# Bitcoin2026PriceOutlook

43.99K

As we enter 2026, where do you see Bitcoin heading this year—holding above the previous cycle high or moving into a prolonged consolidation? With shifting macro conditions, capital flows, and market cycles, is BTC’s long-term price anchor changing? Share your outlook and reasoning.

StylishKuri

#Bitcoin2026PriceOutlook Beyond Cycles: Bitcoin’s Era of Maturity Begins

As Bitcoin moves deeper into 2026, it is increasingly clear that the asset is no longer confined to the traditional four-year halving narrative. More than 21 months after the 2024 halving, price action is now driven less by miner supply shocks and more by liquidity dynamics, institutional behavior, regulation, and macroeconomic alignment. Bitcoin is no longer reacting to a single event—it is responding to an entire global system.

The Age of Full Institutionalization

2026 is shaping up to be the year Bitcoin fully complete

As Bitcoin moves deeper into 2026, it is increasingly clear that the asset is no longer confined to the traditional four-year halving narrative. More than 21 months after the 2024 halving, price action is now driven less by miner supply shocks and more by liquidity dynamics, institutional behavior, regulation, and macroeconomic alignment. Bitcoin is no longer reacting to a single event—it is responding to an entire global system.

The Age of Full Institutionalization

2026 is shaping up to be the year Bitcoin fully complete

- Reward

- 5

- 2

- Repost

- Share

YingYue :

:

2026 GOGOGO 👊View More

#Bitcoin2026PriceOutlook

As we enter 2026, Bitcoin sits at a critical inflection point that could define not only its trajectory for the year but also its evolving role in global financial markets.

Investors are closely watching whether BTC will hold above its previous cycle high, signaling a continuation of long-term bullish momentum, or move into a prolonged consolidation phase, reflecting accumulation and market digestion. The answer depends on multiple intersecting factors, including shifting macro conditions, capital flows, market cycles, regulatory developments, and evolving investor

As we enter 2026, Bitcoin sits at a critical inflection point that could define not only its trajectory for the year but also its evolving role in global financial markets.

Investors are closely watching whether BTC will hold above its previous cycle high, signaling a continuation of long-term bullish momentum, or move into a prolonged consolidation phase, reflecting accumulation and market digestion. The answer depends on multiple intersecting factors, including shifting macro conditions, capital flows, market cycles, regulatory developments, and evolving investor

- Reward

- 16

- 12

- Repost

- Share

Crypto_Buzz_with_Alex :

:

🌱 “Growth mindset activated! Learning so much from these posts.”View More

#Bitcoin2026PriceOutlook

As we move closer to 2026, Bitcoin is entering a more mature phase of its market cycle. With the effects of the 2024 halving still unfolding, reduced supply pressure, growing institutional participation, and expanding real-world use cases are shaping the long-term outlook.

Macroeconomic factors will play a key role. If global liquidity improves and interest rates ease, Bitcoin could benefit as a preferred hedge against inflation and currency uncertainty. At the same time, increasing adoption through ETFs, corporate balance sheets, and payment integrations is strengthen

As we move closer to 2026, Bitcoin is entering a more mature phase of its market cycle. With the effects of the 2024 halving still unfolding, reduced supply pressure, growing institutional participation, and expanding real-world use cases are shaping the long-term outlook.

Macroeconomic factors will play a key role. If global liquidity improves and interest rates ease, Bitcoin could benefit as a preferred hedge against inflation and currency uncertainty. At the same time, increasing adoption through ETFs, corporate balance sheets, and payment integrations is strengthen

BTC1,08%

- Reward

- 6

- 10

- Repost

- Share

EagleEye :

:

Thanks for sharing thins information wacthing closelyView More

Strong Start to 2026: Spot Bitcoin ETFs See Massive Inflows Amid Renewed Institutional Interest

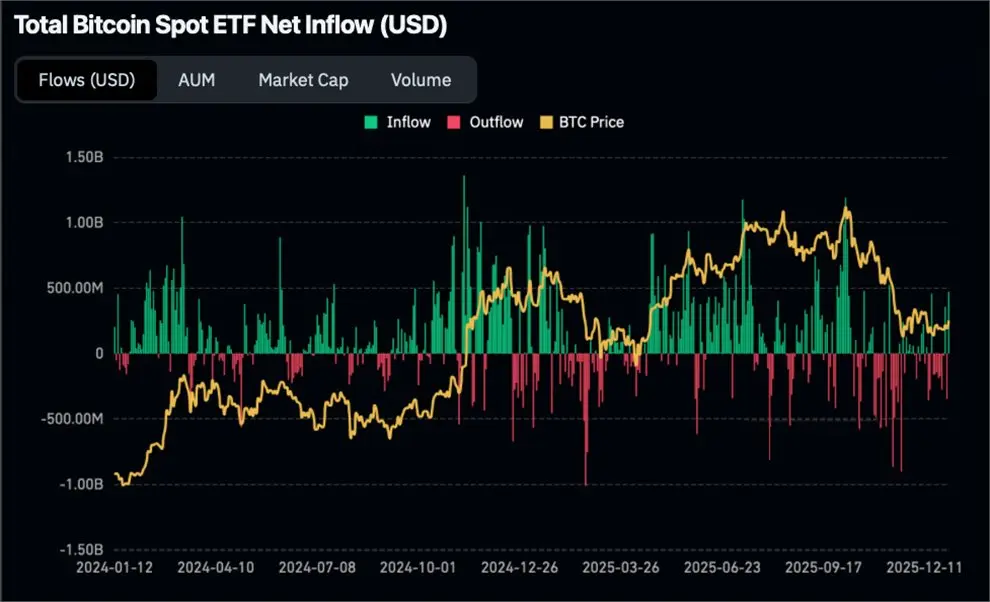

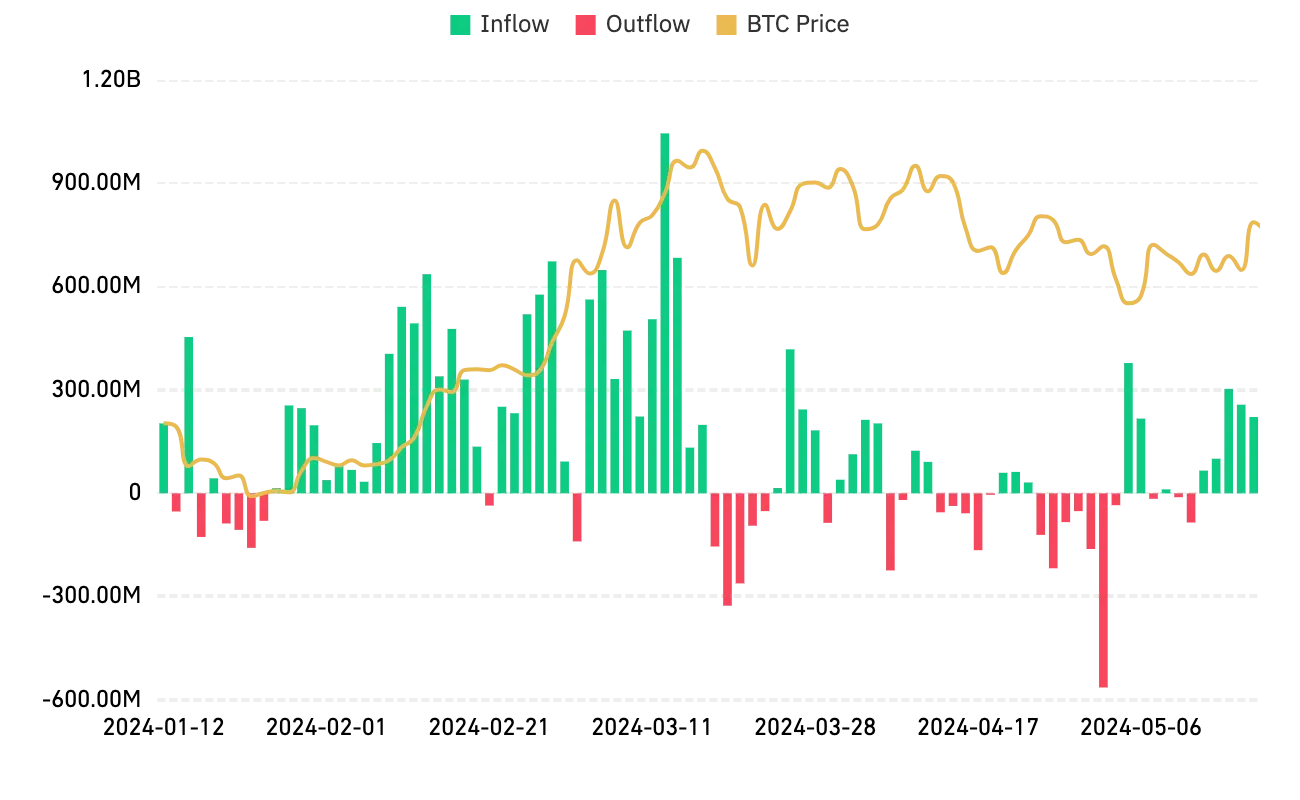

Spot Bitcoin ETFs, which allow investors to gain exposure to Bitcoin without directly holding the cryptocurrency, have kicked off 2026 with remarkable momentum. After a challenging end to 2025 marked by significant outflows, these regulated investment vehicles are witnessing a surge in capital, signaling growing confidence from both institutional and retail investors.

A Reversal from Late 2025 Outflows

2025 concluded on a sour note for spot Bitcoin ETFs. November and December saw record net outflows

Spot Bitcoin ETFs, which allow investors to gain exposure to Bitcoin without directly holding the cryptocurrency, have kicked off 2026 with remarkable momentum. After a challenging end to 2025 marked by significant outflows, these regulated investment vehicles are witnessing a surge in capital, signaling growing confidence from both institutional and retail investors.

A Reversal from Late 2025 Outflows

2025 concluded on a sour note for spot Bitcoin ETFs. November and December saw record net outflows

- Reward

- 71

- 77

- Repost

- Share

Bab谋_Ali :

:

Happy New Year! 🤑View More

Allegations that the US Could Seize Venezuela's Secret Bitcoin Reserves Stirred the Crypto Markets.

✨ Following the capture of Venezuelan President Nicolás Maduro by US forces, speculation that the country's secret crypto asset reserves could be seized by the US continues to affect the cryptocurrency markets.

CNBC's crypto market reporter, MacKenzie Sigalos, highlighted reports that Venezuela converted its oil revenues into Bitcoin via Tether (USDT) to circumvent sanctions. Sigalos stated, "Even the possibility of the US government seizing and holding these assets is a strong bullish signal f

✨ Following the capture of Venezuelan President Nicolás Maduro by US forces, speculation that the country's secret crypto asset reserves could be seized by the US continues to affect the cryptocurrency markets.

CNBC's crypto market reporter, MacKenzie Sigalos, highlighted reports that Venezuela converted its oil revenues into Bitcoin via Tether (USDT) to circumvent sanctions. Sigalos stated, "Even the possibility of the US government seizing and holding these assets is a strong bullish signal f

BTC1,08%

- Reward

- 37

- 20

- Repost

- Share

CryptoAlice :

:

2026 GOGOGO 👊View More

#Bitcoin2026PriceOutlook

As we step into 2026, the narrative is shifting from

"Will we break the ATH?" to "Can we sustain it?" 🧐

Here’s my take on where BTC is heading:

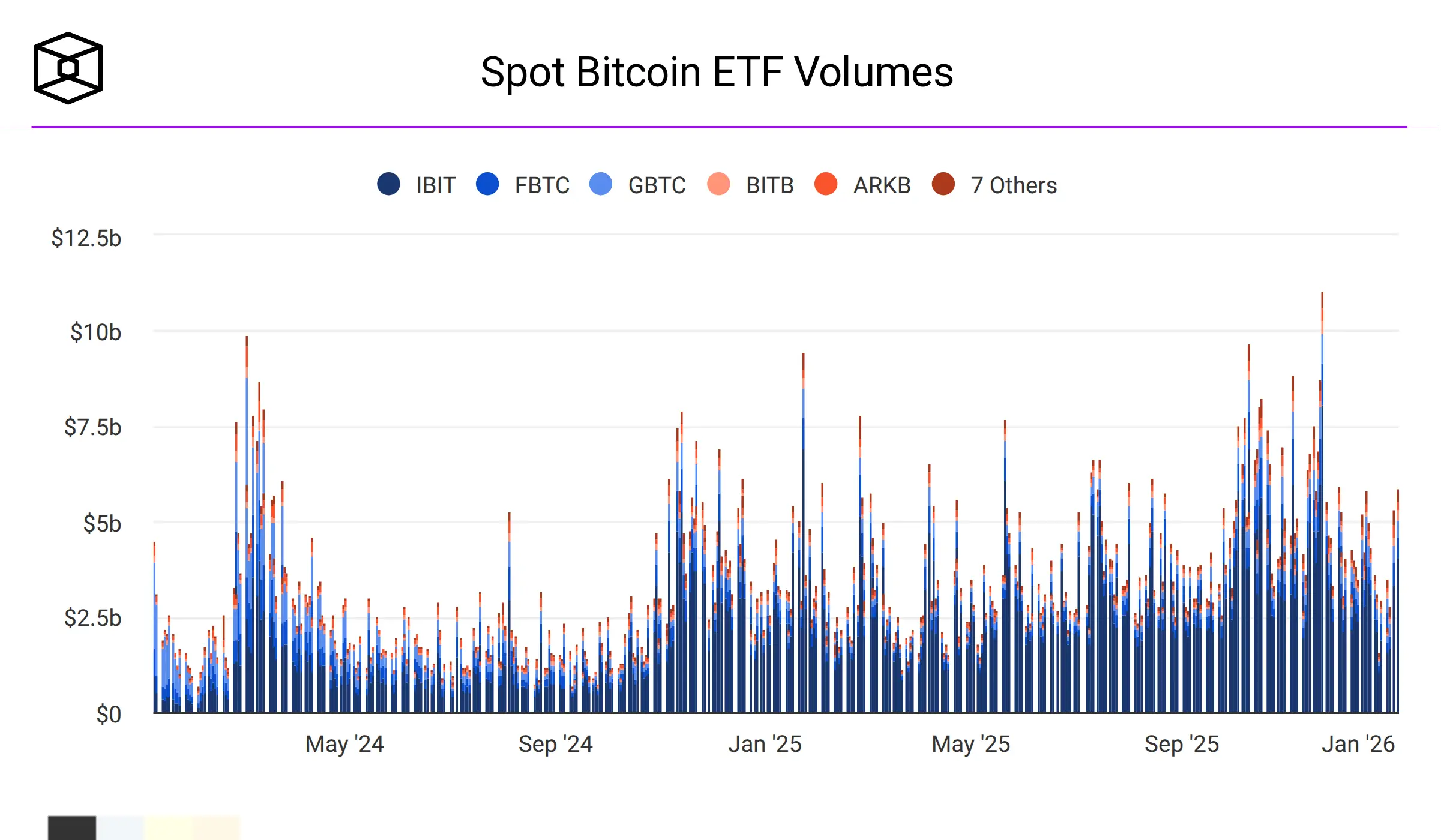

The Scenario: Higher Lows, Not Deep Crashes

I don't see a prolonged consolidation in the trenches. I see Bitcoin holding firmly

above the previous cycle's peak. The 4-year cycle is effectively dead

(or at least severely mutated) thanks to the Spot ETFs. We've moved from a

retail-driven hype cycle to an institutional asset allocation model.

The New Price Anchor The anchor has

changed. It used to be the halving; now it's glo

As we step into 2026, the narrative is shifting from

"Will we break the ATH?" to "Can we sustain it?" 🧐

Here’s my take on where BTC is heading:

The Scenario: Higher Lows, Not Deep Crashes

I don't see a prolonged consolidation in the trenches. I see Bitcoin holding firmly

above the previous cycle's peak. The 4-year cycle is effectively dead

(or at least severely mutated) thanks to the Spot ETFs. We've moved from a

retail-driven hype cycle to an institutional asset allocation model.

The New Price Anchor The anchor has

changed. It used to be the halving; now it's glo

BTC1,08%

- Reward

- 1

- 2

- Repost

- Share

Vortex_King :

:

2026 GOGOGO 👊View More

#Bitcoin2026PriceOutlook As 2026 unfolds, Bitcoin enters a new phase marked by heightened volatility, stronger institutional participation, and growing debate over its next major direction. After peaking above the $120,000 region in late 2025, Bitcoin experienced a healthy correction and began 2026 consolidating, reflecting a market that is transitioning from euphoric expansion to strategic positioning. This phase is not a sign of weakness, but rather a recalibration as investors digest macroeconomic conditions, regulatory developments, and long-term adoption trends.

From a bullish perspective

From a bullish perspective

BTC1,08%

- Reward

- 16

- 17

- Repost

- Share

Sdk13 :

:

2026 GOGOGO 👊View More

#Bitcoin2026PriceOutlook 📈 Bitcoin 2026 Price Outlook — Patience Over Predictions

Instead of chasing extreme price targets, my 2026 Bitcoin outlook is built on structure, adoption, and liquidity — not hype or emotions.

Bitcoin has already proven one thing clearly:

It survives cycles, fear, and narratives — and returns stronger every time.

🔹 What Supports BTC in 2026

• Growing institutional participation

• Spot ETFs improving access and liquidity

• Reduced supply pressure post-halving

• Increasing use of Bitcoin as long-term value storage

🔹 What Could Slow It Down

• Macroeconomic tightening

Instead of chasing extreme price targets, my 2026 Bitcoin outlook is built on structure, adoption, and liquidity — not hype or emotions.

Bitcoin has already proven one thing clearly:

It survives cycles, fear, and narratives — and returns stronger every time.

🔹 What Supports BTC in 2026

• Growing institutional participation

• Spot ETFs improving access and liquidity

• Reduced supply pressure post-halving

• Increasing use of Bitcoin as long-term value storage

🔹 What Could Slow It Down

• Macroeconomic tightening

BTC1,08%

- Reward

- 8

- 11

- Repost

- Share

ybaser :

:

2026 GOGOGO 👊View More

#Bitcoin2026PriceOutlook

Bitcoin 2026 Price Outlook | Measured Growth & Strategic Perspective 🚀

As we move into 2026, Bitcoin demonstrates early signs of resilience and steady momentum. Market structure suggests that accumulation phases are stabilizing, providing a foundation for potential upward trends while volatility remains part of the landscape.

Investors are approaching Bitcoin with disciplined strategy, focusing on long-term positioning, trend confirmation, and prudent risk management. Rather than chasing short-term spikes, the market is rewarding those who stay informed, patient, and

Bitcoin 2026 Price Outlook | Measured Growth & Strategic Perspective 🚀

As we move into 2026, Bitcoin demonstrates early signs of resilience and steady momentum. Market structure suggests that accumulation phases are stabilizing, providing a foundation for potential upward trends while volatility remains part of the landscape.

Investors are approaching Bitcoin with disciplined strategy, focusing on long-term positioning, trend confirmation, and prudent risk management. Rather than chasing short-term spikes, the market is rewarding those who stay informed, patient, and

BTC1,08%

- Reward

- 9

- 4

- Repost

- Share

QueenOfTheDay :

:

Happy New Year! 🤑View More

#Bitcoin2026PriceOutlook GOLDMAN SACHS: Regulation is the next crypto catalyst $RENDER

Goldman is bullish on crypto in 2026, saying regulatory clarity will unlock the next wave of institutional adoption. $BTC

Key points:

SEC uncertainty is fading under new leadership

U.S. market structure bills could open the door to tokenization, DeFi, and major inflows

Infrastructure players stand to benefit most

71% of institutions plan to increase crypto exposure

📊 Snapshot:

#BTC ETFs: ~$115B+ AUM

$ETH ETFs: $20B+

Stablecoins: nearing $300B

With pro-crypto policy momentum in the U.S., 2026 may be the i

Goldman is bullish on crypto in 2026, saying regulatory clarity will unlock the next wave of institutional adoption. $BTC

Key points:

SEC uncertainty is fading under new leadership

U.S. market structure bills could open the door to tokenization, DeFi, and major inflows

Infrastructure players stand to benefit most

71% of institutions plan to increase crypto exposure

📊 Snapshot:

#BTC ETFs: ~$115B+ AUM

$ETH ETFs: $20B+

Stablecoins: nearing $300B

With pro-crypto policy momentum in the U.S., 2026 may be the i

- Reward

- 2

- Comment

- Repost

- Share

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

257.54K Popularity

877.09K Popularity

10.64M Popularity

102.12K Popularity

534.9K Popularity

299.37K Popularity

63.58K Popularity

43.66K Popularity

30.53K Popularity

28.27K Popularity

28.08K Popularity

24.86K Popularity

27.5K Popularity

54.38K Popularity

News

View MoreThe whale "pension-usdt.eth" closed its position to take profit on BTC long positions, with a daily profit of approximately $1 million.

13 m

The Supreme Court ruling could trigger over $175 billion in tariff refunds

16 m

Analysis: The future of Bitcoin depends on market sentiment, with a fair value of approximately $75,000

22 m

Traditional Finance Drop Alert: NTES drops over 4%

32 m

U.S. Democratic Congresswoman Calls on the Treasury Department to Investigate Potential Conflicts of Interest and National Security Risks Involving WLFI

39 m

Pin