# GOLD

237.11K

deltapro

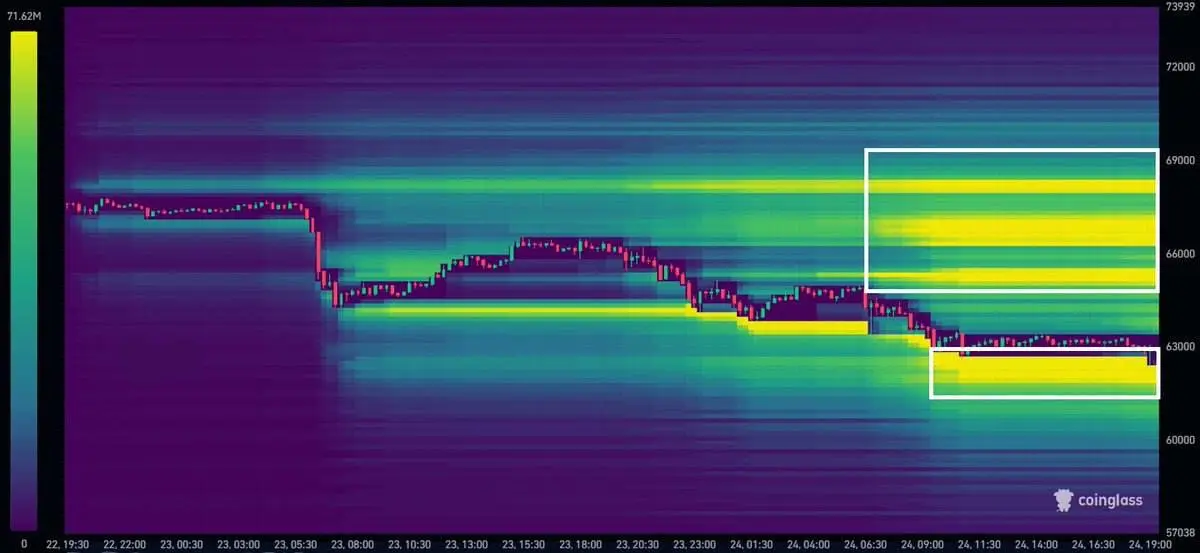

BTC Liquidity Map

Currently, we have liquidity both above and below. Yesterday's correction was too small to completely remove liquidity from below, so we're looking at another move lower.

I'm still leaning toward removing liquidity from below, around $60,000, and only then moving higher.

Currently, we could enter a trading range above $65,000 again, but with a subsequent decline, I wouldn't consider going long just yet.

#btc #usdt #ltc #sol $ETH $GT $XRP #gold

Currently, we have liquidity both above and below. Yesterday's correction was too small to completely remove liquidity from below, so we're looking at another move lower.

I'm still leaning toward removing liquidity from below, around $60,000, and only then moving higher.

Currently, we could enter a trading range above $65,000 again, but with a subsequent decline, I wouldn't consider going long just yet.

#btc #usdt #ltc #sol $ETH $GT $XRP #gold

- Reward

- 2

- 1

- Repost

- Share

deltapro :

:

JPMorgan Chase predicts that the price of gold could reach $6,300 per ounce by the end of 2026.$XAU

Not Just a Breakout — The Beginning of a New Gold Cycle

What happened last Friday was more than a simple breakout.

It wasn’t just a line being crossed — it signaled the end of one phase and the start of another.

When gold breaks out with strength, it rarely moves slowly. In the previous major breakout, price surged nearly 41% within two months. That’s not normal market pace — that’s the rhythm of an advancing cycle, where price doesn’t climb step by step, it leaps.

If this truly is a new cycle, the pattern is familiar:

Early stage: range break, resistance turns into support, momentum f

Not Just a Breakout — The Beginning of a New Gold Cycle

What happened last Friday was more than a simple breakout.

It wasn’t just a line being crossed — it signaled the end of one phase and the start of another.

When gold breaks out with strength, it rarely moves slowly. In the previous major breakout, price surged nearly 41% within two months. That’s not normal market pace — that’s the rhythm of an advancing cycle, where price doesn’t climb step by step, it leaps.

If this truly is a new cycle, the pattern is familiar:

Early stage: range break, resistance turns into support, momentum f

- Reward

- like

- Comment

- Repost

- Share

- Reward

- 1

- Comment

- Repost

- Share

🚀 Gate Alpha New Year Trading Competition Is LIVE

Trade on Alpha from Feb 12, 06:00 – Feb 23, 10:00 (UTC) and compete for a prize pool up to 50,000 USDT.

🔥 Tiered rewards — higher total volume unlocks bigger pool

🏆 Top traders share up to 10% of final pool

🎁 Trade ≥ 3,000 USDT to share 5% extra bonus pool

🎟 Up to 10 lucky draw chances with 100% win rate

🏅 Win Gold Bars & iPhone 17 Pro Max (512GB) worth $1,399

Bigger volume. Bigger rewards. Bigger prizes.

🔗 https://www.gate.com/announcements/article/49836

#GateAlpha #Gold #iphones

#GateSpringFestivalHorseRacingEvent

Trade on Alpha from Feb 12, 06:00 – Feb 23, 10:00 (UTC) and compete for a prize pool up to 50,000 USDT.

🔥 Tiered rewards — higher total volume unlocks bigger pool

🏆 Top traders share up to 10% of final pool

🎁 Trade ≥ 3,000 USDT to share 5% extra bonus pool

🎟 Up to 10 lucky draw chances with 100% win rate

🏅 Win Gold Bars & iPhone 17 Pro Max (512GB) worth $1,399

Bigger volume. Bigger rewards. Bigger prizes.

🔗 https://www.gate.com/announcements/article/49836

#GateAlpha #Gold #iphones

#GateSpringFestivalHorseRacingEvent

- Reward

- 12

- 10

- Repost

- Share

StylishKuri :

:

To The Moon 🌕View More

🚀 Gate Alpha New Year Trading Competition Is LIVE

Trade on Alpha from Feb 12, 06:00 – Feb 23, 10:00 (UTC) and compete for a prize pool up to 50,000 USDT.

🔥 Tiered rewards — higher total volume unlocks bigger pool

🏆 Top traders share up to 10% of final pool

🎁 Trade ≥ 3,000 USDT to share 5% extra bonus pool

🎟 Up to 10 lucky draw chances with 100% win rate

🏅 Win Gold Bars & iPhone 17 Pro Max (512GB) worth $1,399

Bigger volume. Bigger rewards. Bigger prizes.

🔗 https://www.gate.com/announcements/article/49836

#GateAlpha #Gold #iphones

Trade on Alpha from Feb 12, 06:00 – Feb 23, 10:00 (UTC) and compete for a prize pool up to 50,000 USDT.

🔥 Tiered rewards — higher total volume unlocks bigger pool

🏆 Top traders share up to 10% of final pool

🎁 Trade ≥ 3,000 USDT to share 5% extra bonus pool

🎟 Up to 10 lucky draw chances with 100% win rate

🏅 Win Gold Bars & iPhone 17 Pro Max (512GB) worth $1,399

Bigger volume. Bigger rewards. Bigger prizes.

🔗 https://www.gate.com/announcements/article/49836

#GateAlpha #Gold #iphones

- Reward

- like

- Comment

- Repost

- Share

#GateSquare$50KRedPacketGiveaway Gold & Silver just got slammed, wiping out $1.6T in value! 🚨 Panic selling triggered by strong US jobs data and shifting Fed rate cut hopes. What's next? Is this a shakeout or a sign of capital shifting to digital gold like Bitcoin? 💰 Volatility's rising – are you prepared? #Crypto #Gold

BTC7%

- Reward

- 5

- 3

- Repost

- Share

MasterChuTheOldDemonMasterChu :

:

Thank you for sharing the information; it was very inspiring to me.View More

🚨 GATE ALPHA NEW YEAR TRADING COMPETITION IS LIVE 🚨

This is not just another trading event.

This is a high-stakes battlefield with serious rewards on the table.

The Gate.io Alpha New Year Trading Competition has officially started, and the prize pool can reach up to $50,000 USDT.

But that’s not all.

We’re talking about Gold Bars.

We’re talking about an iPhone 17 Pro Max (512GB) worth $1,399. 📱✨

This is where volume turns into value.

🔥 Tiered Prize Pool System

The higher the total trading volume across Alpha…

The bigger the final reward pool becomes.

It can expand all the way up to $50,000

This is not just another trading event.

This is a high-stakes battlefield with serious rewards on the table.

The Gate.io Alpha New Year Trading Competition has officially started, and the prize pool can reach up to $50,000 USDT.

But that’s not all.

We’re talking about Gold Bars.

We’re talking about an iPhone 17 Pro Max (512GB) worth $1,399. 📱✨

This is where volume turns into value.

🔥 Tiered Prize Pool System

The higher the total trading volume across Alpha…

The bigger the final reward pool becomes.

It can expand all the way up to $50,000

- Reward

- like

- Comment

- Repost

- Share

Gate Alpha New Year Trading Competition is LIVE!

Trade on Alpha and unlock a prize pool of up to $50,000 USDT — plus win Gold Bars & an iPhone 17 Pro Max (512GB) worth $1,399! 📱✨

🔥 Tiered prize pool — the more total volume traded, the bigger the rewards unlocked (up to $50,000)

🏆 Leaderboard rewards — top traders share up to 10% of the final pool

🎁 Guaranteed bonus — trade ≥ 3,000 USDT and share 5% extra reward pool

🎟 Trade to earn lucky draw chances (100% win rate, up to 10 chances)

📅 Feb 12, 06:00 – Feb 23, 10:00 (UTC)

Bigger volume. Bigger rewards. Bigger prizes.

https://www.gate.com/

Trade on Alpha and unlock a prize pool of up to $50,000 USDT — plus win Gold Bars & an iPhone 17 Pro Max (512GB) worth $1,399! 📱✨

🔥 Tiered prize pool — the more total volume traded, the bigger the rewards unlocked (up to $50,000)

🏆 Leaderboard rewards — top traders share up to 10% of the final pool

🎁 Guaranteed bonus — trade ≥ 3,000 USDT and share 5% extra reward pool

🎟 Trade to earn lucky draw chances (100% win rate, up to 10 chances)

📅 Feb 12, 06:00 – Feb 23, 10:00 (UTC)

Bigger volume. Bigger rewards. Bigger prizes.

https://www.gate.com/

- Reward

- 6

- 3

- Repost

- Share

AnnaCryptoWriter :

:

To the Moon 🌕View More

Gate Alpha New Year Trading Competition Trade Smart, Win Big

The New Year has started with powerful momentum on Gate Alpha, and this trading competition is designed for traders who want to turn activity into real rewards. With a total prize pool unlocking up to $50,000 USDT, plus premium prizes like Gold Bars and an iPhone 17 Pro Max (512GB), this event combines volume, strategy, and consistency into one exciting opportunity.

🔥 Why This Competition Stands Out

Unlike standard trading events, the Gate Alpha New Year Competition uses a tiered reward structure, meaning the more total trading volu

The New Year has started with powerful momentum on Gate Alpha, and this trading competition is designed for traders who want to turn activity into real rewards. With a total prize pool unlocking up to $50,000 USDT, plus premium prizes like Gold Bars and an iPhone 17 Pro Max (512GB), this event combines volume, strategy, and consistency into one exciting opportunity.

🔥 Why This Competition Stands Out

Unlike standard trading events, the Gate Alpha New Year Competition uses a tiered reward structure, meaning the more total trading volu

- Reward

- 11

- 11

- Repost

- Share

Luna_Star :

:

LFG 🔥View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

82.86K Popularity

172.98K Popularity

38.98K Popularity

9.35K Popularity

428.52K Popularity

334.12K Popularity

47.69K Popularity

59.76K Popularity

2.59K Popularity

6.83K Popularity

9.83K Popularity

7.13K Popularity

1.37K Popularity

2.38K Popularity

34.27K Popularity

News

View MoreData: In the past 24 hours, the entire network has liquidated $527 million, with long positions liquidated at $54.86 million and short positions at $472 million.

12 m

Schmidt: Inflation remains a key issue for the Federal Reserve, with no clear stance on monetary policy response

1 h

Musaleem: Bringing inflation down to target levels helps boost consumption and economic growth

1 h

Musaleem: The job market is vulnerable to increased layoffs

1 h

Musalem: Government shutdown may affect CPI, PCE inflation is a better indicator

1 h

Pin