Texas just changed the Bitcoin game

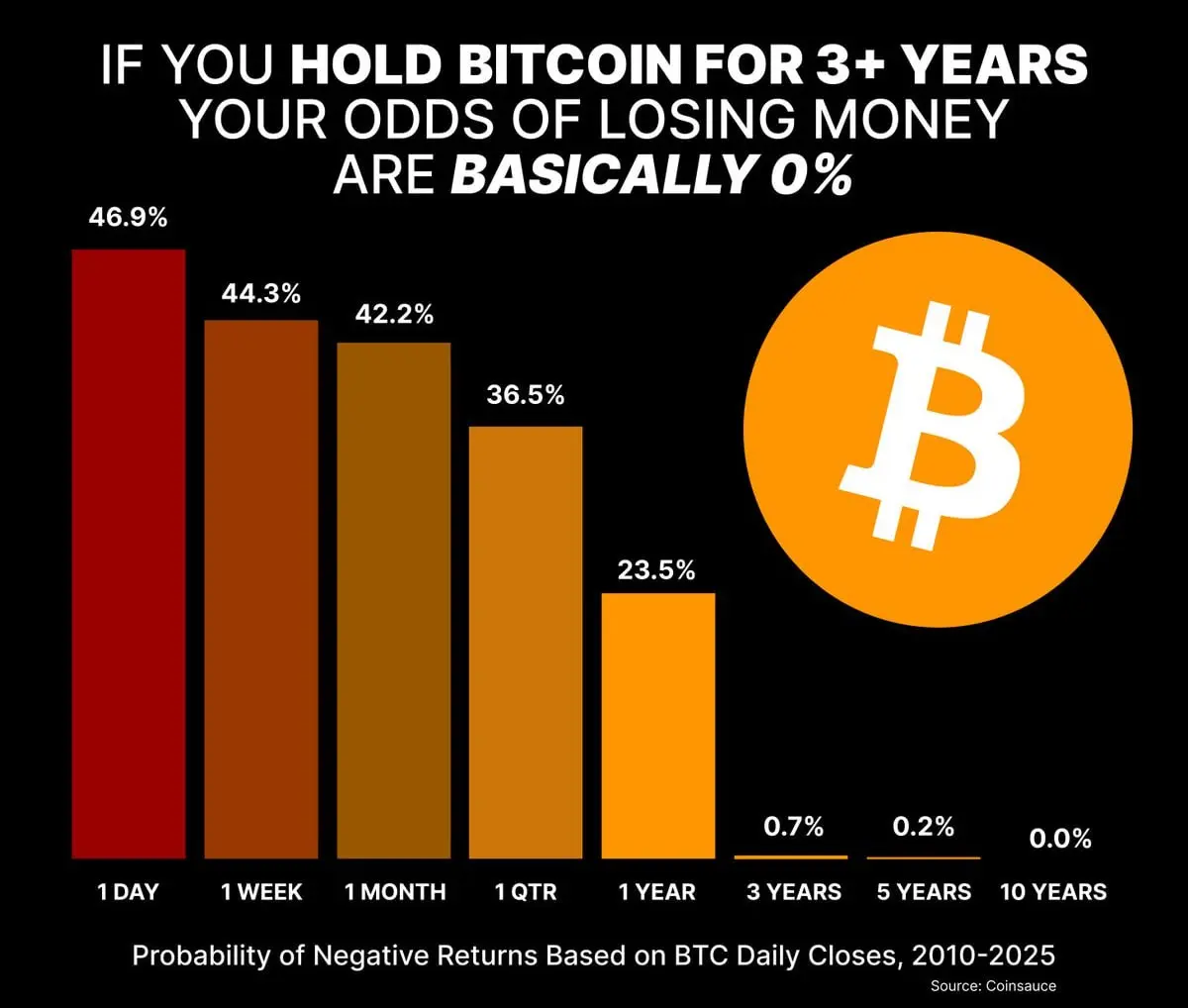

$BTC Texas Lieutenant Governor Dan Patrick has confirmed that Texas is now the first state in history to officially purchase Bitcoin. A massive signal. He also backed President Trump’s pro-crypto stance, making it clear that Texas wants to become the epicenter of America’s digital future.

This is the kind of headline that shifts sentiment fast. When a major state starts stacking, the rest start watching. Bitcoin’s long term story just got a serious new chapter.

#PostonSquaretoEarn$50

$BTC Texas Lieutenant Governor Dan Patrick has confirmed that Texas is now the first state in history to officially purchase Bitcoin. A massive signal. He also backed President Trump’s pro-crypto stance, making it clear that Texas wants to become the epicenter of America’s digital future.

This is the kind of headline that shifts sentiment fast. When a major state starts stacking, the rest start watching. Bitcoin’s long term story just got a serious new chapter.

#PostonSquaretoEarn$50

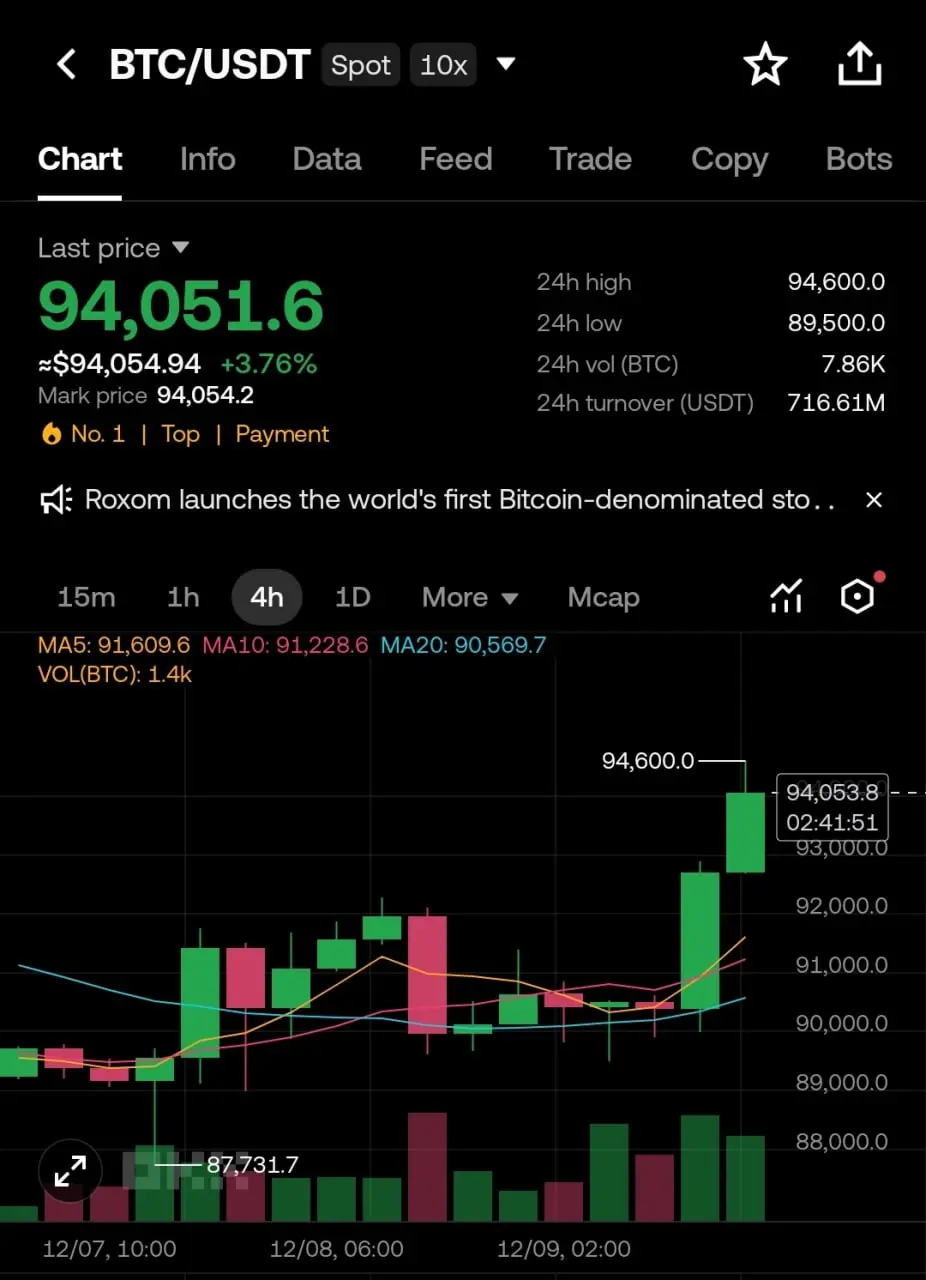

BTC4.25%