# BuyTheDipOrWaitNow?

339.54K

HighAmbition

#BuyTheDipOrWaitNow?

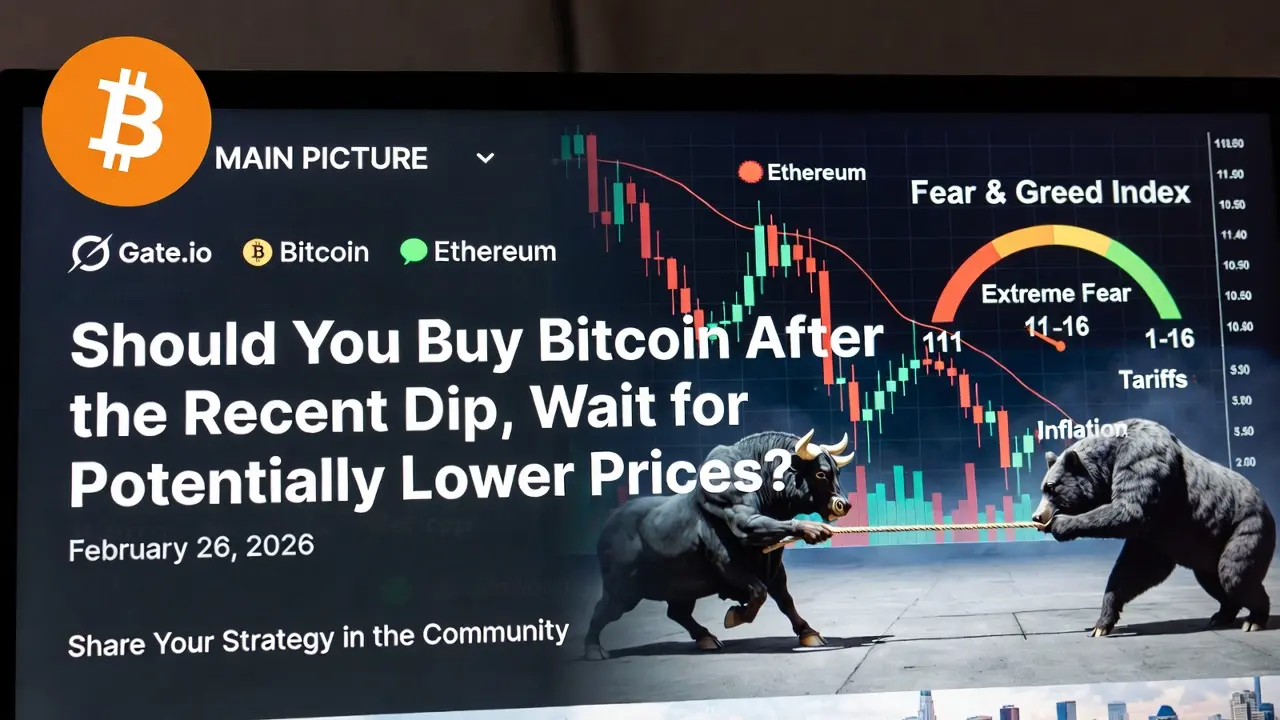

Should You Buy Bitcoin After the Recent Dip, or Wait for Potentially Lower Prices?

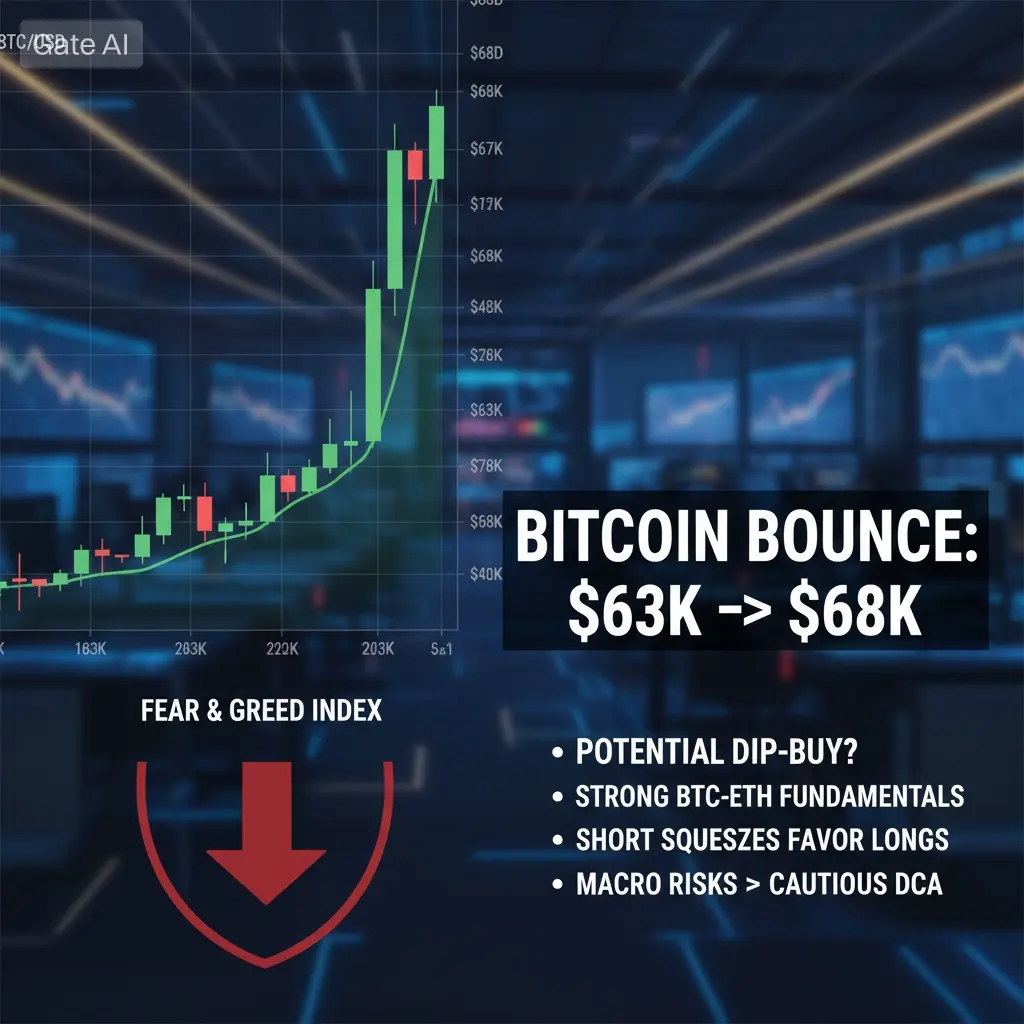

The debate around “buy the dip or wait” is dominating crypto conversations today. After one of the sharpest corrections in recent cycles, Bitcoin (BTC) and the broader crypto market are showing signs of relief, but uncertainty remains. The price action, macro overlays, derivative positioning, and on-chain data all point to a market caught in a classic tug-of-war: bulls defending support, bears exploiting every weak macro cue, and retail investors trying to pick a bottom.

1. Current Market S

Should You Buy Bitcoin After the Recent Dip, or Wait for Potentially Lower Prices?

The debate around “buy the dip or wait” is dominating crypto conversations today. After one of the sharpest corrections in recent cycles, Bitcoin (BTC) and the broader crypto market are showing signs of relief, but uncertainty remains. The price action, macro overlays, derivative positioning, and on-chain data all point to a market caught in a classic tug-of-war: bulls defending support, bears exploiting every weak macro cue, and retail investors trying to pick a bottom.

1. Current Market S

- Reward

- 5

- 3

- Repost

- Share

Discovery :

:

2026 GOGOGO 👊View More

🤔 #BuyTheDipOrWaitNow? — 5 Smart Tips for Volatile Crypto Markets

Buying the dip can be tempting — but in volatile markets, strategy beats impulse. Here are 5 actionable tips:

1️⃣ Scale In Gradually

Don’t deploy all your capital at once. Buy in tranches at different support levels to reduce risk and avoid emotional panic during sudden swings.

2️⃣ Keep Stablecoin Reserves

Maintain cash or stablecoins to take advantage of deeper dips or opportunities on high-conviction assets. Liquidity is your power.

3️⃣ Monitor On-Chain & Market Signals

Watch whale accumulation, DEX flows, open interest, and

Buying the dip can be tempting — but in volatile markets, strategy beats impulse. Here are 5 actionable tips:

1️⃣ Scale In Gradually

Don’t deploy all your capital at once. Buy in tranches at different support levels to reduce risk and avoid emotional panic during sudden swings.

2️⃣ Keep Stablecoin Reserves

Maintain cash or stablecoins to take advantage of deeper dips or opportunities on high-conviction assets. Liquidity is your power.

3️⃣ Monitor On-Chain & Market Signals

Watch whale accumulation, DEX flows, open interest, and

- Reward

- 3

- Comment

- Repost

- Share

#BuyTheDipOrWaitNow?

Understanding Market Cycles, Liquidity Shifts, and Strategic Accumulation in Volatile Times

The question “Buy the dip or wait now?” is far more than a trading decision it is a reflection of how modern markets operate under uncertainty, liquidity dynamics, and institutional influence. Markets are no longer purely driven by retail sentiment; institutional capital, algorithmic flows, and macroeconomic cycles dictate structural behavior. In my view, the current environment represents a transitional phase: prices may fluctuate sharply in the short term, but structural support,

Understanding Market Cycles, Liquidity Shifts, and Strategic Accumulation in Volatile Times

The question “Buy the dip or wait now?” is far more than a trading decision it is a reflection of how modern markets operate under uncertainty, liquidity dynamics, and institutional influence. Markets are no longer purely driven by retail sentiment; institutional capital, algorithmic flows, and macroeconomic cycles dictate structural behavior. In my view, the current environment represents a transitional phase: prices may fluctuate sharply in the short term, but structural support,

- Reward

- 5

- 6

- Repost

- Share

ANTOR :

:

2026 GOGOGO 👊View More

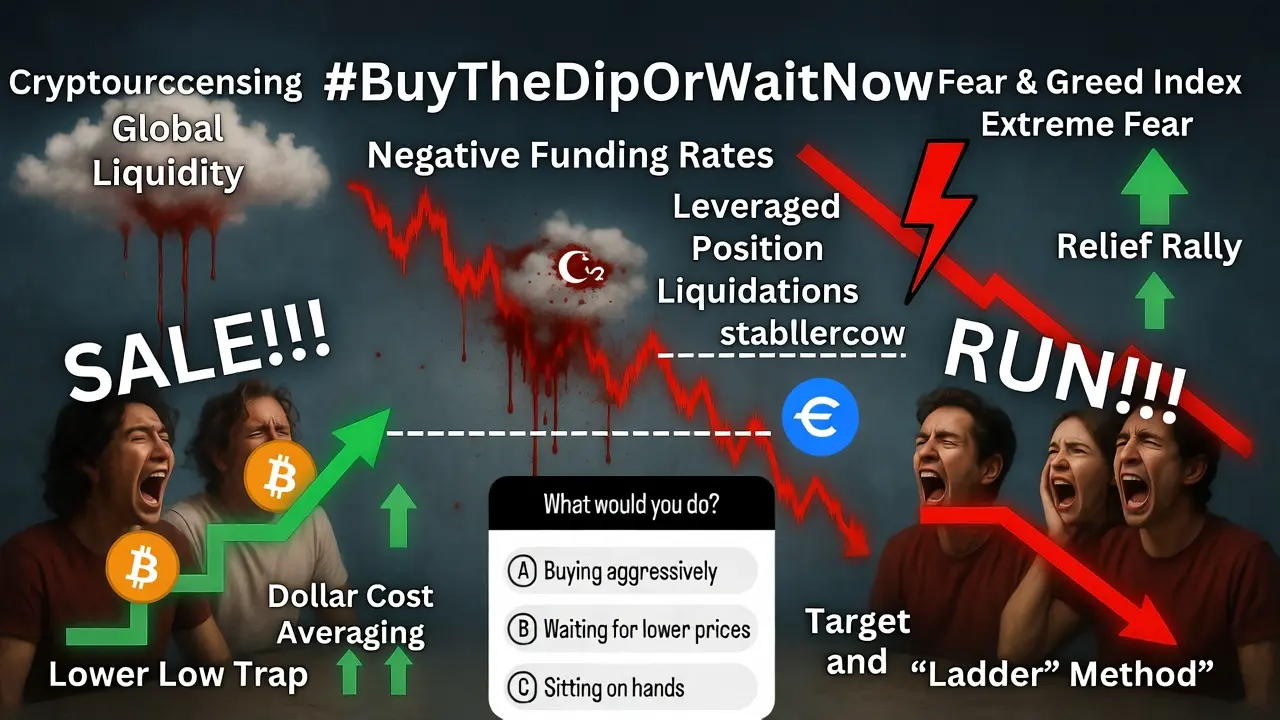

#BuyTheDipOrWaitNow?

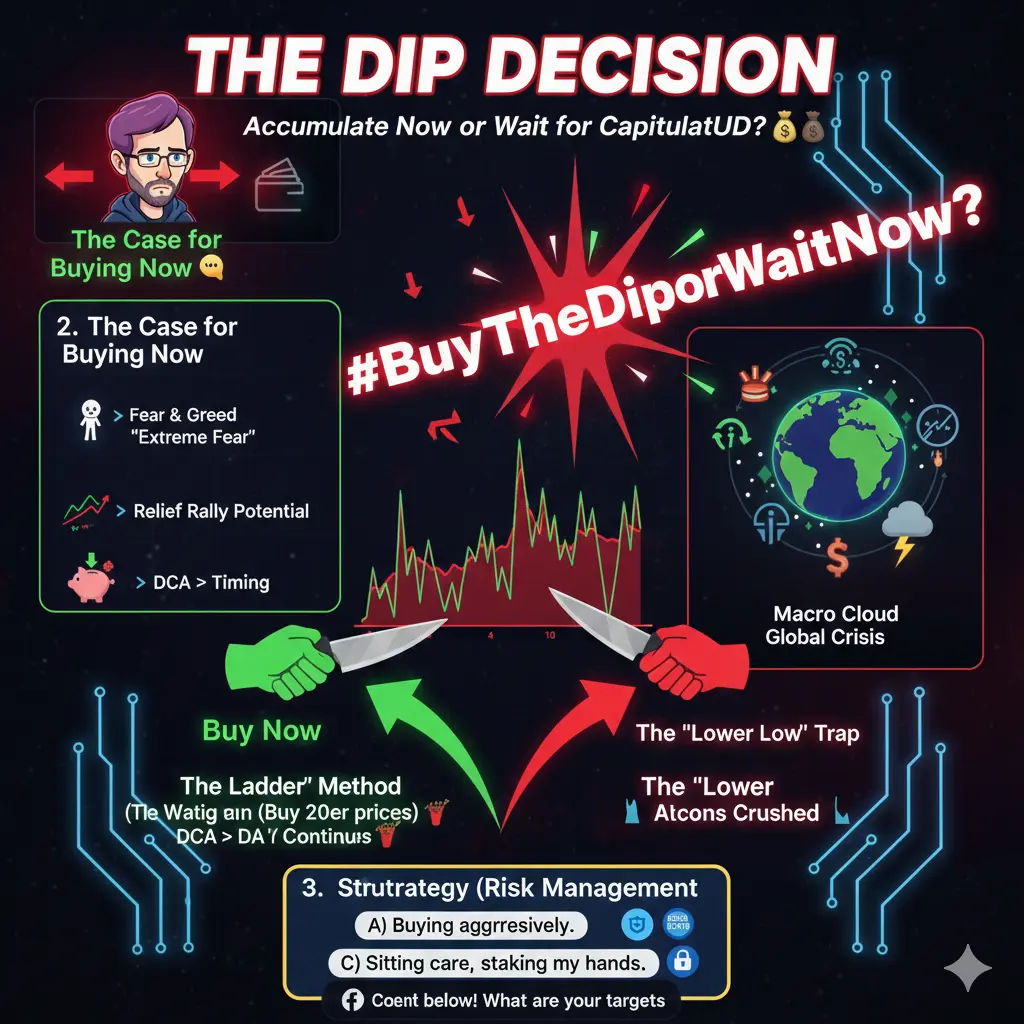

Title: THE DIP DECISION: Accumulate Now or Wait for Capitulation? 🤔

Content:

The charts are bleeding. The funding rates are negative. And your feed is flooded with two types of people: the ones screaming "SALE!!!" and the ones screaming "RUN!!!"

Welcome to the million-dollar question: #BuyTheDipOrWaitNow?

If you've been in crypto long enough, you know that catching a falling knife is painful, but missing the bottom is equally frustrating. So, let's strip away the emotion and look at the data, the cycles, and the strategy.

1. The Case for Buying Now

· Fear & Greed is "Ex

Title: THE DIP DECISION: Accumulate Now or Wait for Capitulation? 🤔

Content:

The charts are bleeding. The funding rates are negative. And your feed is flooded with two types of people: the ones screaming "SALE!!!" and the ones screaming "RUN!!!"

Welcome to the million-dollar question: #BuyTheDipOrWaitNow?

If you've been in crypto long enough, you know that catching a falling knife is painful, but missing the bottom is equally frustrating. So, let's strip away the emotion and look at the data, the cycles, and the strategy.

1. The Case for Buying Now

· Fear & Greed is "Ex

- Reward

- 6

- 4

- Repost

- Share

CryptoChampion :

:

To The Moon 🌕View More

$ESP /USDT Technical Update.

Price is currently holding above a key support zone at $0.148–$0.150, which previously acted as demand. As long as this area holds, a relief bounce is possible. Immediate resistance lies at $0.162–$0.165, followed by a major resistance near $0.178–$0.180.

Entry Zone: $0.148 – $0.152

Targets:

$0.162

$0.170

$0.180

Stop Loss: $0.143

Market structure remains volatile, so manage risk properly and wait for confirmation near support.

#BitcoinBouncesBack #VitalikSellsETH #BuyTheDipOrWaitNow?

Price is currently holding above a key support zone at $0.148–$0.150, which previously acted as demand. As long as this area holds, a relief bounce is possible. Immediate resistance lies at $0.162–$0.165, followed by a major resistance near $0.178–$0.180.

Entry Zone: $0.148 – $0.152

Targets:

$0.162

$0.170

$0.180

Stop Loss: $0.143

Market structure remains volatile, so manage risk properly and wait for confirmation near support.

#BitcoinBouncesBack #VitalikSellsETH #BuyTheDipOrWaitNow?

ESP-17,79%

- Reward

- 2

- Comment

- Repost

- Share

#BuyTheDipOrWaitNow? — GT TOKEN (GT) Edition 💎

Crypto markets never sleep, and neither does the eternal question every trader asks when prices slide: Do you buy the dip… or hold back and wait? When it comes to GT TOKEN (GT), this debate is even hotter because of the token’s utility and its growing role in the crypto ecosystem.

📊 Price Snapshot (as of today vs yesterday):

• Today’s price: ~ $6.88 USD per GT 🟢 (up slightly)

• Yesterday’s price: Around $6.60–$6.90 USD range (slightly lower overall)

This means GT is showing moderate resilience after a dip, and recent data indicates a small upti

Crypto markets never sleep, and neither does the eternal question every trader asks when prices slide: Do you buy the dip… or hold back and wait? When it comes to GT TOKEN (GT), this debate is even hotter because of the token’s utility and its growing role in the crypto ecosystem.

📊 Price Snapshot (as of today vs yesterday):

• Today’s price: ~ $6.88 USD per GT 🟢 (up slightly)

• Yesterday’s price: Around $6.60–$6.90 USD range (slightly lower overall)

This means GT is showing moderate resilience after a dip, and recent data indicates a small upti

GT2,75%

- Reward

- 2

- 1

- Repost

- Share

ybaser :

:

Great work! Very clear and professionaL#BuyTheDipOrWaitNow? Smart Money Isn’t Asking — They’re Executing**

Retail traders keep arguing in circles:

“Is this the bottom?”

“Should I wait?”

“What if it dumps more?”

Meanwhile, smart money doesn’t debate on emotions — they operate on structure.

Here’s the uncomfortable truth no one wants to hear:

📉 Dips don’t announce themselves

📊 Bottoms are built, not predicted

⏳ Waiting for confirmation is the most expensive habit in crypto

When volatility spikes, weak hands freeze.

When fear dominates headlines, disciplined capital quietly scales in.

This market isn’t about being right — it’s about

Retail traders keep arguing in circles:

“Is this the bottom?”

“Should I wait?”

“What if it dumps more?”

Meanwhile, smart money doesn’t debate on emotions — they operate on structure.

Here’s the uncomfortable truth no one wants to hear:

📉 Dips don’t announce themselves

📊 Bottoms are built, not predicted

⏳ Waiting for confirmation is the most expensive habit in crypto

When volatility spikes, weak hands freeze.

When fear dominates headlines, disciplined capital quietly scales in.

This market isn’t about being right — it’s about

- Reward

- 2

- 1

- Repost

- Share

ybaser :

:

Good luck and prosperity 🧧🔍 #BuyTheDipOrWaitNow? 🤔

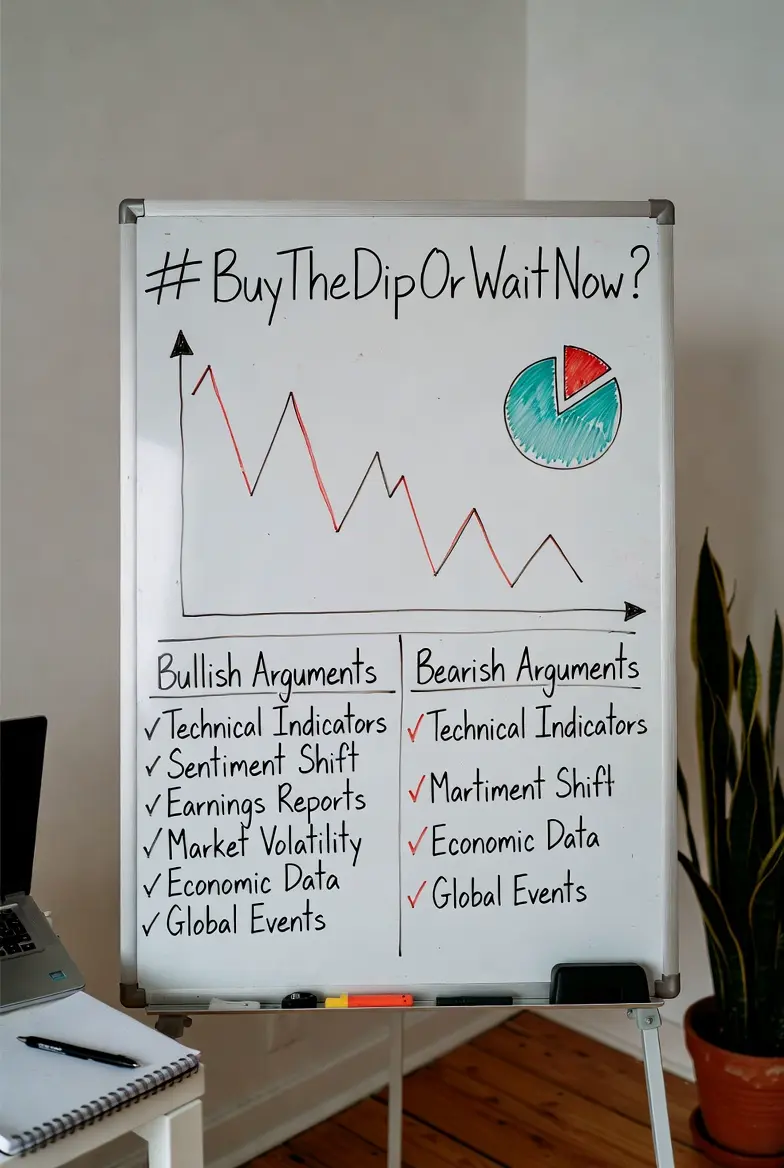

Market's volatile, emotions are high, but strategy's key 💡.

- Buy the dip: Historically rewards conviction, resets momentum, and creates opportunities 📈

- Wait: Patience protects capital, confirms trends, and reduces risk 🛡️

No perfect entry, only strategy 📊. Manage risk:

- Scale in gradually

- Set invalidation levels

- Stay disciplined

Long-term thesis intact? Or structural weakness? 🤔 Make a calculated decision, not an emotional one 💪.$BTC $ETH $SOL

Market's volatile, emotions are high, but strategy's key 💡.

- Buy the dip: Historically rewards conviction, resets momentum, and creates opportunities 📈

- Wait: Patience protects capital, confirms trends, and reduces risk 🛡️

No perfect entry, only strategy 📊. Manage risk:

- Scale in gradually

- Set invalidation levels

- Stay disciplined

Long-term thesis intact? Or structural weakness? 🤔 Make a calculated decision, not an emotional one 💪.$BTC $ETH $SOL

- Reward

- like

- Comment

- Repost

- Share

#BuyTheDipOrWaitNow? — GT TOKEN (GT) Edition 💎

Crypto markets never sleep, and neither does the eternal question every trader asks when prices slide: Do you buy the dip… or hold back and wait? When it comes to GT TOKEN (GT), this debate is even hotter because of the token’s utility and its growing role in the crypto ecosystem.

📊 Price Snapshot (as of today vs yesterday):

• Today’s price: ~ $6.88 USD per GT 🟢 (up slightly)

• Yesterday’s price: Around $6.60–$6.90 USD range (slightly lower overall)

This means GT is showing moderate resilience after a dip, and recent data indicates a small upti

Crypto markets never sleep, and neither does the eternal question every trader asks when prices slide: Do you buy the dip… or hold back and wait? When it comes to GT TOKEN (GT), this debate is even hotter because of the token’s utility and its growing role in the crypto ecosystem.

📊 Price Snapshot (as of today vs yesterday):

• Today’s price: ~ $6.88 USD per GT 🟢 (up slightly)

• Yesterday’s price: Around $6.60–$6.90 USD range (slightly lower overall)

This means GT is showing moderate resilience after a dip, and recent data indicates a small upti

GT2,75%

- Reward

- 11

- 16

- Repost

- Share

HighAmbition :

:

very informative postView More

#BuyTheDipOrWaitNow?

📉 Buy The Dip or Wait Now? – The Smart Investor’s Dilemma

The market pulls back… charts turn red… fear spreads fast.

And the big question echoes everywhere:

#BuyTheDipOrWaitNow?

This is where average traders panic — and smart investors position.

🔎 What Smart Players Ask First:

Is this a healthy correction or trend reversal?

Are fundamentals still strong?

Is volume supporting a bounce?

What’s the broader macro sentiment?

Buying the dip isn’t about emotion — it’s about strategy, timing, and risk management.

💡 When Buying the Dip Makes Sense:

✔ Strong project fundamentals

📉 Buy The Dip or Wait Now? – The Smart Investor’s Dilemma

The market pulls back… charts turn red… fear spreads fast.

And the big question echoes everywhere:

#BuyTheDipOrWaitNow?

This is where average traders panic — and smart investors position.

🔎 What Smart Players Ask First:

Is this a healthy correction or trend reversal?

Are fundamentals still strong?

Is volume supporting a bounce?

What’s the broader macro sentiment?

Buying the dip isn’t about emotion — it’s about strategy, timing, and risk management.

💡 When Buying the Dip Makes Sense:

✔ Strong project fundamentals

- Reward

- 7

- 14

- Repost

- Share

MoonGirl :

:

Ape In 🚀View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

90.04K Popularity

177.4K Popularity

43.05K Popularity

9.79K Popularity

431.22K Popularity

339.54K Popularity

50.05K Popularity

61.56K Popularity

3.55K Popularity

8.25K Popularity

10.76K Popularity

8.1K Popularity

2.13K Popularity

2.88K Popularity

36.02K Popularity

News

View MoreOverview of popular cryptocurrencies on February 26, 2026, with the top three in popularity being: Polkadot, NEAR Protocol, and Uniswap

5 m

FIL (Filecoin) increased by 13.07% in the last 24 hours

8 m

Data: The US SOL spot ETF had a total net inflow of $30,863,700 on the day.

13 m

XRP (XRP Ledger) up 3.51% in the last 24 hours

18 m

NVIDIA gives back today's gains, crypto KOL "CBB" reduces nearly half of their NVDA short position worth tens of millions

24 m

Pin