# GlobalMarkets

5.8K

MissCrypto

🇯🇵 Japan Election 2026: Historic Landslide, Powerful Mandate & Market Shockwaves

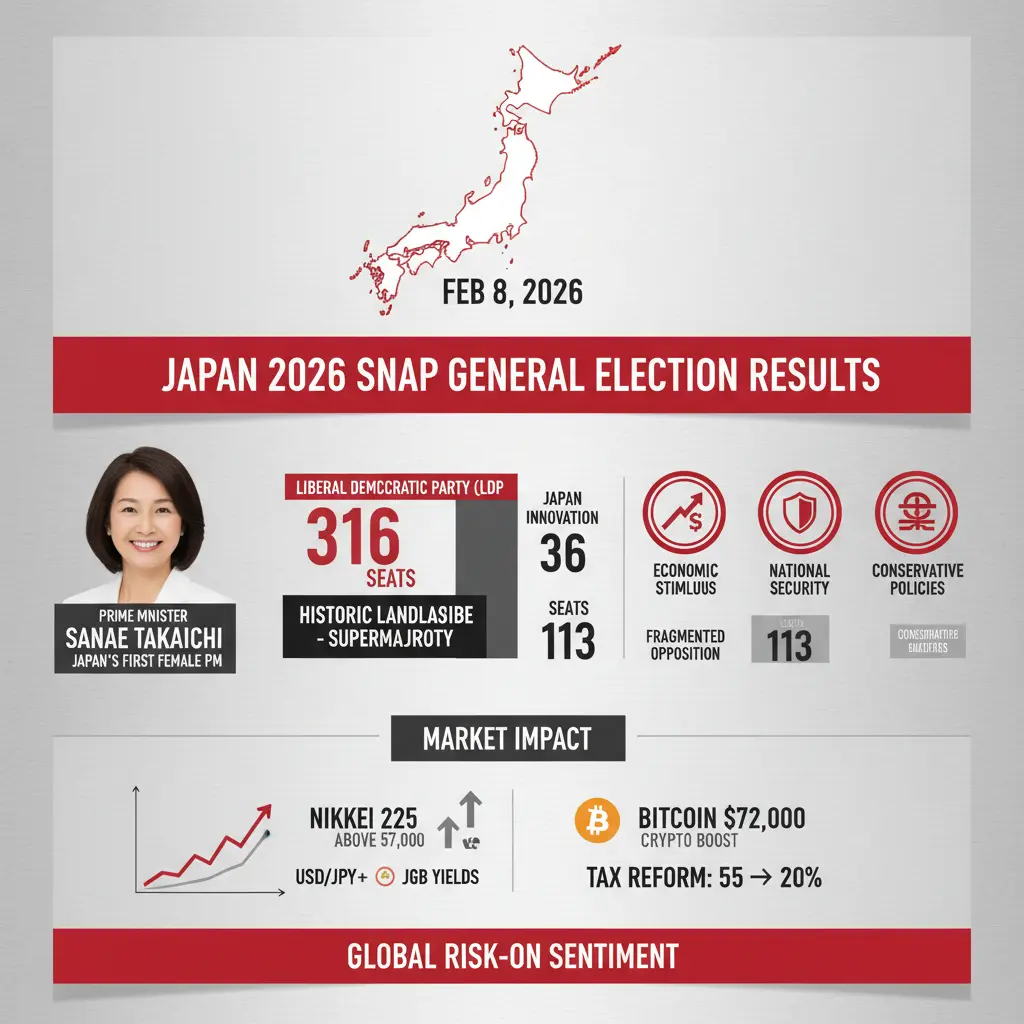

Japan’s February 8, 2026 snap general election has delivered one of the most decisive outcomes in the country’s postwar history. Prime Minister Sanae Takaichi, Japan’s first female PM, secured an overwhelming mandate just months after taking office—reshaping Japan’s political and market landscape in one stroke.

🗳️ Election Outcome at a Glance

Despite heavy snowfall and turnout of ~55.7%, voters handed the Liberal Democratic Party (LDP) an extraordinary 316 seats, granting PM Takaichi a two-thirds supermajority

Japan’s February 8, 2026 snap general election has delivered one of the most decisive outcomes in the country’s postwar history. Prime Minister Sanae Takaichi, Japan’s first female PM, secured an overwhelming mandate just months after taking office—reshaping Japan’s political and market landscape in one stroke.

🗳️ Election Outcome at a Glance

Despite heavy snowfall and turnout of ~55.7%, voters handed the Liberal Democratic Party (LDP) an extraordinary 316 seats, granting PM Takaichi a two-thirds supermajority

BTC-0,97%

- Reward

- 6

- 8

- Repost

- Share

ybaser :

:

Follow closely 🔍View More

Global Tech Sell-Off Hits Risk Assets: What Investors Need to Know

Global financial markets are facing renewed pressure as a broad-based sell-off in technology stocks ripples across risk assets. What began as a pullback in high-growth tech names has evolved into a wider market recalibration, highlighting how deeply interconnected equities, crypto, and emerging markets have become.

At the core of this move is a shift in macro expectations. Persistent inflation, a higher-for-longer interest rate outlook, and tighter financial conditions are forcing investors to reassess valuations—particularly f

Global financial markets are facing renewed pressure as a broad-based sell-off in technology stocks ripples across risk assets. What began as a pullback in high-growth tech names has evolved into a wider market recalibration, highlighting how deeply interconnected equities, crypto, and emerging markets have become.

At the core of this move is a shift in macro expectations. Persistent inflation, a higher-for-longer interest rate outlook, and tighter financial conditions are forcing investors to reassess valuations—particularly f

BTC-0,97%

- Reward

- 1

- 1

- Repost

- Share

Lock_433 :

:

Buy To Earn 💎Here’s a professional post for Gate.io on #USIranNuclearTalksTurmoil:🌍📉 #USIranNuclearTalksTurmoil – Global Markets on AlertOngoing turmoil in U.S.–Iran nuclear talks is creating uncertainty across global markets, influencing risk sentiment and asset volatility. ⚠️✨ What Traders Should Watch:Rising geopolitical tension may impact global market stability 🌐Increased volatility across energy, commodities, and crypto markets 📊Shifts in investor sentiment toward safe-haven and alternative assets 🛡️💡 Gate.io Insight:Stay informed on geopolitical developments and use Gate.io’s advanced trading

- Reward

- 2

- Comment

- Repost

- Share

🚨 BREAKING NEWS 🚨

📉 Stocks Mixed

Global markets fluctuate with sector and regional differences. Tech & growth stocks volatile, while energy & commodities sometimes outperform.

🪙 Bitcoin & Altcoins Volatile

BTC, ETH, XRP swinging sharply due to macro uncertainty and risk sentiment. Traders see opportunities; long-term holders stay cautious.

⚠️ Investors Cautious

Fed news, interest rate expectations, and geopolitical tension create a risk-off mood. Safe-haven assets like gold gain attention.

#BreakingNews

#GlobalMarkets

📉 Stocks Mixed

Global markets fluctuate with sector and regional differences. Tech & growth stocks volatile, while energy & commodities sometimes outperform.

🪙 Bitcoin & Altcoins Volatile

BTC, ETH, XRP swinging sharply due to macro uncertainty and risk sentiment. Traders see opportunities; long-term holders stay cautious.

⚠️ Investors Cautious

Fed news, interest rate expectations, and geopolitical tension create a risk-off mood. Safe-haven assets like gold gain attention.

#BreakingNews

#GlobalMarkets

- Reward

- 3

- 2

- Repost

- Share

DragonFlyOfficial :

:

2026 GOGOGO 👊View More

#MiddleEastTensionsEscalate 🌍

Geopolitical risk is back in focus, and markets are repricing uncertainty in real time. Energy markets are heating up, volatility is spreading, and capital is shifting toward protection rather than speculation.

What we’re seeing: • Oil reacting to supply risk and regional instability

• Equities turning cautious as risk premiums rise

• Gold attracting defensive flows

• Crypto facing short-term pressure as liquidity tightens

This phase isn’t about predicting headlines. It’s about reading capital behavior.

During geopolitical stress, markets reward: • Reduced levera

Geopolitical risk is back in focus, and markets are repricing uncertainty in real time. Energy markets are heating up, volatility is spreading, and capital is shifting toward protection rather than speculation.

What we’re seeing: • Oil reacting to supply risk and regional instability

• Equities turning cautious as risk premiums rise

• Gold attracting defensive flows

• Crypto facing short-term pressure as liquidity tightens

This phase isn’t about predicting headlines. It’s about reading capital behavior.

During geopolitical stress, markets reward: • Reduced levera

- Reward

- 12

- 12

- Repost

- Share

Crypto_Buzz_with_Alex :

:

Really appreciate the clarity and effort you put into this post — it’s rare to see crypto content that’s both insightful and easy to follow. Your perspective adds real value to the community. Keep sharing gems like this! 🚀📊”View More

#MiddleEastTensionsEscalate 🌍

Geopolitical pressure is rising, and markets are reacting fast. Oil volatility up, risk assets shaking, safe havens gaining attention.

Smart traders stay calm, manage risk, and watch liquidity zones carefully.

In uncertain times, discipline > emotions.

#GlobalMarkets #Crypto #Gold #Oil

Geopolitical pressure is rising, and markets are reacting fast. Oil volatility up, risk assets shaking, safe havens gaining attention.

Smart traders stay calm, manage risk, and watch liquidity zones carefully.

In uncertain times, discipline > emotions.

#GlobalMarkets #Crypto #Gold #Oil

- Reward

- 14

- 15

- Repost

- Share

Crypto_Buzz_with_Alex :

:

Really appreciate the clarity and effort you put into this post — it’s rare to see crypto content that’s both insightful and easy to follow. Your perspective adds real value to the community. Keep sharing gems like this! 🚀📊”View More

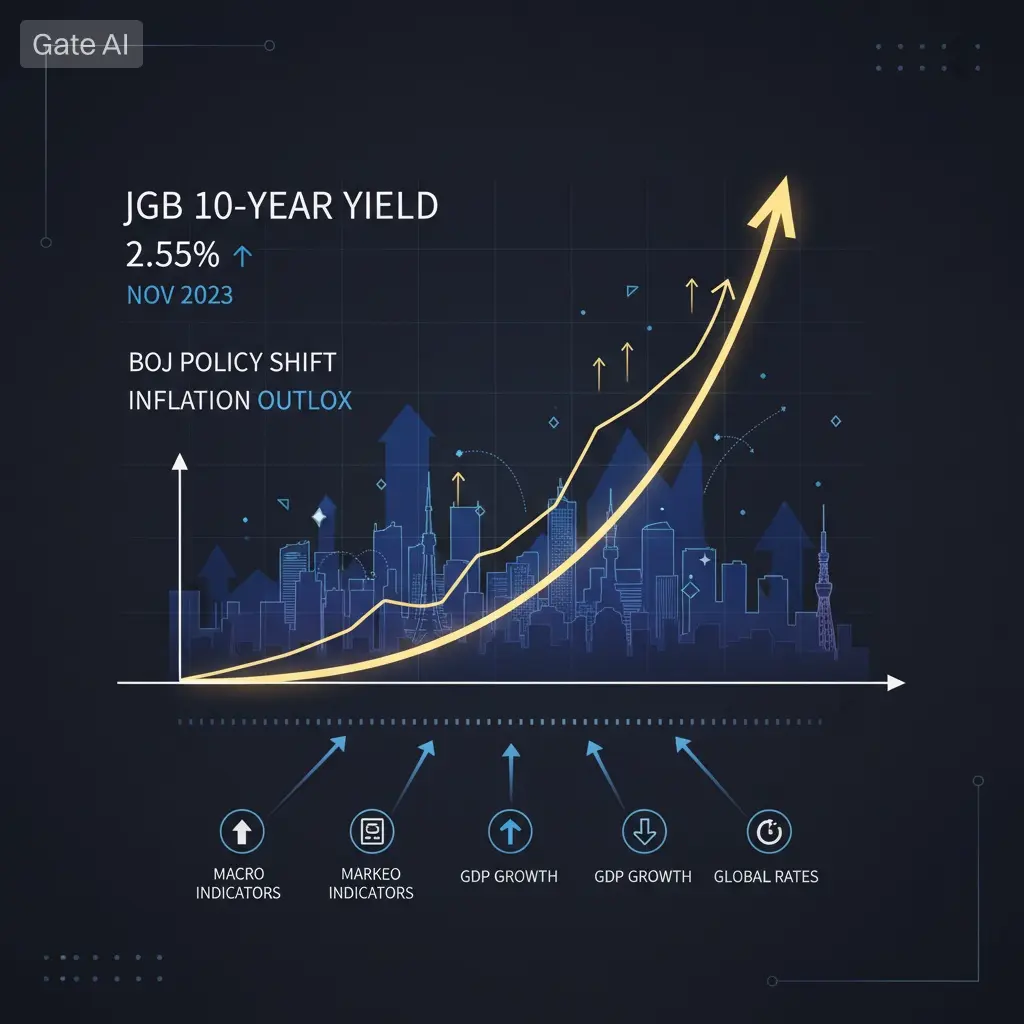

⚠️ #JapanBondMarketSell-Off — Macro Moves That Could Shift Global Markets

Japan’s 30Y & 40Y bond yields jumped over 25 bps, signaling a potential pivot after plans to ease fiscal tightening and boost spending.

Traditionally associated with ultra-low yields, Japan’s move could ripple across global capital flows and interest rate expectations.

📊 Why This Matters

Higher yields in Japan may put pressure on risk assets worldwide, including crypto

Could trigger broader repricing in global bond and equity markets

Macro effects often arrive slowly but with lasting impact

💡 Key Question

Is this a tem

Japan’s 30Y & 40Y bond yields jumped over 25 bps, signaling a potential pivot after plans to ease fiscal tightening and boost spending.

Traditionally associated with ultra-low yields, Japan’s move could ripple across global capital flows and interest rate expectations.

📊 Why This Matters

Higher yields in Japan may put pressure on risk assets worldwide, including crypto

Could trigger broader repricing in global bond and equity markets

Macro effects often arrive slowly but with lasting impact

💡 Key Question

Is this a tem

- Reward

- 1

- Comment

- Repost

- Share

#JapanBondMarketSell-Off 🇯🇵

Japan’s bond market just sent a strong signal to

global markets.

📉

30Y and 40Y JGB yields jumped over 25 bps

after plans to end fiscal tightening and

increase government spending.

So why does this matter beyond Japan?

🌍 Why global markets are watching

·

Higher Japanese yields reduce the need for

Japanese investors to seek returns abroad

·

This could mean less capital flowing into U.S. Treasuries and global bonds

·

Rising yields in Japan can quietly push global rates higher

📈 Impact on risk assets

·

Bonds:

Global bond markets may

Japan’s bond market just sent a strong signal to

global markets.

📉

30Y and 40Y JGB yields jumped over 25 bps

after plans to end fiscal tightening and

increase government spending.

So why does this matter beyond Japan?

🌍 Why global markets are watching

·

Higher Japanese yields reduce the need for

Japanese investors to seek returns abroad

·

This could mean less capital flowing into U.S. Treasuries and global bonds

·

Rising yields in Japan can quietly push global rates higher

📈 Impact on risk assets

·

Bonds:

Global bond markets may

- Reward

- 2

- Comment

- Repost

- Share

📉🌍 #MajorStockIndexesPlunge | Global Markets Under Pressure ⚠️

Major stock indexes have plunged sharply, reflecting rising risk aversion across global markets. Heightened macro uncertainty, policy concerns, and geopolitical developments are driving investors to reassess exposure to risk assets. 📊💥

🔍 What’s Impacting the Markets:

💵 Shifts in interest-rate and liquidity expectations

🌐 Global economic and geopolitical uncertainty

🔄 Rotation toward defensive and safe-haven assets

💡 Equity market stress often spills over into crypto and commodities, increasing volatility. Stay alert and tr

Major stock indexes have plunged sharply, reflecting rising risk aversion across global markets. Heightened macro uncertainty, policy concerns, and geopolitical developments are driving investors to reassess exposure to risk assets. 📊💥

🔍 What’s Impacting the Markets:

💵 Shifts in interest-rate and liquidity expectations

🌐 Global economic and geopolitical uncertainty

🔄 Rotation toward defensive and safe-haven assets

💡 Equity market stress often spills over into crypto and commodities, increasing volatility. Stay alert and tr

- Reward

- 2

- Comment

- Repost

- Share

#FutureOutlook2026

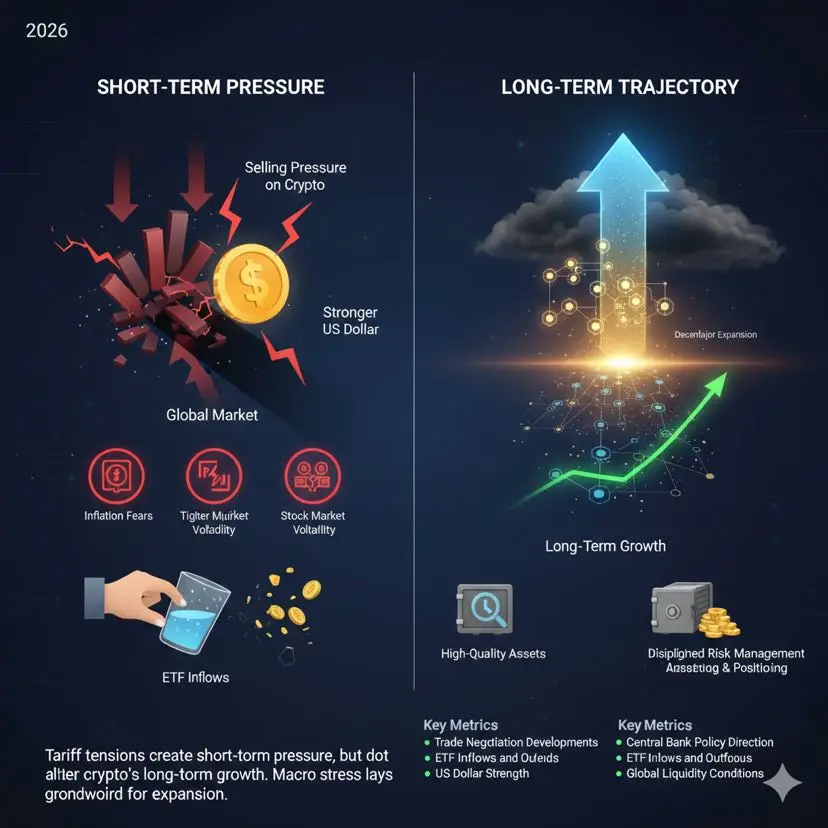

Future Outlook & Market Impact (2026)

Rising global tariff tensions and renewed trade restrictions have become a powerful macro force shaping financial markets in 2026. As geopolitical pressure increases, cryptocurrencies—highly sensitive to liquidity conditions and investor psychology—are once again responding to uncertainty on a global scale.

When tariff conflicts escalate, markets typically shift into a risk-off environment. Investors reduce exposure to volatile assets and move capital toward perceived safety. This transition often creates immediate selling pressure acros

Future Outlook & Market Impact (2026)

Rising global tariff tensions and renewed trade restrictions have become a powerful macro force shaping financial markets in 2026. As geopolitical pressure increases, cryptocurrencies—highly sensitive to liquidity conditions and investor psychology—are once again responding to uncertainty on a global scale.

When tariff conflicts escalate, markets typically shift into a risk-off environment. Investors reduce exposure to volatile assets and move capital toward perceived safety. This transition often creates immediate selling pressure acros

BTC-0,97%

- Reward

- 4

- 3

- Repost

- Share

ybaser :

:

2026 GOGOGO 👊View More

Load More

Join 40M users in our growing community

⚡️ Join 40M users in the crypto craze discussion

💬 Engage with your favorite top creators

👍 See what interests you

Trending Topics

205.95K Popularity

4.34K Popularity

5.79K Popularity

8.94K Popularity

3.44K Popularity

46.97K Popularity

1.39K Popularity

2.78K Popularity

56.5K Popularity

1.33K Popularity

2.04K Popularity

12.06K Popularity

1.57K Popularity

18.84K Popularity

10.67K Popularity

News

View MoreGoldman Sachs CEO Solomon: The macroeconomic situation is very favorable for risk assets

2 m

pippin increased by 51.04% after launching Alpha, current price is 0.3899864108083814 USDT

9 m

Moenihan: Interest rates will continue to decline, which is positive for the market

9 m

S&P Global initially dropped 18% in pre-market trading, now down 16%

13 m

Polymarket will collaborate with Kaito AI to launch the "Attention Market"

14 m

Pin