Post content & earn content mining yield

placeholder

NazarickAinz-sama

I don't know what happened last night, but suddenly it dropped to 7.2. I casually bought some. I guess a lot of people woke up this morning to find their contract positions gone.

View Original- Reward

- like

- 1

- Repost

- Share

DeadAirForce :

:

Not holding a large position? Short-term lows, rebounds can be quite profitable, and the stop-loss level is also good.🟠 Bitcoin drops below $74K, erasing post-Trump rally gains

Bitcoin crashed below $74,000 on Tuesday, falling more than 6% to hit its lowest level since November 2024, when Donald Trump secured his second presidential term.

The leading digital asset had climbed from $74,000 following Trump’s election victory to an all-time high of nearly $126,000 in October 2025. The rally was driven by expectations that his administration would pursue crypto-friendly policies.

Since then, the administration has taken a more lenient stance. A new SEC chair was appointed, the GENIUS Act passed, discussions arou

Bitcoin crashed below $74,000 on Tuesday, falling more than 6% to hit its lowest level since November 2024, when Donald Trump secured his second presidential term.

The leading digital asset had climbed from $74,000 following Trump’s election victory to an all-time high of nearly $126,000 in October 2025. The rally was driven by expectations that his administration would pursue crypto-friendly policies.

Since then, the administration has taken a more lenient stance. A new SEC chair was appointed, the GENIUS Act passed, discussions arou

- Reward

- 1

- Comment

- Repost

- Share

🇺🇸 TODAY: CFTC Chair Michael Selig says the #crypto market structure bill is going to create a “gold standard for #crypto markets in the United States.”#crypto

- Reward

- 1

- 1

- Repost

- Share

ybaser :

:

Buy To Earn 💎OPIBIRD

OPİUM

Created By@Brko

Listing Progress

0.00%

MC:

$0.1

Create My Token

【$ETH Signal】Short Position + Price Drop with Open Interest Anomaly

$ETH Price decreased by 4.78%, but open interest (OI) reached $1.97 billion. Market logic suggests that the decision should be based on open interest to determine whether it's a long squeeze or main force distribution. The current chart shows weak price action (PA), and a decline under high open interest usually indicates forced liquidation or selling pressure from major players, not a healthy correction. Risks should be avoided until clear signals appear.

🎯 Direction: Short Position (NoPosition)

Trade here: 👇 $ETH

---

Fol

View Original$ETH Price decreased by 4.78%, but open interest (OI) reached $1.97 billion. Market logic suggests that the decision should be based on open interest to determine whether it's a long squeeze or main force distribution. The current chart shows weak price action (PA), and a decline under high open interest usually indicates forced liquidation or selling pressure from major players, not a healthy correction. Risks should be avoided until clear signals appear.

🎯 Direction: Short Position (NoPosition)

Trade here: 👇 $ETH

---

Fol

- Reward

- like

- Comment

- Repost

- Share

Good morning, Maca Baka! Grateful to be alive, grateful for your concern. Wishing you a smooth Year of the Horse, a day of breakthrough into the Golden Core stage, full of energy, and keep moving forward.

View Original

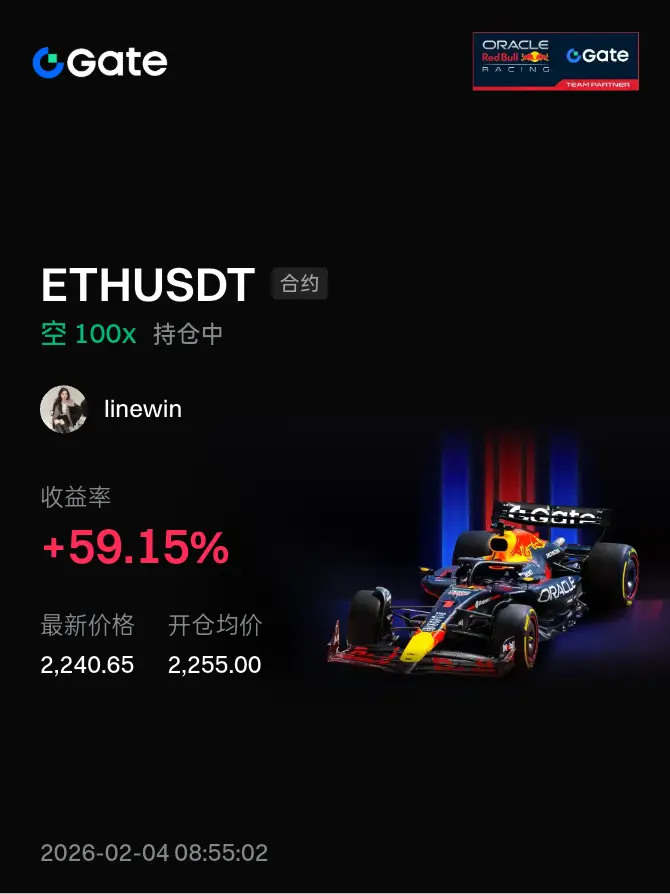

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- like

- Comment

- Repost

- Share

February 4th Short-term Trading Strategy:

ETH: If it moves up first, go short around 2298-2321, take profit at 2248-2188-2150, stop loss on a break above 2350 and retest.

If it moves down first, go long around 2146-2110, take profit at 2212-2248-2290, stop loss if it falls below 2080 and rebounds, there is a price difference between platforms, you can buy/sell with a 2-3 USD difference.

The two levels provided by the host are for light positions to be placed in batches. For short-term trades using 100x leverage, the strategy is to aim for a 50% profit, then reduce positions to protect capital

ETH: If it moves up first, go short around 2298-2321, take profit at 2248-2188-2150, stop loss on a break above 2350 and retest.

If it moves down first, go long around 2146-2110, take profit at 2212-2248-2290, stop loss if it falls below 2080 and rebounds, there is a price difference between platforms, you can buy/sell with a 2-3 USD difference.

The two levels provided by the host are for light positions to be placed in batches. For short-term trades using 100x leverage, the strategy is to aim for a 50% profit, then reduce positions to protect capital

ETH-3,31%

- Reward

- 3

- Comment

- Repost

- Share

#Strategy比特币持仓转为亏损 #白宫加密会议 $OG is making a strong breakout, with price and open interest rising simultaneously. This is a typical signal of institutional entry, rather than just a short squeeze.

🎯 Direction: Long

🎯 Entry: 4.10 - 4.25

🛑 Stop Loss: 3.85 ( Rigid Stop Loss )

🚀 Target 1: 4.80

🚀 Target 2: 5.50

Price action shows strong buying absorption, with over 20% increase accompanied by significant volume, confirming the validity of the breakout. Market sentiment has shifted from hesitation to FOMO, and healthy price movement provides momentum for the subsequent rally. Key support has mo

🎯 Direction: Long

🎯 Entry: 4.10 - 4.25

🛑 Stop Loss: 3.85 ( Rigid Stop Loss )

🚀 Target 1: 4.80

🚀 Target 2: 5.50

Price action shows strong buying absorption, with over 20% increase accompanied by significant volume, confirming the validity of the breakout. Market sentiment has shifted from hesitation to FOMO, and healthy price movement provides momentum for the subsequent rally. Key support has mo

OG21,39%

- Reward

- like

- Comment

- Repost

- Share

Share your views on the upcoming trend of gold$XAU

Short-term outlook

Gold has dropped rapidly from 5600 to 4715 in this wave, a decline of about 15%. This magnitude is still not enough. Whether from a safety margin perspective or a short-term rebound strategy, entering now is not cost-effective.

Gold is already at a position where a short-term top is quite likely. Previously, the RSI was abnormally high, and in such a state, selling pressure is almost inevitable—it's just a matter of timing and magnitude.

Long-term outlook

The big players behind gold have no intention of ending thi

View OriginalShort-term outlook

Gold has dropped rapidly from 5600 to 4715 in this wave, a decline of about 15%. This magnitude is still not enough. Whether from a safety margin perspective or a short-term rebound strategy, entering now is not cost-effective.

Gold is already at a position where a short-term top is quite likely. Previously, the RSI was abnormally high, and in such a state, selling pressure is almost inevitable—it's just a matter of timing and magnitude.

Long-term outlook

The big players behind gold have no intention of ending thi

- Reward

- 6

- 5

- Repost

- Share

ybaser :

:

Hold on tight, we're about to take off 🛫View More

Check out Gate and join me in the hottest event! https://www.gate.com/campaigns/3988?ref_type=132

- Reward

- 1

- Comment

- Repost

- Share

Viewing the Top Market Coins Spot Chart and comparing them

- Reward

- 7

- 1

- Repost

- Share

Satosh陌Nakamato :

:

Sorry, the provided source text appears to be a string of random characters and does not contain any translatable content. Please provide the actual text you need translated.Gold continues its oscillating upward trend, with prices gradually approaching the $4950 level, just one step away from the $5000 mark. The current bullish trend is clear, with good volume support, and short-term technical corrections do not alter the medium-term upward pattern.

In terms of trading strategy, it is recommended to gradually enter long positions around the 4880 zone, with targets at the key levels of 5000, 5100, and 5200; the core principle of operation is to follow the trend and hold positions accordingly, avoiding subjective guesses of the top, and controlling the rhythm based

View OriginalIn terms of trading strategy, it is recommended to gradually enter long positions around the 4880 zone, with targets at the key levels of 5000, 5100, and 5200; the core principle of operation is to follow the trend and hold positions accordingly, avoiding subjective guesses of the top, and controlling the rhythm based

- Reward

- like

- Comment

- Repost

- Share

馬币火

Malaysian Ringgit

Created By@TIANDAO

Listing Progress

100.00%

MC:

$10.75K

Create My Token

#HongKongIssueStablecoinLicenses

Hong Kong to Launch Stablecoin Licensing in March 2026: Regulation, Selectivity, and Global Implications

Hong Kong is poised to take a major step in formalizing stablecoin issuance by granting the city’s first stablecoin issuer licenses as early as March 2026 under its new regulatory framework, a strategic move that reflects both caution and ambition in how digital assets are supervised. The Hong Kong Monetary Authority (HKMA) has signaled that only a very limited number of licenses will be approved in this initial phase, highlighting a phased and selective ap

Hong Kong to Launch Stablecoin Licensing in March 2026: Regulation, Selectivity, and Global Implications

Hong Kong is poised to take a major step in formalizing stablecoin issuance by granting the city’s first stablecoin issuer licenses as early as March 2026 under its new regulatory framework, a strategic move that reflects both caution and ambition in how digital assets are supervised. The Hong Kong Monetary Authority (HKMA) has signaled that only a very limited number of licenses will be approved in this initial phase, highlighting a phased and selective ap

- Reward

- 2

- 6

- Repost

- Share

ybaser :

:

Buy To Earn 💎View More

- Reward

- 1

- 6

- Repost

- Share

linewin :

:

Wake up and keep harvesting, repeatedly harvesting. Wake up and continue to gather resources again and again, never stopping. Keep collecting items, materials, or rewards continuously from the moment you wake up, ensuring you maximize your gains every day.View More

Bitcoin slips below dollars 80000 again. Where does market confidence go from here? Institutions see a potential bottom near dollars 60000 with a recovery window later this year

- Reward

- 1

- 1

- Repost

- Share

ybaser :

:

Buy To Earn 💎#InstitutionalHoldingsDebate Institutional participation in crypto has reached a stage where it no longer asks for permission—it defines the environment. By February 2026, institutions are not just holders of Bitcoin and Ethereum; they are structural actors shaping liquidity conditions, volatility patterns, and long-term market behavior. The conversation has moved beyond “if institutions matter” to “how their behavior rewires the market itself.”

One of the most important shifts is the scale of custody concentration. With millions of BTC and tens of millions of ETH under institutional managemen

One of the most important shifts is the scale of custody concentration. With millions of BTC and tens of millions of ETH under institutional managemen

- Reward

- 1

- 1

- Repost

- Share

ybaser :

:

2026 GOGOGO 👊PayPal\'s H-1B implosion is playing out as expected

- Reward

- like

- Comment

- Repost

- Share

#WhenWillBTCRebound?

Bitcoin is currently not in a simple “dip-buy” phase. The market is moving through a structural correction, driven by macro pressure, liquidity cycles, and institutional positioning. Understanding when BTC may rebound requires separating relief rallies from a true trend reversal.

1️⃣ Current Market Structure: Still Bearish Bias

Bitcoin is trading below key short- and mid-term moving averages, indicating trend weakness rather than accumulation strength.

Price has failed multiple times near the $88K–$90K resistance zone

Lower highs are forming on the daily and weekly struct

Bitcoin is currently not in a simple “dip-buy” phase. The market is moving through a structural correction, driven by macro pressure, liquidity cycles, and institutional positioning. Understanding when BTC may rebound requires separating relief rallies from a true trend reversal.

1️⃣ Current Market Structure: Still Bearish Bias

Bitcoin is trading below key short- and mid-term moving averages, indicating trend weakness rather than accumulation strength.

Price has failed multiple times near the $88K–$90K resistance zone

Lower highs are forming on the daily and weekly struct

BTC-3,04%

- Reward

- 3

- 2

- Repost

- Share

ybaser :

:

2026 GOGOGO 👊View More

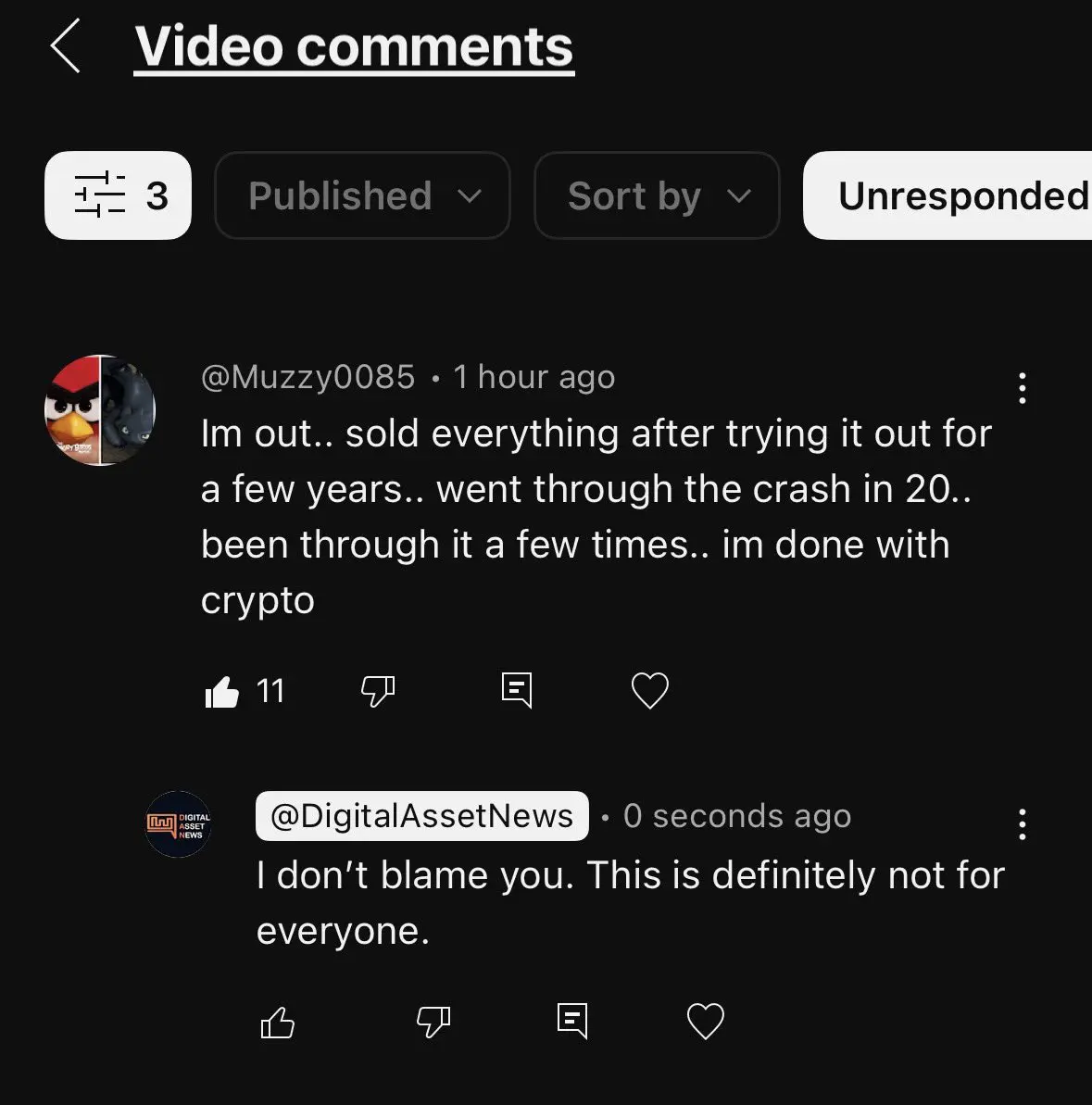

I’m getting more and more of these comments. I can’t blame them and this definitely is NOT for everyone

- Reward

- like

- Comment

- Repost

- Share

If Someone Join Pls Share it If Let’s Share Some Rewards

#StrategyBitcoinPositionTurnsRed

#StrategyBitcoinPositionTurnsRed

[The user has shared his/her trading data. Go to the App to view more.]

- Reward

- 2

- 2

- Repost

- Share

ybaser :

:

2026 GOGOGO 👊View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More20.67K Popularity

13.35K Popularity

8.96K Popularity

978 Popularity

5.53K Popularity

News

View MoreUK's largest Bitcoin treasury company SWC listed on the London Stock Exchange main board

11 m

Aave will gradually shut down the Family iOS wallet and decommission the Avara brand, refocusing on DeFi operations.

12 m

Prediction Market Platform Kairos Completes $2.5 Million Seed Funding Round, Led by a16z

16 m

X announces the $1 million grand prize for the long-form article competition

17 m

Peter Schiff: The BTC/gold exchange rate has fallen 59% from the 2021 high, and Bitcoin is in a long-term bear market measured in gold.

19 m

Pin