Post content & earn content mining yield

placeholder

GuJingci

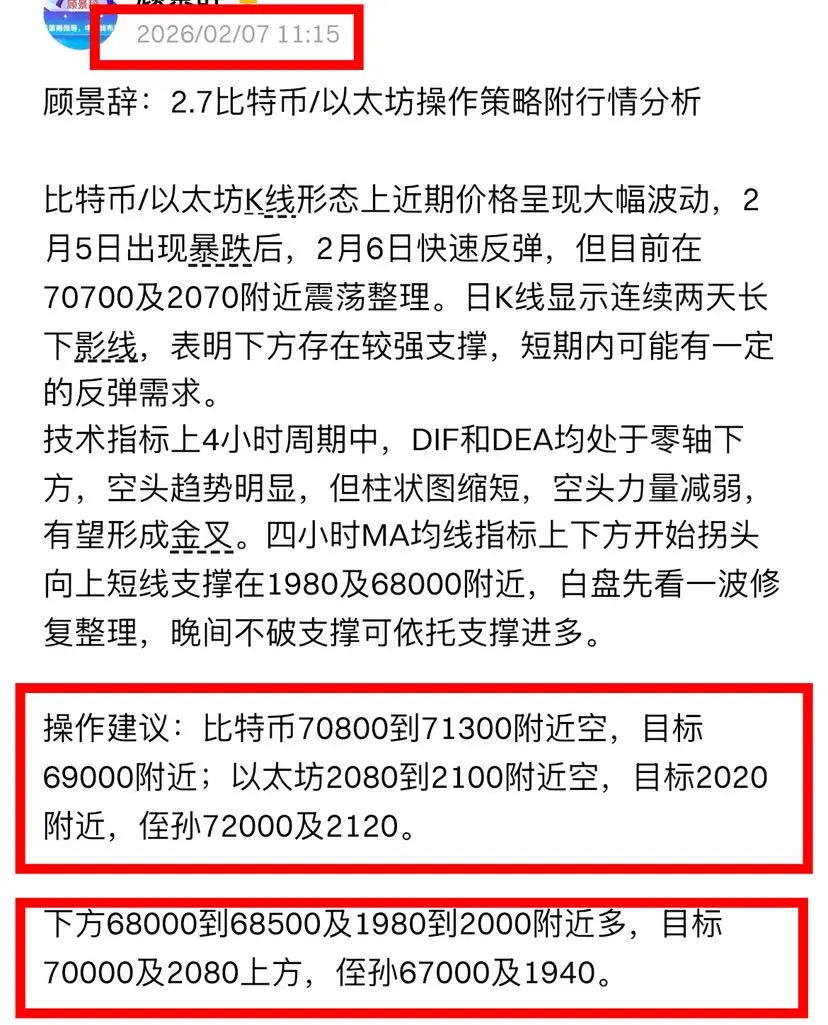

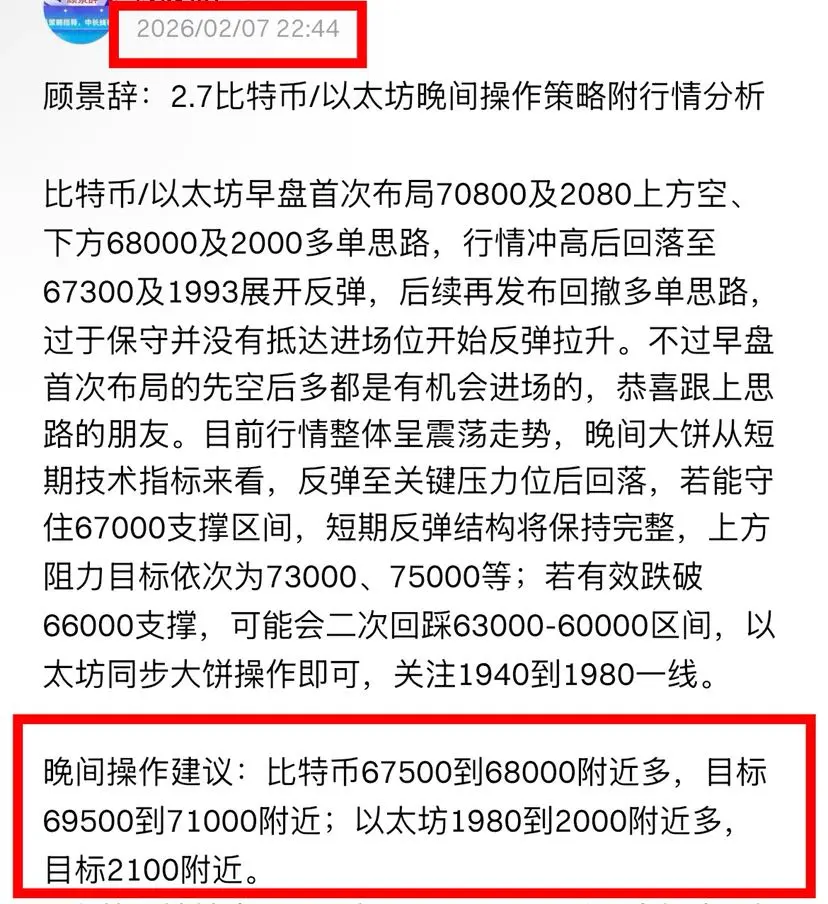

Gu Jingci: Bitcoin/Ethereum yesterday initially shorted then went long, overall space was pretty good

Bitcoin/Ethereum yesterday morning, the strategy was to short above 70800 and 2080. The market surged and then pulled back to 67300 and 1993. Afterwards, went long around 68000 and 2000. In the evening, I again reminded to go long at this level. After a night of consolidation, the price surged to around 70000 and 2130. First shorted then went long, capturing a total of 5500 points and 200 points of space. Congratulations to friends who followed the strategy and successfully made gains.

#当前行情抄底

View OriginalBitcoin/Ethereum yesterday morning, the strategy was to short above 70800 and 2080. The market surged and then pulled back to 67300 and 1993. Afterwards, went long around 68000 and 2000. In the evening, I again reminded to go long at this level. After a night of consolidation, the price surged to around 70000 and 2130. First shorted then went long, capturing a total of 5500 points and 200 points of space. Congratulations to friends who followed the strategy and successfully made gains.

#当前行情抄底

- Reward

- 7

- 2

- Repost

- Share

sheSh :

:

2026 Go Go Go 👊View More

#WhyAreGoldStocksandBTCFallingTogether?

🚨 MAJOR RISK-OFF FLUSH: BTC, GOLD & GDX ALL HIT IN TANDEM – MACRO LIQUIDITY CRUNCH IN EARLY FEB 2026 🚨

This isn't just a crypto crash — it's a broad liquidity/risk-off event slamming even classic safe havens like gold temporarily. High-volume cascades, leverage unwinds, USD strength, and hawkish Fed echoes are forcing correlated selling across assets. Weak hands flushed, but this sets up the classic "fear peak → strong rebound" playbook.

1. CURRENT PRICE & DRAWDOWN SNAPSHOT (as of ~Feb 8, 2026)

Bitcoin (BTC): Trading ~$69,000–$70,000 (bounced hard fro

🚨 MAJOR RISK-OFF FLUSH: BTC, GOLD & GDX ALL HIT IN TANDEM – MACRO LIQUIDITY CRUNCH IN EARLY FEB 2026 🚨

This isn't just a crypto crash — it's a broad liquidity/risk-off event slamming even classic safe havens like gold temporarily. High-volume cascades, leverage unwinds, USD strength, and hawkish Fed echoes are forcing correlated selling across assets. Weak hands flushed, but this sets up the classic "fear peak → strong rebound" playbook.

1. CURRENT PRICE & DRAWDOWN SNAPSHOT (as of ~Feb 8, 2026)

Bitcoin (BTC): Trading ~$69,000–$70,000 (bounced hard fro

BTC-1,68%

- Reward

- 9

- 8

- Repost

- Share

ShizukaKazu :

:

2026 Go Go Go 👊View More

🌈🌈

想要一个温暖的家

Created By@BigGuys,TakeMeBackT

Listing Progress

0.00%

MC:

$2.46K

Create My Token

February 8 Bitcoin Market | Large-Scale Structure and Trading Awareness

From the perspective of large-scale structure, Bitcoin short positions have not yet completed, currently still missing the **final decline—completion of the third wave**.

In terms of time cycles, multiple major bearish cycles are simultaneously entering correction phases. Do not be fooled by short-term rebounds and blindly go long at low prices.

The winter of Bitcoin has arrived, and it will enter a long-term oscillation and correction cycle. This prolonged consolidation may seem frustrating, but it is actually layin

From the perspective of large-scale structure, Bitcoin short positions have not yet completed, currently still missing the **final decline—completion of the third wave**.

In terms of time cycles, multiple major bearish cycles are simultaneously entering correction phases. Do not be fooled by short-term rebounds and blindly go long at low prices.

The winter of Bitcoin has arrived, and it will enter a long-term oscillation and correction cycle. This prolonged consolidation may seem frustrating, but it is actually layin

BTC-1,68%

- Reward

- like

- Comment

- Repost

- Share

$BTC

"What Caused the Great Bitcoin Crash? Evidence Points to Hedge Fund Collapse in Hong Kong"

By: Jeff Roberts, Fortune Magazine

February 6, 2026 Translated with some adaptation

Summary:

- Main causes of the crash:

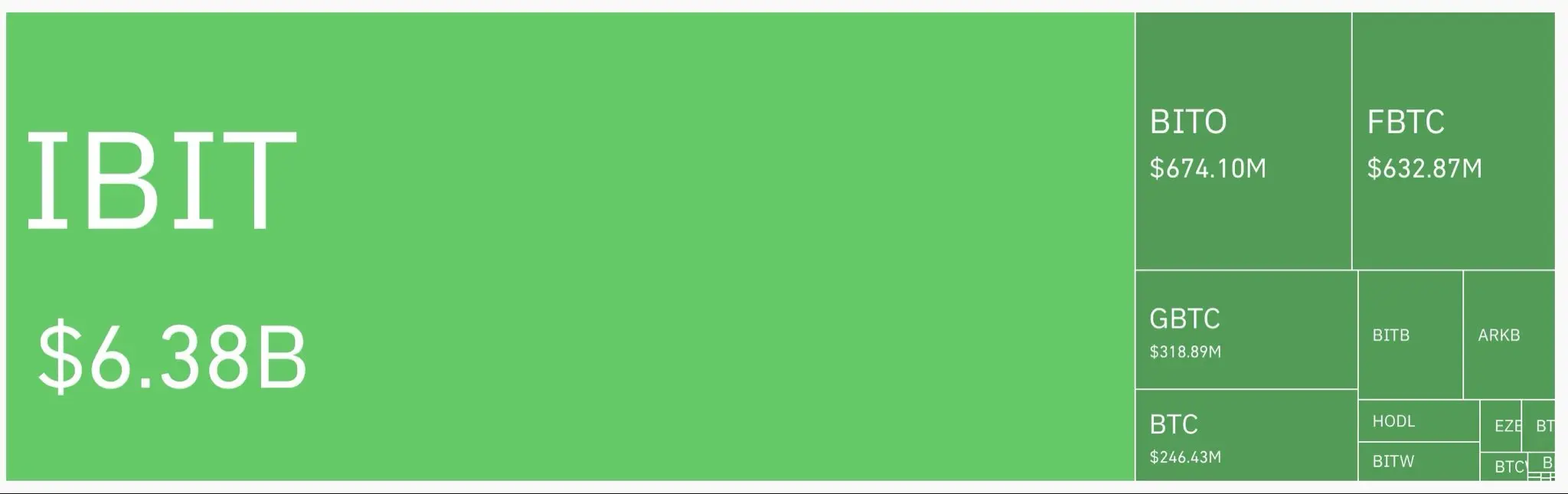

- Hong Kong Hedge Fund Theory: Collapse of hedge funds that used "Yen Carry Trade" (Yen Carry Trade) to finance highly leveraged positions in Bitcoin options for a BlackRock ETF trading Bitcoin spot $ibit (the largest Bitcoin ETF), with additional losses from the silver market.

- Liquidation of positions: The value of positions declined as the market fell, leading to forced sales

View Original"What Caused the Great Bitcoin Crash? Evidence Points to Hedge Fund Collapse in Hong Kong"

By: Jeff Roberts, Fortune Magazine

February 6, 2026 Translated with some adaptation

Summary:

- Main causes of the crash:

- Hong Kong Hedge Fund Theory: Collapse of hedge funds that used "Yen Carry Trade" (Yen Carry Trade) to finance highly leveraged positions in Bitcoin options for a BlackRock ETF trading Bitcoin spot $ibit (the largest Bitcoin ETF), with additional losses from the silver market.

- Liquidation of positions: The value of positions declined as the market fell, leading to forced sales

- Reward

- like

- Comment

- Repost

- Share

Market Analysis and Finding the Best Entry Point

- Reward

- like

- Comment

- Repost

- Share

On February 8th, Bitcoin market analysis from a higher timeframe perspective. The Bitcoin short positions are not yet complete; the final decline, which is the third wave, is still pending. From a time cycle perspective, multiple higher-level timeframes indicate that the bearish trend needs adjustment, so do not be fooled by a temporary rebound. Blindly buying low. The winter of Bitcoin has arrived, and the oscillation cycle will require several years of adjustment. However, this kind of adjustment also sets the stage for future major market movements. So, you must understand that your princip

BTC-1,68%

- Reward

- 2

- 2

- Repost

- Share

GateUser-e177c72e :

:

Is there still no divergence in the larger cycle?View More

Why am I always very optimistic about Bitcoin, God willing?

Decentralized

Non-inflationary

Permissionless

Popular

Divisible

Portable

Self-custody and inheritance

Crazy liquidity and easy liquidation

- Let me explain it to you more:

- Decentralized: Allows you to store and transfer value across time and space without third-party intervention. No entity controls it—neither a central bank nor anyone can stop the Bitcoin network or print it at will. The network operates 24/7 regardless of what happens.

- Non-inflationary: The supply is known and limited. Every four years, there’s a halving that re

View OriginalDecentralized

Non-inflationary

Permissionless

Popular

Divisible

Portable

Self-custody and inheritance

Crazy liquidity and easy liquidation

- Let me explain it to you more:

- Decentralized: Allows you to store and transfer value across time and space without third-party intervention. No entity controls it—neither a central bank nor anyone can stop the Bitcoin network or print it at will. The network operates 24/7 regardless of what happens.

- Non-inflationary: The supply is known and limited. Every four years, there’s a halving that re

MC:$2.48KHolders:2

0.01%

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

#CMEGroupPlansCMEToken #CMEGroupPlansCMEToken

CME Group’s exploration of a proprietary digital token marks a pivotal moment in the convergence of traditional finance and blockchain technology. As one of the largest regulated derivatives exchanges in the world, CME’s interest in tokenization signals a shift in how global financial infrastructure thinks about the movement of capital, the handling of collateral, the settlement of trades, and the operational realities of markets that increasingly operate around the clock. What initially may seem like a technical experiment actually reflects broade

CME Group’s exploration of a proprietary digital token marks a pivotal moment in the convergence of traditional finance and blockchain technology. As one of the largest regulated derivatives exchanges in the world, CME’s interest in tokenization signals a shift in how global financial infrastructure thinks about the movement of capital, the handling of collateral, the settlement of trades, and the operational realities of markets that increasingly operate around the clock. What initially may seem like a technical experiment actually reflects broade

- Reward

- 6

- 9

- Repost

- Share

Peacefulheart :

:

Happy New Year! 🤑View More

Shabana Mahmood could become the next and first Muslim prime minister of the UK if Keir Starmer is to resign. 🇬🇧#crypto

- Reward

- like

- Comment

- Repost

- Share

TMQF

踏马起飞

Created By@FocusOnJungle

Listing Progress

0.00%

MC:

$0.1

Create My Token

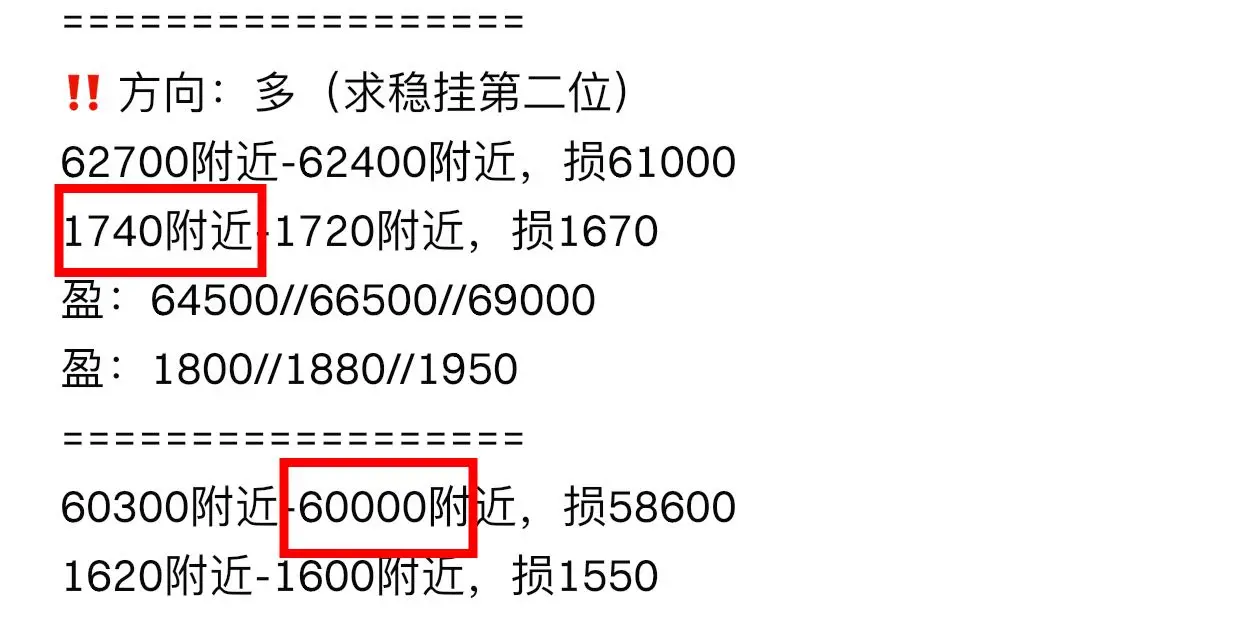

‼️Second order⬇️

‼️Direction: Long (prefer stability, second priority)

Around 67,300 - around 67,000, stop loss at 65,600

Around 2,010 - around 1,990, stop loss at 1,940

Profit: 69,000 // 70,500 // 72,200

Profit: 2,060 // 2,120 // 2,190

#Gate1月透明度报告

View Original‼️Direction: Long (prefer stability, second priority)

Around 67,300 - around 67,000, stop loss at 65,600

Around 2,010 - around 1,990, stop loss at 1,940

Profit: 69,000 // 70,500 // 72,200

Profit: 2,060 // 2,120 // 2,190

#Gate1月透明度报告

- Reward

- like

- Comment

- Repost

- Share

Daily dedicated time for answering private message questions: Regarding real-life choice anxiety, your current issues are: 1. Family background is average, and you have student loans. You want to join the military to alleviate financial pressure. 2. Anxiety about identity transformation, confusion about the future, and hope to make a decision you won't regret. 3. Value conflicts, the collapse of your original cognitive system, worrying that you are "selling freedom" for money. Here's my analysis: Actually, for ordinary people, the most important concern is not political issues, but whether you

View Original- Reward

- like

- Comment

- Repost

- Share

【$SIREN Signal】Hold cash + Cool down and observe after extreme volatility

$SIREN After an almost 200% surge in a single day, the price enters a high-level consolidation and cooling phase. The 4H chart shows a massive long upper shadow, which is a typical signal of profit-taking and main force distribution.

🎯 Direction: Hold cash

Market logic: The 4H cycle shows a massive transaction volume (a single candle nearly 700M USD), but the buy/sell ratio remains around 0.5, indicating that bullish and bearish forces are in brief balance amid intense volatility. Open interest (OI) remains stable rat

View Original$SIREN After an almost 200% surge in a single day, the price enters a high-level consolidation and cooling phase. The 4H chart shows a massive long upper shadow, which is a typical signal of profit-taking and main force distribution.

🎯 Direction: Hold cash

Market logic: The 4H cycle shows a massive transaction volume (a single candle nearly 700M USD), but the buy/sell ratio remains around 0.5, indicating that bullish and bearish forces are in brief balance amid intense volatility. Open interest (OI) remains stable rat

- Reward

- like

- Comment

- Repost

- Share

【$FET Signal】No Position + Weak Consolidation Awaiting Breakout

$FET Consolidating weakly in the 0.161-0.170 range, showing disorderly oscillation after a decline on the 4H timeframe. The price center shifts downward, but buy orders are densely clustered in the 0.161-0.163 area, forming a temporary support. The key contradiction is: open interest remains stable (OI Trend: Stable) while the price declines, combined with negative funding rates (-0.0045%) and sell orders from takers (is_taker_buying: false), indicating that bears are dominant but have not triggered panic selling. It appears more

View Original$FET Consolidating weakly in the 0.161-0.170 range, showing disorderly oscillation after a decline on the 4H timeframe. The price center shifts downward, but buy orders are densely clustered in the 0.161-0.163 area, forming a temporary support. The key contradiction is: open interest remains stable (OI Trend: Stable) while the price declines, combined with negative funding rates (-0.0045%) and sell orders from takers (is_taker_buying: false), indicating that bears are dominant but have not triggered panic selling. It appears more

- Reward

- like

- Comment

- Repost

- Share

#TopCoinsRisingAgainsttheTrend

🔥 #TopCoinsRisingAgainstTheTrend – More Defiance in the Feb 2026 Risk-Off Carnage! 🔥

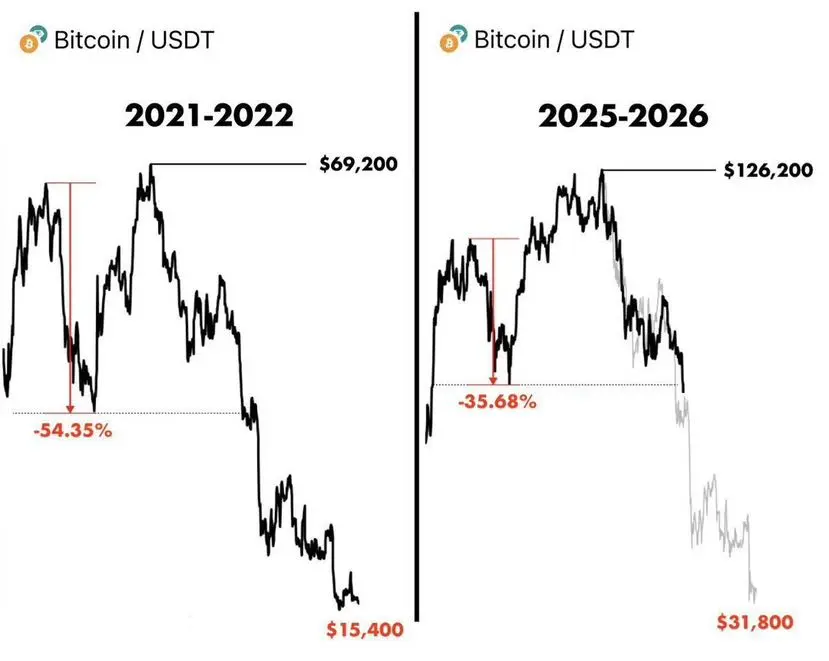

Crypto market remains brutal: BTC bounced from ~$60K–$61K lows to ~$69K–$70K (still -45% from 2025 ATH ~$126K, Feb 5 -15%+ crash), $2B+ liquidations spikes, total cap down hundreds of billions, most alts -15–30% weekly. Yet flight to quality accelerates — blue-chips like ETH holding/rebounding, XRP with ETF/utility rotation, SOL pockets of on-chain strength, and now TRON (TRX) emerging as a resilient performer (steady volumes, stablecoin dominance, shallower % losses).

This is

🔥 #TopCoinsRisingAgainstTheTrend – More Defiance in the Feb 2026 Risk-Off Carnage! 🔥

Crypto market remains brutal: BTC bounced from ~$60K–$61K lows to ~$69K–$70K (still -45% from 2025 ATH ~$126K, Feb 5 -15%+ crash), $2B+ liquidations spikes, total cap down hundreds of billions, most alts -15–30% weekly. Yet flight to quality accelerates — blue-chips like ETH holding/rebounding, XRP with ETF/utility rotation, SOL pockets of on-chain strength, and now TRON (TRX) emerging as a resilient performer (steady volumes, stablecoin dominance, shallower % losses).

This is

- Reward

- 2

- 1

- Repost

- Share

ybaser :

:

2026 Go Go Go 👊#BitwiseFilesforUNISpotETF #BitwiseFilesforUNISpotETF

Bitwise Asset Management has filed a registration statement with the United States Securities and Exchange Commission to launch a spot Uniswap ETF. This moves the industry into a new era where decentralized finance tokens are being considered for traditional investment vehicles. Instead of products tied to futures or derivatives, this ETF would directly hold the UNI token and allow investors exposure through regulated markets.

The filing itself does not mean the ETF will be approved. It marks the beginning of the regulatory review process.

Bitwise Asset Management has filed a registration statement with the United States Securities and Exchange Commission to launch a spot Uniswap ETF. This moves the industry into a new era where decentralized finance tokens are being considered for traditional investment vehicles. Instead of products tied to futures or derivatives, this ETF would directly hold the UNI token and allow investors exposure through regulated markets.

The filing itself does not mean the ETF will be approved. It marks the beginning of the regulatory review process.

- Reward

- 5

- 8

- Repost

- Share

Peacefulheart :

:

2026 GOGOGO 👊View More

#TopCoinsRisingAgainsttheTrend

🔥 #TopCoinsRisingAgainstTheTrend – More Defiance in the Feb 2026 Risk-Off Carnage! 🔥

Crypto market remains brutal: BTC bounced from ~$60K–$61K lows to ~$69K–$70K (still -45% from 2025 ATH ~$126K, Feb 5 -15%+ crash), $2B+ liquidations spikes, total cap down hundreds of billions, most alts -15–30% weekly. Yet flight to quality accelerates — blue-chips like ETH holding/rebounding, XRP with ETF/utility rotation, SOL pockets of on-chain strength, and now TRON (TRX) emerging as a resilient performer (steady volumes, stablecoin dominance, shallower % losses).

This is

🔥 #TopCoinsRisingAgainstTheTrend – More Defiance in the Feb 2026 Risk-Off Carnage! 🔥

Crypto market remains brutal: BTC bounced from ~$60K–$61K lows to ~$69K–$70K (still -45% from 2025 ATH ~$126K, Feb 5 -15%+ crash), $2B+ liquidations spikes, total cap down hundreds of billions, most alts -15–30% weekly. Yet flight to quality accelerates — blue-chips like ETH holding/rebounding, XRP with ETF/utility rotation, SOL pockets of on-chain strength, and now TRON (TRX) emerging as a resilient performer (steady volumes, stablecoin dominance, shallower % losses).

This is

- Reward

- 7

- 7

- Repost

- Share

ShizukaKazu :

:

2026 Go Go Go 👊View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

View More146.14K Popularity

34.39K Popularity

393.16K Popularity

14.92K Popularity

13.89K Popularity

Hot Gate Fun

View More- MC:$0.1Holders:10.00%

- MC:$2.38KHolders:10.00%

- MC:$2.37KHolders:10.00%

- MC:$0.1Holders:10.00%

- MC:$0.1Holders:10.00%

News

View MoreArthur Hayes: There is no secret conspiracy causing crashes in the cryptocurrency market

3 m

Trend Research Sells Additional 20,770 ETH Worth $43.57M, Retains Only 10,303 ETH

20 m

Market Report: Top 5 Cryptocurrency Gainers on February 8, 2026, led by MemeCore

56 m

Browser cache issues cause abnormal display of Arweave network block data.

1 h

Illinois proposes bill to establish state-level Bitcoin reserve

1 h

Pin