#CryptoMarketPullback

Navigating the Current Crypto Market Deleveraging

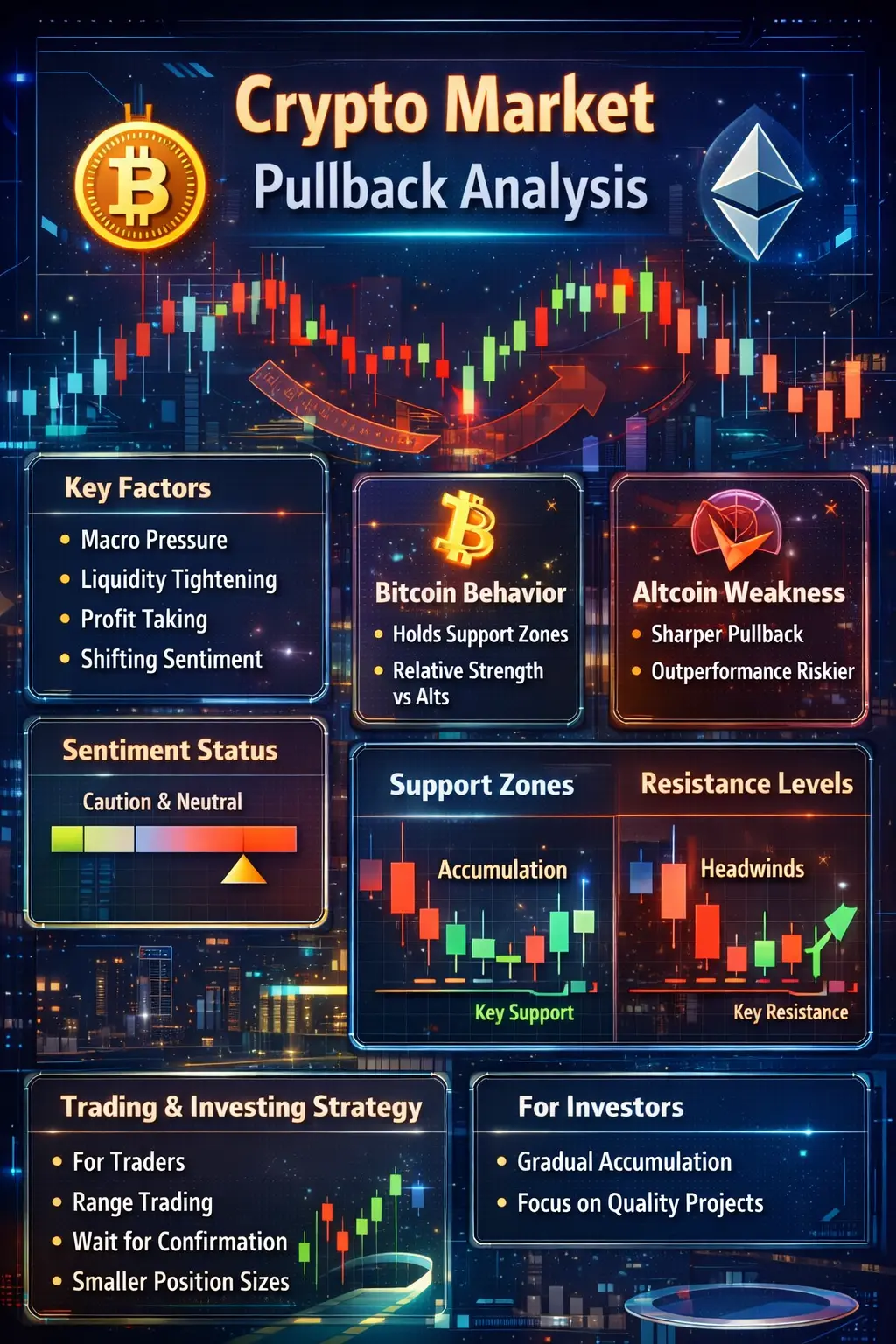

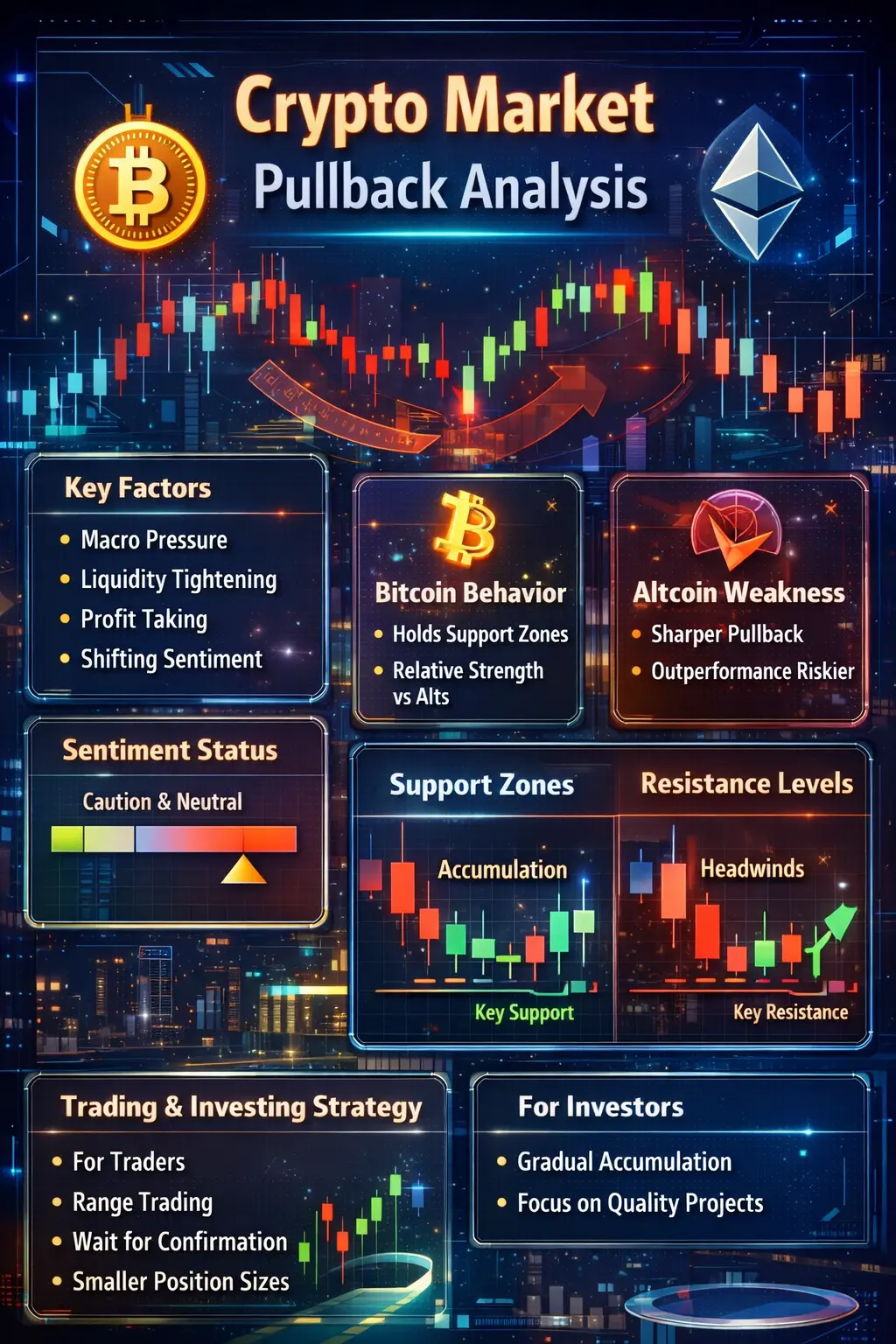

Over the past 24 hours, the crypto market has experienced a sharp deleveraging, with Bitcoin breaking below 76,000 and major altcoins like Ethereum and Solana declining simultaneously. Sudden spikes in volatility create uncertainty, forcing traders to make difficult choices: should one lighten positions to preserve capital, hold firm to ride out the storm, or actively hedge through short positions? In times like these, disciplined risk management, emotional control, and careful observation of market drivers are critical to not only surviving the downturn but also positioning for future gains.

Position Management: Balancing Risk and Opportunity

In the face of continuous declines, my primary priority is protecting capital while maintaining flexibility. Bitcoin’s current support sits around 74,500–75,000, and breaking below this level could trigger further downside toward 73,000–74,000. Rather than holding full positions under these conditions, I reduce high-leverage exposure while keeping partial positions to capture potential rebounds. This approach allows for survival during sharp corrections while retaining upside potential if the market stabilizes. Completely exiting positions might avoid short-term losses but risks missing a sudden recovery, while holding everything exposes the portfolio to forced liquidations and emotional stress. A balanced approach—lightening positions strategically while monitoring key support levels—is essential for navigating such volatile periods.

Profit Strategies: Fighting Volatility and Hedging Risks

High volatility can be daunting, but it also offers opportunities for disciplined traders. Practical strategies include using stop-losses, take-profit levels, and staggered entry or exit points to smooth average prices. Hedging through stablecoins or short contracts can protect against sudden drawdowns, while partial allocation to safe assets maintains liquidity. Observing trading volume and liquidity can help identify oversold conditions and short-term reversals. In such an environment, the goal is not to chase profits aggressively, but to manage risk effectively, maintain flexibility, and avoid panic-driven trades. Tiered scaling and careful risk sizing allow traders to respond to market swings without being emotionally overwhelmed.

Market Drivers: Identifying the Game Changer

This week, multiple macro and regulatory factors have influenced crypto prices. Federal Reserve announcements, geopolitical tensions, and regulatory news—such as high-profile scandals—can all create volatility. Of these, the Federal Reserve’s policy signals appear to be the primary driver, affecting liquidity, leverage, and risk appetite across markets. While geopolitical events and scandals add emotional noise, the Fed’s decisions have measurable impacts on short-term price behavior, margin requirements, and cross-asset correlations. Traders who track these key developments and incorporate them into their strategy are better positioned to respond rationally rather than react impulsively.

Candlestick and Short-Term Market Outlook

From a technical perspective, Bitcoin has formed a series of small-bodied candles around the 76,000 level, suggesting indecision and consolidation. If support near 74,500–75,000 holds, BTC could stabilize and test the 77,500–78,000 resistance zone in the short term. Conversely, a decisive break below 74,500 could trigger further downside toward 73,000–73,500. Volume trends indicate that selling pressure is slightly decreasing, which may signal that the market is approaching a temporary bottom. Traders should respond to confirmed signals such as candle closes and volume spikes rather than attempting to anticipate every move, which helps avoid emotional trading mistakes.

Conclusion: Survival and Strategic Takeaways

At this emotional low point, the most important principle is capital preservation and disciplined execution. Partial position reduction, tiered scaling, hedging, and strict stop-loss management are critical for surviving extreme volatility. Monitoring key levels Bitcoin 74,500–76,000, Ethereum 4,900–5,100, Solana 230–245 and staying alert to macro drivers allows for rational decision-making.

Emotional control, clear risk rules, and patience are as important as technical analysis. Traders who survive the deleveraging intact will be in the strongest position to capitalize on the next market rebound. Ultimately, a systematic, disciplined approach is the most reliable path to success in turbulent conditions.

Navigating the Current Crypto Market Deleveraging

Over the past 24 hours, the crypto market has experienced a sharp deleveraging, with Bitcoin breaking below 76,000 and major altcoins like Ethereum and Solana declining simultaneously. Sudden spikes in volatility create uncertainty, forcing traders to make difficult choices: should one lighten positions to preserve capital, hold firm to ride out the storm, or actively hedge through short positions? In times like these, disciplined risk management, emotional control, and careful observation of market drivers are critical to not only surviving the downturn but also positioning for future gains.

Position Management: Balancing Risk and Opportunity

In the face of continuous declines, my primary priority is protecting capital while maintaining flexibility. Bitcoin’s current support sits around 74,500–75,000, and breaking below this level could trigger further downside toward 73,000–74,000. Rather than holding full positions under these conditions, I reduce high-leverage exposure while keeping partial positions to capture potential rebounds. This approach allows for survival during sharp corrections while retaining upside potential if the market stabilizes. Completely exiting positions might avoid short-term losses but risks missing a sudden recovery, while holding everything exposes the portfolio to forced liquidations and emotional stress. A balanced approach—lightening positions strategically while monitoring key support levels—is essential for navigating such volatile periods.

Profit Strategies: Fighting Volatility and Hedging Risks

High volatility can be daunting, but it also offers opportunities for disciplined traders. Practical strategies include using stop-losses, take-profit levels, and staggered entry or exit points to smooth average prices. Hedging through stablecoins or short contracts can protect against sudden drawdowns, while partial allocation to safe assets maintains liquidity. Observing trading volume and liquidity can help identify oversold conditions and short-term reversals. In such an environment, the goal is not to chase profits aggressively, but to manage risk effectively, maintain flexibility, and avoid panic-driven trades. Tiered scaling and careful risk sizing allow traders to respond to market swings without being emotionally overwhelmed.

Market Drivers: Identifying the Game Changer

This week, multiple macro and regulatory factors have influenced crypto prices. Federal Reserve announcements, geopolitical tensions, and regulatory news—such as high-profile scandals—can all create volatility. Of these, the Federal Reserve’s policy signals appear to be the primary driver, affecting liquidity, leverage, and risk appetite across markets. While geopolitical events and scandals add emotional noise, the Fed’s decisions have measurable impacts on short-term price behavior, margin requirements, and cross-asset correlations. Traders who track these key developments and incorporate them into their strategy are better positioned to respond rationally rather than react impulsively.

Candlestick and Short-Term Market Outlook

From a technical perspective, Bitcoin has formed a series of small-bodied candles around the 76,000 level, suggesting indecision and consolidation. If support near 74,500–75,000 holds, BTC could stabilize and test the 77,500–78,000 resistance zone in the short term. Conversely, a decisive break below 74,500 could trigger further downside toward 73,000–73,500. Volume trends indicate that selling pressure is slightly decreasing, which may signal that the market is approaching a temporary bottom. Traders should respond to confirmed signals such as candle closes and volume spikes rather than attempting to anticipate every move, which helps avoid emotional trading mistakes.

Conclusion: Survival and Strategic Takeaways

At this emotional low point, the most important principle is capital preservation and disciplined execution. Partial position reduction, tiered scaling, hedging, and strict stop-loss management are critical for surviving extreme volatility. Monitoring key levels Bitcoin 74,500–76,000, Ethereum 4,900–5,100, Solana 230–245 and staying alert to macro drivers allows for rational decision-making.

Emotional control, clear risk rules, and patience are as important as technical analysis. Traders who survive the deleveraging intact will be in the strongest position to capitalize on the next market rebound. Ultimately, a systematic, disciplined approach is the most reliable path to success in turbulent conditions.