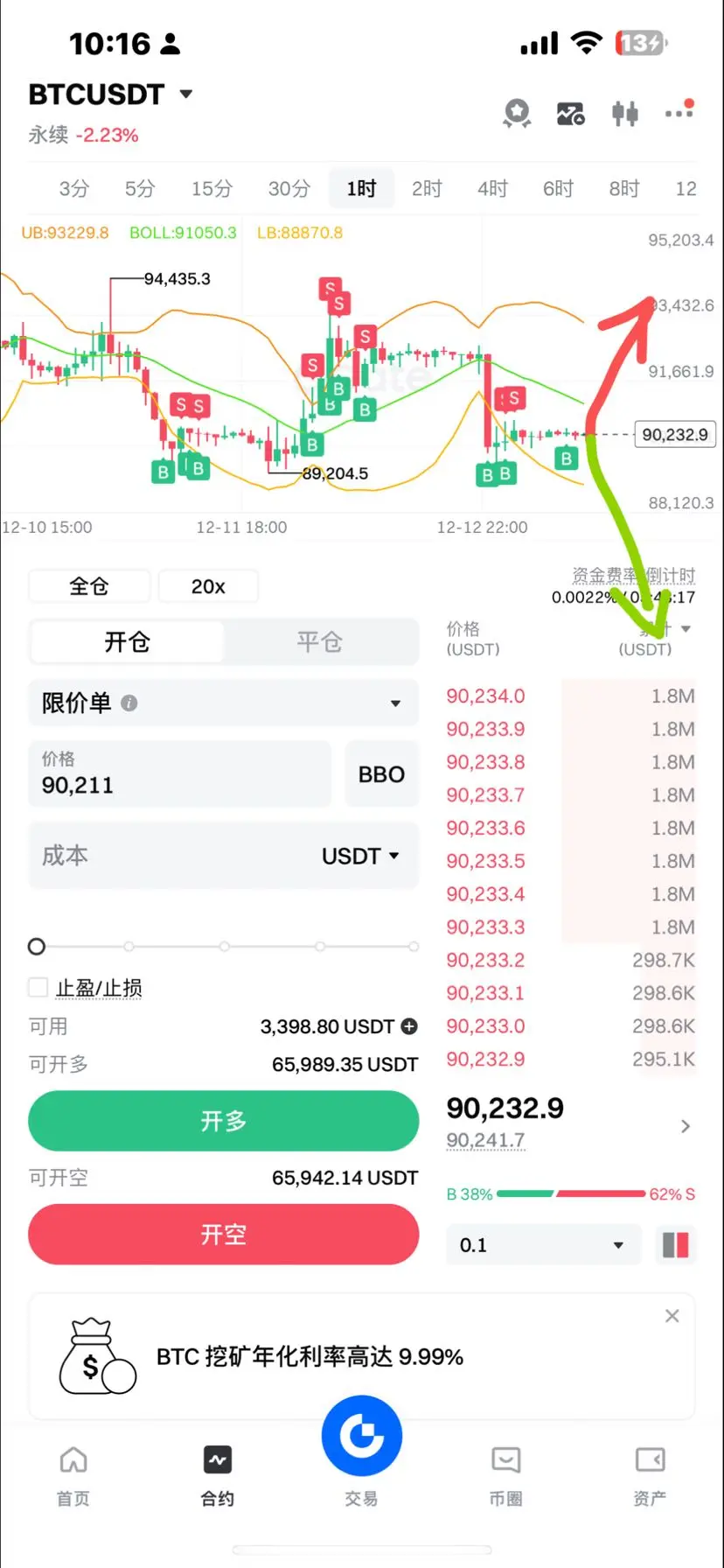

How to consistently win in crypto contracts?

Answer: There is almost no such thing as a "guaranteed win" in crypto contracts, but you can improve your win rate through strict discipline, fund management, trend-following trading, take-profit and stop-loss strategies, and emotional control: the key is to follow the major trend, focus on strong coins during their strong phases, operate with small positions, take profits promptly, set stop-loss at cost price for remaining positions, avoid chasing highs and selling lows, and emotional trading. Stick to the principle of "as long as the green mountai

View OriginalAnswer: There is almost no such thing as a "guaranteed win" in crypto contracts, but you can improve your win rate through strict discipline, fund management, trend-following trading, take-profit and stop-loss strategies, and emotional control: the key is to follow the major trend, focus on strong coins during their strong phases, operate with small positions, take profits promptly, set stop-loss at cost price for remaining positions, avoid chasing highs and selling lows, and emotional trading. Stick to the principle of "as long as the green mountai

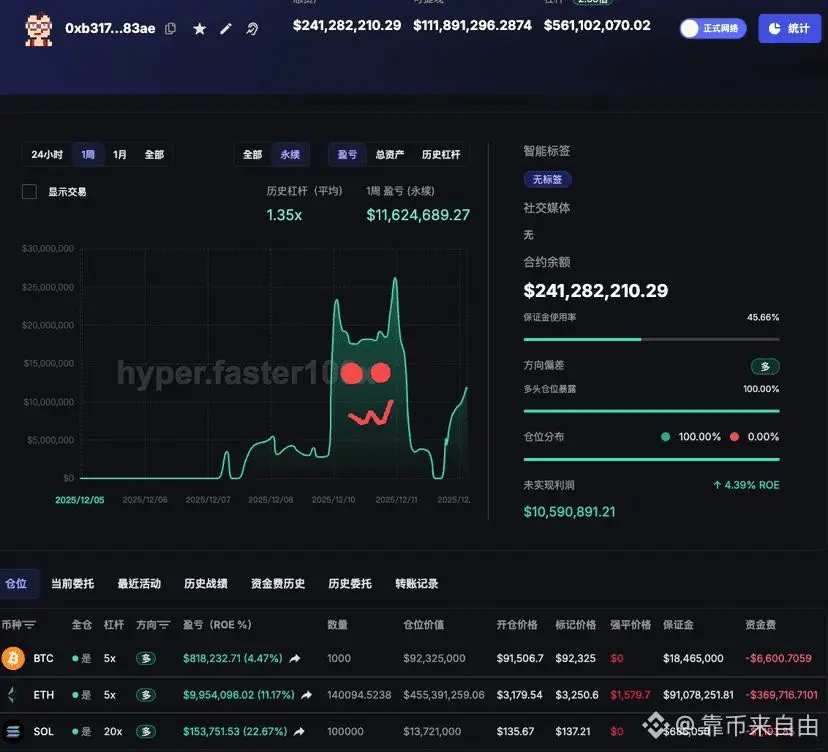

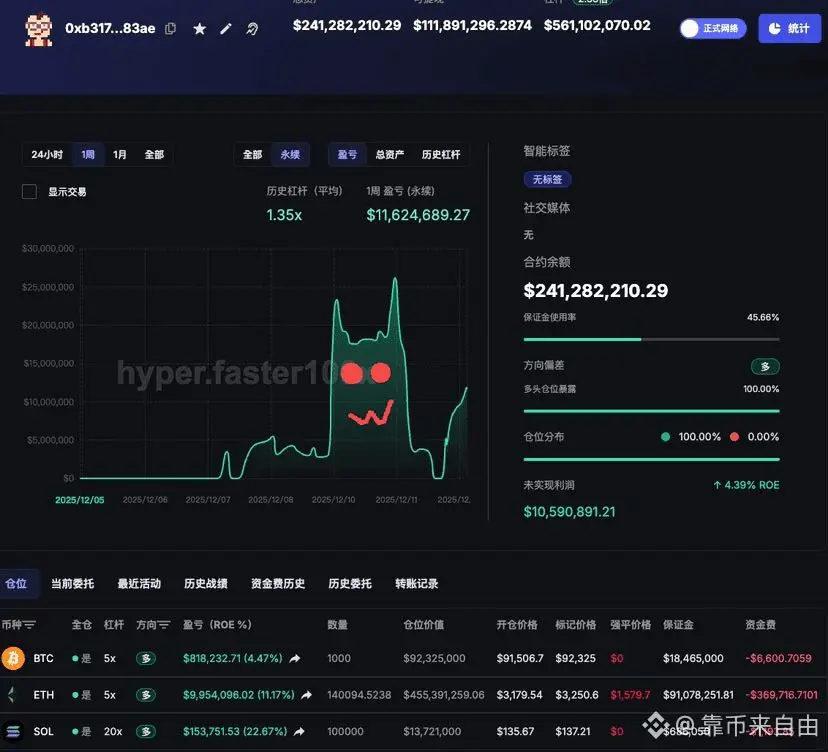

[The user has shared his/her trading data. Go to the App to view more.]