# BitwiseFilesforUNISpotETF

1.62K

Thynk

#BitwiseFilesforUNISpotETF

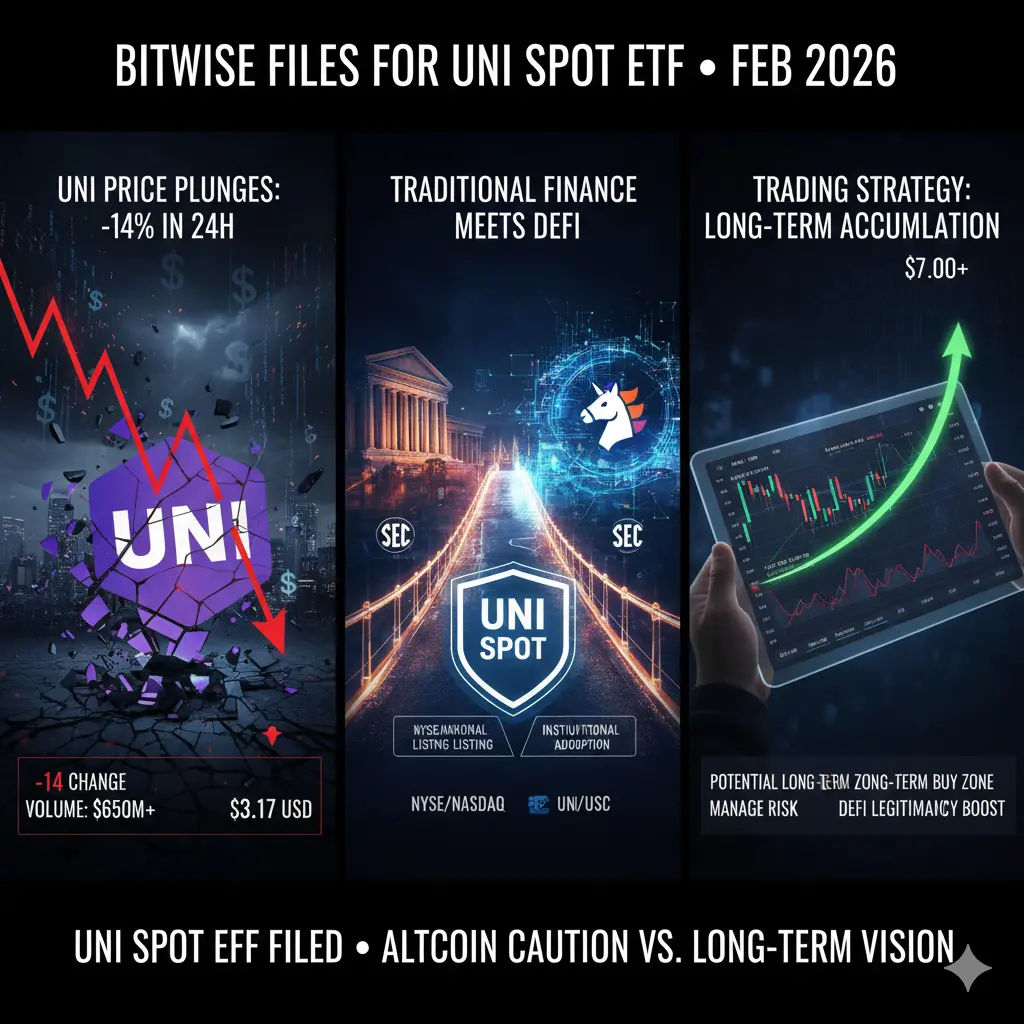

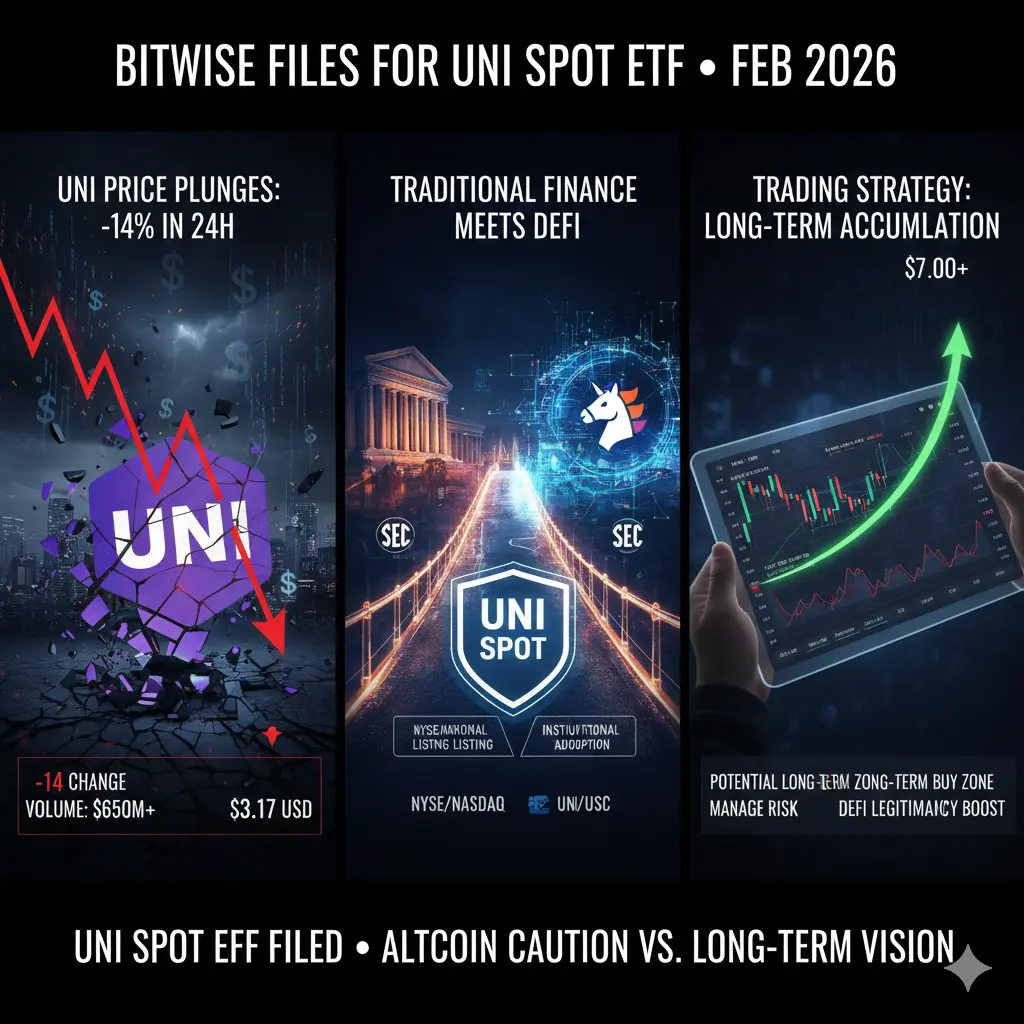

The filing by Bitwise for a spot Uniswap (UNI) ETF marks a pivotal moment in the ongoing convergence between decentralized finance and traditional investment vehicles. Under the theme #BitwiseFilesforUNISpotETF, this development reflects a broader institutional willingness to engage not just with crypto assets as commodities, but with DeFi governance tokens as legitimate components of diversified portfolios. Unlike earlier ETF narratives centered around Bitcoin or Ethereum, this move shifts attention toward protocol-level value, signaling that regulators and asset m

The filing by Bitwise for a spot Uniswap (UNI) ETF marks a pivotal moment in the ongoing convergence between decentralized finance and traditional investment vehicles. Under the theme #BitwiseFilesforUNISpotETF, this development reflects a broader institutional willingness to engage not just with crypto assets as commodities, but with DeFi governance tokens as legitimate components of diversified portfolios. Unlike earlier ETF narratives centered around Bitcoin or Ethereum, this move shifts attention toward protocol-level value, signaling that regulators and asset m

- Reward

- 2

- 2

- Repost

- Share

HeavenSlayerSupporter :

:

Your analysis of Bitwise's submission of a spot UNI ETF application is very insightful, accurately capturing the milestone significance of this event in the integration process of DeFi and traditional finance. You approach from multiple dimensions such as regulatory challenges, market structure evolution, and institutional acceptance, clearly outlining the deeper industry trend behind the UNI ETF application—DeFi is transitioning from a "financial experiment" to "financial infrastructure."View More

#BitwiseFilesforUNISpotETF

Bitwise Becomes First to File S-1 for Spot Uniswap (UNI) ETF – Official registration statement submitted to SEC on February 5, 2026.

UNI Spot ETF Filing Signals DeFi Push into Traditional Finance – Bitwise aims to offer regulated, direct exposure to UNI via stock exchanges.

UNI Token Hits Multi-Year Lows Amid Altcoin Pressure – Despite ETF news, UNI slumps 14–16% in 24 hours as broader market risk-off continues.

Daily UNI Token Burns Hit Record Highs – On-chain activity surges, but price fails to rally – potential supply squeeze long-term?

Institutional Interest in

Bitwise Becomes First to File S-1 for Spot Uniswap (UNI) ETF – Official registration statement submitted to SEC on February 5, 2026.

UNI Spot ETF Filing Signals DeFi Push into Traditional Finance – Bitwise aims to offer regulated, direct exposure to UNI via stock exchanges.

UNI Token Hits Multi-Year Lows Amid Altcoin Pressure – Despite ETF news, UNI slumps 14–16% in 24 hours as broader market risk-off continues.

Daily UNI Token Burns Hit Record Highs – On-chain activity surges, but price fails to rally – potential supply squeeze long-term?

Institutional Interest in

UNI-8,91%

- Reward

- like

- Comment

- Repost

- Share

#BitwiseFilesforUNISpotETF

The crypto market just witnessed another major institutional signal as Bitwise officially moved forward with plans to launch a spot ETF tied to Uniswap’s UNI token. This development has quickly become a hot topic because it goes far beyond price action it touches regulation, DeFi legitimacy, and the future direction of crypto investment products.

What makes this filing especially significant is that it focuses on UNI, a governance token deeply connected to decentralized finance rather than a base-layer asset like Bitcoin or Ethereum. By targeting UNI, Bitwise is eff

The crypto market just witnessed another major institutional signal as Bitwise officially moved forward with plans to launch a spot ETF tied to Uniswap’s UNI token. This development has quickly become a hot topic because it goes far beyond price action it touches regulation, DeFi legitimacy, and the future direction of crypto investment products.

What makes this filing especially significant is that it focuses on UNI, a governance token deeply connected to decentralized finance rather than a base-layer asset like Bitcoin or Ethereum. By targeting UNI, Bitwise is eff

- Reward

- 4

- 5

- Repost

- Share

HighAmbition :

:

Ape In 🚀View More

#BitwiseFilesforUNISpotETF

Bitwise Becomes First to File S-1 for Spot Uniswap (UNI) ETF – Official registration statement submitted to SEC on February 5, 2026.

UNI Spot ETF Filing Signals DeFi Push into Traditional Finance – Bitwise aims to offer regulated, direct exposure to UNI via stock exchanges.

UNI Token Hits Multi-Year Lows Amid Altcoin Pressure – Despite ETF news, UNI slumps 14–16% in 24 hours as broader market risk-off continues.

Daily UNI Token Burns Hit Record Highs – On-chain activity surges, but price fails to rally – potential supply squeeze long-term?

Institutional Interest in

Bitwise Becomes First to File S-1 for Spot Uniswap (UNI) ETF – Official registration statement submitted to SEC on February 5, 2026.

UNI Spot ETF Filing Signals DeFi Push into Traditional Finance – Bitwise aims to offer regulated, direct exposure to UNI via stock exchanges.

UNI Token Hits Multi-Year Lows Amid Altcoin Pressure – Despite ETF news, UNI slumps 14–16% in 24 hours as broader market risk-off continues.

Daily UNI Token Burns Hit Record Highs – On-chain activity surges, but price fails to rally – potential supply squeeze long-term?

Institutional Interest in

UNI-8,91%

- Reward

- 6

- 9

- Repost

- Share

GateUser-68291371 :

:

Hold tight 💪View More

#BitwiseFilesforUNISpotETF In February 2026, Bitwise Asset Management, a leading U.S. crypto asset manager, submitted an S‑1 registration statement to the SEC to launch a Uniswap (UNI) Spot ETF. This filing marks a significant milestone as it would create the first regulated exchange-traded fund that directly tracks the price of the UNI governance token, allowing both institutional and retail investors to access one of the largest decentralized finance (DeFi) assets through traditional brokerage channels. By enabling mainstream market participation in Uniswap, the ETF could bridge the gap betw

- Reward

- 2

- 2

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊View More

#BitwiseFilesforUNISpotETF In February 2026, Bitwise Asset Management, a leading U.S. crypto asset manager, submitted an S‑1 registration statement to the SEC to launch a Uniswap (UNI) Spot ETF. This filing marks a significant milestone as it would create the first regulated exchange-traded fund that directly tracks the price of the UNI governance token, allowing both institutional and retail investors to access one of the largest decentralized finance (DeFi) assets through traditional brokerage channels. By enabling mainstream market participation in Uniswap, the ETF could bridge the gap betw

UNI-8,91%

- Reward

- 5

- 7

- Repost

- Share

GateUser-e008d658 :

:

Continue to plummet, heading towards 2u. The market is experiencing a sharp decline, and if the downward trend continues, the price may reach 2u soon. Investors should stay cautious and monitor the situation closely.View More

#BitwiseFilesforUNISpotETF

Bitwise Initiates Uniswap Spot ETF Filing:

In February 2026, Bitwise Asset Management, a leading U.S. crypto asset manager, submitted an S‑1 registration statement to the SEC to launch a Uniswap (UNI) Spot ETF. This filing represents the first step toward a regulated exchange-traded fund that directly tracks the price of the UNI governance token, enabling institutional and retail investors to access one of the largest decentralized finance (DeFi) assets through traditional brokerage channels.

The Significance of a Spot UNI ETF:

A spot ETF backed by UNI tokens allows

Bitwise Initiates Uniswap Spot ETF Filing:

In February 2026, Bitwise Asset Management, a leading U.S. crypto asset manager, submitted an S‑1 registration statement to the SEC to launch a Uniswap (UNI) Spot ETF. This filing represents the first step toward a regulated exchange-traded fund that directly tracks the price of the UNI governance token, enabling institutional and retail investors to access one of the largest decentralized finance (DeFi) assets through traditional brokerage channels.

The Significance of a Spot UNI ETF:

A spot ETF backed by UNI tokens allows

- Reward

- 8

- 11

- Repost

- Share

ybaser :

:

New Year Wealth Explosion 🤑View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

101.74K Popularity

17.19K Popularity

387.05K Popularity

5.32K Popularity

2.8K Popularity

2.41K Popularity

1.62K Popularity

2.44K Popularity

1.56K Popularity

3.34K Popularity

11.73K Popularity

7.83K Popularity

19.87K Popularity

28.07K Popularity

23.03K Popularity

News

View MoreCryptoQuant: BTC has not yet reached the typical capitulation depth of -70% to -80% in previous cycles

15 m

After this week's US employment data release, the rate cut speculation has increased again, with the probability rising to 16%

18 m

Amidst the deep winter of the market, crypto executives are accelerating their "exits," with three executives announcing career changes within two days.

37 m

Today's Cryptocurrency News (February 6) | Bitcoin briefly falls below $60,000; BlackRock Bitcoin ETF trading volume exceeds $10 billion

53 m

Eigen Labs Developer Relations Director Nader Dabit departs and will join Cognition

55 m

Pin