# BTC

37.68M

GarikBY

Ребят, всем привет!

Рынок после пролива пока живёт в режиме неопределёнки: либо добиваем коррекцию, либо формируем отскок. Структуры сломаны, поэтому работаем только от уровней, без иллюзий.

#BTC

🔼Поддержка: 68–65k — ключевая зона, ниже уже совсем плохо по структуре.

🔽Сопротивление: 70.5–72k, выше — только тогда можно говорить про нормальный лонг.

Пока цена ниже — рынок слабый, отскоки могут быть чисто техническими.

#ETH

🔼Поддержка: 1950–1850

🔽Сопротивление: 2130–2220

Эфир выглядит слабее битка, любой рост пока выглядят как коррекционный.

#SOL

🔼Поддержка: 80–77

🔽Сопротивление: 88–92

Если

Рынок после пролива пока живёт в режиме неопределёнки: либо добиваем коррекцию, либо формируем отскок. Структуры сломаны, поэтому работаем только от уровней, без иллюзий.

#BTC

🔼Поддержка: 68–65k — ключевая зона, ниже уже совсем плохо по структуре.

🔽Сопротивление: 70.5–72k, выше — только тогда можно говорить про нормальный лонг.

Пока цена ниже — рынок слабый, отскоки могут быть чисто техническими.

#ETH

🔼Поддержка: 1950–1850

🔽Сопротивление: 2130–2220

Эфир выглядит слабее битка, любой рост пока выглядят как коррекционный.

#SOL

🔼Поддержка: 80–77

🔽Сопротивление: 88–92

Если

- Награда

- 1

- комментарий

- Репост

- Поделиться

1️⃣ Шансы на консолидацию и рост выше $71K высоки. Ключевой фактор — приток капитала через биржевые фонды (ETF), который, несмотря на волатильность, остается положительным. Однако рынок перегрет, и резкие движения часто вызывают ликвидации. Вероятен сценарий «шаг вперед, два шага назад»: тесты новых максимумов (~$73-74K) с последующими коррекциями к уровням поддержки ($68K, $65K). Окончательный прорыв, на мой взгляд, произойдет ближе к халвингу и на фоне ослабления инфляции в США.

2️⃣ Стратегия: долгосрок vs активная торговля

В основе портфеля — долгосрочное ядро (HODL), которое не продается н

2️⃣ Стратегия: долгосрок vs активная торговля

В основе портфеля — долгосрочное ядро (HODL), которое не продается н

BTC0,03%

- Награда

- лайк

- комментарий

- Репост

- Поделиться

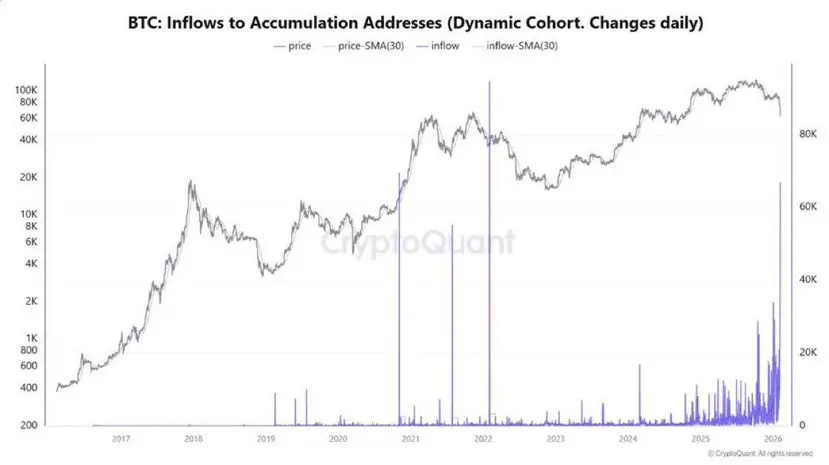

🐋Киты Откупают Падение

6 февраля на так называемые аккумулирующие адреса поступило 66 940 BTC это крупнейший приток за весь текущий цикл.

😐Одна и та же картина, как только Bitcoin падает просыпаются киты и тут же его откупают.

🎯Могу предположить, что сейчас BTC торгуется в зоне интереса больших игроков.

Худший сценарий зона 55-53000$$BTC но и лучший чтоб открыть Лонг позиции

#btc

6 февраля на так называемые аккумулирующие адреса поступило 66 940 BTC это крупнейший приток за весь текущий цикл.

😐Одна и та же картина, как только Bitcoin падает просыпаются киты и тут же его откупают.

🎯Могу предположить, что сейчас BTC торгуется в зоне интереса больших игроков.

Худший сценарий зона 55-53000$$BTC но и лучший чтоб открыть Лонг позиции

#btc

BTC0,03%

- Награда

- 2

- комментарий

- Репост

- Поделиться

Самые важные детали инцидента с южнокорейской биржей.

Биржа планировала раздать бонус около 2 000 KRW, но из-за ошибки система указала $BTC вместо вон.

На внутренних балансах пользователей отразились огромные суммы биткоина — в сумме около 620 000 BTC.

Это были не выведенные монеты, а балансы внутри биржи, но часть пользователей успела продать.

На самой площадке цена BTC кратковременно упала до −17%.

Биржа остановила торговлю, заморозила затронутые аккаунты и вернула около 99,7% средств.

Взлома не было — чисто операционная ошибка.

Вывод:

инфраструктурные сбои могут двигать цену сильнее новост

Биржа планировала раздать бонус около 2 000 KRW, но из-за ошибки система указала $BTC вместо вон.

На внутренних балансах пользователей отразились огромные суммы биткоина — в сумме около 620 000 BTC.

Это были не выведенные монеты, а балансы внутри биржи, но часть пользователей успела продать.

На самой площадке цена BTC кратковременно упала до −17%.

Биржа остановила торговлю, заморозила затронутые аккаунты и вернула около 99,7% средств.

Взлома не было — чисто операционная ошибка.

Вывод:

инфраструктурные сбои могут двигать цену сильнее новост

BTC0,03%

- Награда

- 1

- 1

- Репост

- Поделиться

StinkyFanToken :

:

Держите крепко 💪На графике доминации #USDT видно, что она закрепилась выше линии нисходящего тренда 📊

Если сейчас произойдёт откат на ретест, то #BTC может показать рост в зону $80–87K 📈

Именно на этом росте стоит закрывать лонг-позиции по фьючерсам (не спот).

При таком сценарии альткоины тоже покажут рост,

но этот рост, скорее всего, будет выходным движением.

Один из вариантов, что после ретеста доминация USDT продолжит рост,

а это уже негатив для рынка.

Если сейчас произойдёт откат на ретест, то #BTC может показать рост в зону $80–87K 📈

Именно на этом росте стоит закрывать лонг-позиции по фьючерсам (не спот).

При таком сценарии альткоины тоже покажут рост,

но этот рост, скорее всего, будет выходным движением.

Один из вариантов, что после ретеста доминация USDT продолжит рост,

а это уже негатив для рынка.

BTC0,03%

- Награда

- 2

- комментарий

- Репост

- Поделиться

- Награда

- 2

- комментарий

- Репост

- Поделиться

Год года — удачи, удачи в розыгрыше!🧧 Обратный отсчет 16-го розыгрыша по росту — 2 дня! Ограниченные новогодние сувениры Gate, купоны на возврат высоких комиссий, VIP+1 и другие подарки продолжают раздавать 🎁 Присоединяйтесь прямо сейчас 👉 https://www.gate.com/activities/pointprize?now_period=16 Инструкция по участию: 1️⃣ Выполняйте повседневные задания на площади — публикуйте посты / ставьте лайки / комментируйте / делитесь 2️⃣ Перейдите на личную страницу → нажмите «Рост» →【社区抽奖】 Что вы выиграли сегодня? Поделитесь в комментариях! Ловите последние праздничные удачи! #成长值抽奖第十六期 #BTC #ETH #

- Награда

- лайк

- комментарий

- Репост

- Поделиться

Загрузить больше

Присоединяйтесь к 40M пользователям в нашем растущем сообществе

⚡️ Присоединяйтесь к 40M пользователям в обсуждении криптовалют

💬 Общайтесь с любимыми авторами

👍 Посмотрите, что вас интересует

Популярные темы

194.62K Популярность

51.49K Популярность

24.02K Популярность

8.79K Популярность

3.83K Популярность

6.33K Популярность

7.48K Популярность

3.33K Популярность

16.06K Популярность

8.1K Популярность

4.66K Популярность

4.35K Популярность

19.81K Популярность

19.32K Популярность

38.57K Популярность

Новости

ПодробнееПрезидент The ETF Store: Средняя цена покупки спотового Ethereum ETF составляет 3500 долларов.

1 м

NKN(NKN)за последние 24 часа вырос на 83.22%, текущая цена составляет 0,01 долларов США.

6 м

Данные: за последние 24 часа по всей сети ликвидации на сумму 2.93 миллиарда долларов, ликвидации длинных позиций — 1.54 миллиарда долларов, коротких — 1.38 миллиарда долларов

12 м

Данные: 1075.25 BTC были переведены с анонимного адреса, после чего через посредника отправлены на другой анонимный адрес

12 м

ZKP(zkPass)за последние 24 часа вырос на 41.94%, текущая цена составляет 0.11 долларов США.

13 м

Закрепить