Прогноз стоимости COOKIE в 2025 году: анализ рынка и перспективы развития цифровой экономики Cookie

Введение: Рыночная позиция и инвестиционная привлекательность COOKIE

Cookie DAO (COOKIE), крупнейший индекс AI-агентов и поставщик данных для искусственного интеллекта и пользователей, с момента основания внедряет первый в криптовалютной отрасли индекс AI Agents. К 2025 году рыночная капитализация COOKIE достигла 64 582 118 $, объём обращения составляет примерно 613 140 781 токен, а стоимость удерживается на уровне около 0,10533 $. Этот актив, известный как «Пионер индекса AI Agents», играет всё более значимую роль в предоставлении оперативной аналитики для рынка AI-агентов.

В статье представлен всесторонний анализ динамики цен COOKIE с 2025 по 2030 год с учётом истории, баланса спроса и предложения, развития экосистемы и макроэкономических условий, чтобы дать инвесторам профессиональный прогноз цен и практические инвестиционные стратегии.

I. История цены COOKIE и текущая рыночная ситуация

Динамика цены COOKIE

- 2024: Запуск проекта, стартовая цена — 0,028 $

- Январь 2025: Абсолютный максимум — 0,8468 $

- Сентябрь 2025: Коррекция — снижение до 0,10533 $

Текущая ситуация на рынке COOKIE

COOKIE торгуется по цене 0,10533 $, суточный объём — 319 876,59 $. За последние сутки токен вырос на 2,76%. Рыночная капитализация — 64 582 118,57 $, что соответствует 597-му месту среди всех криптоактивов. В обращении — 613 140 781,97 COOKIE, это 61,31% от общей эмиссии в 999 929 030 COOKIE. В краткосрочной перспективе заметен позитивный импульс — рост на 0,36% за час. Среднесрочно отмечается снижение: минус 7,77% за неделю и минус 17,96% за 30 дней. Долгосрочно COOKIE демонстрирует устойчивый рост: плюс 313,58% за год.

Откройте актуальную цену COOKIE

Результат в запрошенном формате:

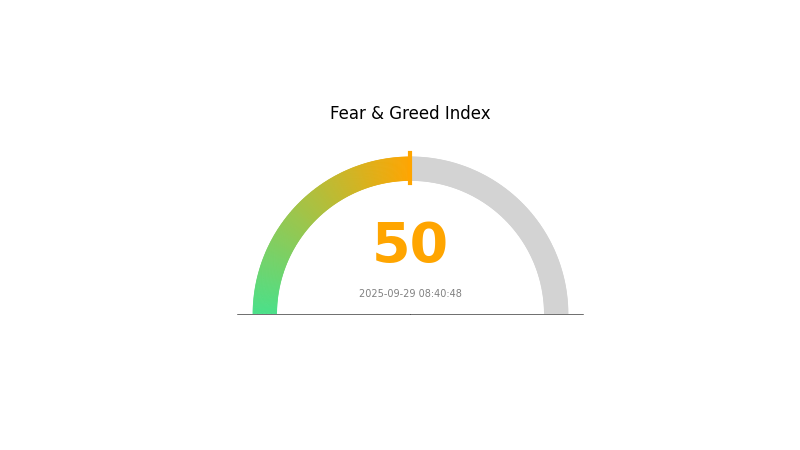

Индикатор настроения рынка COOKIE

29 сентября 2025 г. Индекс страха и жадности: 50 (нейтрально)

Откройте актуальный индекс страха и жадности

Настроения на крипторынке сбалансированы: индекс страха и жадности равен 50, что отражает нейтральный взгляд. Это говорит об отсутствии выраженного оптимизма или пессимизма среди инвесторов. Для одних это признак стабильности, для других — возможного перелома. Как всегда, перед инвестициями в волатильный сектор важно проводить глубокий анализ и учитывать комплекс факторов.

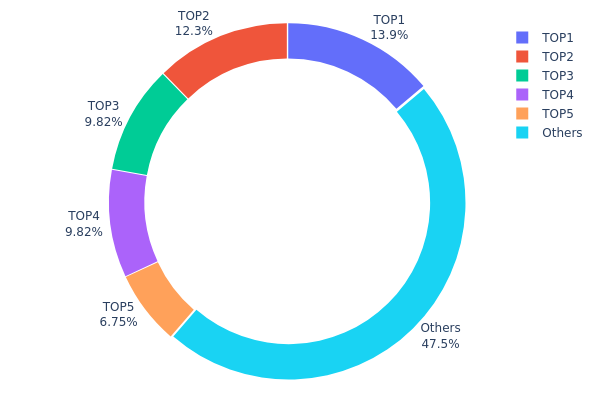

Распределение держателей COOKIE

Структура распределения адресов COOKIE характеризуется высокой концентрацией: пять ведущих адресов держат 52,52% общего объёма, крупнейший — 13,86% всех токенов. Это свидетельствует о средне выраженной централизации.

Такая концентрация способна влиять на рыночные процессы. Крупные держатели могут усиливать волатильность: существенные продажи способны вызвать давление на цену. Если же они ориентированы на долгосрочное хранение, это может стабилизировать рынок. В то же время высокая концентрация повышает риски манипуляций, поскольку скоординированные действия топ-держателей могут существенно влиять на динамику цен.

Остальные 47,48% токенов распределены между другими адресами, что свидетельствует о наличии широкой аудитории, но в целом требуются дополнительные меры контроля над рисками централизации. Необходимо отслеживать поведение крупных держателей и его влияние на рыночную динамику COOKIE.

| Топ | Адрес | Количество | Доля (%) |

|---|---|---|---|

| 1 | 0xf977...41acec | 112 911,32K | 13,86% |

| 2 | 0xb26e...bc1141 | 100 000,00K | 12,27% |

| 3 | 0x458e...ddb992 | 80 000,00K | 9,82% |

| 4 | 0xad43...32429a | 80 000,00K | 9,82% |

| 5 | 0xa880...73b5af | 55 000,00K | 6,75% |

| - | Прочие | 386 588,13K | 47,48% |

II. Основные факторы, влияющие на будущую цену COOKIE

Механизм предложения

- Экспирация опционов: Сроки экспирации опционов вызывают волатильность, когда трейдеры пересматривают позиции по крупным контрактам COOKIE.

- Историческая динамика: Квартальная экспирация оказывает более сильное влияние на цену, чем ежемесячная, на рынке COOKIE.

- Текущий эффект: Масштабные события экспирации могут вызвать ценовые колебания даже при частичном исполнении или хеджировании контрактов.

Динамика институциональных инвесторов и крупных держателей

- Институциональные портфели: Соотношение put/call отражает настроения институциональных и розничных инвесторов. Значение выше 1 — преобладание медвежьих позиций, ниже 1 — ожидание роста.

- Корпоративное внедрение: Н/Д

- Государственная политика: Н/Д

Макроэкономические условия

- Влияние монетарной политики: Н/Д

- Защита от инфляции: Н/Д

- Геополитика: Н/Д

Техническое развитие и экосистема

- Теория Max Pain: Согласно теории Max Pain, цена экспирации опционов обычно стремится к уровню, на котором максимальное число контрактов становится невыгодным, что повышает риски манипуляций.

- Развороты рынка: Экстремальные значения соотношения put/call вблизи экспирации могут сигнализировать о возможных разворотах тренда, когда актив становится перекупленным или перепроданным.

- Применение в экосистеме: Платформы CoinGlass и календари CME Group обеспечивают глубокую аналитику рынка опционов и дают трейдерам преимущество в сравнении со спотовыми участниками благодаря оперативным данным.

III. Прогноз цены COOKIE на 2025–2030 годы

Прогноз на 2025 год

- Консервативный прогноз: 0,07078 $ – 0,10564 $

- Нейтральный прогноз: 0,10564 $ – 0,1236 $

- Оптимистичный прогноз: 0,1236 $ – 0,14 $ (при восстановлении рынка и росте внедрения)

Прогноз на 2027–2028 годы

- Ожидаемая рыночная фаза: возможный период роста и расширения внедрения

- Диапазон цен:

- 2027: 0,12619 $ – 0,17953 $

- 2028: 0,10372 $ – 0,21209 $

- Ключевые драйверы: технологический прогресс, расширение сфер применения, общий рост крипторынка

Долгосрочный прогноз на 2030 год

- Базовый сценарий: 0,18883 $ – 0,20088 $ (при устойчивом рыночном росте)

- Оптимистичный сценарий: 0,20088 $ – 0,23905 $ (при массовой интеграции и благоприятном регулировании)

- Трансформационный сценарий: 0,23905 $ – 0,25 $ (при прорывных технологических изменениях и интеграции в мейнстрим)

- 31 декабря 2030 г.: COOKIE 0,23905 $ (потенциальный максимум при позитивных условиях)

| Год | Максимальная цена (прогноз) | Средняя цена (прогноз) | Минимальная цена (прогноз) | Динамика (%) |

|---|---|---|---|---|

| 2025 | 0,1236 | 0,10564 | 0,07078 | 0 |

| 2026 | 0,14557 | 0,11462 | 0,05846 | 9 |

| 2027 | 0,17953 | 0,13009 | 0,12619 | 23 |

| 2028 | 0,21209 | 0,15481 | 0,10372 | 47 |

| 2029 | 0,21831 | 0,18345 | 0,14676 | 74 |

| 2030 | 0,23905 | 0,20088 | 0,18883 | 91 |

IV. Профессиональные инвестиционные стратегии и управление рисками COOKIE

Методы инвестирования в COOKIE

(1) Стратегия долгосрочного хранения

- Подходит для: долгосрочных инвесторов и энтузиастов AI

- Рекомендации:

- Покупайте COOKIE на коррекциях рынка

- Следите за развитием Cookie DAO и трендами рынка AI-агентов

- Храните токены в надёжных кошельках с резервным копированием

(2) Активные торговые стратегии

- Инструменты технического анализа:

- Скользящие средние — определяйте направление и развороты тренда

- RSI — отслеживайте состояния перекупленности/перепроданности

- Ключевые условия для свинг-трейдинга:

- Анализируйте настроения рынка и уровень внедрения AI-агентов

- Устанавливайте чёткие входы и выходы по техническим индикаторам

Система управления рисками COOKIE

(1) Принципы распределения активов

- Консервативные инвесторы: 1–3% криптопортфеля

- Агрессивные инвесторы: 5–10% криптопортфеля

- Профессиональные инвесторы: до 15% криптопортфеля

(2) Решения для хеджирования рисков

- Диверсификация: балансируйте COOKIE с другими криптоактивами и традиционными инструментами

- Стоп-лоссы: ограничивайте потенциальные убытки

(3) Безопасное хранение

- Рекомендуемый горячий кошелёк: Gate Web3 кошелёк

- Холодное хранение: аппаратные кошельки для долгосрочного удержания

- Меры безопасности: двухфакторная аутентификация, сложные пароли, регулярные обновления ПО

V. Основные риски и вызовы для COOKIE

Рыночные риски COOKIE

- Волатильность: динамика настроений на рынке AI-агентов может вызывать резкие колебания цен

- Конкуренция: появление новых индексов AI-агентов способно снизить долю COOKIE

- Внедрение: замедление принятия технологий AI-агентов может снизить спрос

Регуляторные риски COOKIE

- Неопределённое регулирование: изменения в криптовалютных и AI-нормах могут отразиться на работе проекта

- Международное соответствие: различия в регулировании между странами могут ограничивать глобальное развитие

- Конфиденциальность данных: ужесточение законов о защите данных способно повлиять на сбор информации AI-агентами

Технические риски COOKIE

- Уязвимости смарт-контрактов: возможные эксплойты в исходном коде

- Проблемы масштабируемости: быстрый рост может перегрузить инфраструктуру

- Зависимость от ораклов: необходимость внешних данных для работы AI-агентов

VI. Заключение и рекомендации

Оценка инвестиционной привлекательности COOKIE

COOKIE — уникальная возможность на быстрорастущем рынке AI-агентов с потенциалом долгосрочного роста. При этом инвесторам стоит учитывать высокую волатильность и регуляторные риски в краткосрочной перспективе.

Рекомендации по инвестициям в COOKIE

✅ Новичкам: начните с небольших сумм и сфокусируйтесь на изучении технологий AI-агентов ✅ Опытным инвесторам: используйте сбалансированный подход с учётом личной толерантности к риску ✅ Институциональным инвесторам: ищите стратегические партнёрства и проводите тщательную проверку

Способы участия в торгах COOKIE

- Спотовая торговля: покупка и продажа COOKIE на Gate.com

- Стейкинг: участие в стейкинговых программах, если они доступны в Cookie DAO

- Управление: участие в голосовании DAO, если токен даёт такие права

Криптовалютные инвестиции сопряжены с крайне высоким риском. Данная статья не является инвестиционной рекомендацией. Решения должны приниматься с учётом вашей толерантности к риску и после консультации с профессиональными финансовыми советниками. Не инвестируйте больше, чем можете позволить себе потерять.

FAQ

Стоит ли инвестировать в COOKIE coin?

COOKIE coin обладает инвестиционным потенциалом. Технический анализ показывает сильные результаты и возможность значительного роста. Рекомендуем рассмотреть его для вашего портфеля.

Достигнет ли COOKIE coin уровня 1 $?

Согласно актуальным прогнозам, COOKIE coin может достичь 1 $ к 28 июня 2042 г. Для этого необходим рост на 866,82% от текущей цены при благоприятных условиях рынка.

Какая криптовалюта прогнозируется к росту на 1000x?

Bitcoin Hyper ($HYPER) прогнозируется к росту в 1000 раз, исходя из текущих рыночных тенденций на 29 сентября 2025 г.

Каковы перспективы COOKIE crypto?

COOKIE crypto прогнозируется в диапазоне 0,070–0,280 $ в 2026 году при средней цене 0,142 $. Это предполагает дальнейший рост и стабильность COOKIE в ближайшие годы.

Пригласить больше голосов

Содержание