Trade

Trading Type

Spot

Trade crypto freely

Alpha

Points

Get promising tokens in streamlined on-chain trading

Pre-Market

Trade new tokens before they are officially listed

Margin

Magnify your profit with leverage

Convert & Block Trading

0 Fees

Trade any size with no fees and no slippage

Leveraged Tokens

Get exposure to leveraged positions simply

Futures

Futures

Hundreds of contracts settled in USDT or BTC

Options

HOT

Trade European-style vanilla options

Unified Account

Maximize your capital efficiency

Demo Trading

Futures Kickoff

Get prepared for your futures trading

Futures Events

Participate in events to win generous rewards

Demo Trading

Use virtual funds to experience risk-free trading

Earn

Launch

CandyDrop

Collect candies to earn airdrops

Launchpool

Quick staking, earn potential new tokens

HODLer Airdrop

Hold GT and get massive airdrops for free

Launchpad

Be early to the next big token project

Alpha Points

NEW

Trade on-chain assets and enjoy airdrop rewards!

Futures Points

NEW

Earn futures points and claim airdrop rewards

Investment

Simple Earn

Earn interests with idle tokens

Auto-Invest

Auto-invest on a regular basis

Dual Investment

Buy low and sell high to take profits from price fluctuations

Soft Staking

Earn rewards with flexible staking

Crypto Loan

0 Fees

Pledge one crypto to borrow another

Lending Center

One-stop lending hub

VIP Wealth Hub

Customized wealth management empowers your assets growth

Private Wealth Management

Customized asset management to grow your digital assets

Quant Fund

Top asset management team helps you profit without hassle

Staking

Stake cryptos to earn in PoS products

BTC Staking

HOT

Stake BTC and earn 10% APR

GUSD Minting

Use USDT/USDC to mint GUSD for treasury-level yields

More

Promotions

Activity Center

Join activities and win big cash prizes and exclusive merch

Referral

20 USDT

Earn 40% commission or up to 500 USDT rewards

Announcements

Announcements of new listings, activities, upgrades, etc

Gate Blog

Crypto industry articles

VIP Services

Huge fee discounts

Proof of Reserves

Gate promises 100% proof of reserves

Trending Topics

View More78.18K Popularity

34.01K Popularity

16.82K Popularity

5.93K Popularity

3.59K Popularity

Pin

Grayscale: Why is it optimistic that BTC will continue to rise?

Author: Grayscale Research

Compilation: Felix, PANews

Points

BTC rebounded 130% in 2023 after “losing ground” in 2022 and is poised to be one of the best-performing mainstream assets this year. The crypto market continued to recover in November as various macro risks in the financial markets declined. In the digital asset market, this has led to a shift in market leadership from BTC to an increasingly broad crypto segment. Grayscale believes that the fundamentals of cryptocurrencies are gradually improving, and the supply of major tokens is relatively tight (e.g. due to BTC current ownership structure). This could be in line with the rise in crypto valuations in the coming year, especially if the Fed has ended its tightening and the US economy can avoid a “hard landing” (recession).

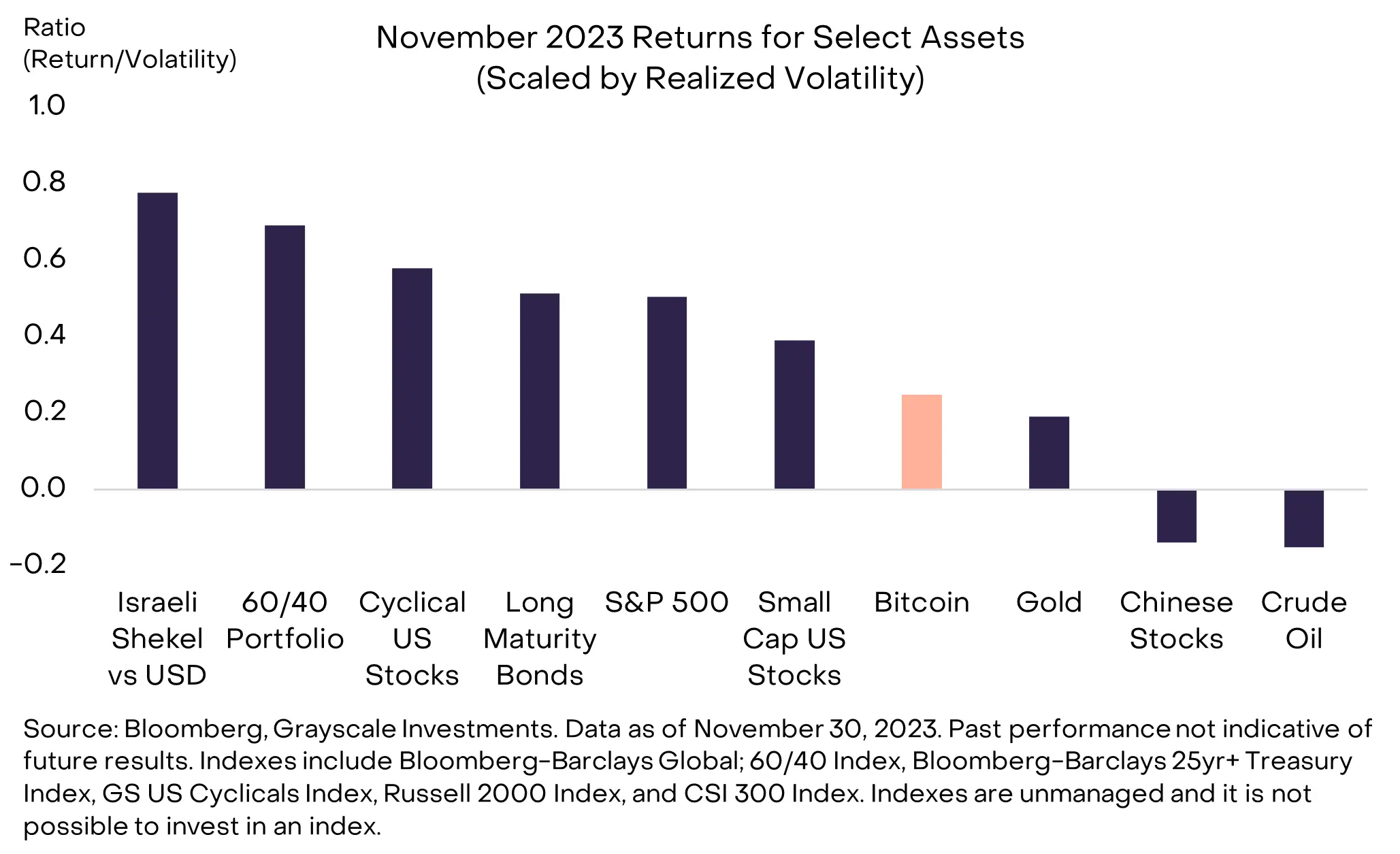

Over the past month, various tail risks in financial markets appear to have declined, helping assets that had previously underperformed to rebound. For example, positive signs of conflict in the Middle East appear to have reduced concerns about broader regional chaos, and assets tied to the Israeli economy have rebounded as a result (Figure 1). Similarly, the price of long-term government bonds rose (yields fell) after the Ministry of Finance announced that the growth in borrowing demand was less than expected. The Consumer Price Index (CPI) also continued to fall, which increased market hopes for a Fed rate cut and a possible “soft landing” for the US economy. On a volatility-adjusted basis, BTC underperformed this month (outperforming since the end of August) but still rose 9% (ETH coin rose 13% in November).

Chart 1: Reduced tail risk drives asset market recovery in November

** **

**

A broader recovery in the crypto market

BTC has been outperforming other crypto assets recently due to the demand for BTC as a digital alternative to gold and optimism about the approval of BTC spot ETFs. However, as the rally extended beyond the BTC, the leadership of the crypto market changed in November.

According to the new framework index of the crypto asset class standard* (note: Grayscale** has partnered with FTSE Russell, a subsidiary of the London Stock Exchange and a London index provider, to launch the crypto index product**, which has five different crypto industry indices: currencies, smart contract platforms, financials, consumer and culture, utilities and services, across more than 150 protocols**), the best performing market segments last month were financial indices, Utilities and Services and Consumers and Culture (Table 2). Among the financial sectors, the Thorchain (RUNE) token rose by 131%; Thorchain runs the decentralized exchange ThorSwap, which has seen an increase in trading activity recently. Among the consumer and culture sectors, the standout performance was the growth of gaming-related tokens ImmutableX and Illuvium. On November 28, Illuvium (up 119%) listed its eponymous game on the Epic Games Store, while ImmutableX, a Layer2 blockchain for crypto gaming apps on ETH Square (up 87%), announced a partnership with Ubisoft.

Chart 2: Financials, Consumer & Culture Cryptocurrencies Outperformed

In addition to the latest price moves, the market is once again focusing on the combination between cryptocurrency and AI technology after the turmoil in OpenAI’s leadership. In Grayscale’s view, there may be synergies between public chains and AI technology. Specifically, blockchain can combat or address the potential societal risks posed by AI, such as deepfakes, bots, and the proliferation of misinformation. In addition, decentralized computing protocols can counter the centralized control of AI models that hold sensitive personal information. Grayscale believes that the main crypto projects related to the AI theme include Akash and Render (GPU sharing), Worldcoin (identity), and Bittensor (open architecture AI development).

As valuations have moved higher, the fundamentals of the crypto industry have also improved. For example, BTC’s hash rate, a measure of the total amount of computing power used to secure a network, reached an all-time high in November (Table 3). This trend can be attributed to the upgrading of miners ahead of next year’s BTC halving, higher token prices (which make older machines profitable), and an oversupply of relatively new machines operated by miner equipment manufacturers. In addition, the increase in stablecoin activity is also responsible for the improvement in crypto fundamentals. Over the past month, the total market capitalization of stablecoins has increased by $4 billion, and the amount of gas used in stablecoin transactions has also increased.

Exhibit 3: BTC hash rate hits all-time high

The fundamental factors that drive BTC prices

After a period of sharp rises, position active crypto traders as relatively “long”. For example, open interest in BTC futures listed on the Chicago Mercantile Exchange (CME) hit an all-time high in November, which may indicate that institutional activity is increasing in the market (Figure 4). At the same time, exchange-traded products (ETPs), including futures products in the United States and spot products overseas, saw net inflows in November. Grayscale estimates that the global net inflow of cryptocurrency ETPs totaled $1.3 billion in November, reaching $2.2 billion for the year.

Chart 4: Open interest in CME BTC futures hits all-time high

In terms of the short-term outlook for the market, the position of a “long” trader means that it may be difficult for the price to rise further. The prices of major crypto tokens have risen sharply, and the benefits have been consumed in advance. In addition, there are some risks to the economic outlook that could undermine the positive trend this year. These include a “hard landing” (recession) for the U.S. economy, a resumption of interest rate hikes or lower-than-expected rate cuts by the Federal Reserve, and/or a prolonged delay in approving BTC spot ETFs for the U.S. market. All of these risks could hinder crypto recovery, at least in the short term.

That being said, in Grayscale’s view, financial markets and macroeconomic conditions may be favorable for BTC and other crypto assets. The supply of BTC was relatively “tight” before potential investors poured into US spot ETF products. For example, the share of BTC supply held by short-term speculators has reached record lows, according to Glassnode data (Table 5). Similarly, Grayscale’s analysis also shows that a large portion of the BTC is held by long-term holders (related reading: Grayscale revealed BTC holder pattern: only 2.3% of BTC have more than 1 coin). The BTC halving next year will also limit the growth of the new token supply. In Grayscale’s view, the combination of inelastic BTC supply and potential new investor inflows should have a positive impact on valuations.

Chart 5: Long-term holders hold **** BTC **** accounts for a large share of **** supply

However, more important than the technical background is the fundamental outlook for BTC. BTC is a macro asset that is seen by many as a digital alternative to physical gold. As a result, the price of BTC is likely to be influenced by the factors driving demand for digital gold, including the Federal Reserve’s monetary policy, the health of the U.S. economy, and the soundness of the fiat monetary system. The market’s reaction to the election of Javier Milei (BTC-friendly) as president of Argentina is the latest example of the impact these factors can have (related: A quick look at Argentina’s new president’s past and key takeaways: severing parental ties, supporting BTC). While there is uncertainty about the macro outlook, economists unanimously expect the Fed to cut interest rates next year and the U.S. economy to avoid a recession. There will also be a U.S. presidential election next year, which is expected to focus on excessive government borrowing, the independence of the Federal Reserve, and other issues that affect the long-term value of the dollar. Grayscale expects this combination to have a positive impact on demand for physical and digital gold and is likely to coincide with rising BTC valuations.

Related reading: 12 charts to interpret the crypto market in November: NFT recovery is strong, and most indicators continue to grow