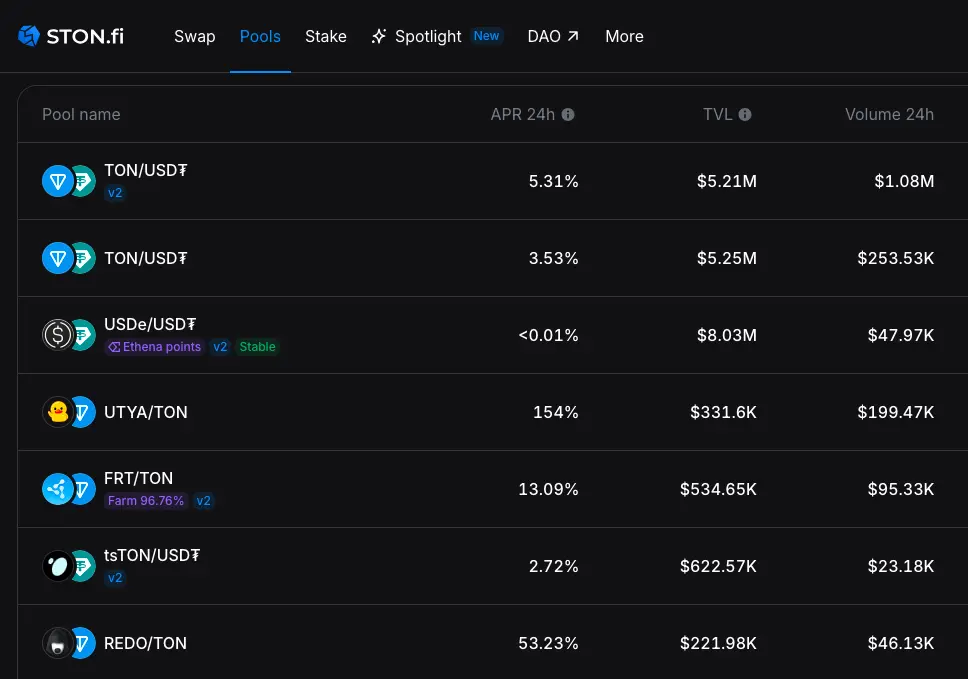

Liquidity Providers Are Ecosystem Partners

Liquidity providers are often treated as short-term participants in DeFi people who deposit capital, earn fees, and leave when yields drop.

In reality, they play a much more important role.

Liquidity providers are not just chasing rewards.

They are supplying the capital infrastructure that allows decentralized markets to function at all.

Without them:

Swaps cannot execute efficiently

Prices become unstable

Slippage increases

Aggregators fail to find good routes

Applications lose reliability

They are closer to market makers than casual users.

STONfi re

Liquidity providers are often treated as short-term participants in DeFi people who deposit capital, earn fees, and leave when yields drop.

In reality, they play a much more important role.

Liquidity providers are not just chasing rewards.

They are supplying the capital infrastructure that allows decentralized markets to function at all.

Without them:

Swaps cannot execute efficiently

Prices become unstable

Slippage increases

Aggregators fail to find good routes

Applications lose reliability

They are closer to market makers than casual users.

STONfi re

TON-0,52%

- Reward

- like

- Comment

- Repost

- Share

Why Deep Liquidity Attracts Builders

Developers do not build serious financial applications on unstable foundations.

No matter how good the user interface is or how innovative the idea may be, an application cannot succeed if:

Prices are inconsistent

Trades fail or execute unpredictably

Liquidity disappears during volatility

Slippage makes features unusable

For builders, these are not minor inconveniences — they are product-breaking risks.

This is why deep, reliable liquidity is one of the most important signals of a healthy ecosystem.

STONfi provides this foundation on TON.

By focusing on lon

Developers do not build serious financial applications on unstable foundations.

No matter how good the user interface is or how innovative the idea may be, an application cannot succeed if:

Prices are inconsistent

Trades fail or execute unpredictably

Liquidity disappears during volatility

Slippage makes features unusable

For builders, these are not minor inconveniences — they are product-breaking risks.

This is why deep, reliable liquidity is one of the most important signals of a healthy ecosystem.

STONfi provides this foundation on TON.

By focusing on lon

- Reward

- like

- Comment

- Repost

- Share

Professional Market Design Matters

Many DeFi platforms compete on speed, new features, or high yields. While these are attractive in the short term, they do not create stable financial systems.

Real markets the kind that institutions and everyday users trust are built on something deeper:

Predictable risk

Stable liquidity

Transparent incentives

Long-term sustainability

Protection against structural weaknesses

This is what professional market design looks like.

In much of DeFi, liquidity providers carry most of the risk, especially from impermanent loss. Fees and token incentives try to compens

Many DeFi platforms compete on speed, new features, or high yields. While these are attractive in the short term, they do not create stable financial systems.

Real markets the kind that institutions and everyday users trust are built on something deeper:

Predictable risk

Stable liquidity

Transparent incentives

Long-term sustainability

Protection against structural weaknesses

This is what professional market design looks like.

In much of DeFi, liquidity providers carry most of the risk, especially from impermanent loss. Fees and token incentives try to compens

TON-0,52%

- Reward

- like

- Comment

- Repost

- Share

TON’s Strategy: Build for Non-Crypto Users

Most blockchains are designed primarily for developers, traders, or technically experienced crypto users. TON takes a different approach.

Its core strategy is simple but powerful: build for everyday users first.

Instead of forcing people to understand wallets, private keys, gas fees, network routing, and token standards, TON aims to hide these complexities behind familiar app-like experiences. The blockchain becomes infrastructure in the background, not something users have to constantly think about.

This design philosophy changes everything.

TON focu

Most blockchains are designed primarily for developers, traders, or technically experienced crypto users. TON takes a different approach.

Its core strategy is simple but powerful: build for everyday users first.

Instead of forcing people to understand wallets, private keys, gas fees, network routing, and token standards, TON aims to hide these complexities behind familiar app-like experiences. The blockchain becomes infrastructure in the background, not something users have to constantly think about.

This design philosophy changes everything.

TON focu

- Reward

- like

- Comment

- Repost

- Share

Why Slippage Is a User Experience Problem

Slippage is often described as a technical detail a percentage shown before confirming a swap. But for users, it is something much more serious: a trust issue.

When someone initiates a trade, they expect the price they see to be close to the price they receive. If the final execution is significantly worse, the experience feels broken, unfair, or even deceptive even when the system is working as designed.

This is why slippage is not just a trading metric. It is a core part of user experience.

High slippage leads to:

Unexpected losses during swaps

Confu

Slippage is often described as a technical detail a percentage shown before confirming a swap. But for users, it is something much more serious: a trust issue.

When someone initiates a trade, they expect the price they see to be close to the price they receive. If the final execution is significantly worse, the experience feels broken, unfair, or even deceptive even when the system is working as designed.

This is why slippage is not just a trading metric. It is a core part of user experience.

High slippage leads to:

Unexpected losses during swaps

Confu

- Reward

- like

- Comment

- Repost

- Share

Liquidity Is Infrastructure, Not a Feature

In decentralized finance, liquidity is often discussed as a feature something that enhances a platform. In reality, liquidity is far more fundamental. It is core infrastructure, just like roads are to cities or servers are to the internet.

Without deep and stable liquidity:

Swaps become expensive due to high slippage

Prices become inconsistent across platforms

Large trades distort markets

Transactions fail more often

Users lose trust and stop returning

No amount of interface design or marketing can compensate for weak liquidity.

This is why STONfi tre

In decentralized finance, liquidity is often discussed as a feature something that enhances a platform. In reality, liquidity is far more fundamental. It is core infrastructure, just like roads are to cities or servers are to the internet.

Without deep and stable liquidity:

Swaps become expensive due to high slippage

Prices become inconsistent across platforms

Large trades distort markets

Transactions fail more often

Users lose trust and stop returning

No amount of interface design or marketing can compensate for weak liquidity.

This is why STONfi tre

TON-0,52%

- Reward

- like

- Comment

- Repost

- Share

Aggregators Need Strong Liquidity

In modern DeFi ecosystems, users expect swaps to be fast, affordable, and accurate. Behind this simple experience lies a complex process: finding the best price across many pools and executing trades efficiently. This is the role of aggregators like Omniston.

Aggregators scan multiple liquidity sources across the network, compare prices and available depth, and automatically route each trade through the most efficient path. This saves users from manual comparisons and protects them from unnecessary slippage.

However, even the most advanced routing engine is li

In modern DeFi ecosystems, users expect swaps to be fast, affordable, and accurate. Behind this simple experience lies a complex process: finding the best price across many pools and executing trades efficiently. This is the role of aggregators like Omniston.

Aggregators scan multiple liquidity sources across the network, compare prices and available depth, and automatically route each trade through the most efficient path. This saves users from manual comparisons and protects them from unnecessary slippage.

However, even the most advanced routing engine is li

TON-0,52%

- Reward

- like

- Comment

- Repost

- Share

DeFi Without Friction

One of the main reasons DeFi has struggled to reach mainstream users is friction. Setting up wallets, managing private keys, understanding gas fees, and choosing swap routes can be confusing even for experienced users let alone newcomers.

TON is changing this by designing its ecosystem around simplicity and abstraction.

Technical processes such as transaction routing and fee handling are increasingly hidden behind clean, intuitive interfaces. Users interact with applications, not blockchains.

Tools like Privy further remove barriers by simplifying wallet creation and auth

One of the main reasons DeFi has struggled to reach mainstream users is friction. Setting up wallets, managing private keys, understanding gas fees, and choosing swap routes can be confusing even for experienced users let alone newcomers.

TON is changing this by designing its ecosystem around simplicity and abstraction.

Technical processes such as transaction routing and fee handling are increasingly hidden behind clean, intuitive interfaces. Users interact with applications, not blockchains.

Tools like Privy further remove barriers by simplifying wallet creation and auth

TON-0,52%

- Reward

- like

- Comment

- Repost

- Share

Sustainable Liquidity Beats Short Term Yield

For much of DeFi’s history, liquidity growth was driven by high rewards and short-term incentives. Protocols attracted users with attractive yields, but when those rewards declined, liquidity often left just as quickly. This created unstable markets, shallow pools, and unreliable trading conditions.

True sustainability requires a different approach.

STONfi focuses on building liquidity that lasts, not just liquidity that appears for a short time. Instead of relying only on incentives, it prioritizes professional liquidity management and risk reducti

For much of DeFi’s history, liquidity growth was driven by high rewards and short-term incentives. Protocols attracted users with attractive yields, but when those rewards declined, liquidity often left just as quickly. This created unstable markets, shallow pools, and unreliable trading conditions.

True sustainability requires a different approach.

STONfi focuses on building liquidity that lasts, not just liquidity that appears for a short time. Instead of relying only on incentives, it prioritizes professional liquidity management and risk reducti

TON-0,52%

- Reward

- like

- Comment

- Repost

- Share

Building the Future Together

A strong DeFi ecosystem is never built by a single protocol or feature. It emerges from well-designed infrastructure, thoughtful user experience, and reliable market foundations working together.

This is exactly what is happening on TON.

TON provides the base layer: a fast, low-fee, and scalable blockchain designed for real-world applications and seamless integration with platforms like Telegram. Its focus on usability allows developers to build products that feel natural to everyday users, not just crypto-native audiences.

On top of this foundation, Privy simplifi

A strong DeFi ecosystem is never built by a single protocol or feature. It emerges from well-designed infrastructure, thoughtful user experience, and reliable market foundations working together.

This is exactly what is happening on TON.

TON provides the base layer: a fast, low-fee, and scalable blockchain designed for real-world applications and seamless integration with platforms like Telegram. Its focus on usability allows developers to build products that feel natural to everyday users, not just crypto-native audiences.

On top of this foundation, Privy simplifi

TON-0,52%

- Reward

- like

- Comment

- Repost

- Share

Deep Liquidity, Faster Trades

Liquidity is the backbone of any decentralized finance ecosystem. Without sufficient liquidity, trades become slow, slippage increases, and users may receive prices far from what they expect. In short, low liquidity makes DeFi unreliable and frustrating for both traders and developers.

This is where STONfi plays a critical role on TON. By providing deep, stable, and professionally managed liquidity pools, STONfi ensures that token swaps and trades execute smoothly and efficiently. Large transactions can be processed without causing sudden price swings, and users c

Liquidity is the backbone of any decentralized finance ecosystem. Without sufficient liquidity, trades become slow, slippage increases, and users may receive prices far from what they expect. In short, low liquidity makes DeFi unreliable and frustrating for both traders and developers.

This is where STONfi plays a critical role on TON. By providing deep, stable, and professionally managed liquidity pools, STONfi ensures that token swaps and trades execute smoothly and efficiently. Large transactions can be processed without causing sudden price swings, and users c

- Reward

- like

- Comment

- Repost

- Share

TON + STONfi = DeFi Made Simple

TON is more than just another blockchain it’s a platform designed for real-world users, not just crypto enthusiasts. With low transaction fees, fast finality, and scalable architecture, TON ensures that blockchain interactions are seamless and efficient. On top of that, its integration with apps like Telegram allows users to access DeFi tools directly in environments they already use every day, making adoption intuitive and frictionless.

But fast and cheap transactions are only part of the story. STONfi adds another crucial layer: deep liquidity and intelligent

TON is more than just another blockchain it’s a platform designed for real-world users, not just crypto enthusiasts. With low transaction fees, fast finality, and scalable architecture, TON ensures that blockchain interactions are seamless and efficient. On top of that, its integration with apps like Telegram allows users to access DeFi tools directly in environments they already use every day, making adoption intuitive and frictionless.

But fast and cheap transactions are only part of the story. STONfi adds another crucial layer: deep liquidity and intelligent

TON-0,52%

- Reward

- 2

- 1

- Repost

- Share

LittleQueen :

:

2026 GOGOGO 👊TON’s DeFi Direction Is Clear

The TON ecosystem is carving out a unique path in the world of decentralized finance by focusing on usability, sustainability, and professional grade infrastructure. Unlike many blockchain networks that prioritize features or hype, TON is designing its ecosystem around the needs of real users and developers, making DeFi practical and accessible at scale.

Here’s how TON is approaching this:

✔ Invisible blockchain UX: The goal is to make blockchain operations feel invisible to end users. Wallets, swaps, and routing are abstracted behind intuitive interfaces, allowin

The TON ecosystem is carving out a unique path in the world of decentralized finance by focusing on usability, sustainability, and professional grade infrastructure. Unlike many blockchain networks that prioritize features or hype, TON is designing its ecosystem around the needs of real users and developers, making DeFi practical and accessible at scale.

Here’s how TON is approaching this:

✔ Invisible blockchain UX: The goal is to make blockchain operations feel invisible to end users. Wallets, swaps, and routing are abstracted behind intuitive interfaces, allowin

TON-0,52%

- Reward

- like

- Comment

- Repost

- Share

Why Omniston Matters for TON DeFi

As the TON ecosystem grows, DeFi applications become more complex behind the scenes. Tokens are spread across multiple pools and exchanges, prices constantly change, and liquidity is fragmented across different venues. Without proper infrastructure, users would need to manually search for the best swap routes and developers would need to build complicated routing logic themselves.

This is where Omniston becomes essential.

Omniston acts as a liquidity aggregation layer for TON, automatically scanning available pools and decentralized exchanges to find the most

As the TON ecosystem grows, DeFi applications become more complex behind the scenes. Tokens are spread across multiple pools and exchanges, prices constantly change, and liquidity is fragmented across different venues. Without proper infrastructure, users would need to manually search for the best swap routes and developers would need to build complicated routing logic themselves.

This is where Omniston becomes essential.

Omniston acts as a liquidity aggregation layer for TON, automatically scanning available pools and decentralized exchanges to find the most

TON-0,52%

- Reward

- 2

- 1

- Repost

- Share

HighAmbition :

:

2026 GOGOGO 👊Blockchain Adoption Is About Invisibility

The most successful blockchains are not the ones with the most complex technology, but the ones where users don’t need to think about the technology at all. Real adoption happens when blockchain becomes invisible, when people can use applications naturally without worrying about wallets, gas fees, transaction routing, or network mechanics. TON is steadily moving in this direction by shifting core blockchain operations into seamless, app level experiences. Instead of forcing users to manually connect wallets, approve multiple transactions or understand

The most successful blockchains are not the ones with the most complex technology, but the ones where users don’t need to think about the technology at all. Real adoption happens when blockchain becomes invisible, when people can use applications naturally without worrying about wallets, gas fees, transaction routing, or network mechanics. TON is steadily moving in this direction by shifting core blockchain operations into seamless, app level experiences. Instead of forcing users to manually connect wallets, approve multiple transactions or understand

- Reward

- like

- Comment

- Repost

- Share

I’ve been using Stonfi for a while now, swapping tokens, providing liquidity, and farming rewards. I thought I already understood everything on the platform… until I noticed a feature many people overlook: Arbitrary Provision.

At first, it doesn’t sound special. But once you understand it, you realize how useful it actually is.

What is Arbitrary Provision?

On most DEXs, when you add liquidity to a pool, you must deposit tokens in a fixed ratio, usually 50/50.

For example:

If you want to add liquidity to a STON/USDT pool, you must provide equal value of STON and USDT.

Arbitrary Provision remove

At first, it doesn’t sound special. But once you understand it, you realize how useful it actually is.

What is Arbitrary Provision?

On most DEXs, when you add liquidity to a pool, you must deposit tokens in a fixed ratio, usually 50/50.

For example:

If you want to add liquidity to a STON/USDT pool, you must provide equal value of STON and USDT.

Arbitrary Provision remove

DEFI-2,23%

- Reward

- 3

- 3

- Repost

- Share

EagleEye :

:

2026 GOGOGO 👊View More

Omniston Just Made $TON Swaps Smarter on RangoExchange

If you’ve ever swapped TON tokens, you know the pain jumping between apps, checking multiple pools, and still wondering if you got the best rate..

That friction is now history.

Omniston, STONfi’s powerful liquidity aggregation engine, is officially powering TON swaps on RangoExchange quietly doing the heavy lifting behind the scenes so users don’t have to.

🔍 What this means for users:

✅ Optimized routing

Omniston scans multiple liquidity pools and automatically finds the best swap path no manual comparison needed.

✅ Access to long tail TO

If you’ve ever swapped TON tokens, you know the pain jumping between apps, checking multiple pools, and still wondering if you got the best rate..

That friction is now history.

Omniston, STONfi’s powerful liquidity aggregation engine, is officially powering TON swaps on RangoExchange quietly doing the heavy lifting behind the scenes so users don’t have to.

🔍 What this means for users:

✅ Optimized routing

Omniston scans multiple liquidity pools and automatically finds the best swap path no manual comparison needed.

✅ Access to long tail TO

TON-0,52%

- Reward

- 1

- Comment

- Repost

- Share

Decentralization is often talked about as a checkbox: either a project is decentralized, or it isn’t. But that framing misses the reality of how decentralized systems actually form.

Decentralization is not a static state it’s a process.

It emerges over time through incentives, participation, governance, and real usage. Early on, most networks rely on coordination, core contributors, and concentrated decision-making simply to function. What matters is not where a system starts, but whether its design allows power, control, and value to progressively diffuse outward.

This is where onchain infras

Decentralization is not a static state it’s a process.

It emerges over time through incentives, participation, governance, and real usage. Early on, most networks rely on coordination, core contributors, and concentrated decision-making simply to function. What matters is not where a system starts, but whether its design allows power, control, and value to progressively diffuse outward.

This is where onchain infras

- Reward

- 1

- Comment

- Repost

- Share

Not all blockchains scale the same way, because they don’t compete the same way.

Ethereum, Solana and TON optimize for different adoption paths, not just different technical metrics.

Ethereum scales through layers. Rollups, modular design, and abstraction give developers maximum flexibility. But users must actively look for tools.

DeFi on Ethereum is competitive by default protocols fight for attention, liquidity and mindshare in an open market.

Solana scales through performance.

High throughput and low latency reduce execution friction. This enables fast, composable apps, but users still ch

Ethereum, Solana and TON optimize for different adoption paths, not just different technical metrics.

Ethereum scales through layers. Rollups, modular design, and abstraction give developers maximum flexibility. But users must actively look for tools.

DeFi on Ethereum is competitive by default protocols fight for attention, liquidity and mindshare in an open market.

Solana scales through performance.

High throughput and low latency reduce execution friction. This enables fast, composable apps, but users still ch

- Reward

- like

- Comment

- Repost

- Share