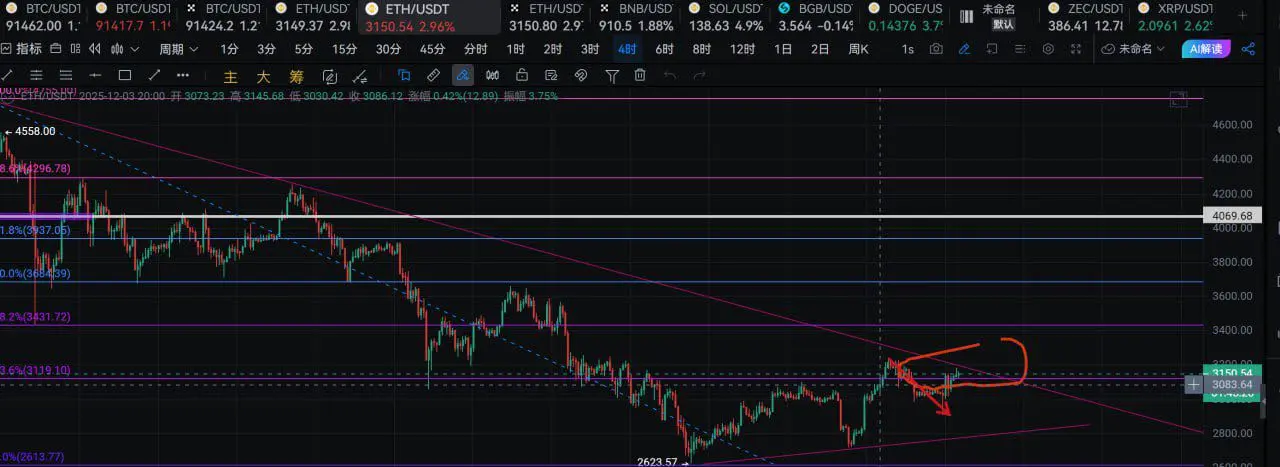

Night of 12.9 to daytime of 12.10

BTC Short-term

1. If the price rises to around 3150, go short, stop loss at 3180

2. If the price pulls back to around 3080, go long, stop loss at 3050

3. If the price pulls back to around 3030, go long, stop loss at 3000

4. If there is a 15-minute candle closing below 3000, go short, stop loss at 3030; if it doesn't break, go long

5. If there is a 15-minute candle closing below 2900, go short, stop loss at 3020; if it doesn't break, then—

6. If the price pulls back to around 2940, go long, stop loss at 2910

7. If the price can stabilize above 3180, chase long

View Original