ETHEN

No content yet

ETHEN

Hello my Gate family. Let’s talk honestly about where this market really stands:

I hope you’re doing well, staying calm, and most importantly staying rational in a market that loves to test emotions. I want to talk today in a very grounded way about the big question everyone is asking but very few are answering clearly. Are the major coins still pushing back. Has the market already found its bottom. And most importantly, is this actually the right time to buy the dip or is patience still the real edge. I am not here to hype anything. I

I hope you’re doing well, staying calm, and most importantly staying rational in a market that loves to test emotions. I want to talk today in a very grounded way about the big question everyone is asking but very few are answering clearly. Are the major coins still pushing back. Has the market already found its bottom. And most importantly, is this actually the right time to buy the dip or is patience still the real edge. I am not here to hype anything. I

- Reward

- 2

- 1

- Repost

- Share

SYEDA :

:

Watching Closely 🔍An SEC roundtable doesn’t mean instant bullish or bearish moves. What it really means is uncertainty, and uncertainty is where volatility lives. When regulators talk, markets listen, but they also overreact. I’ve seen this pattern enough times to know that the first move is rarely the real move.

If the tone leans constructive, price squeezes fast. If the language feels restrictive, we get a shakeout that tests conviction. Either way, this is not a moment to trade on emotion. It’s a moment to watch how price reacts after the noise settles.

When events like this hit, I focus on structure, not he

If the tone leans constructive, price squeezes fast. If the language feels restrictive, we get a shakeout that tests conviction. Either way, this is not a moment to trade on emotion. It’s a moment to watch how price reacts after the noise settles.

When events like this hit, I focus on structure, not he

BTC-3.88%

- Reward

- 2

- Comment

- Repost

- Share

When I see the Fear & Greed Index sitting at 16, I don’t panic, I pause.

Because when there is extreme fear, price is usually doing its job, shaking out weak hands, forcing emotions to the surface. I’ve learned over time that markets rarely reward comfort. They reward patience when conviction is hardest to hold.

Right now, there’s fear in headlines, fear in timelines, fear in candles. And that tells me something important: most people are reacting, not thinking. When everyone feels the same thing at once, risk is often already priced in.

I’m not saying this is the exact bottom. Markets don’t a

Because when there is extreme fear, price is usually doing its job, shaking out weak hands, forcing emotions to the surface. I’ve learned over time that markets rarely reward comfort. They reward patience when conviction is hardest to hold.

Right now, there’s fear in headlines, fear in timelines, fear in candles. And that tells me something important: most people are reacting, not thinking. When everyone feels the same thing at once, risk is often already priced in.

I’m not saying this is the exact bottom. Markets don’t a

BTC-3.88%

- Reward

- 1

- Comment

- Repost

- Share

NIGHT is trading around 0.0636 after a sharp pullback from the 0.0694 high. The move down was driven by aggressive long liquidations as price lost the intraday support zone and slipped below short term moving averages. That flush cleared late longs and shifted positioning back to neutral to slightly defensive.

Liquidity behavior shows sell side pressure easing near 0.0626, where buyers stepped in and absorbed the move. Volume spiked during the selloff and then cooled, which usually signals forced selling rather than sustained distribution. Whale activity looks reactive rather than aggressive,

Liquidity behavior shows sell side pressure easing near 0.0626, where buyers stepped in and absorbed the move. Volume spiked during the selloff and then cooled, which usually signals forced selling rather than sustained distribution. Whale activity looks reactive rather than aggressive,

NIGHT-14.66%

- Reward

- 1

- Comment

- Repost

- Share

Almost $200M hitting the market in a single week isn’t noise. It’s supply showing up all at once, and when that happens, price usually reacts before people finish reading the headline.

Especially when a single name like ASTER leads with such a large share, there’s always pressure somewhere.

What matters to me is timing. When liquidity is already selective, unlocks tend to test conviction. Strong projects absorb it and move on. Weaker ones bleed quietly while everyone looks elsewhere.

So if you’re positioned, this is the week to be awake, not emotional.

Understand where supply comes from, whe

Especially when a single name like ASTER leads with such a large share, there’s always pressure somewhere.

What matters to me is timing. When liquidity is already selective, unlocks tend to test conviction. Strong projects absorb it and move on. Weaker ones bleed quietly while everyone looks elsewhere.

So if you’re positioned, this is the week to be awake, not emotional.

Understand where supply comes from, whe

- Reward

- 2

- Comment

- Repost

- Share

If you believe currencies will keep getting diluted over time, then owning Bitcoin isn’t about chasing upside. It’s about opting out of a system that slowly leaks value. That’s the part many people miss. This isn’t a trade, it’s a position.

What stands out to me is who is saying it. When the head of the world’s largest asset manager frames Bitcoin as a hedge against debasement, it tells you the conversation has shifted. What was once considered extreme is now being spoken in plain, institutional language.

So when I hold Bitcoin, I’m not reacting to today’s price. I’m responding to a longer rea

What stands out to me is who is saying it. When the head of the world’s largest asset manager frames Bitcoin as a hedge against debasement, it tells you the conversation has shifted. What was once considered extreme is now being spoken in plain, institutional language.

So when I hold Bitcoin, I’m not reacting to today’s price. I’m responding to a longer rea

BTC-3.88%

- Reward

- 2

- 1

- Repost

- Share

SYEDA :

:

HODL Tight 💪What makes the NIGHT launch interesting is not the token itself, but the way Midnight is trying to fix a problem most blockchains quietly ignore.

On most networks, usage slowly destroys capital. Every transaction eats into the same asset that users and developers are expected to hold long term. Over time, this creates pressure to sell, especially for teams building real products. Midnight takes a different route by separating value from consumption.

NIGHT functions as a capital asset, while DUST acts as the operational fuel. Holding NIGHT continuou

On most networks, usage slowly destroys capital. Every transaction eats into the same asset that users and developers are expected to hold long term. Over time, this creates pressure to sell, especially for teams building real products. Midnight takes a different route by separating value from consumption.

NIGHT functions as a capital asset, while DUST acts as the operational fuel. Holding NIGHT continuou

NIGHT-14.66%

- Reward

- 3

- 1

- Repost

- Share

LittleQueen :

:

Watching Closely 🔍When I see a monthly MACD flip bearish, I don’t panic, and I don’t dismiss it either. I respect it.

This signal has a long memory. When it shows up on the 1M chart, it usually means momentum is slowing at a structural level, not just a short-term shakeout. And yes, the 4-year cycle matters, because crowd behavior tends to rhyme when liquidity tightens.

But here’s the part people skip. Indicators don’t operate in a vacuum. Back in 2019–2020, this same setup failed because liquidity flipped fast. QT paused, T-bill buying started, and QE followed. Pr

This signal has a long memory. When it shows up on the 1M chart, it usually means momentum is slowing at a structural level, not just a short-term shakeout. And yes, the 4-year cycle matters, because crowd behavior tends to rhyme when liquidity tightens.

But here’s the part people skip. Indicators don’t operate in a vacuum. Back in 2019–2020, this same setup failed because liquidity flipped fast. QT paused, T-bill buying started, and QE followed. Pr

- Reward

- 2

- Comment

- Repost

- Share

NIGHT is trading around 0.0496 after a clean rebound from the 0.0474 liquidity sweep. That downside move flushed weak longs and triggered liquidations, which is visible in the long lower wicks and the quick reclaim above short term moving averages. Price has now pushed back above the intraday trend line, signaling a short term momentum shift.

Liquidity behavior shows bids stepping in aggressively near 0.0475, suggesting whale accumulation rather than panic selling. Volume expanded on the bounce, confirming real participation. Funding on perps remains relatively calm, which tells me this move i

Liquidity behavior shows bids stepping in aggressively near 0.0475, suggesting whale accumulation rather than panic selling. Volume expanded on the bounce, confirming real participation. Funding on perps remains relatively calm, which tells me this move i

NIGHT-14.66%

- Reward

- 2

- Comment

- Repost

- Share

Five out of twelve FOMC members already leaning toward a January cut tells me something important: the pressure is shifting. When jobless claims start talking louder than inflation headlines, the Fed’s tone usually follows. Not all at once, not cleanly, but step by step.

There is still uncertainty, and there will be volatility around every data print. But when I look at history, markets rarely wait for full consensus. They move when the direction becomes obvious, not when it becomes comfortable.

For me, this is less about one 25 bps cut and more about what it signals. Liquidity conditions are

There is still uncertainty, and there will be volatility around every data print. But when I look at history, markets rarely wait for full consensus. They move when the direction becomes obvious, not when it becomes comfortable.

For me, this is less about one 25 bps cut and more about what it signals. Liquidity conditions are

BTC-3.88%

- Reward

- 1

- Comment

- Repost

- Share

When BlackRock says Bitcoin can grow faster than the internet, I do not hear hype. I hear pattern recognition. I remember how the internet felt early on, when adoption looked slow, messy, and misunderstood, yet everything underneath was compounding quietly.

What makes Bitcoin different is timing. The internet grew without instant global capital rails. Bitcoin has them from day one. So when institutions, nations, and individuals all tap into the same network, growth does not move in decades, it compresses.

I am not expecting straight lines or easy price a

What makes Bitcoin different is timing. The internet grew without instant global capital rails. Bitcoin has them from day one. So when institutions, nations, and individuals all tap into the same network, growth does not move in decades, it compresses.

I am not expecting straight lines or easy price a

BTC-3.88%

- Reward

- 2

- Comment

- Repost

- Share

BTC is trading near 90,500 after a sharp intraday recovery from the 89,200 liquidity sweep. The bounce was driven by short liquidations below 89.5k, where sell pressure got absorbed quickly and price reclaimed the intraday moving averages. That reclaim shifted short term momentum back to the upside and forced late shorts to cover.

Liquidity behavior shows buyers defending the 90k handle aggressively, while sell side liquidity above 90.6k to 90.8k remains the next magnet. Volume expanded on the impulse candle, signaling real participation rather than a weak bounce. Whale activity looks tactical

Liquidity behavior shows buyers defending the 90k handle aggressively, while sell side liquidity above 90.6k to 90.8k remains the next magnet. Volume expanded on the impulse candle, signaling real participation rather than a weak bounce. Whale activity looks tactical

BTC-3.88%

- Reward

- 2

- Comment

- Repost

- Share

FDUSD pulled back sharply from 0.9991 after a liquidity sweep that triggered a cluster of fast sell orders. The drop into 0.9983 flushed out short term leverage and cleared resting bids, which is why the bounce that followed came with clean absorption. Price is now stabilizing around 0.9985 with a slow grind upward, but momentum remains neutral.

MA5 and MA10 have just curled upward and are flattening against MA30, showing early signs that short term pressure is easing but not yet reversing into strength. Volume on the recovery is modest, meaning whales are not aggressively repositioning. This

MA5 and MA10 have just curled upward and are flattening against MA30, showing early signs that short term pressure is easing but not yet reversing into strength. Volume on the recovery is modest, meaning whales are not aggressively repositioning. This

FDUSD-0.03%

- Reward

- 2

- Comment

- Repost

- Share

LUNA continues to trade under strong downside pressure as sellers keep control of the 15m structure. The breakdown from 0.20455 accelerated once price lost MA10 and MA5, with both averages now sharply angled downward, confirming sustained trend momentum.

Liquidity was swept at 0.17760 where forced selling and small liquidation clusters appeared, which is why we saw an immediate bounce from that exact level.

Even with the bounce, buyers are not showing dominance. Volume on green candles remains weaker compared to the sell-side bursts, signaling that larger players are not aggressively absorbin

Liquidity was swept at 0.17760 where forced selling and small liquidation clusters appeared, which is why we saw an immediate bounce from that exact level.

Even with the bounce, buyers are not showing dominance. Volume on green candles remains weaker compared to the sell-side bursts, signaling that larger players are not aggressively absorbin

LUNA-20.14%

- Reward

- 3

- Comment

- Repost

- Share

NIGHT is attempting a recovery after the liquidity sweep at 0.04617, and the latest 15m candle shows the first sign of buyers stepping back in. The bounce aligns with a clear short covering reaction because liquidations were triggered right into the low. That created a pocket of thin liquidity, allowing price to snap back toward the previous micro resistance.

Even with the bounce, structure remains in a downtrend. Price is still trading below MA5, MA10 and MA30, and all three averages continue pointing downward. This shows sellers still control the trend and buyers are only reacting, not leadi

Even with the bounce, structure remains in a downtrend. Price is still trading below MA5, MA10 and MA30, and all three averages continue pointing downward. This shows sellers still control the trend and buyers are only reacting, not leadi

NIGHT-14.66%

- Reward

- 2

- Comment

- Repost

- Share

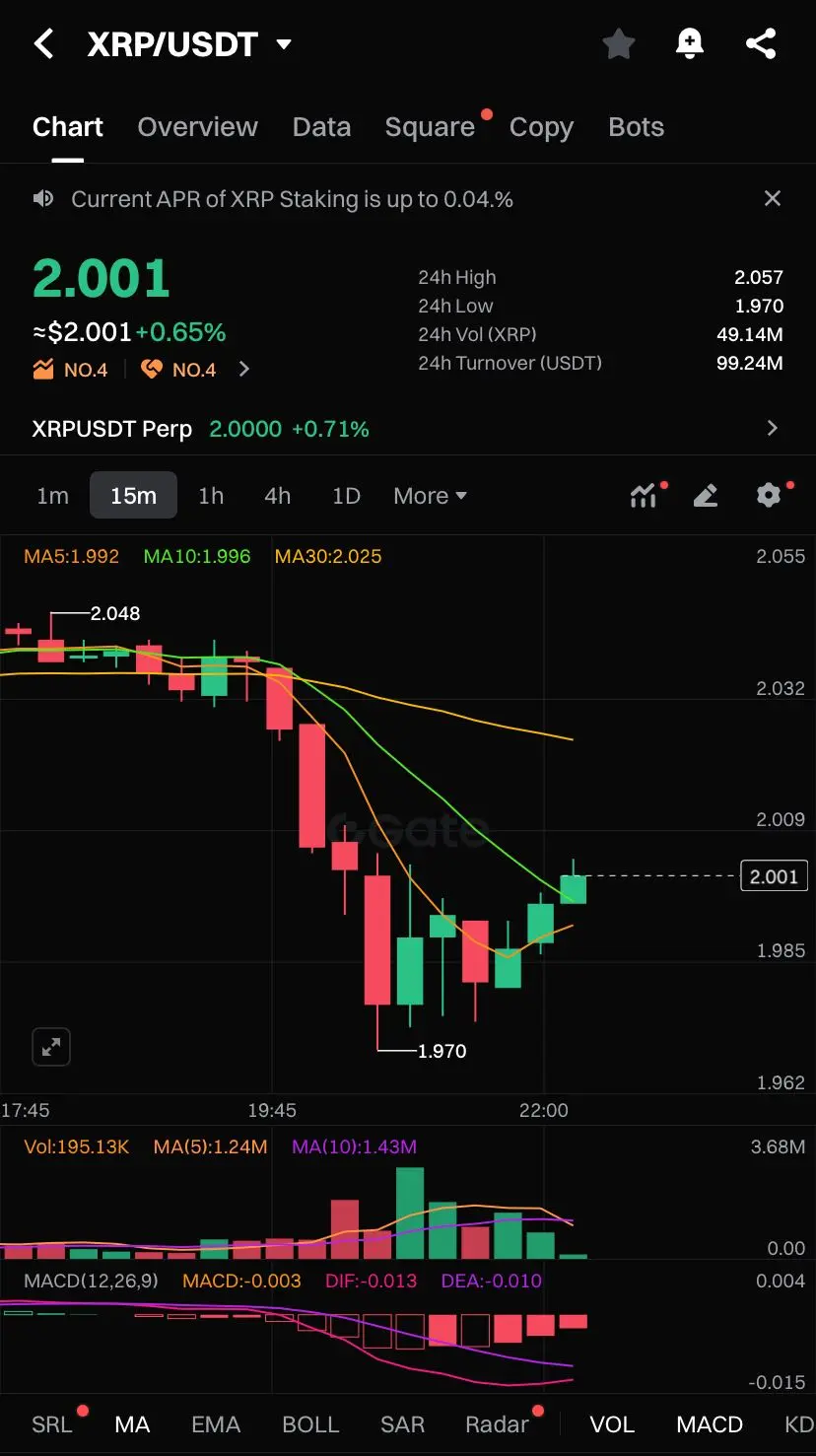

XRP is pushing a mild recovery after tagging 1.970, which acted as the intraday liquidity sweep. The bounce shows buyers defending the level, but the broader structure is still bearish because price remains below MA5, MA10 and MA30, all angled downward. This alignment signals that any upside here is corrective unless XRP reclaims 2.020 with strong participation.

Liquidity behavior shows sell side pressure easing as volume spikes appeared near the lows. That pattern often signals short covering rather than aggressive whale accumulation. No large absorption candles yet, which suggests big player

Liquidity behavior shows sell side pressure easing as volume spikes appeared near the lows. That pattern often signals short covering rather than aggressive whale accumulation. No large absorption candles yet, which suggests big player

XRP-5.86%

- Reward

- 3

- Comment

- Repost

- Share

GT is trying to stabilize around 10.29 after a steady intraday selloff that pushed price down into the 10.25 liquidity pocket. The reaction from that level is visible but still weak, suggesting buyers are not yet stepping in with conviction. Most of the bounce candles remain small and low volume, showing that the move is more about shorts covering than real accumulation.

Price is still trading below all short term moving averages MA5, MA10, and MA30. All three are angled downward and spreading apart, confirming a bearish micro trend. Until GT reclaims at least the MA10 with a strong green cand

Price is still trading below all short term moving averages MA5, MA10, and MA30. All three are angled downward and spreading apart, confirming a bearish micro trend. Until GT reclaims at least the MA10 with a strong green cand

GT-3.13%

- Reward

- 2

- Comment

- Repost

- Share

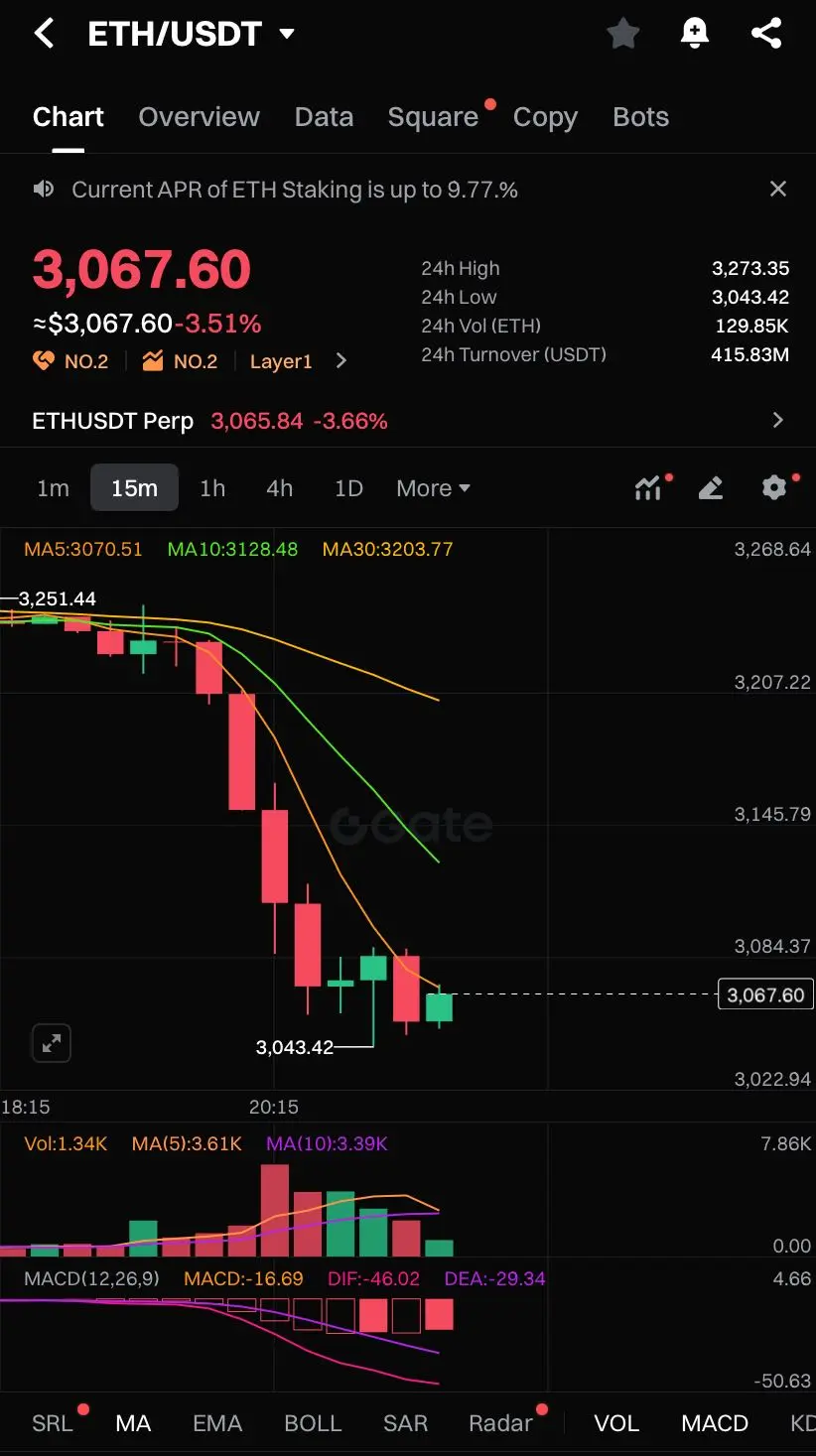

ETH is trading around 3067 after a clean breakdown from the 3250 to 3200 supply zone, and the chart shows sellers firmly in control on the 15 minute structure. The move lower was driven by a sharp increase in red volume, signalling forced liquidations and aggressive market selling rather than slow profit taking. The low at 3043 was swept, but the rebound lacked strength, showing buyers are still defensive and not yet willing to commit to a reversal.

Price is trading well below all three major short term moving averages MA5, MA10, and MA30. All of them are sloping downward and widening, which c

Price is trading well below all three major short term moving averages MA5, MA10, and MA30. All of them are sloping downward and widening, which c

ETH-6.28%

- Reward

- 4

- 2

- Repost

- Share

GateUser-38e516db :

:

Stay strong and HODL💎View More

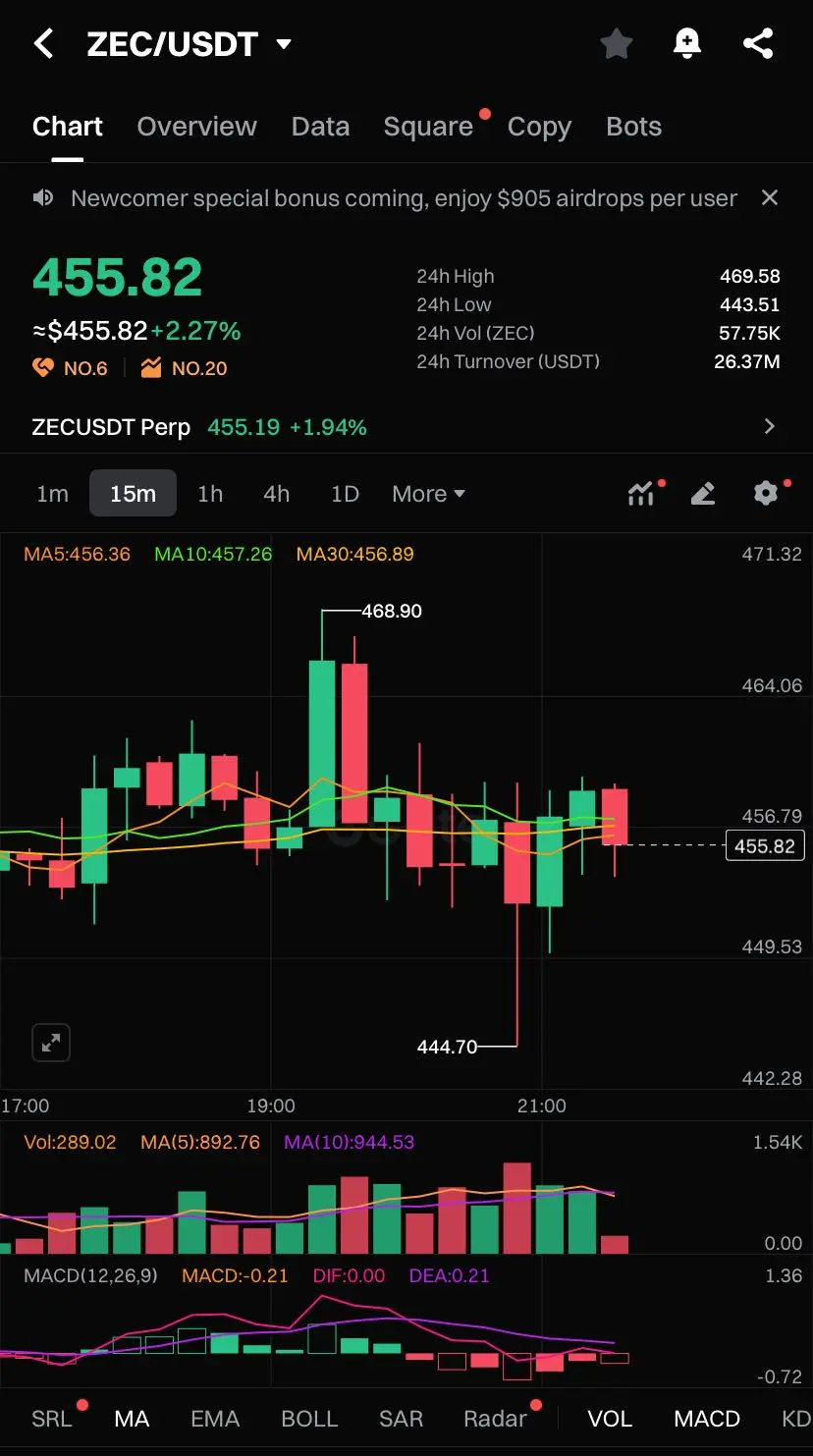

ZEC is trading around 455 after rejecting the 468 zone, and the chart shows a market that is trying to stabilise but still lacks strong momentum. The sell wick at 468.90 reveals clear profit taking from larger players, and the follow up candles show liquidity thinning out each time price moves above 456. Buyers are active, but not aggressive enough to reclaim the short term trend.

Price is currently sitting near the MA5 and MA10 zone, which are flat and signalling indecision. MA30 is slightly above price, which usually means the short term trend is neutral to mildly bearish until the moving av

Price is currently sitting near the MA5 and MA10 zone, which are flat and signalling indecision. MA30 is slightly above price, which usually means the short term trend is neutral to mildly bearish until the moving av

ZEC-2.43%

- Reward

- 3

- Comment

- Repost

- Share

A Journey Into the Night: My First Encounter with the Midnight Network and Its Revolutionary Design

I remember the moment clearly I had been scrolling through some discussions about privacy and Layer 1 ecosystems when a name I had never heard of caught my eye. "Midnight Network." It wasn’t just the name that piqued my curiosity, but the talk of something new in the privacy space. A token designed to not be hidden, but still protect sensitive data? At first, I didn’t get it. Privacy and transparency don’t often go hand in hand, do they?

But the more I du

I remember the moment clearly I had been scrolling through some discussions about privacy and Layer 1 ecosystems when a name I had never heard of caught my eye. "Midnight Network." It wasn’t just the name that piqued my curiosity, but the talk of something new in the privacy space. A token designed to not be hidden, but still protect sensitive data? At first, I didn’t get it. Privacy and transparency don’t often go hand in hand, do they?

But the more I du

NIGHT-14.66%

- Reward

- 3

- Comment

- Repost

- Share