# eTh

23.89M

GarikBY

#eth

В Ethereum Foundation опубликовали дорожную карту на 2026 год.

Команда объявила три ключевых направления развития:

1. Scale (масштабирование).

➤ Повышение лимита газа до 100m+.

➤ Больше пропускной способности для L2.

➤ Подготовка к параллельной обработке транзакций.

2. Improve UX (улучшение удобства).

➤ Внедрение смарт-кошельков на уровне самой сети, чтобы ими можно было пользоваться без дополнительных сервисов и посредников.

➤ Упрощение взаимодействия между разными L2-блокчейнами.

3. Harden the L1 (защита сети).

➤ Усиление безопасности.

➤ Работа над устойчивостью к цензуре.

➤ Подготовк

В Ethereum Foundation опубликовали дорожную карту на 2026 год.

Команда объявила три ключевых направления развития:

1. Scale (масштабирование).

➤ Повышение лимита газа до 100m+.

➤ Больше пропускной способности для L2.

➤ Подготовка к параллельной обработке транзакций.

2. Improve UX (улучшение удобства).

➤ Внедрение смарт-кошельков на уровне самой сети, чтобы ими можно было пользоваться без дополнительных сервисов и посредников.

➤ Упрощение взаимодействия между разными L2-блокчейнами.

3. Harden the L1 (защита сети).

➤ Усиление безопасности.

➤ Работа над устойчивостью к цензуре.

➤ Подготовк

ETH-2,71%

- Награда

- 2

- комментарий

- Репост

- Поделиться

Новости и прогнозы криптоаналитиков – февраль 2026

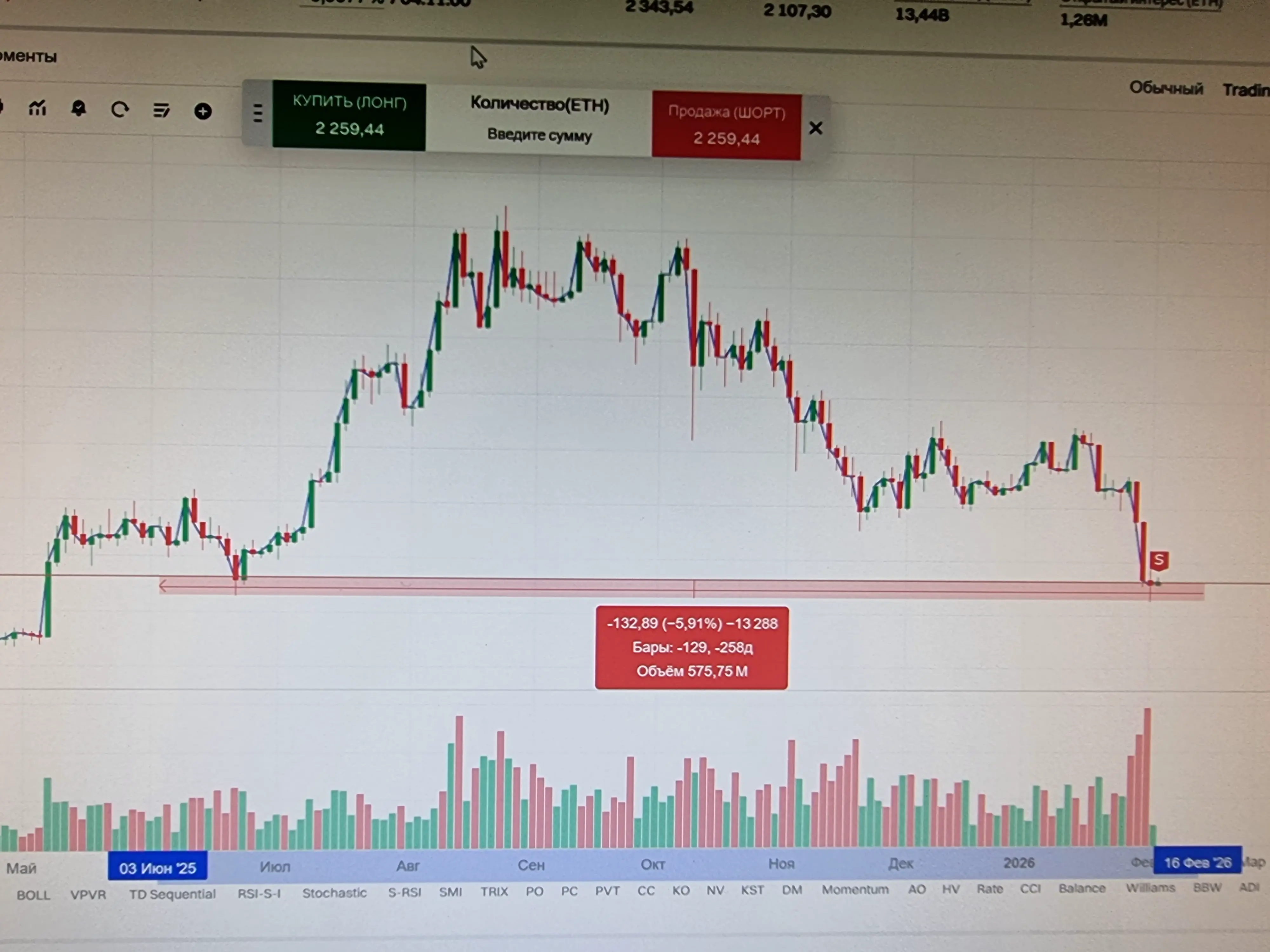

• $BTC держится около 68–70 тыс., $ETH — около 2 тыс.

• Рынок волатильный, частично в коррекции, институциональный спрос пока слабый.

• Standard Chartered: BTC может опуститься до 50 тыс., ETH до 1,4 тыс., но к концу года ожидается восстановление.

• Питер Брандт: дно ещё не достигнуто, возможно осенью 2026.

• Bernstein: даже после падения BTC может восстановиться за счёт институционалов.

Вывод: коррекция продолжается, долгосрочный потенциал сохраняется.

#BTC #ETH #Crypto

• $BTC держится около 68–70 тыс., $ETH — около 2 тыс.

• Рынок волатильный, частично в коррекции, институциональный спрос пока слабый.

• Standard Chartered: BTC может опуститься до 50 тыс., ETH до 1,4 тыс., но к концу года ожидается восстановление.

• Питер Брандт: дно ещё не достигнуто, возможно осенью 2026.

• Bernstein: даже после падения BTC может восстановиться за счёт институционалов.

Вывод: коррекция продолжается, долгосрочный потенциал сохраняется.

#BTC #ETH #Crypto

- Награда

- 2

- 1

- Репост

- Поделиться

CryptoNews_every_day :

:

до дна ещё ой как далеко падать этому скаму- Награда

- лайк

- комментарий

- Репост

- Поделиться

#BuyTheDipOrWaitNow?

Бычий кит открывает длинную позицию по #ETH на $80MРазумно ли использовать кредитное плечо 20x сегодня?20-кратное кредитное плечо на $ETH сегодня? Вы, по сути, танцуете на мине. 💣

Мы только что наблюдали, как Trend Research потеряла 680 миллионов долларов, пытаясь защитить свои кредиты Aave, когда ETH на прошлой неделе достиг отметки в 1750 долларов.

Ставки финансирования наконец-то стали отрицательными, что обычно является сигналом к «дну», но с учетом того, что в этом месяце уже было списано 15 миллиардов долларов общего кредитного плеча, ликвидность крайне мала.

2%

Бычий кит открывает длинную позицию по #ETH на $80MРазумно ли использовать кредитное плечо 20x сегодня?20-кратное кредитное плечо на $ETH сегодня? Вы, по сути, танцуете на мине. 💣

Мы только что наблюдали, как Trend Research потеряла 680 миллионов долларов, пытаясь защитить свои кредиты Aave, когда ETH на прошлой неделе достиг отметки в 1750 долларов.

Ставки финансирования наконец-то стали отрицательными, что обычно является сигналом к «дну», но с учетом того, что в этом месяце уже было списано 15 миллиардов долларов общего кредитного плеча, ликвидность крайне мала.

2%

- Награда

- 3

- комментарий

- Репост

- Поделиться

Двойное дно на #eth 2D ...

Однако, не все так очевидно, как вам рисуют этот график.

Взгляните на ч/б рис. и обратите внимание на послевоенный фрактал слева с текущей ситуацией.

Цена должна повторить падение до 1636 #usdt

И только оттуда (и то не факт) цена может начать расти с целью в р-н $3k.

Однако, не все так очевидно, как вам рисуют этот график.

Взгляните на ч/б рис. и обратите внимание на послевоенный фрактал слева с текущей ситуацией.

Цена должна повторить падение до 1636 #usdt

И только оттуда (и то не факт) цена может начать расти с целью в р-н $3k.

ETH-2,71%

- Награда

- 3

- 1

- Репост

- Поделиться

Escaperwin :

:

DYOR 🤓Фондовая биржа восстановилась, акции снова выросли, дешёвый доллар дал возможность золоту побить исторический рекорд.

Золото уже перегерто и скоро вся ликвидность на 30 миллиардов долларов пойдет в криптовалюта! Это значит что скоро альтсезон!

Сейчас время покупать на споте.

$ETH

#altseason

#eth

#btc

#TariffTensionsHitCryptoMarket

Золото уже перегерто и скоро вся ликвидность на 30 миллиардов долларов пойдет в криптовалюта! Это значит что скоро альтсезон!

Сейчас время покупать на споте.

$ETH

#altseason

#eth

#btc

#TariffTensionsHitCryptoMarket

ETH-2,71%

РК:$3.45KДержатели:1

0.00%

- Награда

- 4

- комментарий

- Репост

- Поделиться

- Награда

- лайк

- комментарий

- Репост

- Поделиться

🎄 Крипто Санта в деле! Грядет ли праздничный ралли? 🚀Друзья, крипторынок и конец года — это особая магия! ✨ Исторически декабрь может быть очень щедрым. Почему?

🎁 Сезон надежд: Инвесторы строят планы на новый год, вливают средства, верят в рост.

📈 Ликвидность: Часто приходит от традиционных рынков в поисках большей динамики.

🧨 Волатильность = возможности: Даже на боковом движении есть шансы хорошо заработать на входах. #ETH #BTC

🎁 Сезон надежд: Инвесторы строят планы на новый год, вливают средства, верят в рост.

📈 Ликвидность: Часто приходит от традиционных рынков в поисках большей динамики.

🧨 Волатильность = возможности: Даже на боковом движении есть шансы хорошо заработать на входах. #ETH #BTC

- Награда

- 12

- 4

- Репост

- Поделиться

ybaser :

:

Счастливого Рождества ⛄Подробнее

Том Ли, соучредитель и руководитель исследовательского отдела Fundstrat, заявил, что к началу 2026 года цена ETH может вырасти до $7000–9000, поскольку Уолл-стрит ускоряет усилия по токенизации активов и переносу финансовой активности в блокчейн. cointelegraph

🔍 Bitmine застейкали 74 880 #ETH ($219,2 млн) 5 часов назад.

🔍 Bitmine застейкали 74 880 #ETH ($219,2 млн) 5 часов назад.

ETH-2,71%

- Награда

- лайк

- комментарий

- Репост

- Поделиться

- Награда

- 1

- 1

- Репост

- Поделиться

RedpeterEx :

:

Бычья пробежка 🐂Загрузить больше

Присоединяйтесь к 40M пользователям в нашем растущем сообществе

⚡️ Присоединяйтесь к 40M пользователям в обсуждении криптовалют

💬 Общайтесь с любимыми авторами

👍 Посмотрите, что вас интересует

Популярные темы

289.24K Популярность

21.97K Популярность

35.02K Популярность

11.66K Популярность

448.3K Популярность

345.14K Популярность

2.93K Популярность

98.4K Популярность

11.28K Популярность

94.04K Популярность

14.86K Популярность

10.7K Популярность

5.29K Популярность

5.68K Популярность

38.91K Популярность

Новости

ПодробнееNetflix после падения вырос почти на 8%, акции показывают сильное движение

2 м

MARA занимается развитием бизнеса по созданию AI-центров обработки данных, цена акции выросла на 17% после закрытия торгов

3 м

Benchmark ожидает переход Strategy к модели финансирования STRC, устанавливая целевую цену в 705 долларов США

8 м

SBF в тюрьме поддерживает законопроект CLARITY, подвергся критике со стороны сенаторов обеих партий

9 м

Курс Circle достиг $90, аналитики положительно оценивают диверсификацию бизнеса по стабильным монетам

14 м

Закрепить