Elementalist

No content yet

Elementalist

Many people think that risk comes from market volatility, but the real danger often hides in missing information.

When Stream Finance collapsed on November 3rd, $93 million vanished, and another $160 million was frozen. xUSD fell from $1 to five cents. What the public saw was a platform claiming to be market-neutral and strategy-driven, but internally it was a layered leverage loop. Even scarier, its proof of reserves was always “coming soon.”

Everyone handed over their money for an 18% yield, trusting a promise that asset proof would come later. In the end, when the system collapsed, it dragg

View OriginalWhen Stream Finance collapsed on November 3rd, $93 million vanished, and another $160 million was frozen. xUSD fell from $1 to five cents. What the public saw was a platform claiming to be market-neutral and strategy-driven, but internally it was a layered leverage loop. Even scarier, its proof of reserves was always “coming soon.”

Everyone handed over their money for an 18% yield, trusting a promise that asset proof would come later. In the end, when the system collapsed, it dragg

- Reward

- like

- Comment

- Repost

- Share

In today's on-chain world, payments remain the most easily overlooked yet fundamental component. Users want faster transfers, merchants want more stable settlements, and project teams want assets to flow seamlessly across chains. In reality, these seemingly simple needs are still hindered by fees, delays, and complex operations.

@blazpaylabs aims to change this most critical yet challenging layer of infrastructure.

Within the BlazPay ecosystem, payments are no longer an obstacle between chains but become a seamlessly integrated experience. The team is building a unified payment gateway that sp

View Original@blazpaylabs aims to change this most critical yet challenging layer of infrastructure.

Within the BlazPay ecosystem, payments are no longer an obstacle between chains but become a seamlessly integrated experience. The team is building a unified payment gateway that sp

- Reward

- like

- Comment

- Repost

- Share

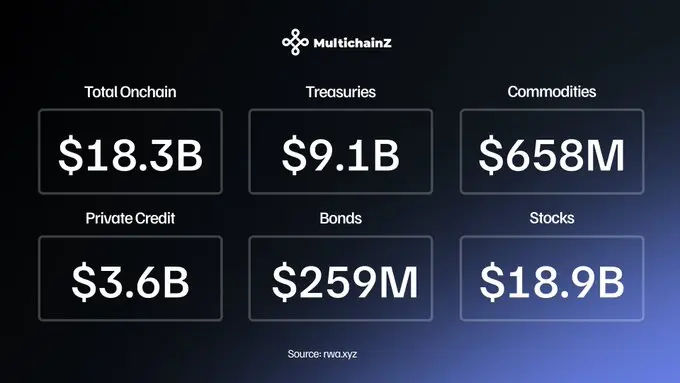

The story of a trillion-dollar track always begins with accumulating strength in places unseen.

Over the past decade, the on-chain world has been like a rapidly flowing river, while traditional finance remains as solid and slow as a mountain. What’s always been missing between the two is a true bridge—one that can carry massive capital while maintaining both transparency and efficiency.

When the industry predicts that $28.7 trillion in assets will be on-chain by 2030, this is no longer a distant vision, but an inevitable structural shift. Assets will move on-chain for greater efficiency, capit

Over the past decade, the on-chain world has been like a rapidly flowing river, while traditional finance remains as solid and slow as a mountain. What’s always been missing between the two is a true bridge—one that can carry massive capital while maintaining both transparency and efficiency.

When the industry predicts that $28.7 trillion in assets will be on-chain by 2030, this is no longer a distant vision, but an inevitable structural shift. Assets will move on-chain for greater efficiency, capit

MVRK-0.2%

- Reward

- like

- Comment

- Repost

- Share

Pacifica is not just a simple exchange; it is committed to building an infrastructure that serves future traders and builders—a perpetual contract trading platform that combines high performance, transparent settlement, and self-custody security.

In the world of @pacifica_fi, trading is more than just placing and closing orders. It is designed as a complete and verifiable chain for liquidity and risk management. Order matching speeds are close to those of centralized exchanges, while settlement and margin management are executed entirely on-chain.

As a result, users can enjoy the smooth experi

View OriginalIn the world of @pacifica_fi, trading is more than just placing and closing orders. It is designed as a complete and verifiable chain for liquidity and risk management. Order matching speeds are close to those of centralized exchanges, while settlement and margin management are executed entirely on-chain.

As a result, users can enjoy the smooth experi

- Reward

- like

- Comment

- Repost

- Share

We have become accustomed to proving ourselves in the real world with paper documents.

A bank statement, a credit report, a manually reviewed conclusion—these seemingly formal documents determine whether a person can borrow money or earn trust. Yet, these proofs are often fragile, easily lost, and dependent on the judgment of a few institutions.

True credit is actually much richer than these documents. It includes every fulfilled obligation, every choice made, every timely repayment—a trajectory that traditional systems cannot fully record, let alone publicly verify.

Within the @LayerBankFi fr

A bank statement, a credit report, a manually reviewed conclusion—these seemingly formal documents determine whether a person can borrow money or earn trust. Yet, these proofs are often fragile, easily lost, and dependent on the judgment of a few institutions.

True credit is actually much richer than these documents. It includes every fulfilled obligation, every choice made, every timely repayment—a trajectory that traditional systems cannot fully record, let alone publicly verify.

Within the @LayerBankFi fr

COOKIE-6%

- Reward

- like

- Comment

- Repost

- Share

The first impression that useTria gives is never just about a wallet or a small tool, but rather a fundamental logic that's redefining the on-chain account system. Its core philosophy is simple yet disruptive: enabling everyone to enjoy a clear experience comparable to traditional banks, all while maintaining self-custody.

In the past, managing assets on-chain meant hassles—using bridges for cross-chain transfers, setting gas for network changes, and dealing with asset fragmentation across chains was exhausting. What useTria does is hide all these underlying complexities behind the system, all

View OriginalIn the past, managing assets on-chain meant hassles—using bridges for cross-chain transfers, setting gas for network changes, and dealing with asset fragmentation across chains was exhausting. What useTria does is hide all these underlying complexities behind the system, all

- Reward

- like

- Comment

- Repost

- Share

The first impression MultichainZ gives is that of a quiet yet powerful underlying force. As the demand for cross-chain solutions continues to grow globally, more and more developers are realizing that true interoperability is not about adding more complex logic to a single chain, but about enabling all chains to connect freely, like highways linking cities. $CHAINZ was born against this backdrop, aiming to make cross-chain functionality no longer a technical challenge, but a natural infrastructure capability.

Within the @MultichainZ_ network, assets and messages from every chain can be secure

View OriginalWithin the @MultichainZ_ network, assets and messages from every chain can be secure

- Reward

- like

- Comment

- Repost

- Share

Almanak has never felt like an ordinary research platform from the very beginning. Instead, it feels more like an engine that makes all on-chain systems computational, verifiable, and predictable again.

It is working with an increasing number of protocols, infrastructure teams, and developers to enable complex on-chain economic logic to be truly understood. In the past, the connections between protocol parameters, market reactions, and user behaviors were like scattered puzzle pieces. Now, Almanak’s models piece them together, ultimately pointing toward a clearer path: enabling on-chain system

It is working with an increasing number of protocols, infrastructure teams, and developers to enable complex on-chain economic logic to be truly understood. In the past, the connections between protocol parameters, market reactions, and user behaviors were like scattered puzzle pieces. Now, Almanak’s models piece them together, ultimately pointing toward a clearer path: enabling on-chain system

COOKIE-6%

- Reward

- like

- Comment

- Repost

- Share