ステーブルコインは過度な特権をさらに加速させるのか?

短期的には、ステーブルコインの成長によって米国の財政的な制約が緩和され、ドルの基軸通貨としての優位性が押し上げられる可能性がありますが、ステーブルコインは最終的にはその国の制度の質に関する議論を一層複雑にするに過ぎません。長期的にドルの地位を左右するのは、米国の財政規律と中央銀行が低く安定したインフレを維持できる能力です。

出典:Photo by SpaceX on Unsplash

トランプ政権は、ステーブルコインの需要拡大によって連邦財政赤字を補填することに大きな期待を寄せています。この需要は、米財務省が債務の平均償還期間を短縮する(国債の発行量を維持したまま短期証券の発行を増やす)という主要な公式理由のひとつとされています。

(ちなみに、債務の平均償還期間の短縮は、FRBへの金利引き下げ圧力を強める方法でもあると私は考えています。)

また、ステーブルコイン需要がすでに米国短期債の金利低下要因となっているとの証拠もあります。

さらに、政権はステーブルコイン需要を米ドル基軸通貨の地位を支える重要な柱と位置づけています。

その理由は明確です。

財務長官Bessentは、ステーブルコイン市場が2兆ドル規模まで拡大するとしています(さらに大きな数値も目にします)。ほとんどのステーブルコインがドルにペッグされていることから、ステーブルコイン需要は実質的にドル需要と言えます。

GENIUS法では米ドル現金、米国内の保証付き銀行預金、残存期間93日までの米国債が準備資産として認められており、こうした需要は連邦債務に流れることが想定されます。

米国内の視点では、ステーブルコインが実際に米国債の純需要を押し上げるかはまだ判断が分かれています。ステーブルコインが何を代替するか次第です。

たとえば、短期米国債に投資されているマネーファンドの持分を保有する代わりに、資産の一部をステーブルコインにシフトした場合、米国債への純需要は増加しません。

現時点では仮説ですが、ドルと米国債の純需要を押し上げる最大の経路は、国際的な「ドル化チャネル」―ステーブルコイン需要によるドル化効果だと考えます。

ステーブルコインは、インフレ率が高く自国通貨が弱い、銀行制度が未発達な国々を中心に、米国外の多くの人々に米ドルへのアクセスを飛躍的に向上させています。

もっとも、非米国民間部門によるステーブルコインの需要増加は、公式筋のドル需要減少により部分的に相殺される可能性があります。なぜなら、

ステーブルコインによって米国外のバランスシートにおけるドル資産比率が高まることで世界金融の安定性が向上します。その結果、新興国の通貨ミスマッチが減少し、これは新興国政府が予防的にドル需要を持つ主な要因となっています。

ドルの制度―再論

それでも私は、ステーブルコイン需要がドルの役割にどれほど有効なのか、根本的な疑念があります。問題はドルそのものと、それを支える制度です。

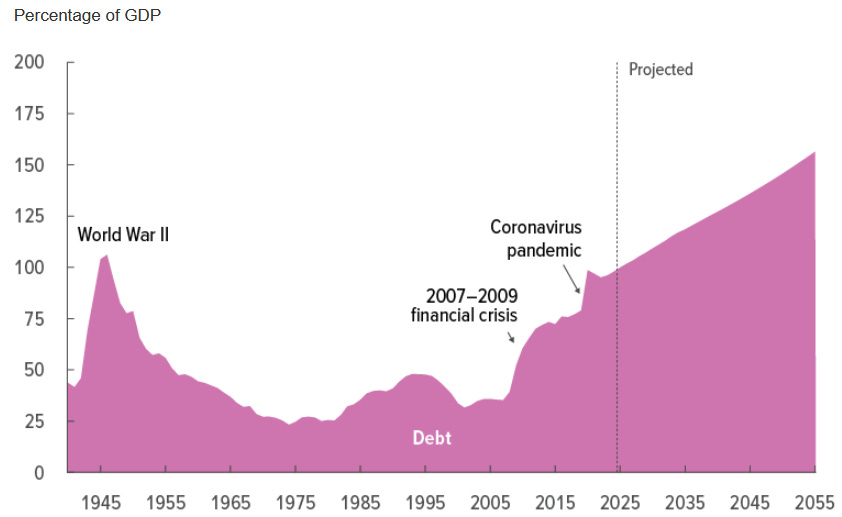

米国の財政状況は広く認識されているため、詳述は割愛します。

出典:Congressional Budget Office(2025年3月)

長年アメリカに敬意を抱いてきたヨーロッパの立場として、政治的分断によって生じた財政破綻装置の存在を指摘するのは私だけではないでしょう。

この財政破綻装置が今なお機能し続ける最大の要因は、米ドルの基軸通貨地位による米国債への需要です。ドルの過剰特権が米国連邦政府の財政余地を広げています。

しかし、それでも根本的な財政改革の必要性は消えません。改革は主に連邦税収の増加に集中すべきです(欧州の場合は支出削減が主眼となります)。

話をステーブルコインに戻します。

ステーブルコインの米国債需要拡大によって短期的な財政政策の制約は緩和されますが、長期的な課題の解決には至らず、財政破綻装置を崩壊させるものでもありません。

むしろ、抜本的な財政改革を妨げる可能性が高まります。

つまり、ステーブルコインは米国の政治家に過剰特権とともに、自滅のための余計なロープを手渡すことになりかねません。

そしてFRBの問題です。

私は、過剰特権によって財政当局への制約が緩む場合、金融政策には独立した制約が必要だと主張してきました。金融政策は財政政策の要求に従属すべきではありません(トランプ氏やその運動が求めるような形で)。この状況を回避するための必要条件が、FRBの独立性です。

重要なのは、FRBの独立性が失われてインフレ率が高止まりする事態になれば、ステーブルコインは結局ドルの地位向上に寄与しなくなるということです。

ステーブルコインの裏付けとは?

最終的に、

Pierpaolo Benigno氏が指摘するとおり、重要なのはステーブルコインの裏付け方法です。

マネタリードミナンス体制(中央銀行が物価安定を確保し、財政当局が債務の持続可能性を単独で担う状況)では、ステーブルコインとそれを裏付ける米国債は最終的に課税によって保証されます。「ステーブルコインが安全であるためには、米国債自体が安全でなければならない」のです。

財政ドミナンス体制では、ステーブルコインは究極的に中央銀行によって裏付けられます。この場合、FRBが対応するステーブルコイン発行をマネタイズせざるを得ず、インフレ圧力をもたらす可能性があります。

総括すると、短期的にはステーブルコイン拡大が米国財政制約の緩和やドルの基軸通貨地位の強化につながるものの、最終的にはステーブルコインが制度の質に関する課題を一層複雑にするだけです。長期的には、ドルの維持に必要なのは米国の財政規律と中央銀行による低インフレの実現能力です。

免責事項:

- 本記事は[Thin Ice Macroeconomics]より転載しています。著作権は原著者[Spyros Andreopoulos]に帰属します。転載にご異議がある場合は、Gate Learnチームまでご連絡ください。迅速にご対応いたします。

- 免責事項:本記事の意見・見解は著者個人のものであり、いかなる投資助言も意図するものではありません。

- 本記事の他言語翻訳はGate Learnチームによるものです。特段の記載がない限り、翻訳記事のコピー・配布・盗用を禁じます。

関連記事

ステーブルコインとは何ですか?

USDeとは何ですか?USDeの複数の収益方法を公開します

Yalaの詳細な説明:$YUステーブルコインを媒体としたモジュラーDeFi収益アグリゲーターの構築

USDT0とは何ですか

USDCとドルの未来