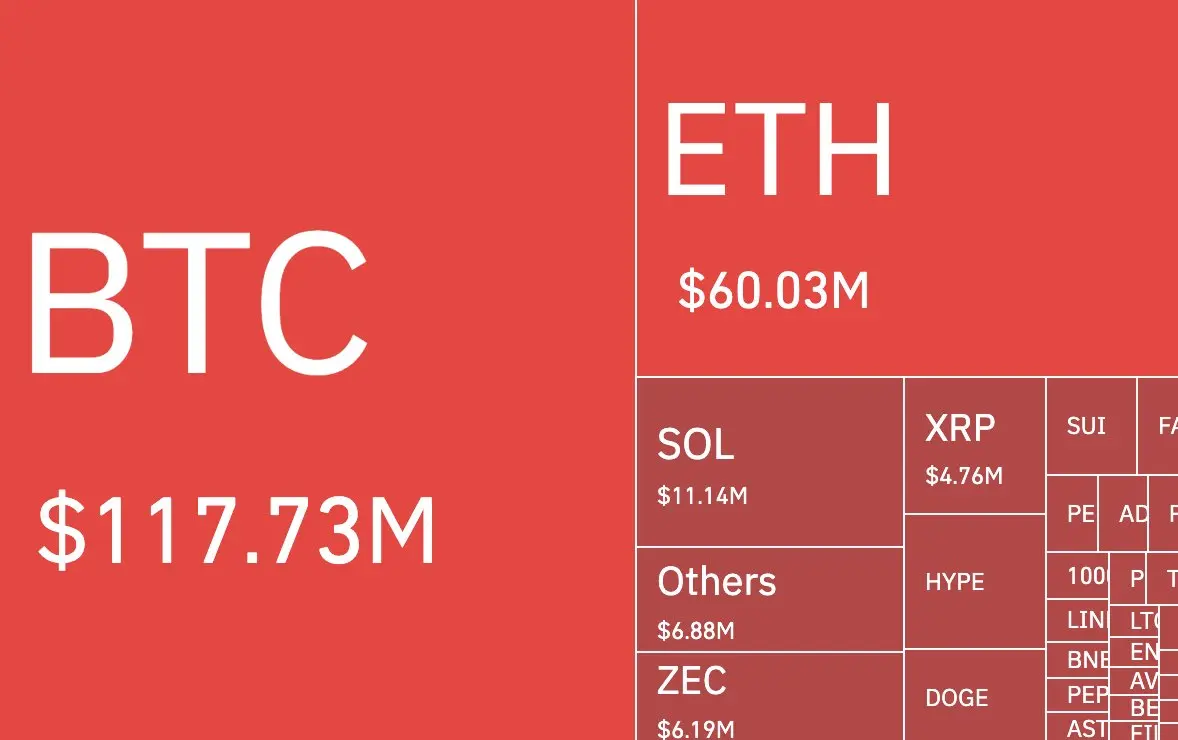

Latest market updates on major coins. This is a review from a crypto enthusiast, based purely on my own observations.

Crypto Market Overview: November 29 - December 6, 2025.

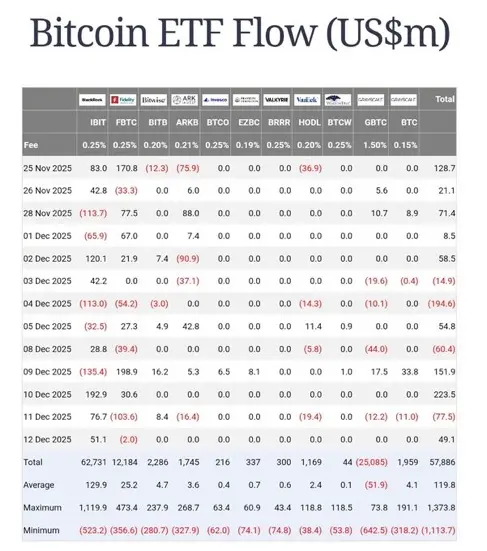

The market spent the week with mixed sentiment: sharp moves, quick rebounds, and a lot of caution among traders. I see this even in myself, as I’m not rushing and just observing for now. BTC is driving the market’s overall dynamics, while altcoins are looking for support points after declines.

BTC. Bitcoin experienced strong price swings this week—from a deep drop to a partial recovery. Demand is returning gradually, but

Crypto Market Overview: November 29 - December 6, 2025.

The market spent the week with mixed sentiment: sharp moves, quick rebounds, and a lot of caution among traders. I see this even in myself, as I’m not rushing and just observing for now. BTC is driving the market’s overall dynamics, while altcoins are looking for support points after declines.

BTC. Bitcoin experienced strong price swings this week—from a deep drop to a partial recovery. Demand is returning gradually, but