SatoshiClub

No content yet

SatoshiClub

- Reward

- like

- Comment

- Repost

- Share

I was told that there was no more Jane Street 😭

- Reward

- like

- Comment

- Repost

- Share

BREAKING: OpenAI announces $110B in new investment at a $730B valuation.

- Reward

- like

- Comment

- Repost

- Share

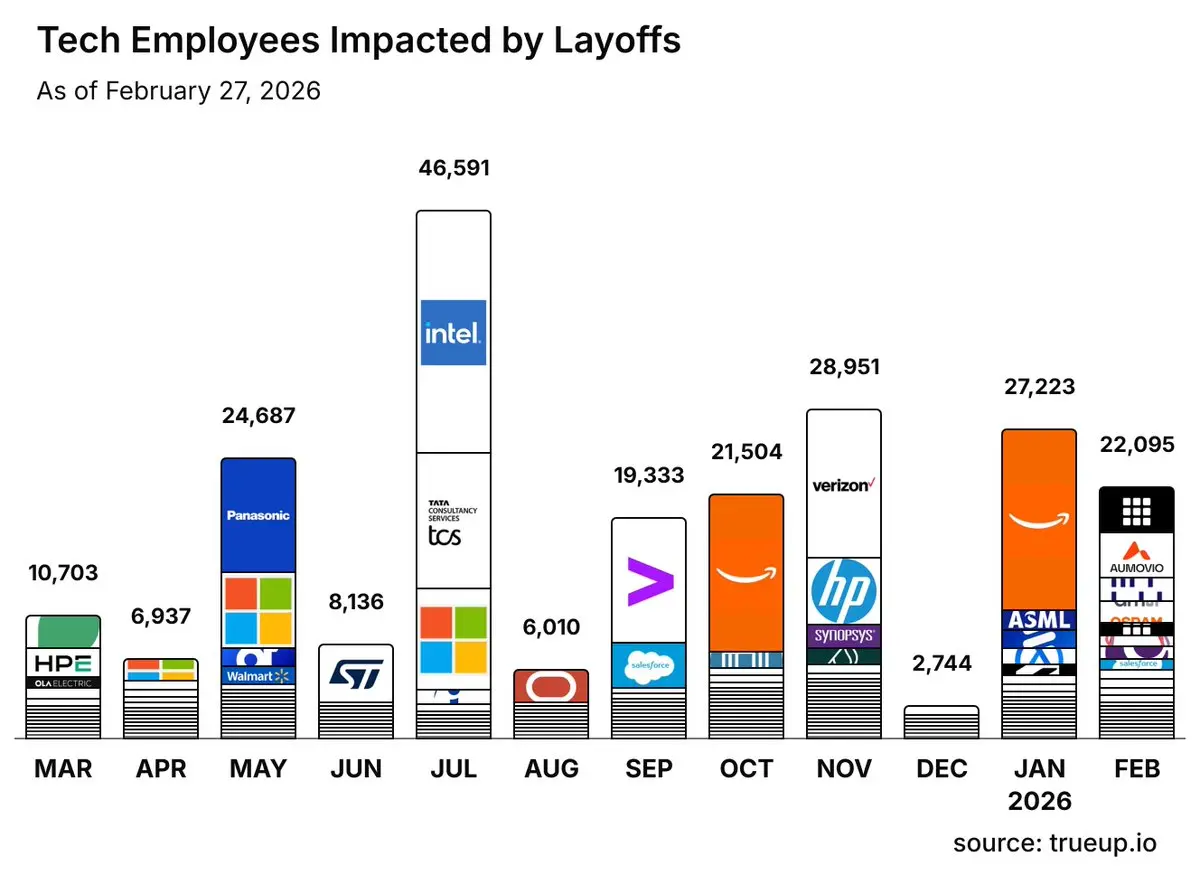

2026 LAYOFFS:

Amazon - 16,000

Aumovio - 4,000

Block - 4,000

WiseTech Global - 2,000

ams OSRAM - 2,000

ASML - 1,700

Ericsson - 1,600

Meta - 1,500

Salesforce - 1,000

Livspace - 1,000

Ocado - 1,000

Autodesk - 1,000

eBay - 800

Lucid Motors - 800

CyberArk - 700

Pinterest - 675

Telstra - 650

Ola Electric - 620

Playtika - 500

Workday - 400

T-Mobile - 393

ANGI Homeservices - 350

LA Semiconductor - 350

C3ai - 312

Ericsson (Spain) - 300

Peloton - 287

Oracle - 254

Kiwi - 250

Kaseya - 250

FormFactor - 220

Gemini - 200

Zillow - 200

Zupee - 200

Expedia - 162

Remitly - 110

HGS - 100

AOL - 100

HCLTech - 100

L

Amazon - 16,000

Aumovio - 4,000

Block - 4,000

WiseTech Global - 2,000

ams OSRAM - 2,000

ASML - 1,700

Ericsson - 1,600

Meta - 1,500

Salesforce - 1,000

Livspace - 1,000

Ocado - 1,000

Autodesk - 1,000

eBay - 800

Lucid Motors - 800

CyberArk - 700

Pinterest - 675

Telstra - 650

Ola Electric - 620

Playtika - 500

Workday - 400

T-Mobile - 393

ANGI Homeservices - 350

LA Semiconductor - 350

C3ai - 312

Ericsson (Spain) - 300

Peloton - 287

Oracle - 254

Kiwi - 250

Kaseya - 250

FormFactor - 220

Gemini - 200

Zillow - 200

Zupee - 200

Expedia - 162

Remitly - 110

HGS - 100

AOL - 100

HCLTech - 100

L

- Reward

- like

- Comment

- Repost

- Share

GM!

Happy Friday.

Happy Friday.

- Reward

- like

- Comment

- Repost

- Share

Block ($XYZ) jumps over +20% after announcing plans to cut more than 40% of its workforce.

Markets clearly like cost cuts.

Now the question is how many other companies will follow the same playbook.

Markets clearly like cost cuts.

Now the question is how many other companies will follow the same playbook.

- Reward

- 2

- Comment

- Repost

- Share

🚨 Trump-backed American Bitcoin Corp. reports a massive $59 million loss for Q4 2025.

The crypto mining firm's stock has crashed nearly 90% from its September peak.

The crypto mining firm's stock has crashed nearly 90% from its September peak.

BTC2,51%

- Reward

- 1

- Comment

- Repost

- Share

GM!

Happy Thursday.

Happy Thursday.

- Reward

- like

- Comment

- Repost

- Share

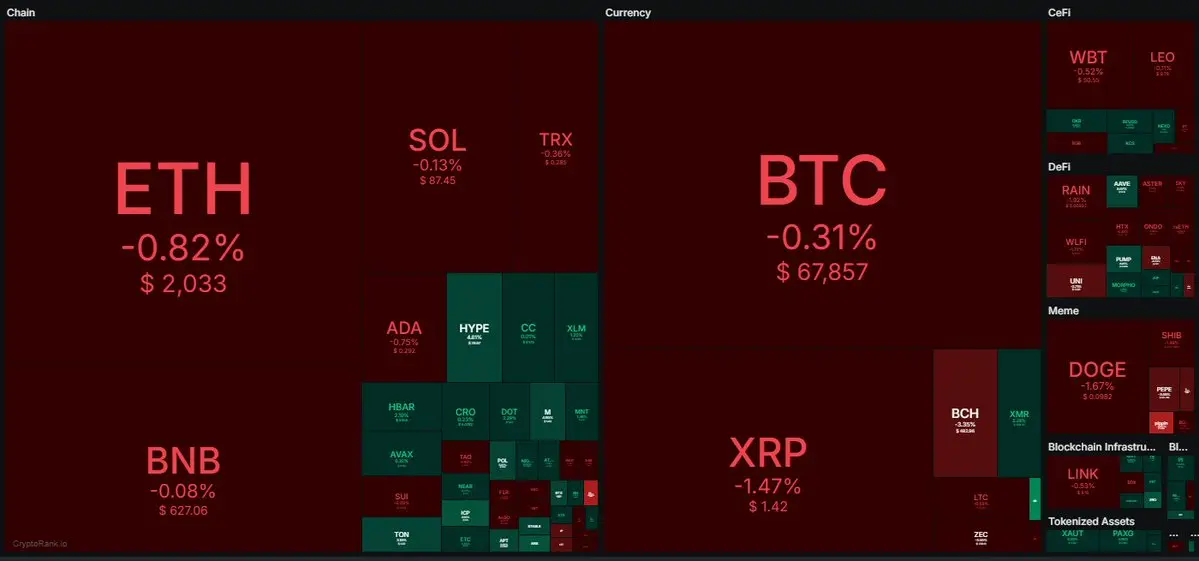

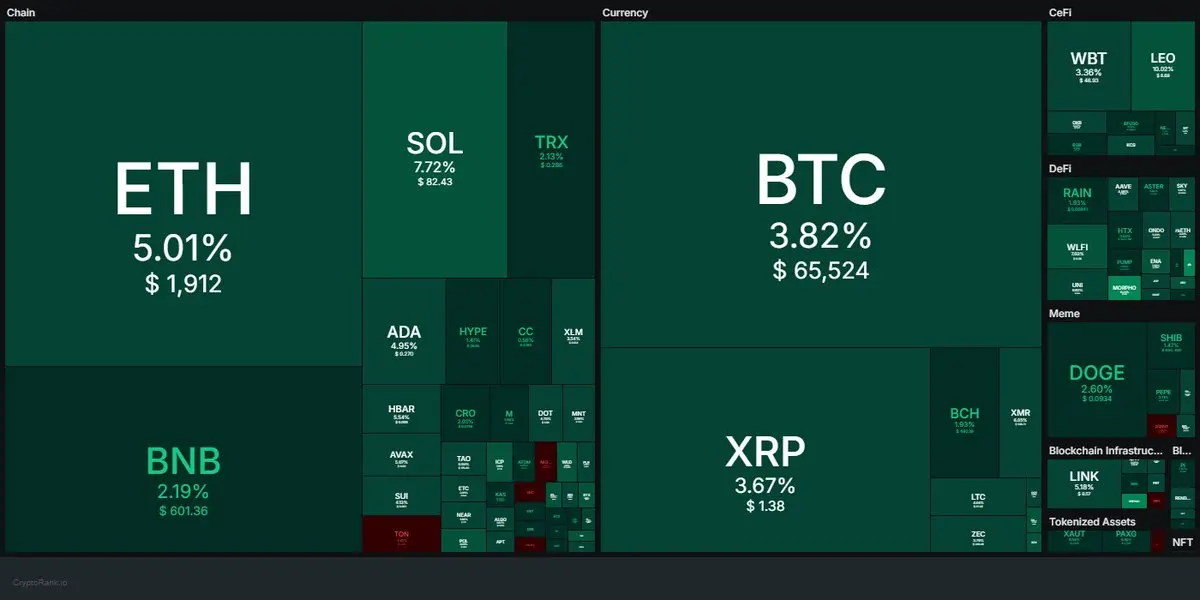

Why is Bitcoin bottoming right now?

- BTC is the most oversold it has been since the FTX crash.

- Big funds are selling global stocks at the fastest rate since the trade mess in April 2025.

- Jamie Dimon is seeing signs that look like the 2008 financial crisis.

- The BTC premium was negative for 40 days straight before finally turning green.

- Google searches for "can't sell house" are at a record high.

Even if we hit the $40,000-50,000 level, that is exactly where I want to put my money and stop checking the charts for a long time.

- BTC is the most oversold it has been since the FTX crash.

- Big funds are selling global stocks at the fastest rate since the trade mess in April 2025.

- Jamie Dimon is seeing signs that look like the 2008 financial crisis.

- The BTC premium was negative for 40 days straight before finally turning green.

- Google searches for "can't sell house" are at a record high.

Even if we hit the $40,000-50,000 level, that is exactly where I want to put my money and stop checking the charts for a long time.

BTC2,51%

- Reward

- like

- Comment

- Repost

- Share

🚨 BREAKING: GD Culture Group (Nasdaq: GDC) shares surge 15% after Board approves the sale of its 7,500 BTC reserve.

BTC2,51%

- Reward

- like

- Comment

- Repost

- Share

Lighter officials confirm a 1,000 BTC whale sell order just triggered a major flash crash.

Prices briefly cratered to $47,000 before an immediate rebound.

Prices briefly cratered to $47,000 before an immediate rebound.

BTC2,51%

- Reward

- like

- 1

- Repost

- Share

欣欣向荣2688 :

:

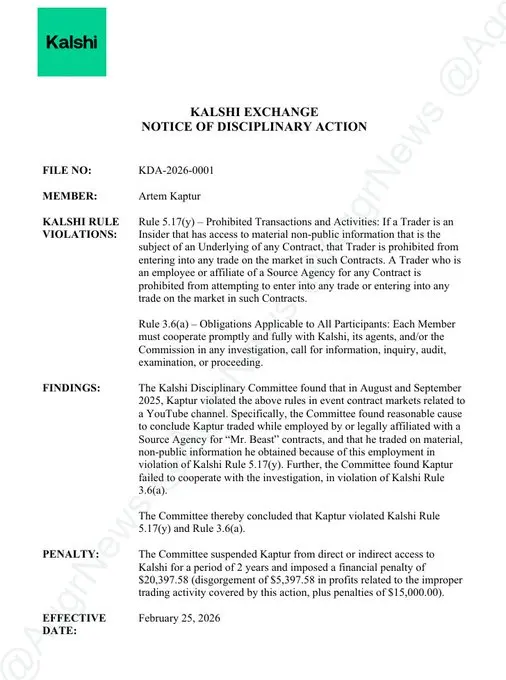

2026 Go Go Go 👊BREAKING: Kalshi has banned a MrBeast video editor for 2 years for using secret work info to win bets.

Artem Kaptur must pay over $20,000 in fines after trading on YouTube video details before they were public.

Artem Kaptur must pay over $20,000 in fines after trading on YouTube video details before they were public.

- Reward

- like

- Comment

- Repost

- Share

- Reward

- like

- Comment

- Repost

- Share

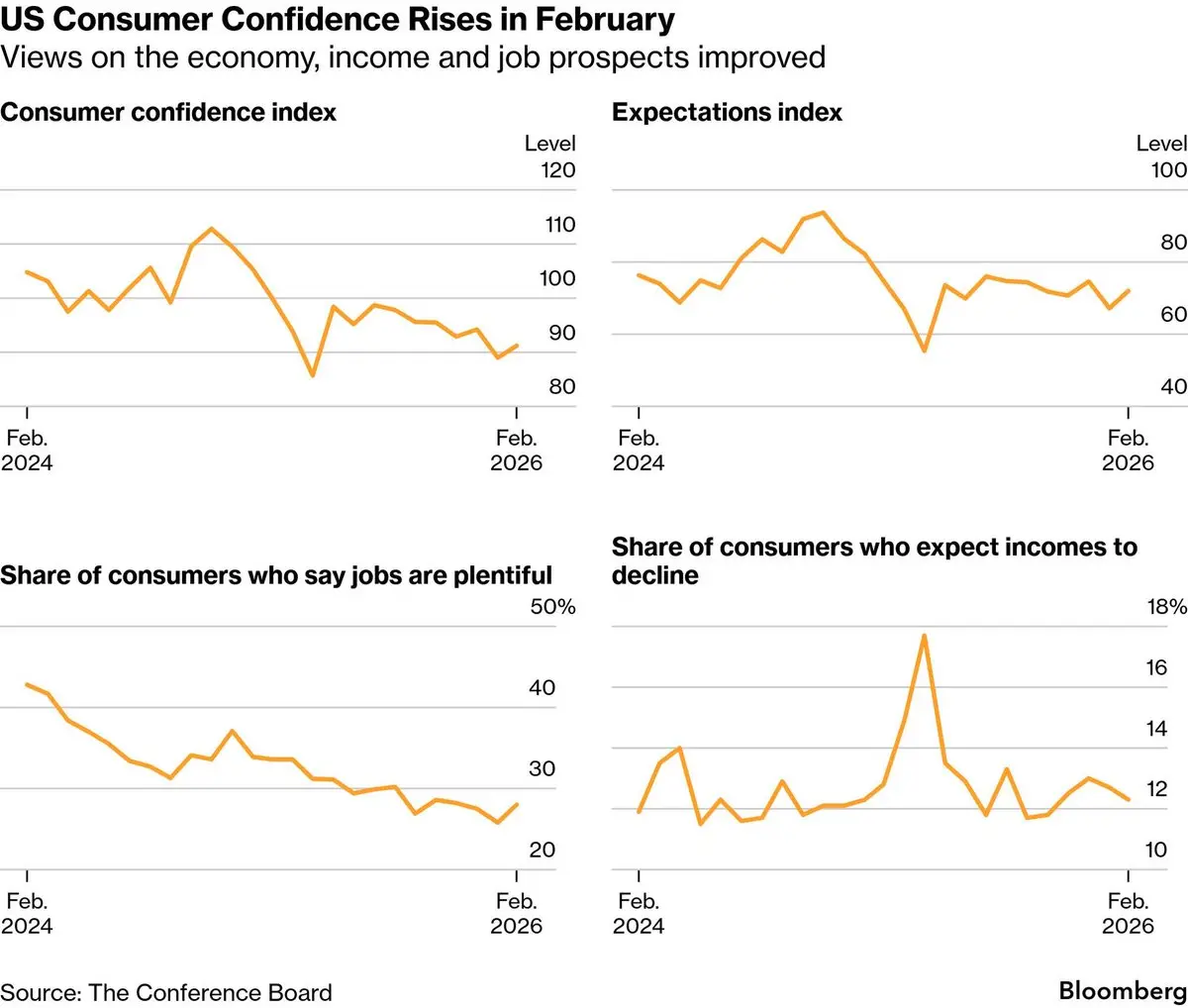

U.S. consumer confidence rose to 91.2 in February, up from 89.

This is usually good for markets.

When people feel better about jobs and income, they spend more, and risk assets often react positively.

This is usually good for markets.

When people feel better about jobs and income, they spend more, and risk assets often react positively.

- Reward

- 1

- Comment

- Repost

- Share

GM!

Happy Wednesday.

Happy Wednesday.

- Reward

- like

- Comment

- Repost

- Share

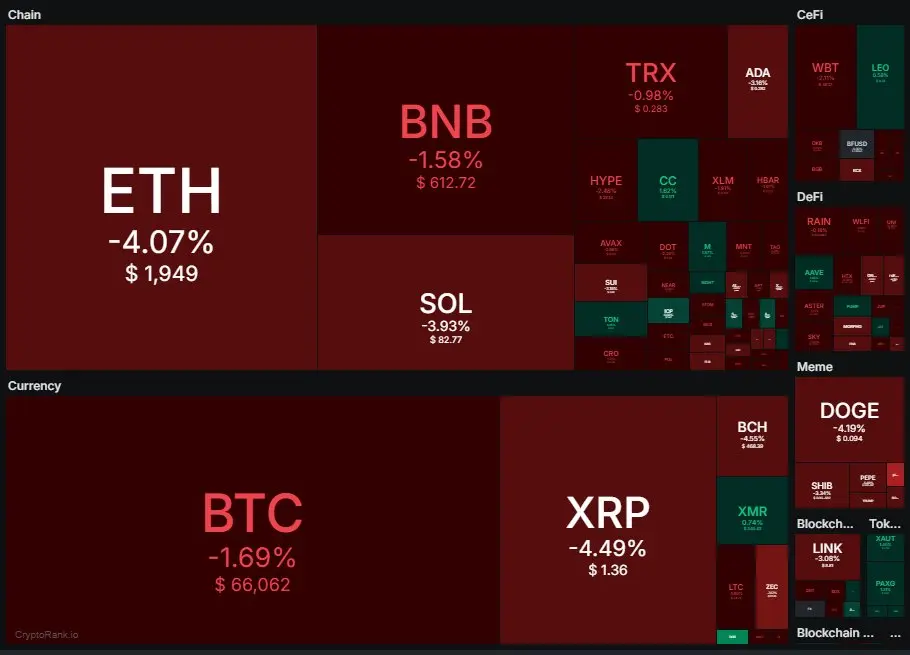

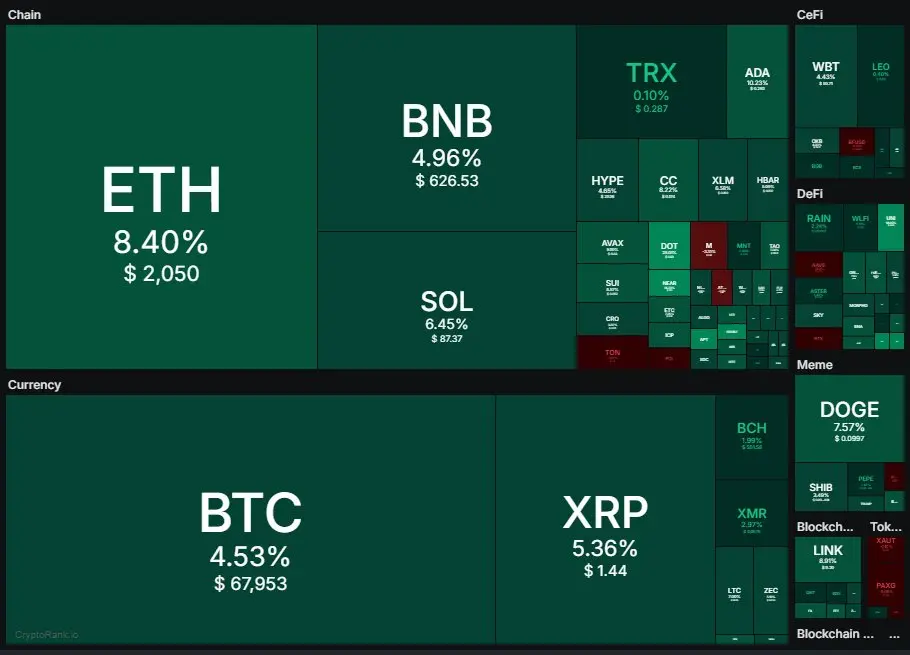

142 days of down only.

It’s been tough.

But this is exactly how bottoms form, slow, painful, exhausting.

More red days could still come, but Bitcoin is likely forming a base around here.

The hardest part has already passed.

It’s been tough.

But this is exactly how bottoms form, slow, painful, exhausting.

More red days could still come, but Bitcoin is likely forming a base around here.

The hardest part has already passed.

BTC2,51%

- Reward

- like

- Comment

- Repost

- Share

BREAKING: META IS PLANNING TO MAKE STABLECOIN COMEBACK IN LATE 2026 FOLLOWING PREVIOUS DIEM FAILURE

- Reward

- 1

- Comment

- Repost

- Share

South Korean prosecutors allege a man attempted to murder his business partner by poisoning his coffee with pesticide after a six-figure crypto investment deal went wrong.

The victim survived but was placed in a medically induced coma for three days after collapsing at a Seoul café.

The 39-year-old suspect has been charged with attempted murder and violations of South Korea’s Pesticide Control Act.

The victim survived but was placed in a medically induced coma for three days after collapsing at a Seoul café.

The 39-year-old suspect has been charged with attempted murder and violations of South Korea’s Pesticide Control Act.

- Reward

- like

- Comment

- Repost

- Share

Trending Topics

View More42.47M Popularity

157.9K Popularity

118.09K Popularity

1.67M Popularity

518.31K Popularity

Pin